First-time home buyers are an important demographic when it comes to the health of the housing market. Because they’ve historically accounted for about 40 percent of home sales, they garner a lot of attention from experts, economists, and analysts hoping to gauge how the market is doing and where it’s headed. In recent years, first-time buyers have been less active than usual. The financial crash and recession led to a long period where Americans of typical home-buying age did not have the economic stability or job security to feel comfortable pursuing homeownership. Then, even after economic conditions began to improve, a lack of affordable, starter homes kept many younger Americans on the sidelines. This year, conditions are still challenging but new numbers from Freddie Mac show things may finally be changing. That’s because, first quarter results show that first-time buyers accounted for 46 percent of new mortgages during the early part of this year. That’s the largest quarterly share since 2012 and an indication that young Americans are finally becoming more active in the real-estate market. More here.

What Is The Most Prosperous City In The US?

Prosperous is defined as “successful in material terms; flourishing financially.” And, while money isn’t everything, it’s safe to say we all want to be successful and wouldn’t mind flourishing financially. So where in the country is the best place to live if you want some prosperity? Well, the answer might surprise you. That’s because a new study – looking at factors such as population, median income, home values, share of inhabitants holding higher education degrees, poverty rate, and unemployment – determined that Odessa, Texas was the the top city for prosperity, beating out heavy hitters like Washington DC, New York, Los Angeles, Atlanta, and Charleston. So what about Odessa makes it the most prosperous city in America? Well, from 2000 to 2016, the city experienced a 38 percent spike in income growth, home values rose 91 percent, and the poverty rate dropped by 36 percent. Those are some impressive numbers but the story behind the story is that Odessa benefited from a surge in crude oil production, which boosted the city’s fortunes and lifted it to the top spot on the list. More here.

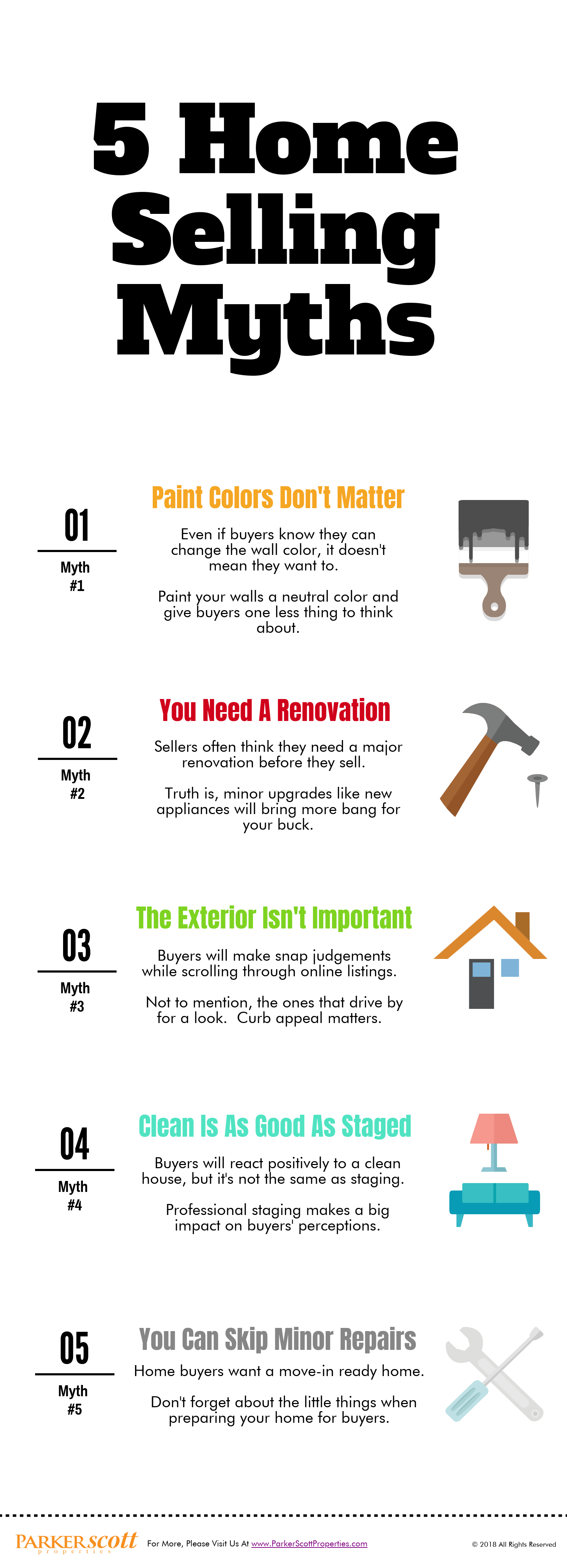

5 Home Selling Myths

Rising Incomes Help To Offset Affordability Challenges

After the financial crisis and housing crash, there were plenty of homes for sale but very few interested buyers. Americans were financially unstable and worried about keeping their jobs. And while they may’ve liked to buy a home, it wasn’t the right time. Gradually, though, Americans became more secure in their jobs and more interested in buying a home. But, at the same time, the housing market also began bouncing back. And with prices higher and mortgage rates beginning to rise, Americans wanted to buy but began to worry about whether or not they could afford it. This year, with inventory low, prices rising, and mortgage rates creeping up, buyers face some challenges. Fortunately, though, new research shows incomes are also on the rise. The National Association of Home Builders’ Housing Opportunity Index, for example, shows Americans are making more money, which is helping to offset declining affordability. In fact, median family income is up from $68,000 last year to $71,900. And, at that income, 61.6 percent of recently sold homes were affordable. More here.

A First-Time Buyer’s Guide to Home Maintenance

May Newsletter

Prices Below Peak In Nearly Half Of All Markets

If you’ve been at all interested in shopping for a home, you’ve likely heard news about rising home prices. Since the housing crash, home values have rebounded and, in some areas, the climb has been quick. However, news about increasing prices should be measured against how far they fell. In other words, though prices have rebounded, they are still below their previous peaks in many markets. In fact, according to recent numbers from ATTOM Data Solutions, median home prices are still below their pre-recession peaks in 46 percent of the 105 metro areas analyzed – including cities like Chicago, Baltimore, Tucson, Las Vegas, and New York-Newark-Jersey City. That’s why it’s always a good idea to look into where prices are in the specific neighborhoods where you’d most be interested in buying. Price increases will vary from one city to the next. So there may still be opportunities for buyers in the areas you’d like to live, despite home prices’ overall upward trend. More here.

How To Know When It’s Your Time To Buy

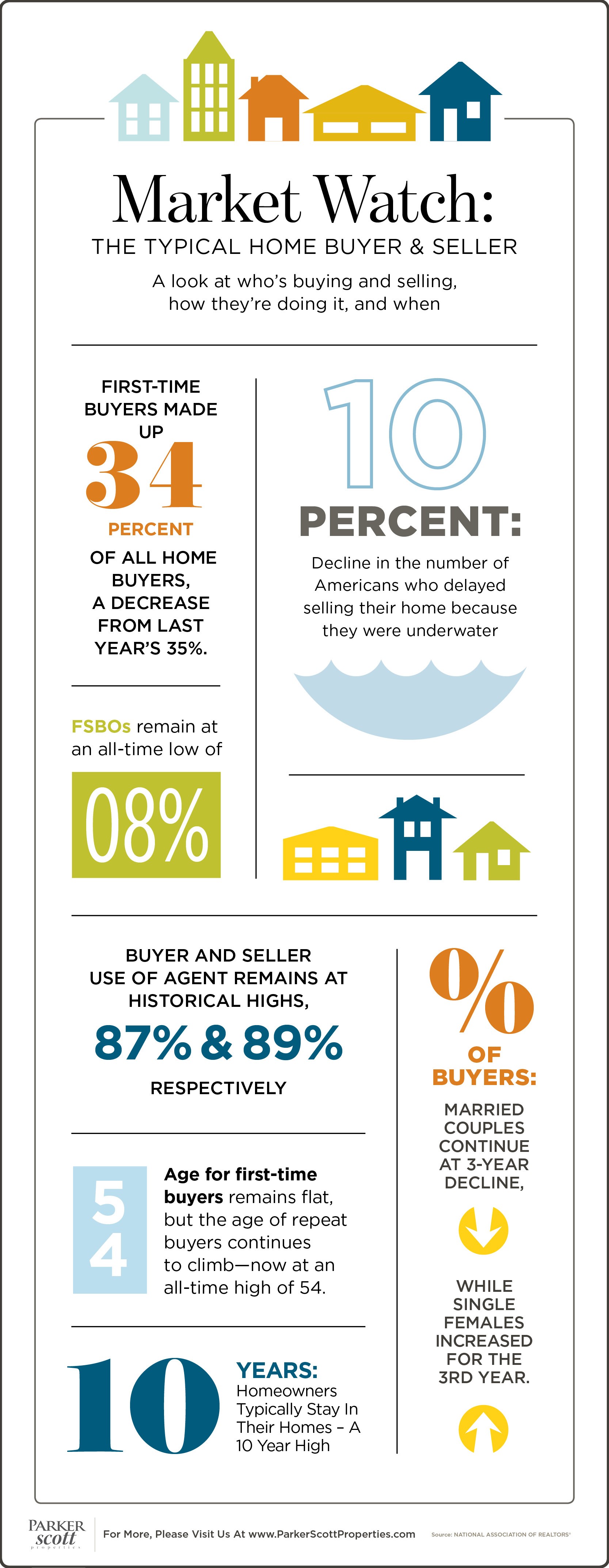

MARKET WATCH: The Typical Home Buyer & Seller

What To Look for When Looking At Homes