May Newsletter

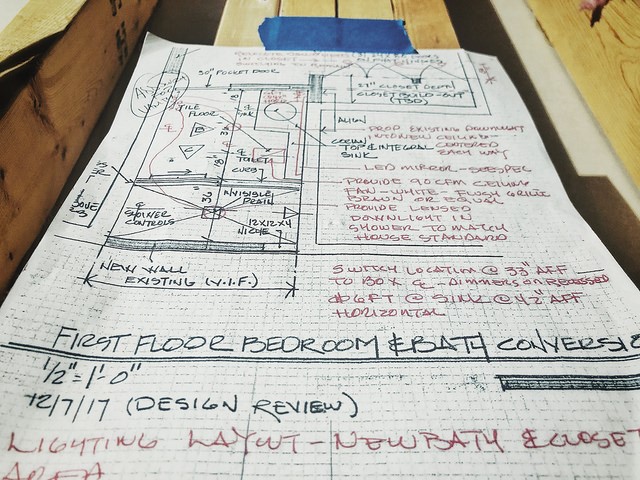

Busy Buyers Say They Hope To Avoid Renovations

Unless you’re buying a new house, you’re likely to be choosing which house to buy based on how much work it might need. And if you don’t have the time and expertise to do the work yourself, you’re going to have to factor possible remodeling costs into your buying equation. In other words, it can get complicated. That’s why, today’s home buyer says they’re looking for a move-in ready home that requires very little renovation. Busy schedules and tight budgets mean many Americans don’t have the resources or time to invest in a major kitchen overhaul or bathroom upgrade. But is it realistic to expect to find the perfect home in perfect condition at a time when many markets have lower-than-normal inventory levels? Well, probably not. That’s why buyers should have an idea about what they will or won’t compromise on before heading out to shop homes. Conversely, home sellers should think about any investments they can make before listing that might help sell their house at a higher price.

Homes Sell At Fastest Recorded Pace In 2017

Making big decisions quickly is not usually a recipe for success. However, in today’s housing market, that’s exactly what home buyers have to do. That’s because homes are selling faster than ever these days. In fact, according to a recent analysis, the average home took 81 days to sell last year. And that includes closing, which usually takes four to six additional weeks. In other words, since many markets have more buyers than they do available homes, houses for sale are selling fast. So what should buyers do to prepare for possible competition? Well, for starters, adjust your expectations. A recent report from Zillow found the average buyer spends just over four months searching for a home and makes two offers before successfully buying a house. That means, expect a process. Outside of that, be prepared. Get prequalified, know what you want, what you want to spend, and what your dealbreakers are. The more prepared you are, the more likely you’ll make good decisions, even if they have to be made quickly. More here.

How To Know When It’s Your Time To Buy

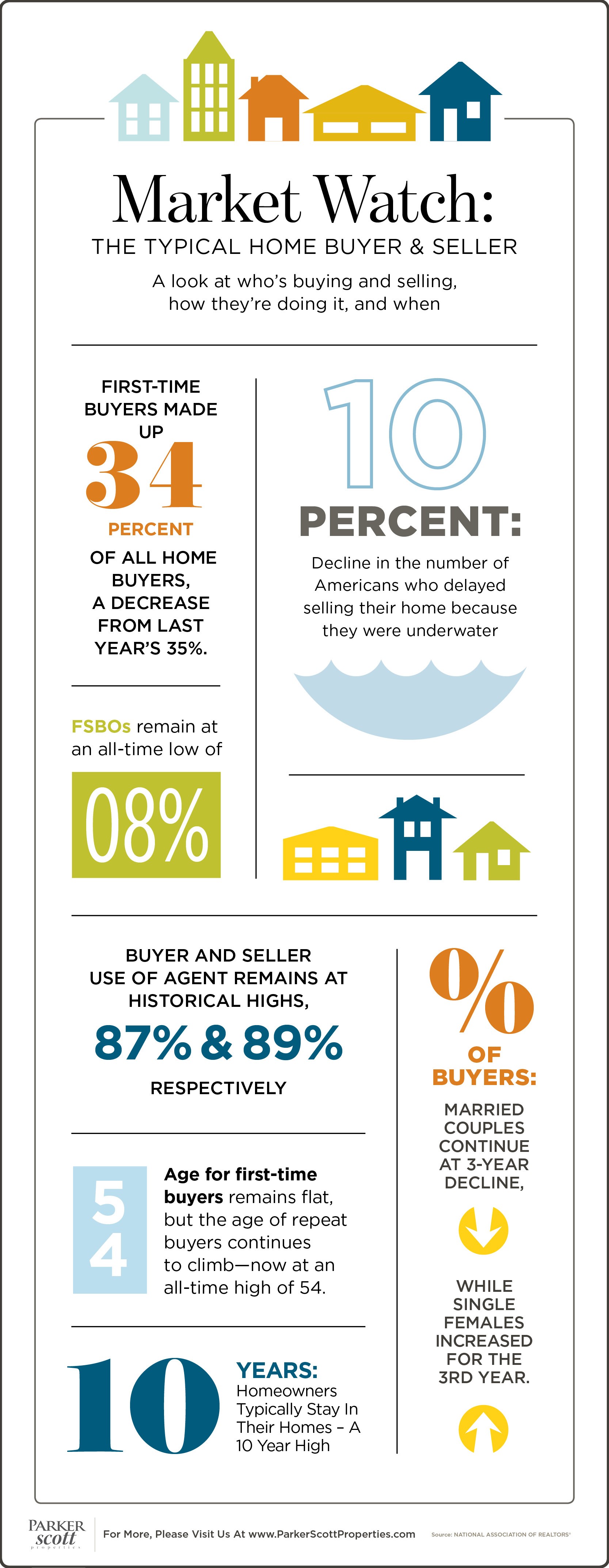

MARKET WATCH: The Typical Home Buyer & Seller

What To Look for When Looking At Homes

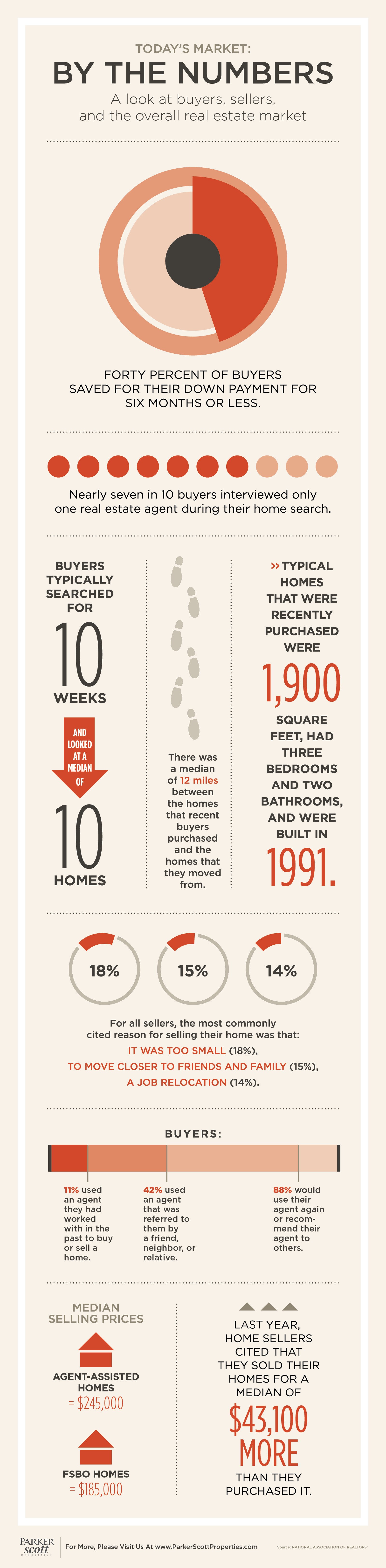

Today’s Market By The Numbers

How Mortgage Rate Increases Affect Home Buyers

Mortgage rates have been increasing lately and there is an expectation that they will move higher this year. But while home prices get a lot of attention, rising mortgage rates are a little more difficult for buyers to calculate in terms of what it will cost them. Here’s some help. According to one recent model, a less than one percent increase in mortgage rates over the next year would result in a $100 increase to the typical monthly mortgage payment. But since the costs of homeownership are influenced by many different factors, this projection has to make certain assumptions about things like the rate at which home prices will increase, for example. In other words, any increase to mortgage rates will cost home buyers but just how much is difficult to calculate precisely. So what should home buyers expect? Well, since a stronger economy and improved job market make it more likely that the Fed will raise interest rates further this year, buyers should expect that mortgage rates will remain low by historical standards but continue to edge higher, taking monthly mortgage payments higher along with them. More here.

Homes Stay On The Market For Fewer Days

These days, there are a lot of people interested in buying a house. A stronger economy, more jobs, and years of pent-up demand have led to a rising number of Americans who are eager to make a move. But while that’s positive, more buyers active in the market also means homes sell faster. In fact, according to Nationwide’s recent Health of Housing Markets Report, the average home was on the market for just 67 days in 2017 – with houses in some market going in half that time. That means, buyers need to do their homework, cause they may not have the luxury of being able to take their time debating each home’s pros and cons. It also means good news for sellers. “As we head into spring and the traditional season when sales heat up, buyers will find that desirable homes won’t be on the market for long,” says David Berson, Nationwide’s senior vice president and chief economist. “Today, the average home is on the market almost half the length of time that it was six years ago. Of course, that is good news for people looking to sell their home.” More here.