Most regions offer house hunters a variety of architectural styles to choose from. Whether you prefer bungalows to ranches or modern over contemporary, you can likely find something that fits your preference. But, according to one recent survey, what you’re looking for might depend on your age. That’s because the results show millennial home buyers are looking for a different kind of home than older buyers. For example, younger buyers expressed a preference for colonial and contemporary homes, when they had a preference at all. On the other hand, buyers over the age of 55 were much more interested in finding a ranch – which is an architectural style favored by only 6 percent of millennials. Of course, some of this has to do with practicalities – such as retirees in search of a one-story home because it eliminates any concern about future mobility and navigating stairs – but it’s also a question of personal taste and aesthetics. Ultimately, though, whatever type of house Americans say they prefer, they generally all say they want that house to have ample storage, a garage, and multiple bedrooms. More here.

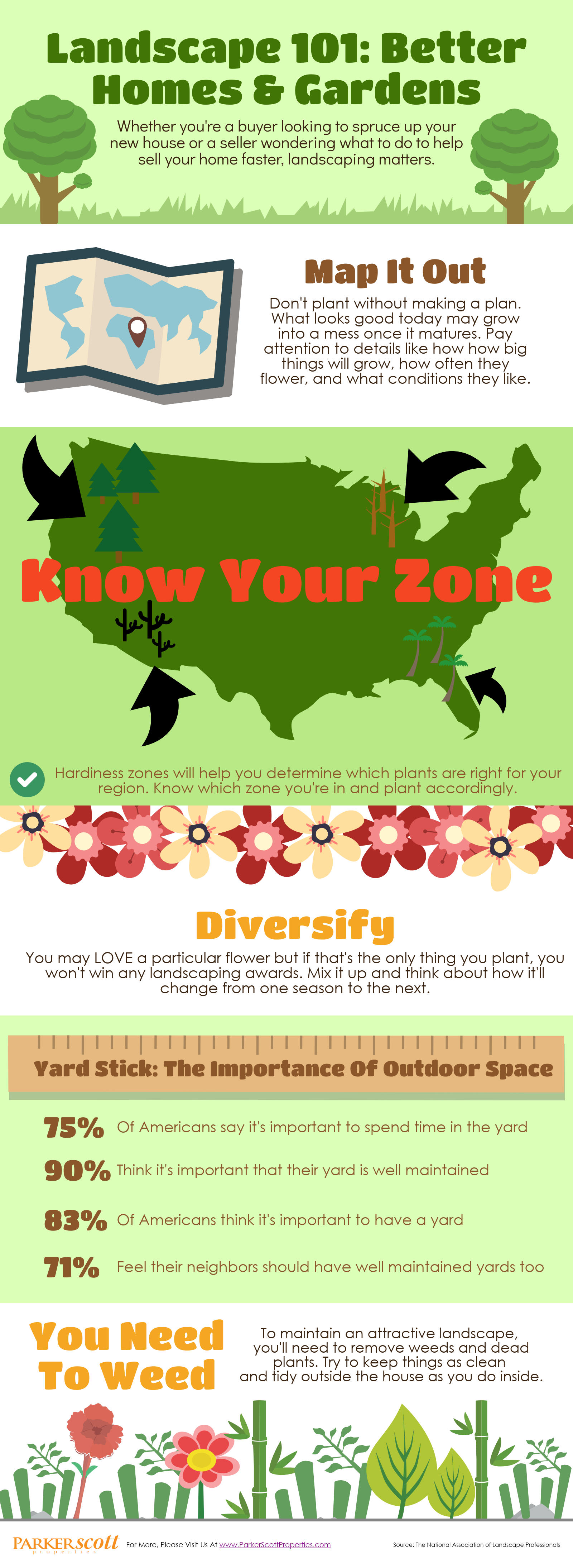

If you’re a homeowner, you know the to-do list is never ending. And, if you’re a buyer, you’ll know soon enough. That’s because, owning a home means maintaining a home. Proof of that can be seen in the fifth annual LightStream Home Improvement Survey. According to the results, 58 percent of surveyed homeowners say they’re planning to spend money on home improvement projects in 2018. And the number who said they plan on spending $35,000 or more has doubled from last year. But though there are more homeowners planning projects this year, the list of projects hasn’t changed all that much. Once again, outdoor upgrades remain the most popular, with decks, patios, and landscape projects topping the list. Kitchen and bathroom remodels, of course, also rank high, coming second and third on Americans’ home improvement, to-do list. So how are these homeowners planning on paying for all these upgrades and renovations? Well, the vast majority said they were paying for their projects out of savings. However, another way homeowners are saving on their home improvement bills is by doing, at least, some of the work themselves. More

If you’re a homeowner, you know the to-do list is never ending. And, if you’re a buyer, you’ll know soon enough. That’s because, owning a home means maintaining a home. Proof of that can be seen in the fifth annual LightStream Home Improvement Survey. According to the results, 58 percent of surveyed homeowners say they’re planning to spend money on home improvement projects in 2018. And the number who said they plan on spending $35,000 or more has doubled from last year. But though there are more homeowners planning projects this year, the list of projects hasn’t changed all that much. Once again, outdoor upgrades remain the most popular, with decks, patios, and landscape projects topping the list. Kitchen and bathroom remodels, of course, also rank high, coming second and third on Americans’ home improvement, to-do list. So how are these homeowners planning on paying for all these upgrades and renovations? Well, the vast majority said they were paying for their projects out of savings. However, another way homeowners are saving on their home improvement bills is by doing, at least, some of the work themselves. More