Four Things To Do Before You Buy

When choosing where you’d like to live, there are a number of factors that you have to weigh. For example, some people may value privacy over convenience while others may prefer proximity to family and friends over entertainment and recreation options. In short, it’s a personal choice. And a lot of times it comes down to whether you’d like to live in a city setting or the suburbs. This is a common debate and one that typically falls along demographic lines. In other words, where you are in life will determine where you want to live. More proof of this is found in a recent report detailing the preferences of millennials. According to the results, young Americans overwhelming choose metropolitan areas known for their hip neighborhoods and closeness to job opportunities. In fact, a look at the top 10 zip codes with the largest population of millennials shows that areas like Chicago’s West Loop, Boston’s North End, and Manhattan’s Financial District are overwhelmingly popular with a younger demographic. Other city neighborhoods that make the list include Capitol Hill in Denver, Mission Bay in San Francisco, and Dallas’ Arts District. More here.

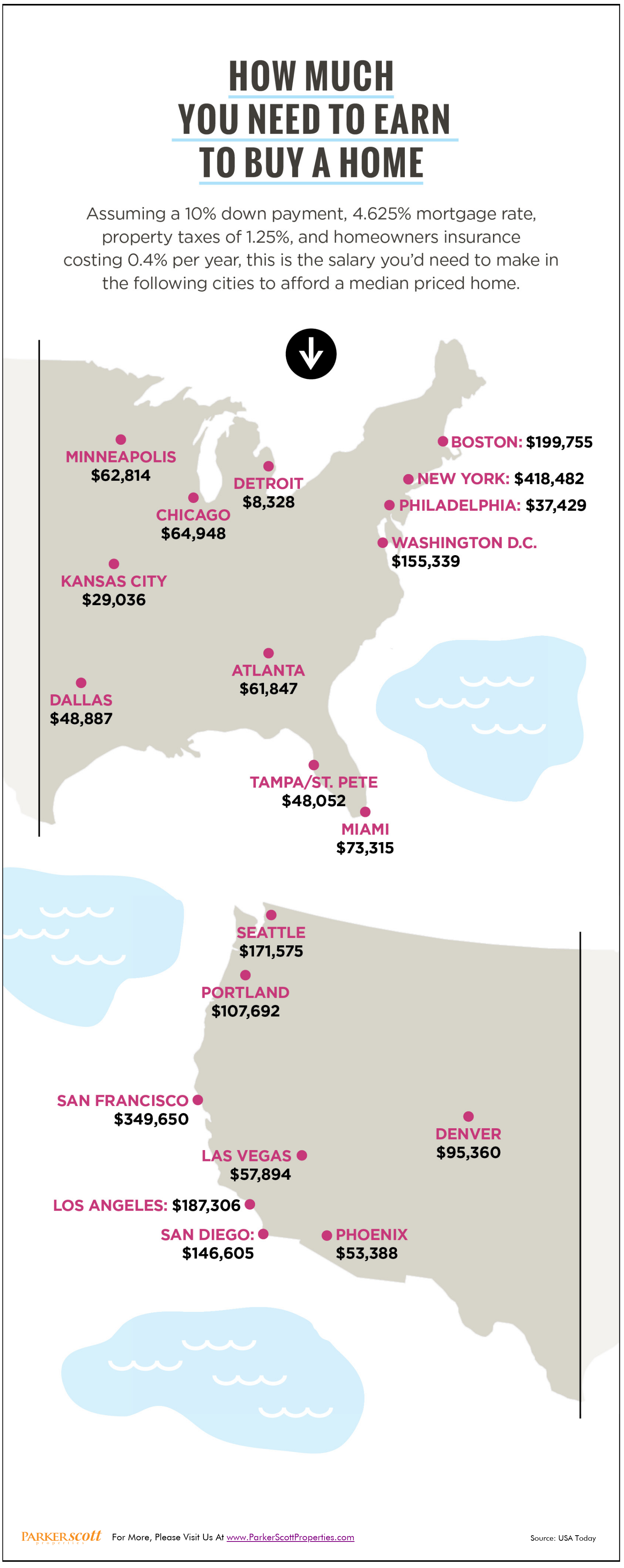

With rental costs and home prices both increasing, it’s become more challenging for renters to save for a down payment. How much so? Well, according to one recent analysis, the typical renter will have to save for nearly six and a half years to come up with a 20 percent down payment on a median-priced home. And, since the median home value is currently $216,000, depending on your prospective neighborhood, it could take even longer to save up for a house. Renters who aspire to homeownership shouldn’t get discouraged, though. Despite the fact that a 20 percent down payment is the standard amount recommended by financial experts, it is not a requirement in order to buy a house. In fact, depending on the particular terms of your mortgage, you can put down as little as 3 percent. In 2017, for example, 29 percent of first-time buyers had a down payment between 3 and 9 percent. That’s why it’s important to explore your options before deciding homeownership is out of reach. More here.

Home prices have been climbing for the past few years. And while that has presented affordability challenges for buyers in some markets, it’s also produced big gains for homeowners who’ve sold a home recently. Take, for example, new estimates showing that, nationally, the typical home seller, after living somewhere for eight years, made nearly $40,000 on their home sale. That’s good news for homeowners. And, in some markets, the sales gain is even higher. Homeowners in the Dallas-Fort Worth area saw a median sales gain of $56,297 after just 7.4 years and, in San Jose, sellers’ median price gain was nearly $300,000. But while that may be encouraging for anyone who hopes to sell soon, there is a flip side. Because many home sellers hope to use any money they make on their home sale as a down payment for their next home, the amount gained on a sale may not seem as significant, especially if you’re buying a home in the same market and price range. More here.

When it comes time to make a move, most of us are choosing between renting a place or buying a house. And making that calculation has a lot to do with where you are in your life and what your goals are. But it also has a lot to do with your financial situation. Because of this, ATTOM Data Solutions analyzes the average rent for a three-bedroom property, weekly wage data, and home price information in 540 counties nationwide in an effort to determine whether renting or buying is the more affordable choice. According to their most recent Rental Affordability Report, buying a home is still the more affordable choice in a majority of markets. However, the data is a bit more complicated than that. In fact, though buying is more affordable in the majority of markets, it isn’t in a lot of the country’s most populated counties. The data shows that many markets where the population is above 1 million have affordability challenges not seen in areas further from major metropolitan centers. More here.

Your sense of smell can be a peculiar thing. Odors that overwhelm some people, don’t affect others. And odors that you’re accustom to seem to disappear altogether after a while. So it’s no surprise that homeowners might worry that their home may be giving off an unpleasant scent. And, during the holidays, this becomes even more of a concern, as it’s a popular time of year to have houseguests. Fortunately, there are some fairly common places you can target to ensure that you’ve eliminated any odors that may be going undetected. One of the more obvious targets is pets. If you have animals in your home, make sure you clean their favorite places, pillows, beds, and blankets, etc. Basements and bedding are also common places for odors to linger. Mold and mildew can cause mustiness in basement areas but can also be detected by sight, which makes addressing it even easier. Be sure also to keep your bedding clean and your mattress fresh. Another obvious spot to check for odors is your refrigerator and freezer. Check that there’s no grime, grit, or leftovers lurking in the back that are emitting odors. Overall, paying some regular attention to these hot spots can help remove any worry about how your home smells to holiday house guests or, if you’re selling your home, potential buyers. More here.

Who Buys Vacation Homes And Where They Buy

Everyone, at one time or another, has dreamed of buying a vacation home. Whether it was just a temporary fantasy brought on by a particularly perfect trip or it was something more real, it’s hard not to think about the joys of owning a place in your favorite town or getaway spot. But who’s actually buying vacation homes and where are the most popular locations to have a house? Well, the National Association of Realtors collects that info each year as part of their Investment and Vacation Home Buyers Survey. This year’s results show that, among vacation home buyers, the South is the most popular area to buy. In fact, a full 47 percent of vacation homes bought last year were purchased in the South. The West came in second with 25 percent. Also, beach houses outpace all others, with sales more than doubling the number of homes purchased in the mountains, at a lake, or in the country. And who’s most likely to buy a vacation home? Not surprisingly, Lawrence Yun, NAR’s chief economist, says older buyers. “Baby boomers at or near retirement continue to propel the demand for second homes, although headwinds softened the overall volume of vacation sales last year,” Yun said. In 2015, the median household income of a vacation home buyer was $103,700 and the property they purchased was a median distance of 200 miles away from their primary home. More here.