It isn’t news that home prices have been headed upward for awhile now. And, according to the latest S&P Case-Shiller Home Price Indices, they are continuing to climb at around the same pace as they have been in recent months. Which is to say, the price increases haven’t yet slowed. Of course, how quickly prices are increasing depends on where you’re looking to buy. Large metropolitan areas – and especially those in the West – are seeing the sharpest increases, while the price gains are more muted in the Midwest. But, no matter where you are, the best way to prepare for higher prices is to know what you want, what you can afford, and where your limits are. In competitive and higher priced markets, having a firm idea of what you can spend and where you’ll compromise will make it less likely that you’ll end up going over budget because of a bidding war or buying more house than you can comfortably afford. Making sure you’re prepared before heading out to look at homes also means securing financing in advance, so you’ll be ready to make an offer when you find a home you love. More here.

Young Adults Hold Key To This Year’s Market

First-time home buyers are an important demographic when tracking the health of the housing market. That’s because, they typically make up nearly half of all home sales. In recent years, however, young Americans have been buying fewer homes than in the past. In fact, Freddie Mac’s most recent monthly outlook says 15 percent of young adults between the ages of 25 and 35 are living in their parents’ home – a five percent increase from 2000. However, it isn’t because they’re not interested in homeownership. Largely, the economy and a lack of affordable starter homes have been to blame for a lower-than-normal number of first-time home buyers. But with an improved economy and job market, will more young adults become buyers this year? Len Kiefer, Freddie Mac’s deputy chief economist, says there’s reason for optimism. “Starting off the year, things are looking pretty good for the U.S. economy and housing markets,” Kiefer says. “Mortgage rates are low, economic growth has accelerated in recent quarters, and housing is coming off its best year in a decade.” More here.

Buyer Basics: What’s A Contingency?

What To Do If You Live In A Competitive Market

These days, competition and affordability are two of home buyers’ main concerns. This isn’t surprising, as no one likes to pay more for less. Naturally, we prefer to find a bargain and we certainly don’t want to have to fight off other interested buyers to get it. That’s why recent research looking at the country’s most competitive markets is of interest. The results show the most competitive markets are located in the West, though in just about any desirable neighborhood you could find more buyers than available homes. That means, even if you aren’t living in San Francisco or Seattle, you should be ready for the possibility that you won’t be the only home buyer interested in the house you choose. So what’s the best way to increase your odds of beating the competition and getting the house you want? Preparation. Be prepared and get prequalified before you start shopping. Buyers with financing in place before they start looking at houses are more appealing to sellers. If you’ve got your financing in place and a firm idea of what your price range and budget are, you will be in better position should you find yourself in a bidding war. More here.

Buying More Affordable Than Rent In Most Markets

When it comes time to make a move, most of us are choosing between renting a place or buying a house. And making that calculation has a lot to do with where you are in your life and what your goals are. But it also has a lot to do with your financial situation. Because of this, ATTOM Data Solutions analyzes the average rent for a three-bedroom property, weekly wage data, and home price information in 540 counties nationwide in an effort to determine whether renting or buying is the more affordable choice. According to their most recent Rental Affordability Report, buying a home is still the more affordable choice in a majority of markets. However, the data is a bit more complicated than that. In fact, though buying is more affordable in the majority of markets, it isn’t in a lot of the country’s most populated counties. The data shows that many markets where the population is above 1 million have affordability challenges not seen in areas further from major metropolitan centers. More here.

A Few Small Repair Jobs To Do This Winter

Get a Head Start on Planning Your Garden, Even if It’s Snowing

The Total Value Of All The Homes In the US

Perhaps you’ve never thought about how much all the homes in the country would cost if their values were totaled. But, according to recently released data from Zillow, that number is now $31.8 trillion – and that’s up $2 trillion from the year before. Zillow senior economist Aaron Terrazas says the national housing stock hit record heights in 2017. “Strong demand from buyers and the ongoing inventory shortage keep pushing values higher, especially in some of the nation’s booming coastal markets,” Terrazas said. In fact, the New York and Los Angeles markets alone account for more than 8 percent of the value of all U.S. housing. According to the report, each are now worth more than $2.5 trillion. Among the cities seeing the most rapid growth, Columbus led the way, with a 15.1 percent increase – though San Jose, Dallas, Seattle, Tampa, Las Vegas, and Charlotte also grew by more than 10 percent over the past year. More here.

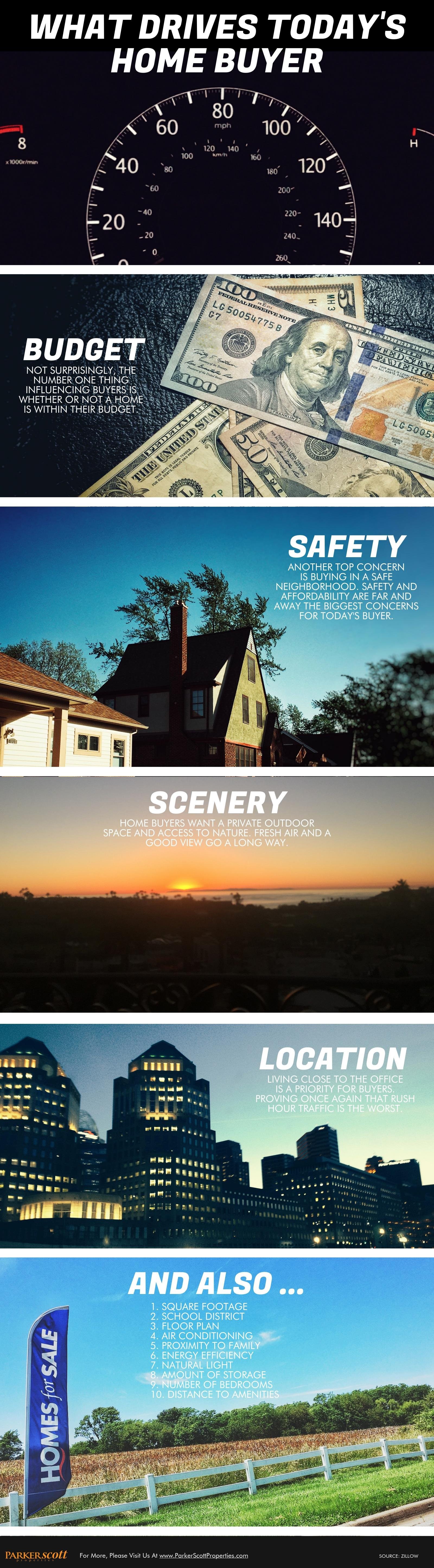

What Drives Today’s Home Buyer

The One Thing Home Buyers Won’t Compromise On

Buying a home means making a lot of choices. You’re going to have to make decisions on everything from how far you’re willing to drive to work and how much storage space you’ll need for all your stuff. The best way to handle the long list of choices you’re going to have to sort through is by breaking into things you can live without and things you have to have. Deciding in advance where you will and won’t compromise will make the buying process easier once you’re fully submerged. So what are the things home buyers are least willing to give up on? Well, according to one recent survey, most buyers say they want a house that doesn’t require a lot of renovations or upgrades. In fact, nearly one third of respondents said this was non-negotiable. And that makes sense. After all, who wants to go through the ups-and-downs of the home buying process only to move into a house that requires months worth of work before you can enjoy it? Other things buyers said they wouldn’t compromise on included a bigger home, outdoor space, a great neighborhood, and a shorter commute. More here.