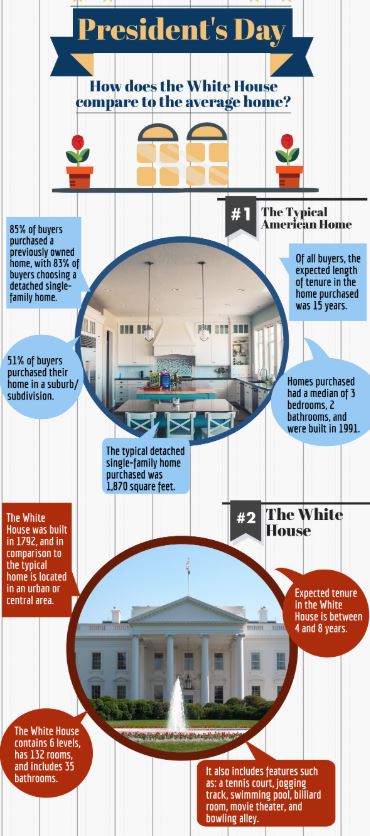

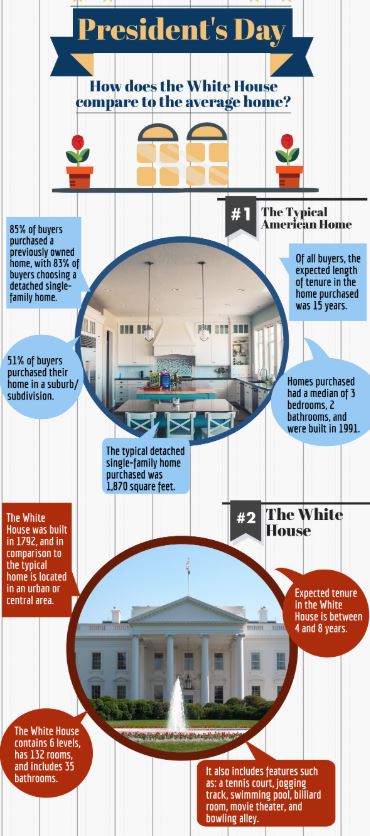

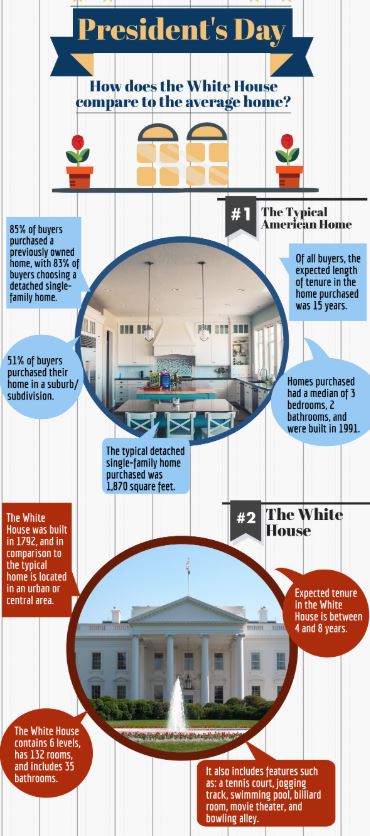

How does the White House compare to the average home?

|

||||||

|

||||||

|

||||||

|

2504 New York Avenue

MLS # 199048 $134,700

|

||||||

|

Welcome home to New York Avenue. This charming bungalow is situated in the quiet community known as Avondale. Being just minutes from Downtown, SCAD, Memorial and Candler Hospitals and the Truman Corridor this home is in an ideal location for active people on the go. Original hardwood floors throughout and fresh paint make this house a move in read |

||||||

Travis Sawyer REALTOR®

Website: http://www.savrealestate.com/

Mobile: 912-308-7430

|

||||||

| Listing Courtesy of Parker Scott PropertiesCopyright 2019 Savannah Multi-List Corporation. All right reserved. |