Changes Come To The Luxury Home Market

The high end of the real estate market has followed a different path since the financial crisis and housing crash. But while the luxury home market was able to avoid some of the ups-and-downs the rest of the market has endured, things are beginning to change. In fact, one recent analysis shows the number of homes for sale priced at or above $1 million dollars fell significantly during the first quarter of this year, as compared to the year before. And, if inventory continues to drop, the luxury home market could see some of the spiking prices and competition for available homes that buyers have found in more affordable price ranges. However, those this may be true, the effects have, so far, been far more muted than in the overall market. For example, the average luxury home was on the market for 82 days during the last quarter. That’s faster than the same time last year but much longer than the overall average. For comparison, the National Association of Realtors’ most recent numbers show the typical existing home was on the market for just 30 days, with 50 percent of homes sold in less than a month. More here.

A First-Time Buyer’s Guide to Home Maintenance

What To Consider When Thinking About Remodeling

May Newsletter

How Mortgage Rate Increases Affect Home Buyers

Mortgage rates have been increasing lately and there is an expectation that they will move higher this year. But while home prices get a lot of attention, rising mortgage rates are a little more difficult for buyers to calculate in terms of what it will cost them. Here’s some help. According to one recent model, a less than one percent increase in mortgage rates over the next year would result in a $100 increase to the typical monthly mortgage payment. But since the costs of homeownership are influenced by many different factors, this projection has to make certain assumptions about things like the rate at which home prices will increase, for example. In other words, any increase to mortgage rates will cost home buyers but just how much is difficult to calculate precisely. So what should home buyers expect? Well, since a stronger economy and improved job market make it more likely that the Fed will raise interest rates further this year, buyers should expect that mortgage rates will remain low by historical standards but continue to edge higher, taking monthly mortgage payments higher along with them. More here.

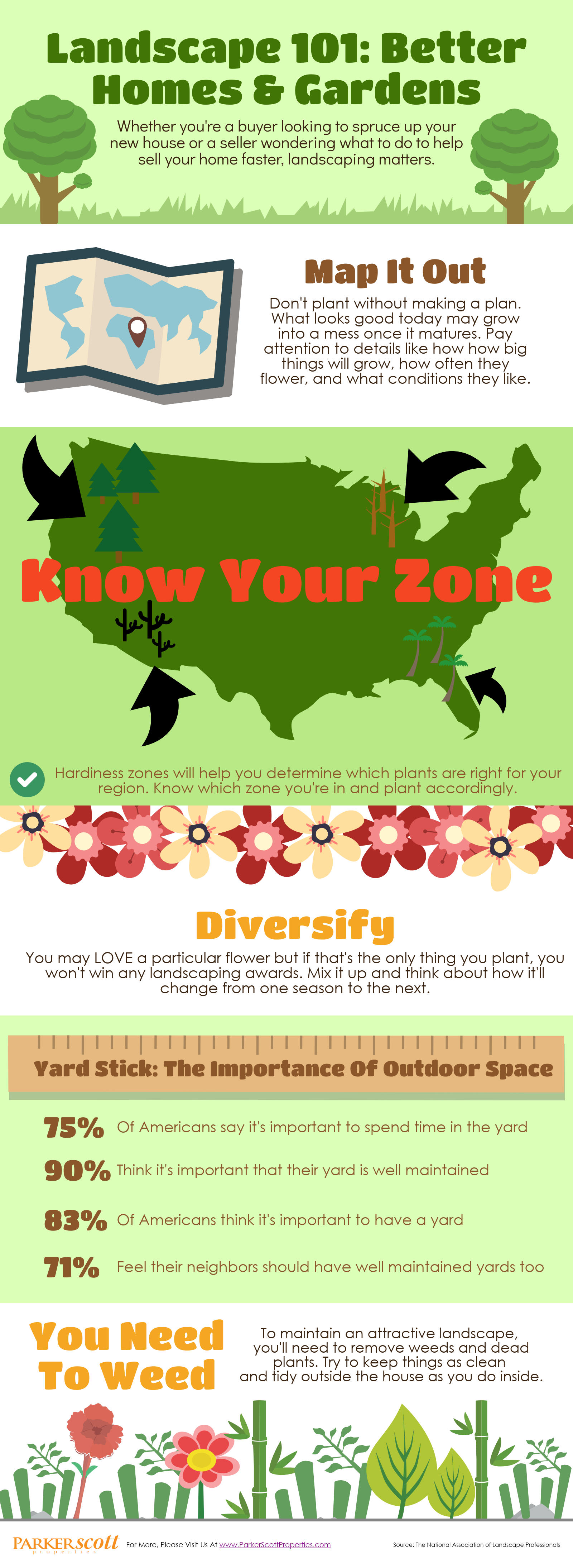

Landscape 101: Better Homes & Gardens