As everyone knows, real estate is mostly about location. What $500,000 buys you in one neighborhood will be far different than what it affords you in another. Put another way, your money will go a lot farther in the Midwest than it will on the West Coast. Which is why a recent analysis showing a growing number of cities where the median home value is $1 million or more isn’t quite what it initially seems. Though it’s true that the number of million dollar cities has doubled over the past five years and that, within a year, there will likely be 23 more, a closer look at where these cities are will help explain the numbers. That’s because most of those new million dollar cities are located in areas that are already among the most expensive in the country. For example, more than half of the new metros added will be in the areas surrounding major cities like Los Angeles, New York, Seattle, and San Jose. Which means, while it still represents an increase in home values across the country, the growing number of million-dollar metros doesn’t necessarily reflect an acceleration in home price increases. More here.

Remodeling Index Finds Home Repairs On The Rise

Maintenance is a big part of being a homeowner. Put simply, owning a home means having a never-ending to-do list and, depending on your level of know-how, some of it will require the help of a professional. These jobs can range from major renovations such as putting an addition on your house to basic upkeep and repairs like having ducts cleaned and fixing leaks. Essentially, you are your home’s temporary caretaker and how well you take care of it will affect not only how comfortable and enjoyable your home is to live in but also how much you can ask for it when you sell. These days, it seems Americans are increasingly interested in fixing up their homes. In fact, newly released data from the National Association of Home Builders shows home remodeling contractors are busy right now. So what kind of jobs are most in demand? Well, results show demand is highest for basic maintenance and repairs, while additions and alterations – both major and minor – saw slight declines during the second quarter. In short, Americans are tackling their to-do lists and fixing up their homes. This could be due to improved economic conditions and a stronger job market, though it may also be that current homeowners are tending to their homes in hopes of listing them someday soon. More here.

A Beginner’s Guide to Managing a Remodel

What Do Homeowners Do With Their Equity?

One of the main arguments in favor of buying a home is equity. When you rent, you’re sending your monthly payment to a landlord. As a buyer, your monthly mortgage payment is helping to build equity. Of course, many homeowners wait and then, following the sale of their house, use their accumulated equity to help buy their next home. But you can also use a home equity loan to access the value your home has accrued. So what do homeowners who take home equity loans do with the money? Well, a recent survey asked borrowers and came up with an answer. Not surprisingly, the top reason homeowners took out loans was to fund home improvement or remodeling projects. This is a common strategy since taking out a loan to improve your house means you may be able to recoup some of the cost if, and when, you sell the home. Other common answers included money to invest in another property, emergency expenses, retirement funds, and debt consolidation. More here.

First Quarter Sees Return Of First-Time Buyers

First-time home buyers are an important demographic when it comes to the health of the housing market. Because they’ve historically accounted for about 40 percent of home sales, they garner a lot of attention from experts, economists, and analysts hoping to gauge how the market is doing and where it’s headed. In recent years, first-time buyers have been less active than usual. The financial crash and recession led to a long period where Americans of typical home-buying age did not have the economic stability or job security to feel comfortable pursuing homeownership. Then, even after economic conditions began to improve, a lack of affordable, starter homes kept many younger Americans on the sidelines. This year, conditions are still challenging but new numbers from Freddie Mac show things may finally be changing. That’s because, first quarter results show that first-time buyers accounted for 46 percent of new mortgages during the early part of this year. That’s the largest quarterly share since 2012 and an indication that young Americans are finally becoming more active in the real-estate market. More here.

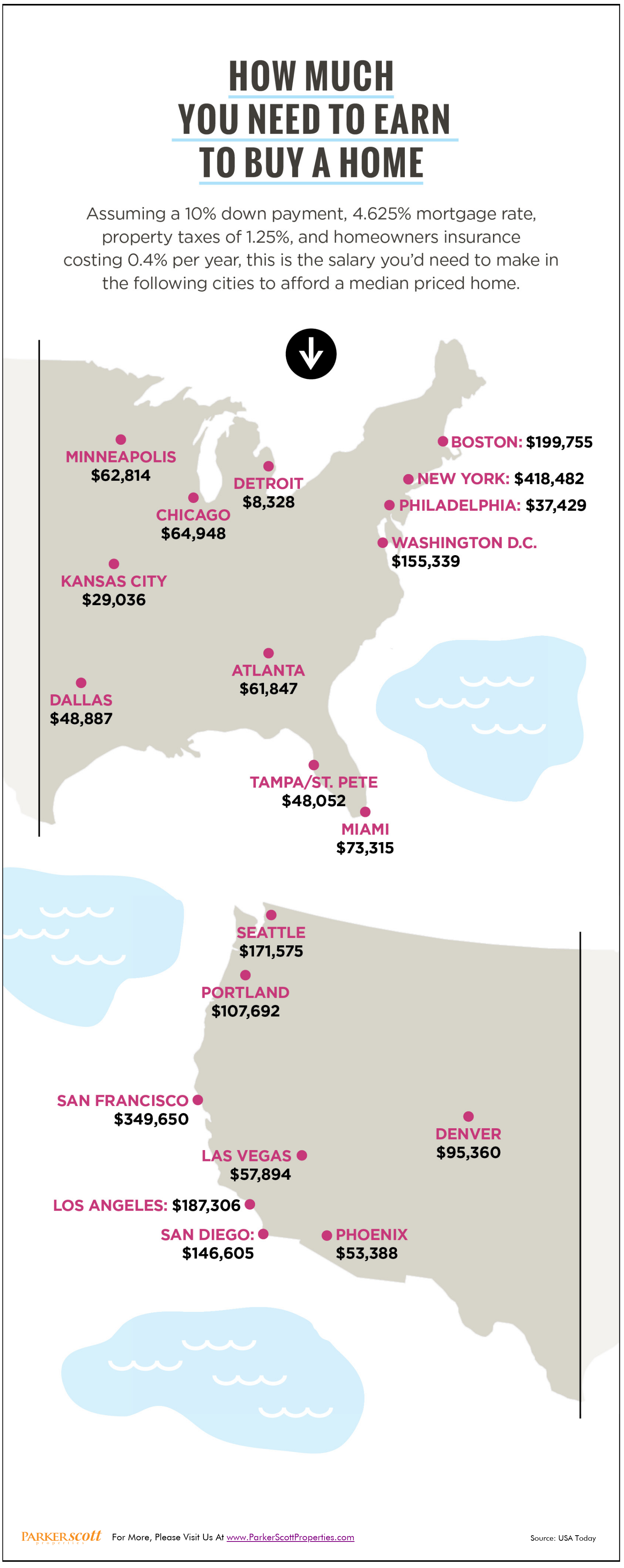

How Much You Need To Earn To Buy A Home

First Quarter Sees Return Of First-Time Buyers

First-time home buyers are an important demographic when it comes to the health of the housing market. Because they’ve historically accounted for about 40 percent of home sales, they garner a lot of attention from experts, economists, and analysts hoping to gauge how the market is doing and where it’s headed. In recent years, first-time buyers have been less active than usual. The financial crash and recession led to a long period where Americans of typical home-buying age did not have the economic stability or job security to feel comfortable pursuing homeownership. Then, even after economic conditions began to improve, a lack of affordable, starter homes kept many younger Americans on the sidelines. This year, conditions are still challenging but new numbers from Freddie Mac show things may finally be changing. That’s because, first quarter results show that first-time buyers accounted for 46 percent of new mortgages during the early part of this year. That’s the largest quarterly share since 2012 and an indication that young Americans are finally becoming more active in the real-estate market. More here.

Household Cleaning Hacks For The Soon-To-Be Mover

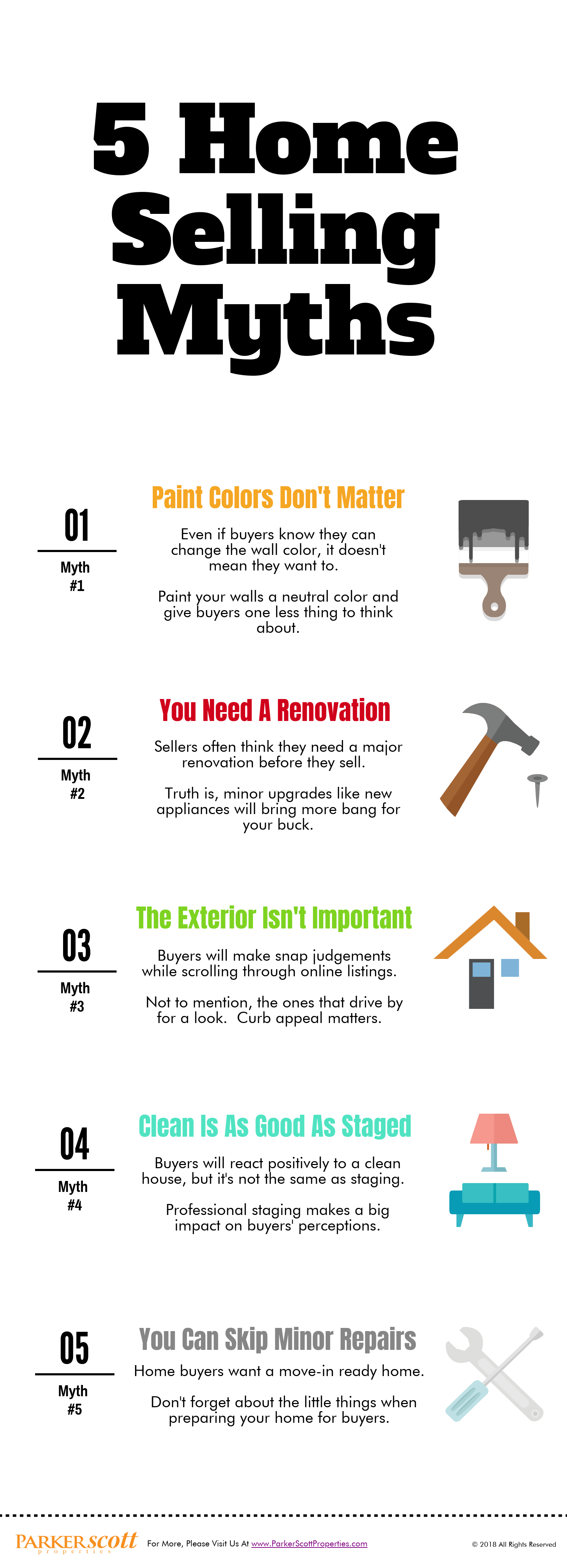

5 Home Selling Myths

Changes Come To The Luxury Home Market

The high end of the real estate market has followed a different path since the financial crisis and housing crash. But while the luxury home market was able to avoid some of the ups-and-downs the rest of the market has endured, things are beginning to change. In fact, one recent analysis shows the number of homes for sale priced at or above $1 million dollars fell significantly during the first quarter of this year, as compared to the year before. And, if inventory continues to drop, the luxury home market could see some of the spiking prices and competition for available homes that buyers have found in more affordable price ranges. However, those this may be true, the effects have, so far, been far more muted than in the overall market. For example, the average luxury home was on the market for 82 days during the last quarter. That’s faster than the same time last year but much longer than the overall average. For comparison, the National Association of Realtors’ most recent numbers show the typical existing home was on the market for just 30 days, with 50 percent of homes sold in less than a month. More here.