Buying a home is not something most people do very often. Unless you’re a real-estate investor or have to move frequently for work, you’re likely going to stay in the home you buy for more than a couple of years. In fact, recent data shows homeowners tend to stay in their house somewhere between 10 and 13 years. So it shouldn’t be surprising that there are some common misconceptions about the buying process and the best way to go about finding and buying a house. But, according to a recent survey, one common misstep is becoming less and less common. That’s because, the survey found nearly two thirds of recent buyers looked for financing before looking at homes and, among first-time buyers the number jumped to 85 percent. This is the right way to do things for a couple of reasons. First, meeting with a mortgage professional before heading out on the trail will let you know exactly where your price range is and what you may be qualified to borrow. Secondly, in a competitive market, having your financing already lined up means you can act fast when you find a home you love. If you’re not prequalified, a more prepared buyer is likely to make an offer and have the home under contract before you’ve even completed your application. More here.

Homes Sell Quickly Even As Inventory Improves

New data from the National Association of Realtors shows the typical for-sale property was on the market for just 26 days in April. And, though sales were down during the month, the speed with which homes are selling is evidence that buyers are interested and active in the market. Lawrence Yun, NAR’s chief economist, says homes are selling at a record pace. “What is available for sale is going under contract at a rapid pace,” Yun said. “Since NAR began tracking this data in May 2011, the median days a listing was on the market was at an all-time low in April, and the share of homes sold in less than a month was at an all-time high.” In fact, 57 percent of homes were sold in less than 30 days in April. Among the reasons homes are selling so quickly this spring is a lower-than-normal number of homes available for sale. Since buyer demand is high and the number of homes available to buy is low, homes are being sold very quickly. However, April’s numbers also show inventory was up 9.8 percent from the month before, which is an encouraging sign for hopeful home buyers. More here.

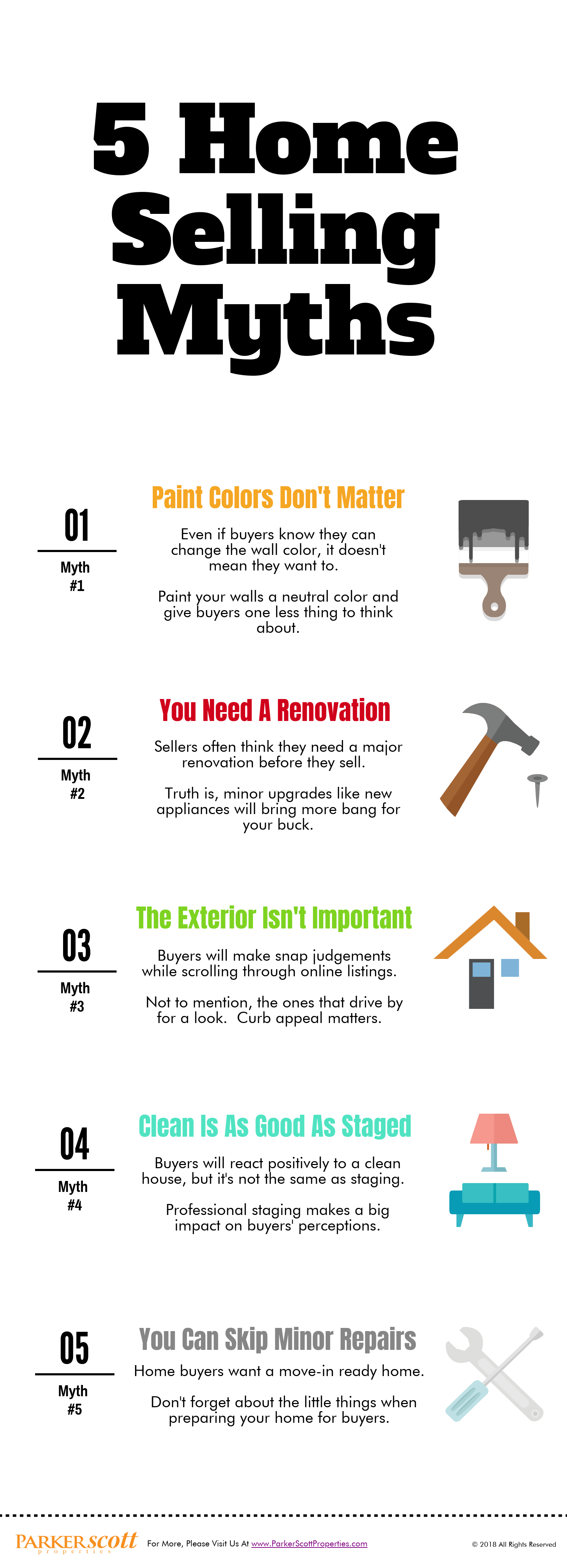

5 Home Selling Myths

Take A Seat

Renovations And The Cost Of Selling

It isn’t just the home’s buyer who has to settle up at the end of the closing process, sellers have costs too. In fact, according to one recent estimate, the average seller spends $15,000 before they hand over the keys to their home’s new owner. A big part of that is closing costs, agent commission, and any repairs required following the home’s inspection. But another chunk of that is renovations done before the sale. In fact, a large majority of homeowners fix up their homes before putting them on the market. Things like having the home painted, cleaned, and staged can add up for the 80 percent of homeowners who decide to spruce things up before showing their house. Nationally, the average cost of home improvements done before selling was $2,650, though that can vary greatly from region to region and is also dependent on the type of work that is done to get the house in shape. Of course, unlike buyers, home sellers have the sale of their home to help cover their costs but – assuming they’re going to buy another home – these expenses will obviously have an effect on how much money they have left over to put toward their next house. More here.