A rising number of Americans surveyed for Fannie Mae’s monthly Home Purchase Sentiment Index say their income is higher than it was last year at this time. But has more money made them more likely to buy or sell a house? Well, according to February’s survey results, it’s hard to say. That’s because, after an increase in January, housing sentiment fell in February – with respondents expressing less confidence in a number of categories. In fact, the number of participants who said it’s a good time to buy a house was down, as was the percentage of participants who said it was a good time to sell. But if January saw increases in housing confidence, why the drop in February? Doug Duncan, Fannie Mae’s senior vice president and chief economist, says some of the uncertainty has to do with changing economic headlines. “Volatility in consumer housing sentiment continued in February, with the new tax law beginning to impact respondents’ take-home pay and the stock market creating negative headlines due to early-month turbulence,” Duncan said. In short, people have more money but they’re still a bit unsure of what lies ahead for the market. More here.

If you’re a homeowner, you know the to-do list is never ending. And, if you’re a buyer, you’ll know soon enough. That’s because, owning a home means maintaining a home. Proof of that can be seen in the fifth annual LightStream Home Improvement Survey. According to the results, 58 percent of surveyed homeowners say they’re planning to spend money on home improvement projects in 2018. And the number who said they plan on spending $35,000 or more has doubled from last year. But though there are more homeowners planning projects this year, the list of projects hasn’t changed all that much. Once again, outdoor upgrades remain the most popular, with decks, patios, and landscape projects topping the list. Kitchen and bathroom remodels, of course, also rank high, coming second and third on Americans’ home improvement, to-do list. So how are these homeowners planning on paying for all these upgrades and renovations? Well, the vast majority said they were paying for their projects out of savings. However, another way homeowners are saving on their home improvement bills is by doing, at least, some of the work themselves. More

If you’re a homeowner, you know the to-do list is never ending. And, if you’re a buyer, you’ll know soon enough. That’s because, owning a home means maintaining a home. Proof of that can be seen in the fifth annual LightStream Home Improvement Survey. According to the results, 58 percent of surveyed homeowners say they’re planning to spend money on home improvement projects in 2018. And the number who said they plan on spending $35,000 or more has doubled from last year. But though there are more homeowners planning projects this year, the list of projects hasn’t changed all that much. Once again, outdoor upgrades remain the most popular, with decks, patios, and landscape projects topping the list. Kitchen and bathroom remodels, of course, also rank high, coming second and third on Americans’ home improvement, to-do list. So how are these homeowners planning on paying for all these upgrades and renovations? Well, the vast majority said they were paying for their projects out of savings. However, another way homeowners are saving on their home improvement bills is by doing, at least, some of the work themselves. More

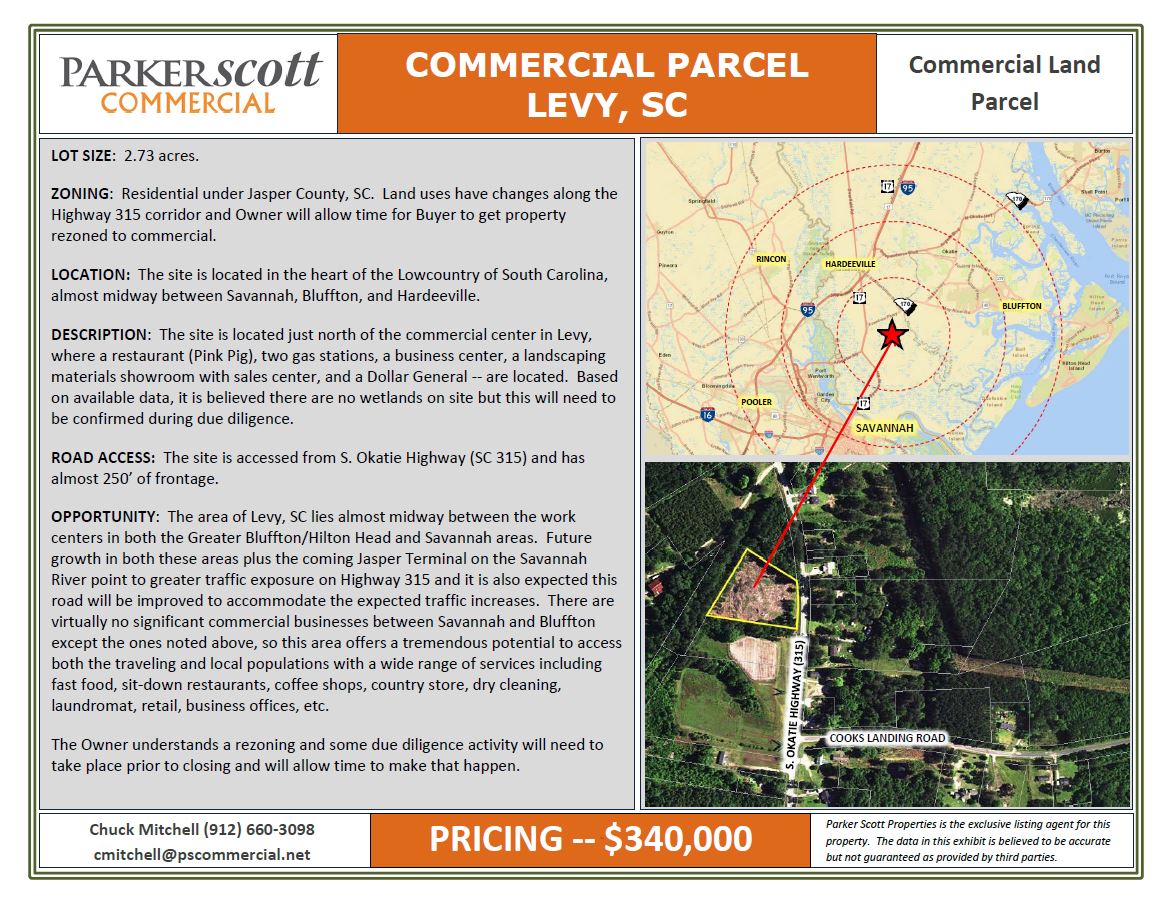

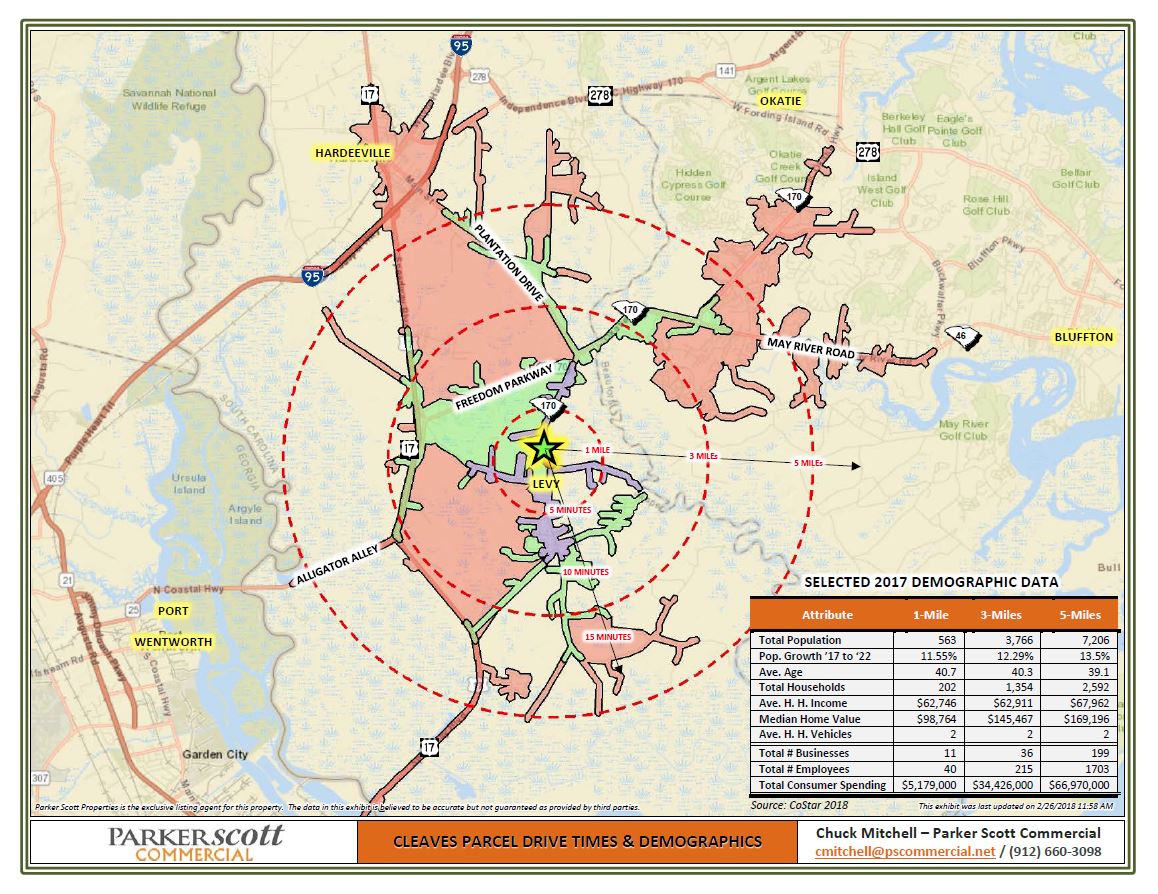

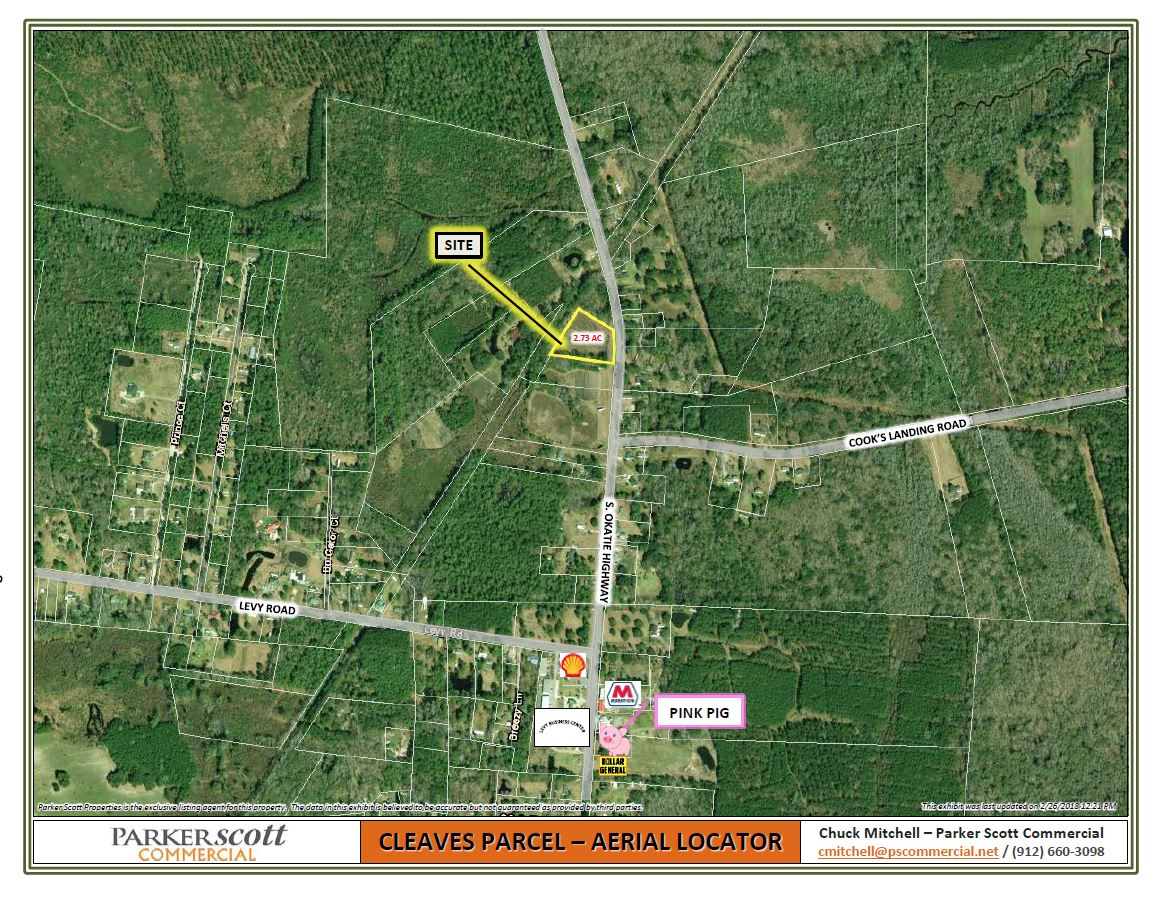

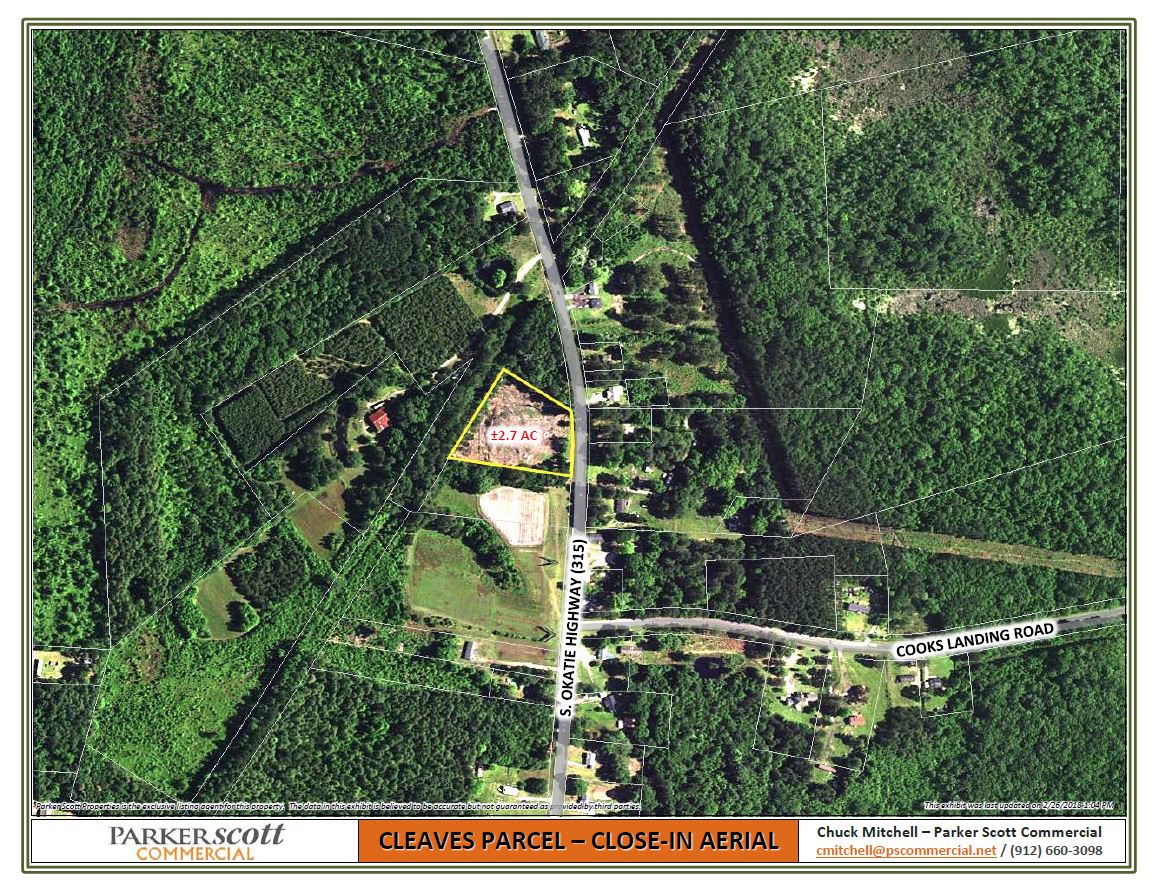

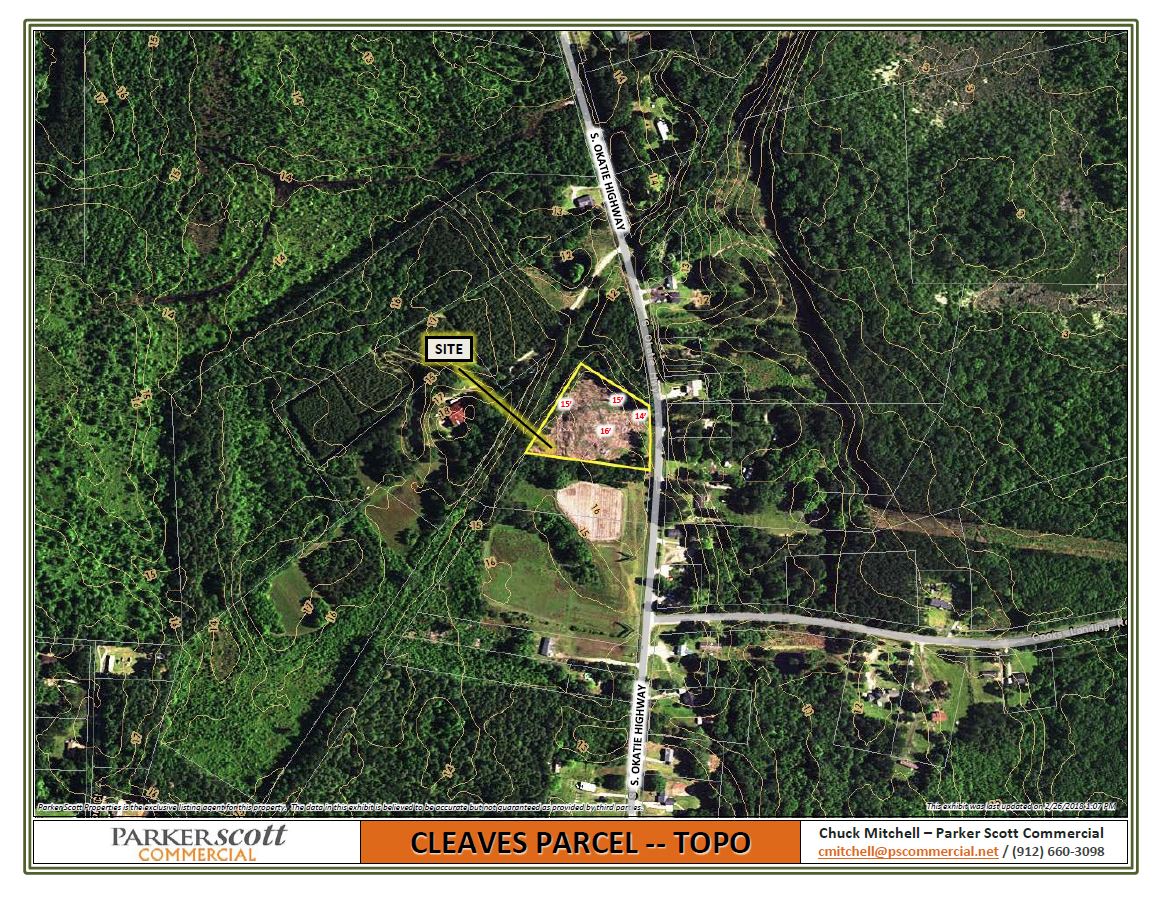

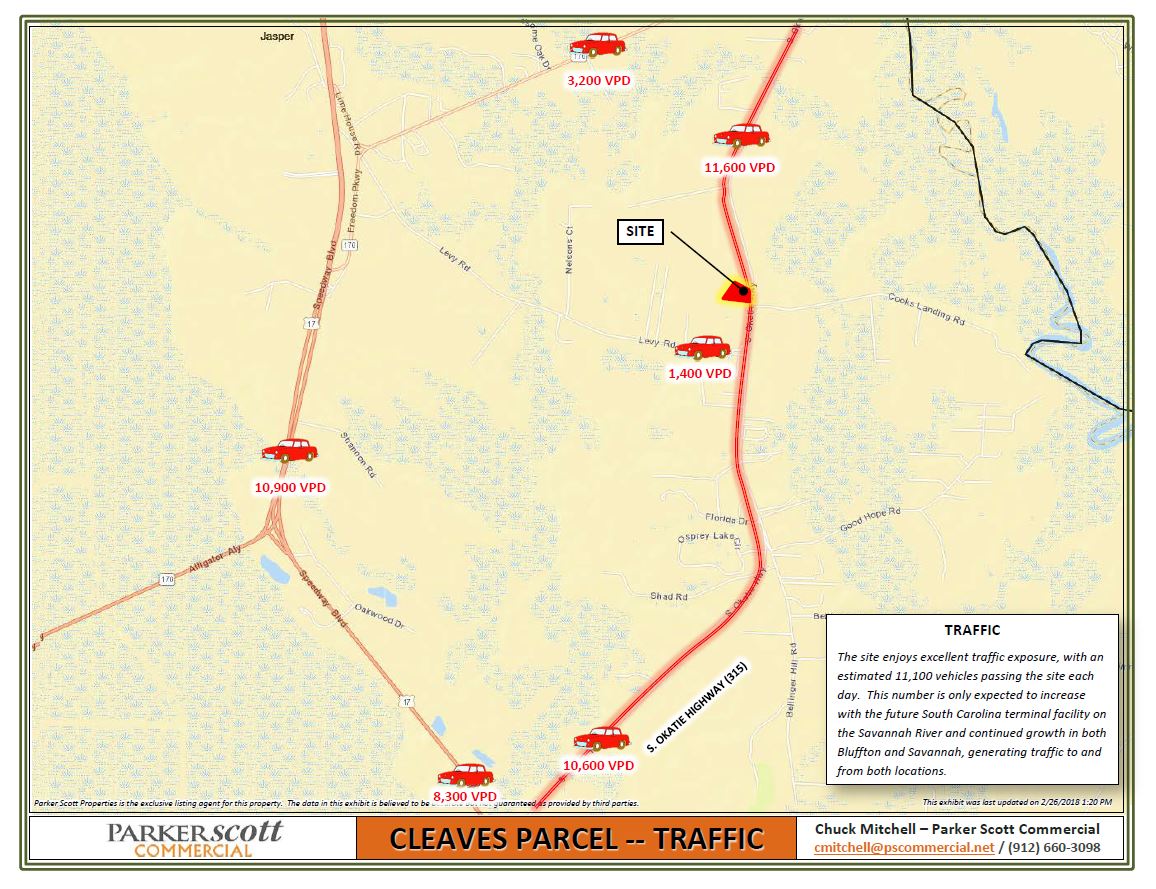

CLEAVES PARCEL BROCHURE

CLEAVES PARCEL BROCHURE