How A Sellers’ Market Could Be Good For Buyers

The housing market is about supply and demand. When there are a lot of buyers and too few homes, prices and competition rise, making it a good time for homeowners who want to sell. When there are more homes than buyers, prices fall and bargains abound. In short, the market will usually favor either buyers or sellers. But, naturally, conditions that are good for buyers will lead to more buyers and vice versa. In other words, the pendulum swings back and forth. Which is why, a recent survey holds hope for buyers concerned about higher prices and increasing competition. The National Association of Realtors’ Housing Opportunities and Market Experience survey found that 75 percent of Americans think now is a good time to sell a home. And, if the perception that it’s a good time to sell leads to more homes being listed for sale, that will soon begin to moderate prices, making buying a more affordable proposition for the almost equal number of Americans who say they think now is a good time to buy. More here.

Where Are The Fastest Growing Luxury Markets?

When shopping for a house to buy, it’s hard not to fantasize about the homes just out of your price range. Regardless of what you plan to spend, it’s fun to imagine buying a house even bigger, nicer, and more feature filled than the ones within your reach. And, with the Internet, it’s easier than ever to steal a glance inside the nicest homes in the area. In fact, you can shop real estate in any area. But, while we’re all familiar with famous luxury markets such as Beverly Hills or Aspen, Colo., what are the nation’s lesser-known, up-and-coming luxury markets? Well, according to a new index from the National Association of Realtors’ consumer website, East Coast house hunters looking for a warm weather getaway have propelled Sarasota and Collier counties in Florida to two of the top five spots on the list of fastest growing luxury markets. Other areas that made the list include counties containing Castle Rock, Colo., San Jose, Calif., Queens N.Y., Seattle, Jersey City, and Redwood City, Calif. But, if you’re planning a move to one of these hot spots, you have to move fast as they all have seen 10 to 20 percent price increases over the past year. More here.

Millennials Are Skipping Starter Homes for Their Dream Home

A new trend has begun to emerge. With home prices skyrocketing in the starter home category, many first-time homebuyers are skipping the traditional starter homes and moving right into their dream homes.

A new trend has begun to emerge. With home prices skyrocketing in the starter home category, many first-time homebuyers are skipping the traditional starter homes and moving right into their dream homes.

What’s a Starter Home?

According to the National Association of Realtors (NAR), simply put, a starter home is a one or two-bedroom home (sometimes even a small, three bedroom). “Prices vary widely by market but starters on average cost $150,000 to $250,000 while trade-up and premium homes cost upwards of $300,000.”

Finding Their Forever Homes Now

A recent CNBC article revealed that there are many factors that delayed older millennials (ages 25-35) from buying a home earlier in their lives. The aftereffects of the Great Recession teaming up with larger education costs forced many to either remain living in their parent’s homes or to rent. With the economy continuing to improve, many millennials have been able to break into better-paying jobs which has helped spur down payment savings. As the dream of homeownership comes closer to reality, many millennials are saving for their forever homes.

According to the latest statistics from NAR, 30% of millennials bought homes for $300,000 or more this year (up from 14% in 2013). Diane Swonk, Chief Economist at Grant Thornton weighed in saying, “They rented for longer. Now they’re going to where they want to stay.”

More and more millennials are settling down, getting married, and starting families, which is a huge factor driving them to look for larger homes.

Increased competition in the starter home market has also been a driving force in waiting to afford their dream homes. Inventory in the starter home market is down 14.2% from last year, according to research from Trulia. This has driven prices up and has led to bidding wars. Many first-time buyers who were originally looking for starter homes are realizing that for just a little bit more of an investment, they could afford trade-up or premium homes instead.

June 2018 Newsletter

The Latest On Where Home Prices Are Headed

Home prices are a top concern for both home buyers and sellers. After all, a lot of the calculus that goes into determining whether or not it’s a good time to sell or buy a house is based on where home values are and where they are expected to be in the future. For that reason, it’s good to follow the S&P Case-Shiller Home Price Indices, as they are considered the leading measure of U.S. home prices. According to the latest data, prices have continued to rise at around the same pace they’ve been increasing, with both month-over-month and year-over-year data showing little change. In short, prices are going up but no faster than they have been. David M. Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, says things aren’t expected to change any time soon. “Unless inventories increase faster than sales, or the economy slows significantly, home prices are likely to continue rising,” Blitzer says. But despite rising prices, Blitzer notes that the market is calmer today than it was during the last price boom in the early 2000s. More here.

Why The New Home Market Matters To You

If you aren’t in the market for a new home, why should you care about the new home market? Well, for starters, it plays a very important role in the health of the housing market. And that affects all buyers, not just new home buyers. How? Simply put, new home construction is the quickest way to add homes for sale to the market. And, when more homes are added, buyers can be more choosy, which results in less competition and fewer home price spikes. In other words, when new homes are being built and sold, the overall real estate market benefits, including buyers looking for an existing home in a more affordable price range. So, if that’s true, how’s the new home market doing? According to the latest numbers from the Commerce Department, new home sales were 11.6 percent above last year’s level in April, which is good. But, though year-over-year numbers are positive, recent revisions to totals from the first three months of the year were revised downward, indicating some lingering weakness in the market. More here.

Household Cleaning Hacks For The Soon-To-Be Mover

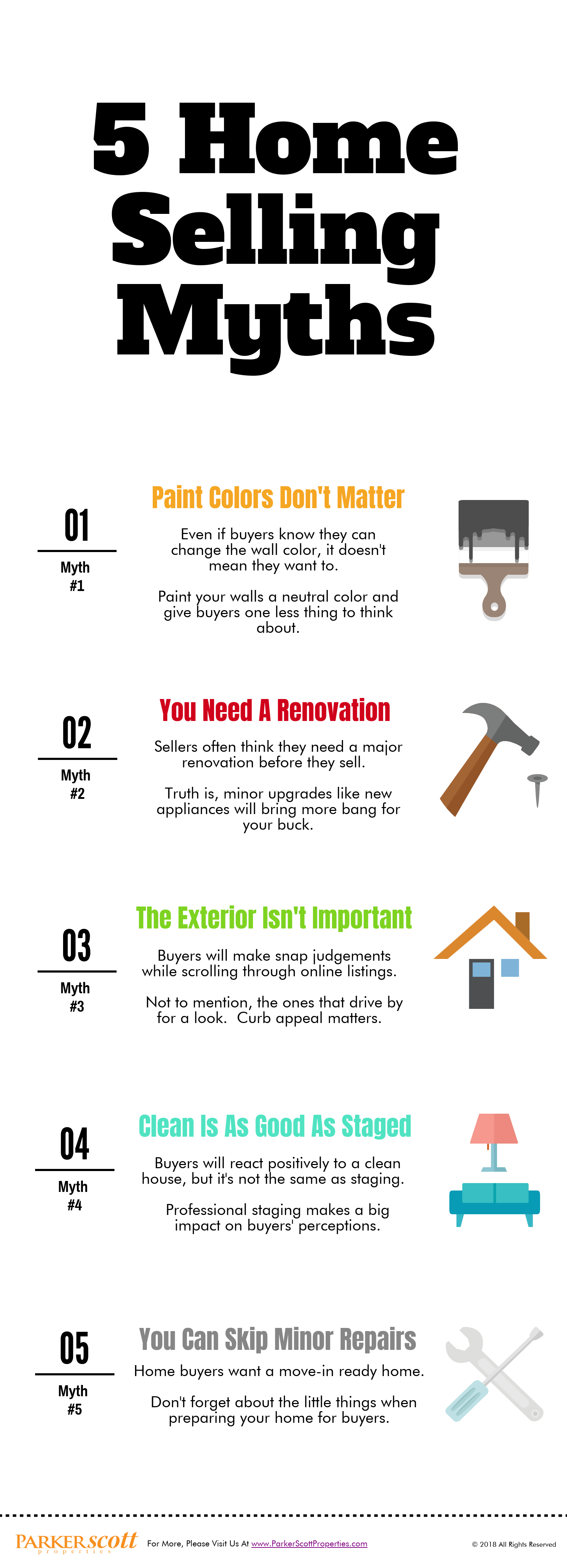

5 Home Selling Myths

Changes Come To The Luxury Home Market

The high end of the real estate market has followed a different path since the financial crisis and housing crash. But while the luxury home market was able to avoid some of the ups-and-downs the rest of the market has endured, things are beginning to change. In fact, one recent analysis shows the number of homes for sale priced at or above $1 million dollars fell significantly during the first quarter of this year, as compared to the year before. And, if inventory continues to drop, the luxury home market could see some of the spiking prices and competition for available homes that buyers have found in more affordable price ranges. However, those this may be true, the effects have, so far, been far more muted than in the overall market. For example, the average luxury home was on the market for 82 days during the last quarter. That’s faster than the same time last year but much longer than the overall average. For comparison, the National Association of Realtors’ most recent numbers show the typical existing home was on the market for just 30 days, with 50 percent of homes sold in less than a month. More here.