Real estate, of course, is about location. From neighborhood to neighborhood, conditions may differ. Pricier neighborhoods will have different dynamics than more affordable areas. Hot spots that offer buyers features and amenities will have different conditions than less popular areas farther from the action. That’s why most people work with professionals when buying or selling a home. It’s good to be able to lean on the experience of someone with expertise in the specific parts of town you’re interested in. But that’s not to say you can’t have a general sense of where the market is headed and what to expect when you hit the streets in search of a house. Take the most recent forecast from Freddie Mac, for example. The outlook says, though the market will slow down this fall and winter, high demand for homes will mean more sales and competition next year. It also says home price growth will begin to slow next year, though you should expect mortgage rates to continue to edge higher through 2020. Overall, according to Freddie Mac’s outlook, home buyers and sellers should expect next year’s market to look relatively similar to this year’s. More here.

The Winter Market May Be Good For Buyers

Typically, spring and summer are thought of as the prime times to buy or sell a home. There are a number of reasons for this, including weather and the end of the school year. But whatever the reason, there are usually more homes for sale and more active buyers during what is typically the busiest sales season. Fall and winter, on the other hand, are the time of the year when the housing market slows down. The approaching holidays and colder temperatures across much of the country mean fewer Americans are in the mood for a move. But that can mean opportunities for buyers who are. A recent analysis looked at the country’s largest metro areas and compared typical affordability levels, projected rent increases, and the share of listings with a price cut to determine where buyers might have the best chances in the coming months. The results showed conditions in hot markets like Orlando, Boston, Seattle, and Las Vegas are becoming more favorable as the end of the year approaches. That means, interested buyers may be in a better position this fall and winter than they will be next spring when things begin to heat back up. More here.

Homes For Sale Stay On The Market Longer

During the spring and summer, homes for sale were selling fast. So fast that the typical home was on the market less than a month. And while home buyers should still expect desirable homes to go quickly, there may be some relief in sight. That’s because, new numbers from the National Association of Realtors show that the majority of homes are now on the market more than a month. In fact, properties typically sold in 32 days in September, an improvement over August when homes moved in just 29 days. Lawrence Yun, NAR’s chief economist, says a trend may be developing. “There is a clear shift in the market with another month of rising inventory on a year over year basis, though seasonal factors are leading to a third straight month of declining inventory,” Yun said. “Homes will take a bit longer to sell compared to the super-heated fast pace seen earlier this year.” At the current sales pace, there is a 4.4-month supply of available homes for sale. A 6-month supply is generally considered a healthy market. More here.

Saving A Down Payment May Be Easier Than You Think

Saving for a down payment is one of the biggest obstacles first-time home buyers face. While repeat buyers can use the sale of their home to help fund a down payment on a new house, first timers have to save from scratch. And this can be difficult when also facing hurdles like higher rent payments and student loan debt. But, like everything real-estate related, location matters. In fact, according to a new analysis, saving a down payment for an entry-level home is much easier in some locations than others. For example, after factoring the median household income among millennials and their estimated annual savings, the analysis determined that a first-time home buyer could save for a 20 percent down payment in under five years in 10 major cities, including Chicago, Dallas, Baltimore, St. Louis, Austin, and Washington DC. Of course, the time it takes to save a down payment is longer on the West Coast, where home prices are higher. But considering the fact that a 20 percent down payment is not a requirement, even in pricier areas saving up enough to buy a home is not an unattainable goal. More here.

Four Things To Look For In A Neighborhood

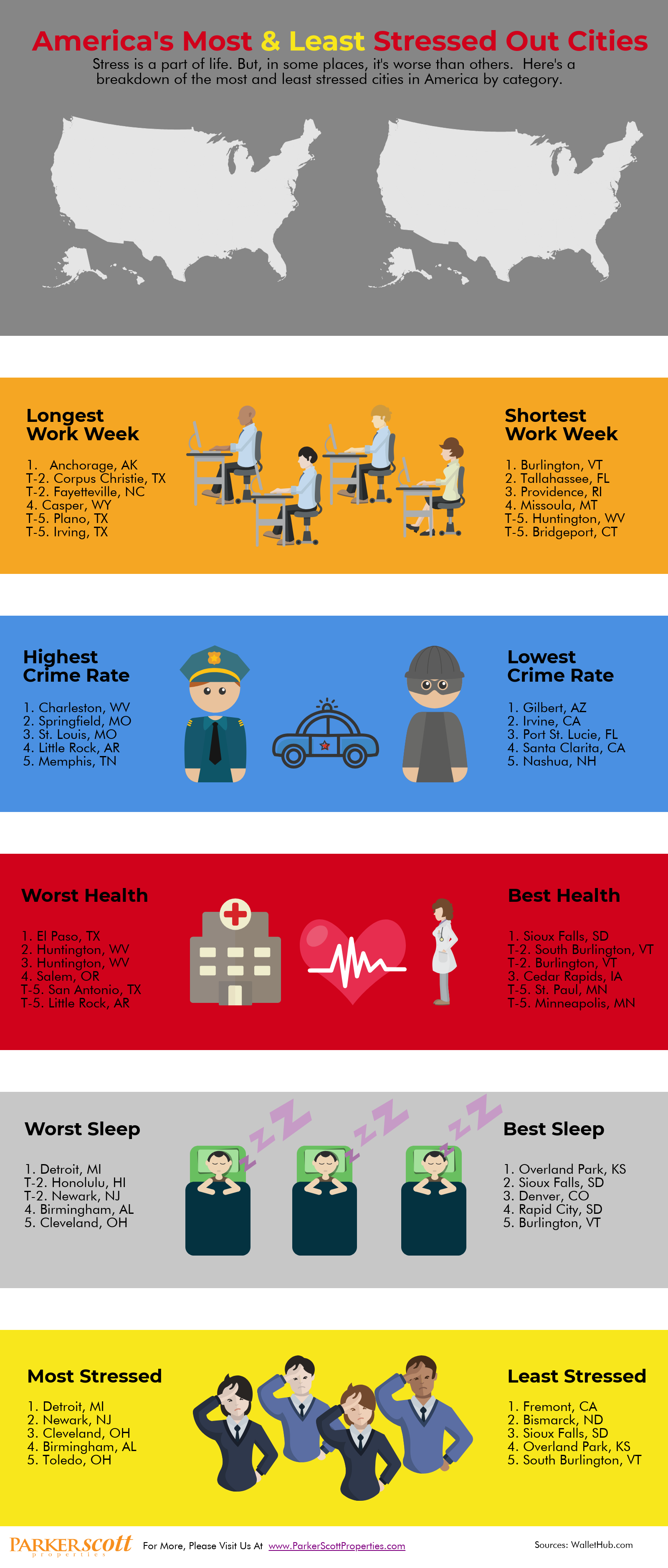

America’s Most & Least Stressed Out Cities

The Rising Cost Of Renting A Home

When debating whether to rent or buy your next place, the argument in favor of renting usually includes the fact that it’ll be cheaper – especially since you don’t have to pay for closing costs or save for a down payment. However, renting a place isn’t all that cheap these days and, depending on what you’re looking for, prices may be rising even faster than expected. According to recently released data, rental rates are increasing and particularly among two and three-bedroom homes. In fact, rental homes, generally, are climbing in price faster than apartments. Nationally, a typical two-bedroom now costs $1,310 per month and the cost for a typical three-bedroom is up to $1,445. And, depending on your local market, it could be even higher. So why is rent rising faster for homes than it is for apartments? Well, for some of the same reasons home prices are climbing. For one, new, and smaller, apartments are the focus of most rental unit construction, while the supply of single-family homes to rent is mostly fixed. More here.

How A Sellers’ Market Could Be Good For Buyers

The housing market is about supply and demand. When there are a lot of buyers and too few homes, prices and competition rise, making it a good time for homeowners who want to sell. When there are more homes than buyers, prices fall and bargains abound. In short, the market will usually favor either buyers or sellers. But, naturally, conditions that are good for buyers will lead to more buyers and vice versa. In other words, the pendulum swings back and forth. Which is why, a recent survey holds hope for buyers concerned about higher prices and increasing competition. The National Association of Realtors’ Housing Opportunities and Market Experience survey found that 75 percent of Americans think now is a good time to sell a home. And, if the perception that it’s a good time to sell leads to more homes being listed for sale, that will soon begin to moderate prices, making buying a more affordable proposition for the almost equal number of Americans who say they think now is a good time to buy. More here.

Millennials Are Skipping Starter Homes for Their Dream Home

A new trend has begun to emerge. With home prices skyrocketing in the starter home category, many first-time homebuyers are skipping the traditional starter homes and moving right into their dream homes.

A new trend has begun to emerge. With home prices skyrocketing in the starter home category, many first-time homebuyers are skipping the traditional starter homes and moving right into their dream homes.

What’s a Starter Home?

According to the National Association of Realtors (NAR), simply put, a starter home is a one or two-bedroom home (sometimes even a small, three bedroom). “Prices vary widely by market but starters on average cost $150,000 to $250,000 while trade-up and premium homes cost upwards of $300,000.”

Finding Their Forever Homes Now

A recent CNBC article revealed that there are many factors that delayed older millennials (ages 25-35) from buying a home earlier in their lives. The aftereffects of the Great Recession teaming up with larger education costs forced many to either remain living in their parent’s homes or to rent. With the economy continuing to improve, many millennials have been able to break into better-paying jobs which has helped spur down payment savings. As the dream of homeownership comes closer to reality, many millennials are saving for their forever homes.

According to the latest statistics from NAR, 30% of millennials bought homes for $300,000 or more this year (up from 14% in 2013). Diane Swonk, Chief Economist at Grant Thornton weighed in saying, “They rented for longer. Now they’re going to where they want to stay.”

More and more millennials are settling down, getting married, and starting families, which is a huge factor driving them to look for larger homes.

Increased competition in the starter home market has also been a driving force in waiting to afford their dream homes. Inventory in the starter home market is down 14.2% from last year, according to research from Trulia. This has driven prices up and has led to bidding wars. Many first-time buyers who were originally looking for starter homes are realizing that for just a little bit more of an investment, they could afford trade-up or premium homes instead.

Americans Say Now Is The Time To Buy

Every month, Fannie Mae surveys Americans to better understand how they view the housing market, their personal finances, and the overall economy. Their Home Purchase Sentiment Index is a measure of how people around the country feel about buying or selling a home. And, according to the most recent results, they currently feel like it’s time to buy. In fact, there was a 10 percent increase in the number of respondents who said they felt like it was the right time compared to February’s survey. Doug Duncan, Fannie Mae’s senior vice president and chief economist, says sentiment has been volatile lately. “The HPSI’s recent run of volatility continued in March, as it recovered last month’s loss and remained within the five-point range of the past twelve months,” Duncan said. “The primary driver of this month’s increase was the sizable rise in the net share of consumers who think it’s a good time to buy a home, which returned the indicator to its year-ago level.” Boosted optimism about buying a house may be due to the spring buying season or perhaps a feeling among potential buyers that affordability conditions may worsen if they wait. More here.

Every month, Fannie Mae surveys Americans to better understand how they view the housing market, their personal finances, and the overall economy. Their Home Purchase Sentiment Index is a measure of how people around the country feel about buying or selling a home. And, according to the most recent results, they currently feel like it’s time to buy. In fact, there was a 10 percent increase in the number of respondents who said they felt like it was the right time compared to February’s survey. Doug Duncan, Fannie Mae’s senior vice president and chief economist, says sentiment has been volatile lately. “The HPSI’s recent run of volatility continued in March, as it recovered last month’s loss and remained within the five-point range of the past twelve months,” Duncan said. “The primary driver of this month’s increase was the sizable rise in the net share of consumers who think it’s a good time to buy a home, which returned the indicator to its year-ago level.” Boosted optimism about buying a house may be due to the spring buying season or perhaps a feeling among potential buyers that affordability conditions may worsen if they wait. More here.