First-time home buyers are an important demographic when tracking the health of the housing market. That’s because, they typically make up nearly half of all home sales. In recent years, however, young Americans have been buying fewer homes than in the past. In fact, Freddie Mac’s most recent monthly outlook says 15 percent of young adults between the ages of 25 and 35 are living in their parents’ home – a five percent increase from 2000. However, it isn’t because they’re not interested in homeownership. Largely, the economy and a lack of affordable starter homes have been to blame for a lower-than-normal number of first-time home buyers. But with an improved economy and job market, will more young adults become buyers this year? Len Kiefer, Freddie Mac’s deputy chief economist, says there’s reason for optimism. “Starting off the year, things are looking pretty good for the U.S. economy and housing markets,” Kiefer says. “Mortgage rates are low, economic growth has accelerated in recent quarters, and housing is coming off its best year in a decade.” More here.

What To Do If You Live In A Competitive Market

These days, competition and affordability are two of home buyers’ main concerns. This isn’t surprising, as no one likes to pay more for less. Naturally, we prefer to find a bargain and we certainly don’t want to have to fight off other interested buyers to get it. That’s why recent research looking at the country’s most competitive markets is of interest. The results show the most competitive markets are located in the West, though in just about any desirable neighborhood you could find more buyers than available homes. That means, even if you aren’t living in San Francisco or Seattle, you should be ready for the possibility that you won’t be the only home buyer interested in the house you choose. So what’s the best way to increase your odds of beating the competition and getting the house you want? Preparation. Be prepared and get prequalified before you start shopping. Buyers with financing in place before they start looking at houses are more appealing to sellers. If you’ve got your financing in place and a firm idea of what your price range and budget are, you will be in better position should you find yourself in a bidding war. More here.

Buying More Affordable Than Rent In Most Markets

When it comes time to make a move, most of us are choosing between renting a place or buying a house. And making that calculation has a lot to do with where you are in your life and what your goals are. But it also has a lot to do with your financial situation. Because of this, ATTOM Data Solutions analyzes the average rent for a three-bedroom property, weekly wage data, and home price information in 540 counties nationwide in an effort to determine whether renting or buying is the more affordable choice. According to their most recent Rental Affordability Report, buying a home is still the more affordable choice in a majority of markets. However, the data is a bit more complicated than that. In fact, though buying is more affordable in the majority of markets, it isn’t in a lot of the country’s most populated counties. The data shows that many markets where the population is above 1 million have affordability challenges not seen in areas further from major metropolitan centers. More here.

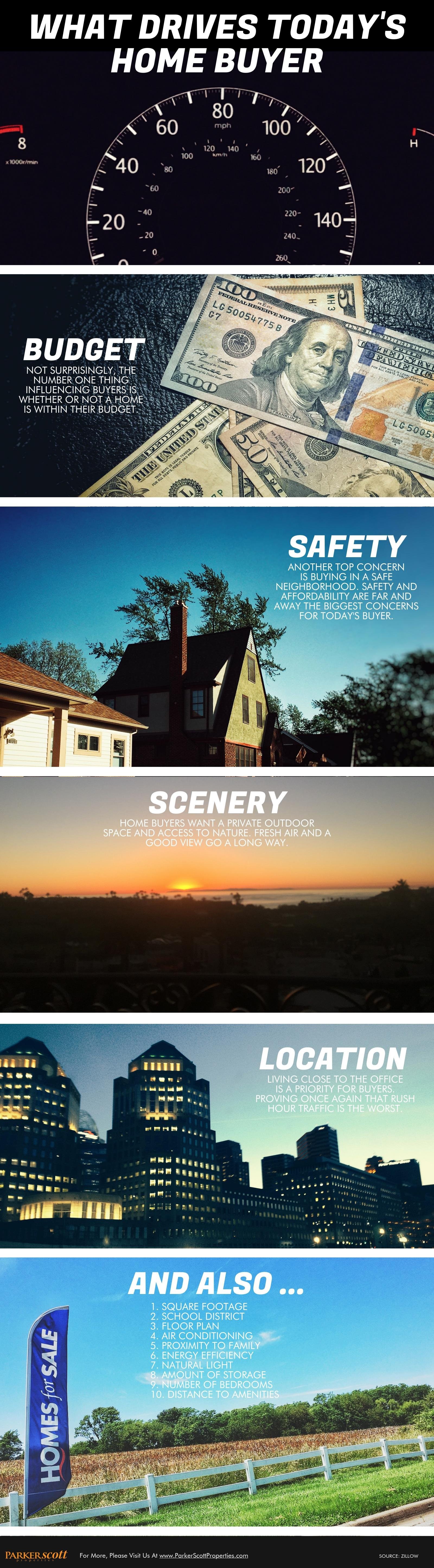

What Drives Today’s Home Buyer

Analyst Says Don’t Expect Big Changes In 2018

Housing market fundamentals have been relatively steady, for some time now. Mortgage rates have been low by historical standards, prices have been rising, and inventory has been down. All three of these factors, combined with a growing economy and stronger job market, have kept the real-estate market in a kind of limbo. While the economy and favorable mortgage rates have helped drive buyer demand, there have also been fewer homes for sale, which helps push prices upward. In other words, there are a lot of positives but there are also challenges. Freddie Mac economist, Leonard Kiefer, says this year’s market will likely continue along the same path – though he predicts some improvement. “Income growth should remain positive, but not enough to offset the other factors affecting home buyer affordability,” Kiefer wrote in a recent article. “We’re expecting that interest rates will remain low, but gradually move higher. Housing construction should gradually pick up, helping to supply more homes to inventory-starved markets. More housing supply and modestly higher rates will lead to a moderation in house price growth.” More here.

Current Homeowners Say They’re Ready To Buy

The National Association of Realtors’ Housing Opportunities and Market Experience survey asks consumers about buying and selling a home, their financial situation, and their perceptions of the economy. According to the fourth quarter results, Americans are generally optimistic about the housing market, with majorities expressing that they feel now is both a good time to be selling a home and a good time to buy a home. However, some groups are more optimistic than others. For example, among current homeowners, 79 percent say they feel it is a good time to buy a home. On the other hand, just 60 percent of current renters feel as optimistic. Other groups that were more optimistic included those with household incomes above $100,000 and those living in the Midwest and South. So what do the results mean? Well, one takeaway is that an increasing number of current homeowners who want to move could mean a potential boost in the number of homes available for sale next year. That’s good news for all prospective home buyers, as an increase in for-sale inventory will help improve affordability conditions. More here.

A Few Things You Can Ignore While House Hunting

The Gig Economy And Homeownership

Smartphones and the internet have given rise to a number of on-demand services that offer Americans the ability to supplement their income by providing work as independent contractors. Whether delivering groceries or ride sharing, many Americans are now working in what is known as the “gig economy.” In fact, as part of their third quarter National Housing Survey, Fannie Mae found nearly one-fifth of adults have worked in the gig economy. Generally speaking, these Americans have other full-time work, though younger respondents were more likely to rely on these types of jobs for income. Overall, however, participants in this type of work were more positive about their household income and financial outlook. But how does this type of job impact prospects for buying and owning a home? Well, that remains to be seen. Though gig-economy workers are generally more confident in their income, they also express concern about being able to qualify for a mortgage and save for a down payment. Particularly, among current renters, gig-economy workers were less likely to say they’d buy a home the next time they move. Also, there is some question about how underwriting standards handle what is becoming an increasingly popular way for Americans to make some money on the side. More here.

Rising Home Values Mean Immediate Gains For Buyers

There are many factors to consider when deciding whether or not it’s a good time for you to buy a house. Most of these are personal and have to do with the needs and desires of you and your family. Market conditions may influence your decision, but ultimately the best time for you to buy a house is when you’re ready. And while that’s largely true, knowing what’s going on in the market can still be important, as it gives you a feel for what to expect during your home search and after. For example, recent research shows that the average house is $12,500 more valuable today than it was just a year ago. And, though that will be disappointing news to buyers who have seen their purchasing power reduced over the last year, it should also be encouraging to prospective buyers – as rising prices may mean your future home’s value continues to increase once you’ve become the owner. In other words, if home prices continue to increase at the same pace during the next year, buying a house now may mean you’re – not only getting a better deal now than you would if you wait – but you’ll also be able to start building equity almost immediately. More here.