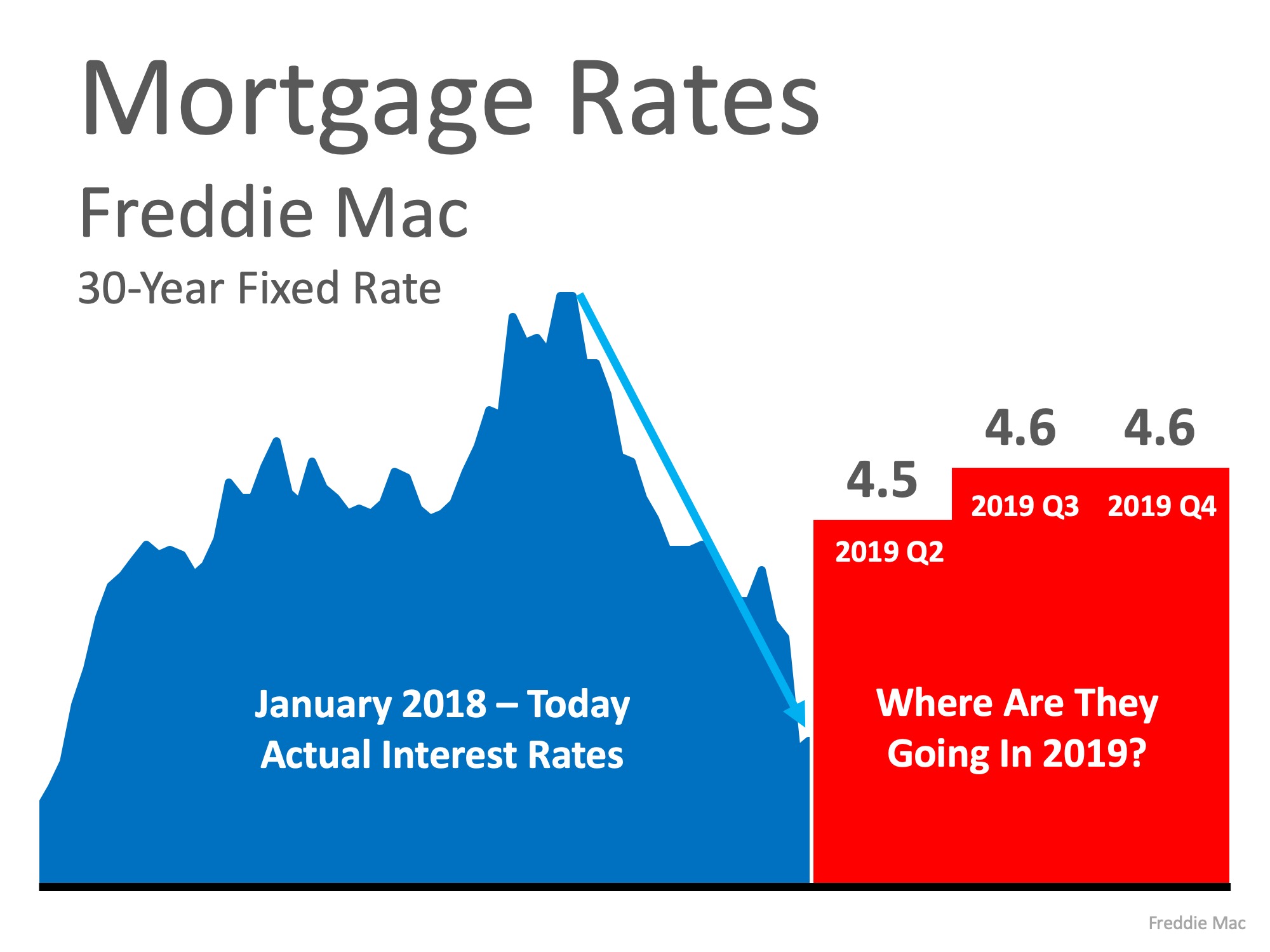

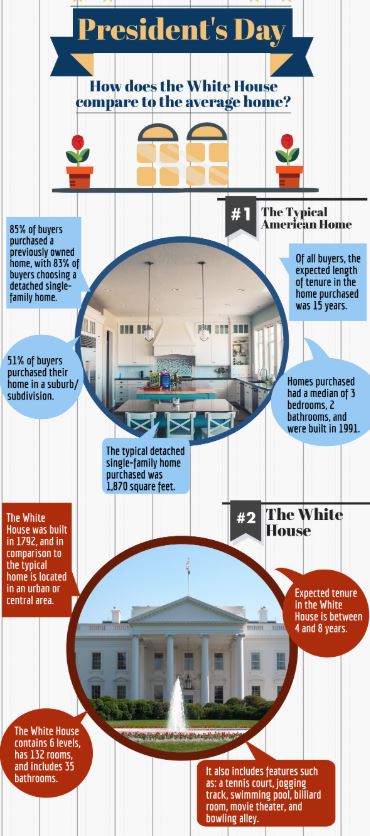

The housing crisis is finally in the rear-view mirror as the real estate market moves down the road to a complete recovery. Home values are up and distressed sales (foreclosures and short sales) have fallen to their lowest point in years. The market will continue to strengthen in 2019.

However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory! Buyer demand naturally increases during the summer months, but supply has not kept up.

Here are the thoughts of a few industry experts on the subject:

Lawrence Yun, Chief Economist at National Association of Realtors

“Further increases in inventory are highly desirable to keep home prices in check, the sustained steady gains in home sales can occur when home price appreciation grows at roughly the same pace as wage growth.”

Jessica Lautz, Vice President of NAR

“There’s a supply-demand mismatch… More inventory is needed at the lower end and a price reduction may be needed at the upper end.”

Danielle Hale, Chief Economist of Realtor.com

“Heading into spring, U.S. prices are expected to continue to rise and inventory is expected to continue to increase, but at a slower pace than we’ve seen the last few months as fewer sellers want to contend with this year’s more challenging conditions… A buyer’s experience will vary notably depending on the market and price point they’re targeting.”

Bottom Line

If you are thinking of selling, now may be the time! Demand for your house will be strong at a time when there is very little competition. That could lead to a quick sale for a really good price!