Landscape 101: Better Homes & Gardens

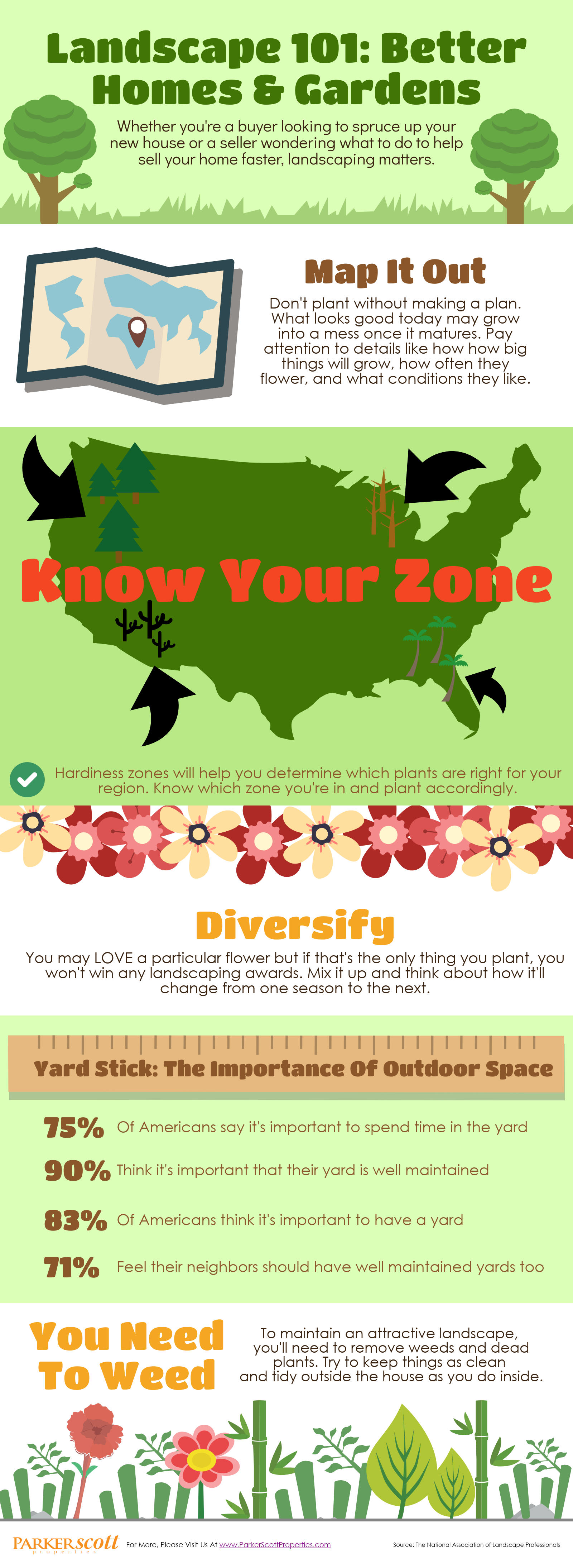

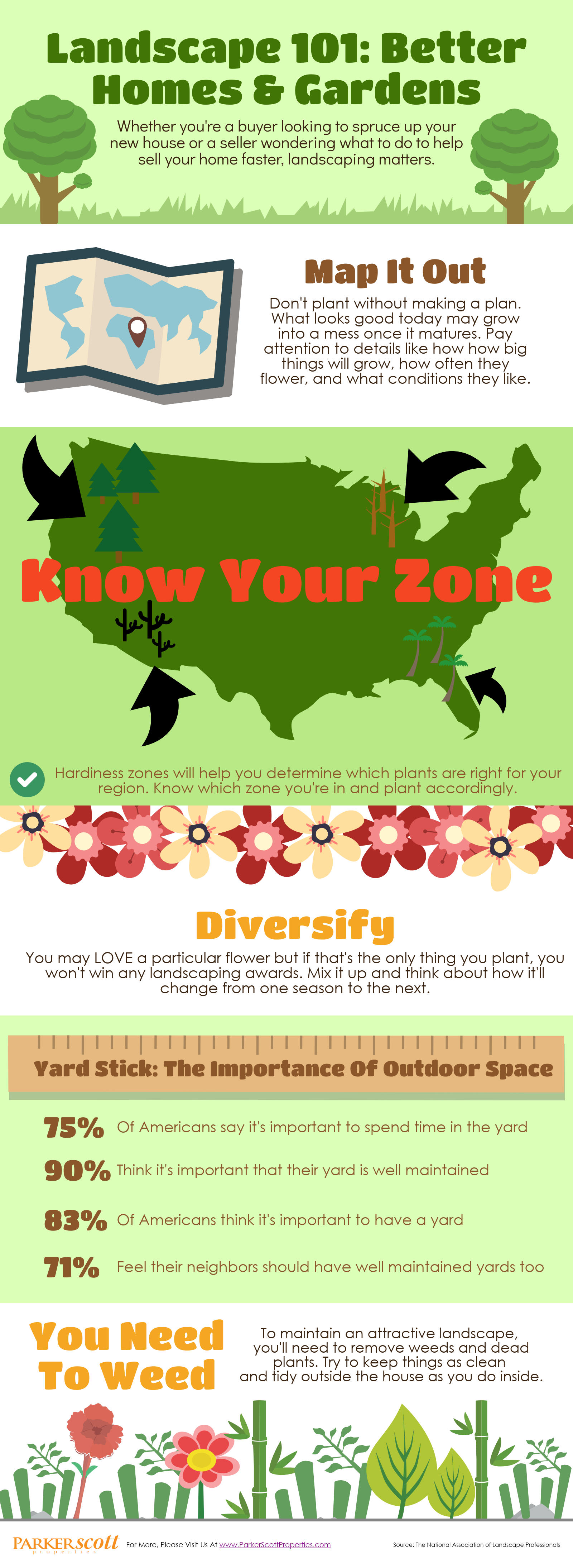

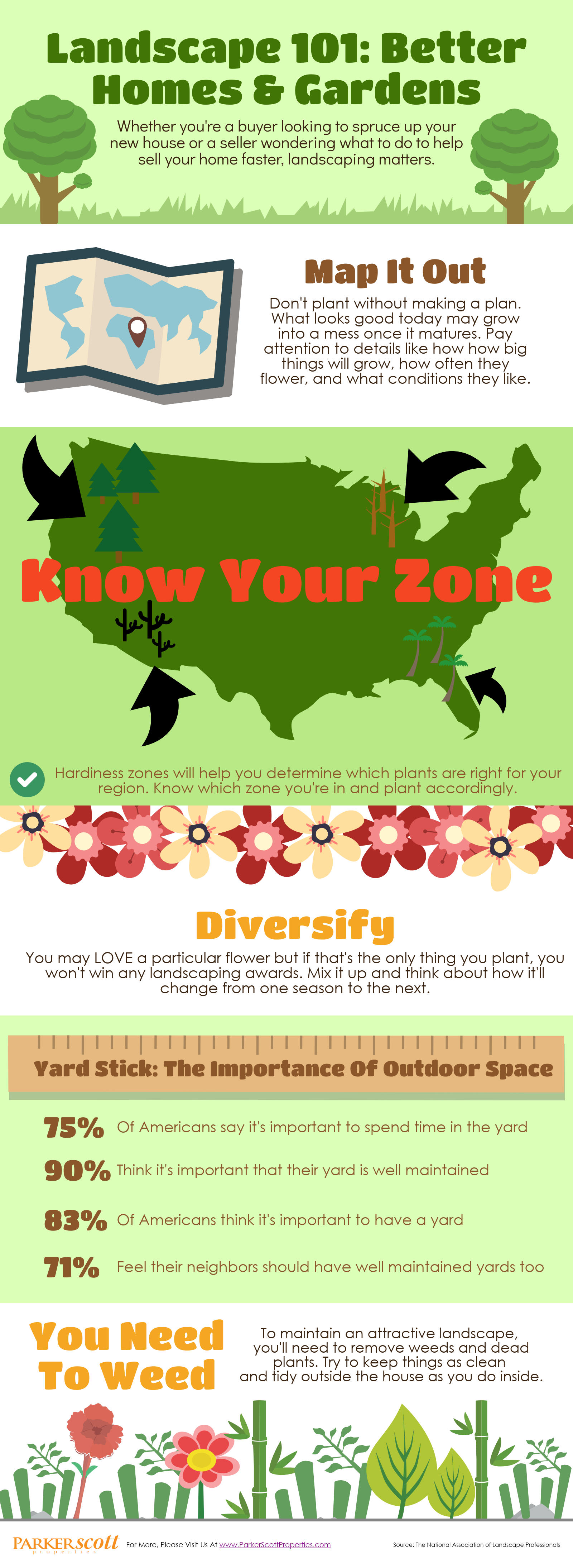

If you’re a homeowner, you know the to-do list is never ending. And, if you’re a buyer, you’ll know soon enough. That’s because, owning a home means maintaining a home. Proof of that can be seen in the fifth annual LightStream Home Improvement Survey. According to the results, 58 percent of surveyed homeowners say they’re planning to spend money on home improvement projects in 2018. And the number who said they plan on spending $35,000 or more has doubled from last year. But though there are more homeowners planning projects this year, the list of projects hasn’t changed all that much. Once again, outdoor upgrades remain the most popular, with decks, patios, and landscape projects topping the list. Kitchen and bathroom remodels, of course, also rank high, coming second and third on Americans’ home improvement, to-do list. So how are these homeowners planning on paying for all these upgrades and renovations? Well, the vast majority said they were paying for their projects out of savings. However, another way homeowners are saving on their home improvement bills is by doing, at least, some of the work themselves. More here

If you’re a homeowner, you know the to-do list is never ending. And, if you’re a buyer, you’ll know soon enough. That’s because, owning a home means maintaining a home. Proof of that can be seen in the fifth annual LightStream Home Improvement Survey. According to the results, 58 percent of surveyed homeowners say they’re planning to spend money on home improvement projects in 2018. And the number who said they plan on spending $35,000 or more has doubled from last year. But though there are more homeowners planning projects this year, the list of projects hasn’t changed all that much. Once again, outdoor upgrades remain the most popular, with decks, patios, and landscape projects topping the list. Kitchen and bathroom remodels, of course, also rank high, coming second and third on Americans’ home improvement, to-do list. So how are these homeowners planning on paying for all these upgrades and renovations? Well, the vast majority said they were paying for their projects out of savings. However, another way homeowners are saving on their home improvement bills is by doing, at least, some of the work themselves. More here

A “bedroom community” refers to a suburb outside a major metropolis where the majority of residents commute to the city for work. These town have a number of characteristics that identify them but, according to new research from NeighborhoodScout, they are also known for safety. In fact, these suburban cities topped their most recent list of the nation’s safest cities. Andrew Schiller, CEO of NeighborhoodScout, says bedroom communities combine features that are attractive to home buyers. “We continue to see bedroom communities, which are within large metro areas and near major urban centers like Boston, Chicago, and New York, make the top of our list,” Schiller says. “These safe communities within the urban/suburban fabric of America’s largest metropolitan areas often combine access to high-paying jobs in the urban center, decent schools, and a high quality of life. This access to opportunity increases home values, with the result often being lower crime.” Cities in the Northeast topped the list, including Ridgefield, CT, which was named the country’s safest city. More here.

It isn’t news that home prices have been headed upward for awhile now. And, according to the latest S&P Case-Shiller Home Price Indices, they are continuing to climb at around the same pace as they have been in recent months. Which is to say, the price increases haven’t yet slowed. Of course, how quickly prices are increasing depends on where you’re looking to buy. Large metropolitan areas – and especially those in the West – are seeing the sharpest increases, while the price gains are more muted in the Midwest. But, no matter where you are, the best way to prepare for higher prices is to know what you want, what you can afford, and where your limits are. In competitive and higher priced markets, having a firm idea of what you can spend and where you’ll compromise will make it less likely that you’ll end up going over budget because of a bidding war or buying more house than you can comfortably afford. Making sure you’re prepared before heading out to look at homes also means securing financing in advance, so you’ll be ready to make an offer when you find a home you love. More here.

There’s no shortage of opinions, these days. Which means, you’ve probably heard varying viewpoints on whether or not buying a house is really a smart investment. Especially following the housing crash, it became more popular to say that buying a home may not, in fact, be a better financial choice than renting. But despite the debate, recent research shows that the vast majority of Americans still see homeownership as a path to increased financial security. For example, a recent survey from NeighborWorks found 81 percent of all adults and 71 percent of millennials believe owning a home is good for financial stability. Among the reasons this remains true is the fact that, unlike rent, your monthly mortgage payment is actually buying you an increasing percentage of ownership in your home. As you build up a larger share of ownership and your equity increases, so does your net worth – making homeownership an excellent way of investing in something long term while also enjoying the immediate benefits. More here.