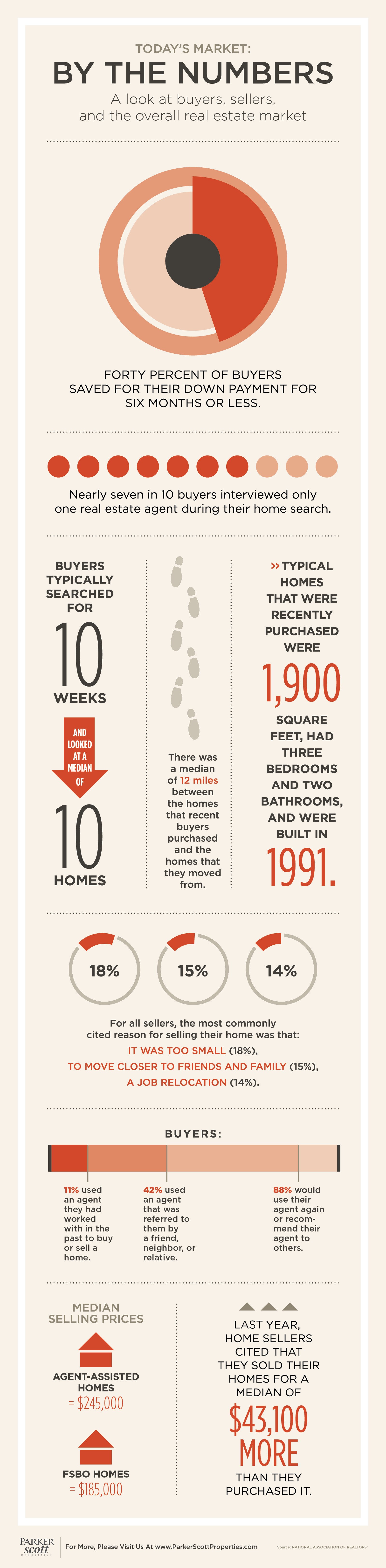

Unless you’re buying a new house, you’re likely to be choosing which house to buy based on how much work it might need. And if you don’t have the time and expertise to do the work yourself, you’re going to have to factor possible remodeling costs into your buying equation. In other words, it can get complicated. That’s why, today’s home buyer says they’re looking for a move-in ready home that requires very little renovation. Busy schedules and tight budgets mean many Americans don’t have the resources or time to invest in a major kitchen overhaul or bathroom upgrade. But is it realistic to expect to find the perfect home in perfect condition at a time when many markets have lower-than-normal inventory levels? Well, probably not. That’s why buyers should have an idea about what they will or won’t compromise on before heading out to shop homes. Conversely, home sellers should think about any investments they can make before listing that might help sell their house at a higher price.

From all accounts, this spring’s housing market is going to be a busy one. High buyer demand has carried over from last year and so have inventory concerns in many markets. In other words, anyone hoping to find and buy a house this spring should be prepared for competition from other interested buyers. What does that mean? Well, in short, it means moving quickly and saving up some extra money to sweeten the pot, if necessary. In fact, according to a recent survey, home buyers say they are checking online listings every day and 40 percent say they’re planning to put more than 20 percent down. Other strategies buyers say they’re employing this spring to beat the competition include setting price alerts and offering above asking price. Overall, home buyers are aware of current conditions and are preparing themselves for the possibility of having to win over a home seller with an offer that exceeds all others. As evidence of this, just six percent of survey respondents said they are doing nothing to prepare for competition from other buyers. More here.

A rising number of Americans surveyed for Fannie Mae’s monthly Home Purchase Sentiment Index say their income is higher than it was last year at this time. But has more money made them more likely to buy or sell a house? Well, according to February’s survey results, it’s hard to say. That’s because, after an increase in January, housing sentiment fell in February – with respondents expressing less confidence in a number of categories. In fact, the number of participants who said it’s a good time to buy a house was down, as was the percentage of participants who said it was a good time to sell. But if January saw increases in housing confidence, why the drop in February? Doug Duncan, Fannie Mae’s senior vice president and chief economist, says some of the uncertainty has to do with changing economic headlines. “Volatility in consumer housing sentiment continued in February, with the new tax law beginning to impact respondents’ take-home pay and the stock market creating negative headlines due to early-month turbulence,” Duncan said. In short, people have more money but they’re still a bit unsure of what lies ahead for the market. More here.