Traditionally, home ownership has been seen as part of settling down. Getting married and starting a family went hand-in-hand with buying a home and planting roots in a community. But though they’re still common motivating factors, marriage and children aren’t the only reasons someone might want to become a homeowner. And so there are an increasing number of single home buyers active in the housing market. Among them, women are outpacing men. In fact, according to the National Association of Realtors’ most recent numbers, 65 percent of home buyers in 2017 were married couples but 18 percent were single women. And while that may not seem like a lot, the percentage has risen in each of the last three years and has nearly doubled over the past 35 years. Additionally, single women home buyers outpace single men by a wide margin. One recent study found that in the country’s 50 largest metropolitan areas, single women own more than 70,000 more homes than single men, with cities like New Orleans, Miami, and Birmingham, Ala., showing more than a quarter of households owned and occupied by single women. More here.

Optimism About Income Helps Housing Sentiment

For a while now, there’s been a balance between the feeling that buying a home is becoming less affordable and the perception that the economy is getting stronger. Americans are concerned about rising home prices and mortgage rates but, at the same time, they’re also seeing more job opportunities and higher wages. How this might affect a decision about making a move is fairly obvious. In short, your feelings about whether or not it’s a good time for you to buy a house are likely tied to your feelings about your job security and income. If you’re feeling confident in your money, you’re more likely to consider buying. Which is part of the reason Fannie Mae’s monthly Home Purchase Sentiment Index has been relatively unchanged over the past several months. The index – which measures Americans perceptions of the housing market, economy, and their personal financial situation – was virtually flat in November from the month before. Doug Duncan says housing sentiment has cooled but it’s been offset by optimism about the economy. “Consumers perceptions of growth in their household income reached a survey high this month, helping to absorb some of the impact of increasing mortgage rates on housing market activity,” Duncan said. “Meanwhile, the net share of consumers expecting home prices to increase over the next 12 months continues to moderate, dropping by 13 percentage points since this time last year.” More here.

HAPPY THANKSGIVING

November Newsletter

Homes Sell Quickly Even As Inventory Improves

New data from the National Association of Realtors shows the typical for-sale property was on the market for just 26 days in April. And, though sales were down during the month, the speed with which homes are selling is evidence that buyers are interested and active in the market. Lawrence Yun, NAR’s chief economist, says homes are selling at a record pace. “What is available for sale is going under contract at a rapid pace,” Yun said. “Since NAR began tracking this data in May 2011, the median days a listing was on the market was at an all-time low in April, and the share of homes sold in less than a month was at an all-time high.” In fact, 57 percent of homes were sold in less than 30 days in April. Among the reasons homes are selling so quickly this spring is a lower-than-normal number of homes available for sale. Since buyer demand is high and the number of homes available to buy is low, homes are being sold very quickly. However, April’s numbers also show inventory was up 9.8 percent from the month before, which is an encouraging sign for hopeful home buyers. More here.

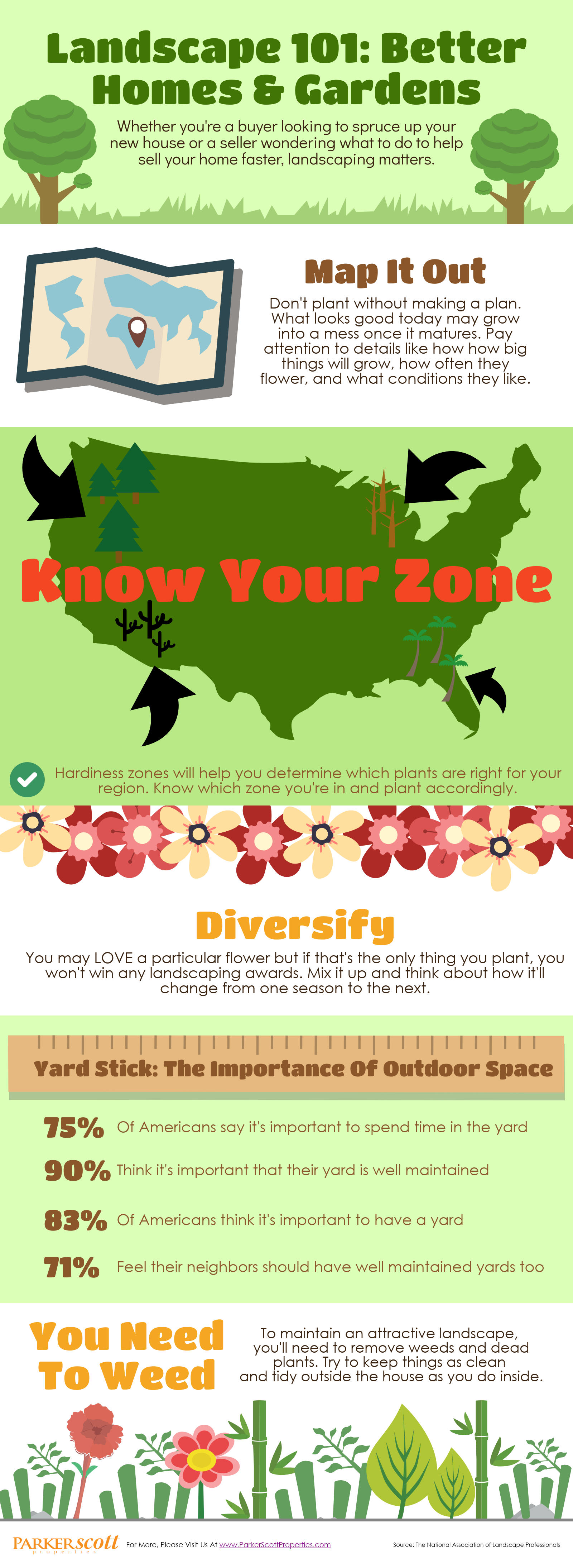

Landscape 101: Better Homes & Gardens