Perception doesn’t always match reality but, when it comes to financial markets, it can make a difference. For example, if you’ve ever invested in the stock market, you know that a company’s stock can rise or fall based on the day’s news, even if the company’s fundamentals and outlook remain the same as the day before. In short, perception matters. And, in today’s housing market, there’s a perception that there are few affordable homes available to prospective buyers. In fact, according to a recent analysis from Fannie Mae, though only 8 percent of homeowners consider their current mortgage unaffordable, 45 percent said that affordable housing is difficult to find in their area. Which provides a snapshot of what is going on in many markets across the country. Homeowners that want to sell may be waiting because they don’t feel they’ll find an affordable house to move into. The flip side of this, however, is that as long as current homeowners aren’t selling their homes, inventory shortages will continue, which is the primary factor behind recent price increases. More here.

July Newsletter

A Beginner’s Guide to Managing a Remodel

Sales Trail Hot Summer Housing Market

The National Association Of Realtors’ most recent Pending Home Sales Index shows that the hot summer housing market has not deterred hopeful home buyers from looking for a house to buy. But though there is a high level of demand from buyers, supply issues continue to hold back sales numbers. In fact, the index found that the number of contracts to buy homes signed in May was essentially flat from the month before. Lawrence Yun, NAR’s chief economist, says sales are being hurt by low inventory but recent news that new home construction hit a 10-year high should be encouraging to prospective buyers. “Several would-be buyers this spring were kept out of the market because of supply and affordability constraints,” Yun said. “The healthy economy and job market should keep many of them actively looking to buy, and any rise in inventory would certainly help them find a home.” Regionally, results were mixed, with the Midwest, Northeast, and West all seeing modest increases, while the South saw a 3.5 percent drop. Pending home sales numbers are an important indicator, as they cover contract signings and not closings, which means they often foreshadow upcoming sales data. More here.

20 Ideas for Easygoing Summer Parties

How To Keep Your House Cool This Summer

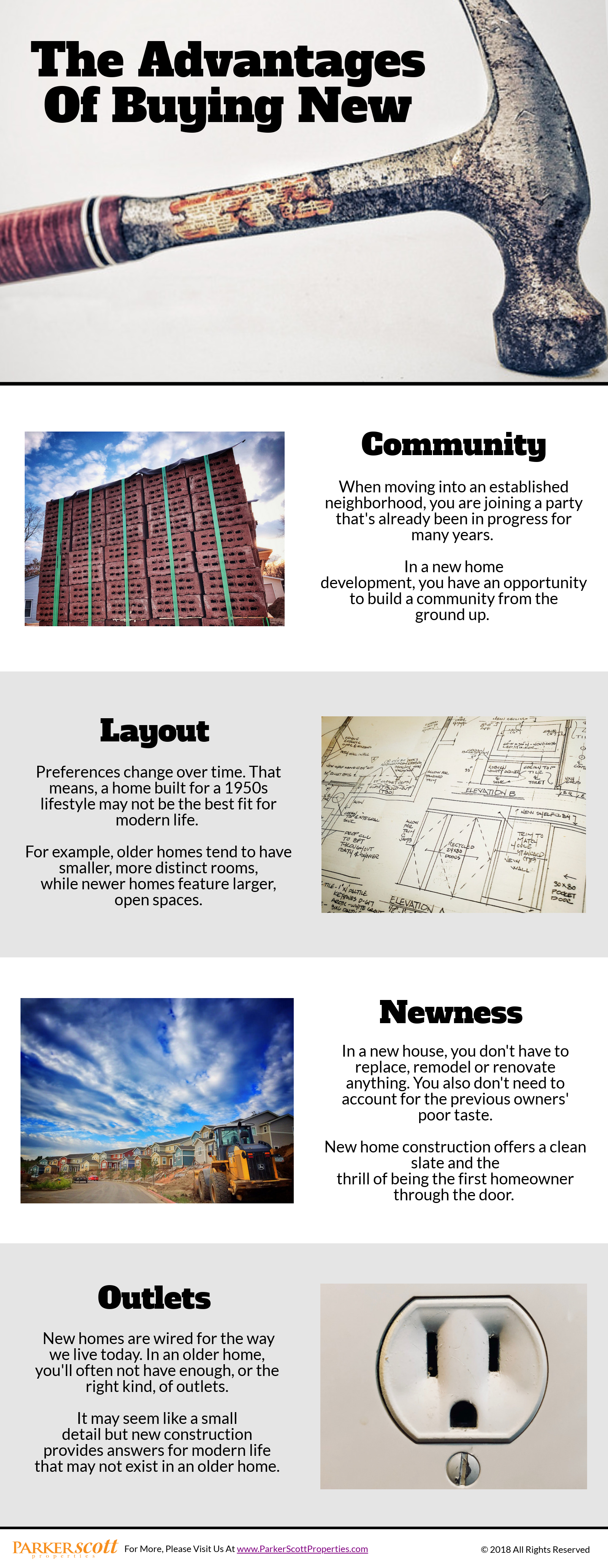

The Advantages Of Buying New

Where Are The Fastest Growing Luxury Markets?

When shopping for a house to buy, it’s hard not to fantasize about the homes just out of your price range. Regardless of what you plan to spend, it’s fun to imagine buying a house even bigger, nicer, and more feature filled than the ones within your reach. And, with the Internet, it’s easier than ever to steal a glance inside the nicest homes in the area. In fact, you can shop real estate in any area. But, while we’re all familiar with famous luxury markets such as Beverly Hills or Aspen, Colo., what are the nation’s lesser-known, up-and-coming luxury markets? Well, according to a new index from the National Association of Realtors’ consumer website, East Coast house hunters looking for a warm weather getaway have propelled Sarasota and Collier counties in Florida to two of the top five spots on the list of fastest growing luxury markets. Other areas that made the list include counties containing Castle Rock, Colo., San Jose, Calif., Queens N.Y., Seattle, Jersey City, and Redwood City, Calif. But, if you’re planning a move to one of these hot spots, you have to move fast as they all have seen 10 to 20 percent price increases over the past year. More here.

First Quarter Sees Return Of First-Time Buyers

First-time home buyers are an important demographic when it comes to the health of the housing market. Because they’ve historically accounted for about 40 percent of home sales, they garner a lot of attention from experts, economists, and analysts hoping to gauge how the market is doing and where it’s headed. In recent years, first-time buyers have been less active than usual. The financial crash and recession led to a long period where Americans of typical home-buying age did not have the economic stability or job security to feel comfortable pursuing homeownership. Then, even after economic conditions began to improve, a lack of affordable, starter homes kept many younger Americans on the sidelines. This year, conditions are still challenging but new numbers from Freddie Mac show things may finally be changing. That’s because, first quarter results show that first-time buyers accounted for 46 percent of new mortgages during the early part of this year. That’s the largest quarterly share since 2012 and an indication that young Americans are finally becoming more active in the real-estate market. More here.

Why The New Home Market Matters To You

If you aren’t in the market for a new home, why should you care about the new home market? Well, for starters, it plays a very important role in the health of the housing market. And that affects all buyers, not just new home buyers. How? Simply put, new home construction is the quickest way to add homes for sale to the market. And, when more homes are added, buyers can be more choosy, which results in less competition and fewer home price spikes. In other words, when new homes are being built and sold, the overall real estate market benefits, including buyers looking for an existing home in a more affordable price range. So, if that’s true, how’s the new home market doing? According to the latest numbers from the Commerce Department, new home sales were 11.6 percent above last year’s level in April, which is good. But, though year-over-year numbers are positive, recent revisions to totals from the first three months of the year were revised downward, indicating some lingering weakness in the market. More here.