What To Look for When Looking At Homes

Analysis Finds Property Tax On The Rise

When considering the costs of homeownership, it’s sometimes easy to forget about property tax. Home buyers focus a lot of attention on their prospective mortgage payment and the potential cost of any remodels and renovations but often forget to think about how much taxes will run them each year. This is a mistake. Take, for example, new research from ATTOM Data Solutions. Their recent tax analysis found that the average property tax on a single family home last year was $3,399, a 3 percent increase from 2016. That’s nearly $300 a month. But property taxes can differ from one place to the next. As evidence, states like Hawaii, Alabama, Colorado, Tennessee, and West Virginia were found to have lower than average effective property tax rates. They can also vary from city to city. That’s why it’s a good idea to look into how much homeowners pay in property taxes in the areas where you’d most like to buy a home. It may not sway your decision on where you buy, but it will give you a more accurate assessment of how much it’ll cost to buy a house in a particular city. More here.

What Style Of House Do You Prefer?

Most regions offer house hunters a variety of architectural styles to choose from. Whether you prefer bungalows to ranches or modern over contemporary, you can likely find something that fits your preference. But, according to one recent survey, what you’re looking for might depend on your age. That’s because the results show millennial home buyers are looking for a different kind of home than older buyers. For example, younger buyers expressed a preference for colonial and contemporary homes, when they had a preference at all. On the other hand, buyers over the age of 55 were much more interested in finding a ranch – which is an architectural style favored by only 6 percent of millennials. Of course, some of this has to do with practicalities – such as retirees in search of a one-story home because it eliminates any concern about future mobility and navigating stairs – but it’s also a question of personal taste and aesthetics. Ultimately, though, whatever type of house Americans say they prefer, they generally all say they want that house to have ample storage, a garage, and multiple bedrooms. More here.

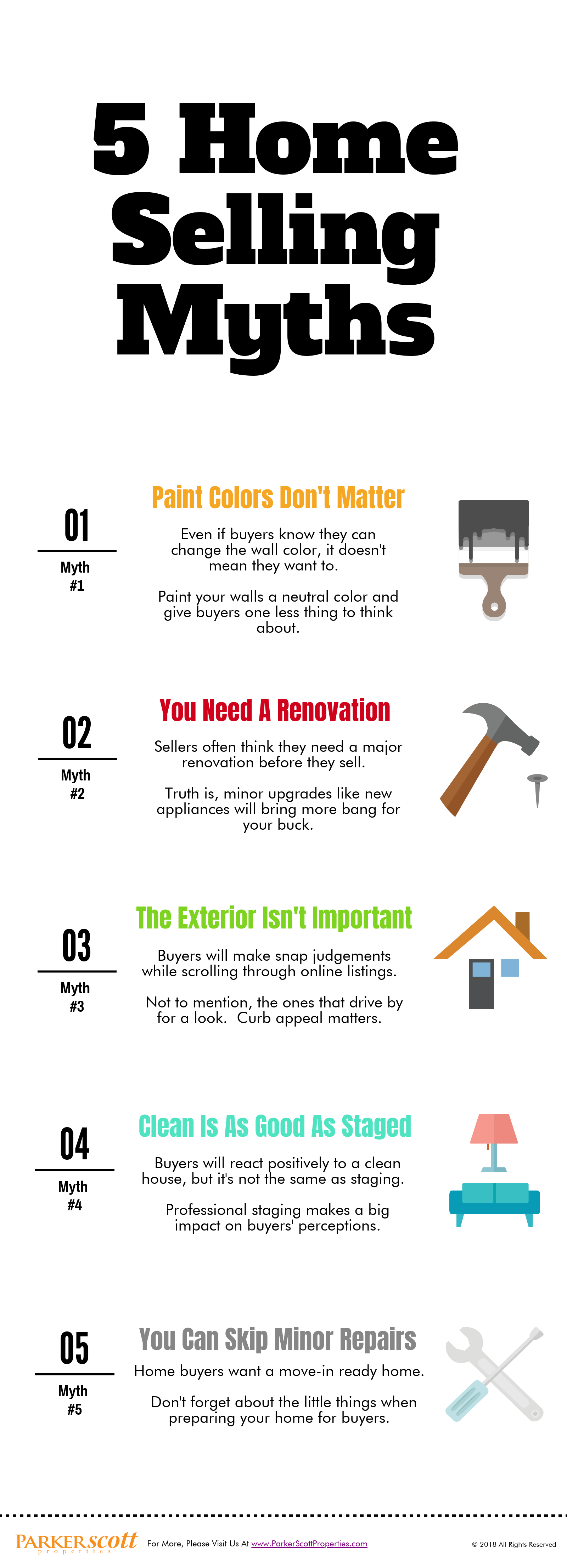

5 Home Selling Myths

Homes Stay On The Market For Fewer Days

These days, there are a lot of people interested in buying a house. A stronger economy, more jobs, and years of pent-up demand have led to a rising number of Americans who are eager to make a move. But while that’s positive, more buyers active in the market also means homes sell faster. In fact, according to Nationwide’s recent Health of Housing Markets Report, the average home was on the market for just 67 days in 2017 – with houses in some market going in half that time. That means, buyers need to do their homework, cause they may not have the luxury of being able to take their time debating each home’s pros and cons. It also means good news for sellers. “As we head into spring and the traditional season when sales heat up, buyers will find that desirable homes won’t be on the market for long,” says David Berson, Nationwide’s senior vice president and chief economist. “Today, the average home is on the market almost half the length of time that it was six years ago. Of course, that is good news for people looking to sell their home.” More here.

The Neighborhood Feature Buyers Want At Any Age

The factors that influence a home buyer’s decision to buy a particular house in a particular neighborhood are very similar across demographic groups. After all, our lives are more similar than they are different. We all want to live in a safe neighborhood with access to things we want and need, like recreation and health care providers. However, depending on the age of the buyer, there are some are other neighborhood features, like schools, that may appeal more to a younger home buyer than an older one. For that reason, the National Association of Realtors’ Home Buyer and Seller Generational Trends study takes an annual look at who’s buying homes, what kind of homes, and for what reasons. Lawrence Yun, NAR’s chief economist, says the results show there is one factor that appeals to buyers of all ages. “The sense of community and wanting friends and family nearby is a major factor for many home buyers of all ages,” Yun said. “Similar to Gen X buyers who have their parents living at home, millennial buyers with kids may seek the convenience of having family nearby to help raise their family.” In short, proximity to family and friends was important to buyers of all ages, whether they were millennials or baby boomers. More here.

Homeowner Equity Continues To Increase

When you buy a house, you’re not just purchasing a place to live. You’re also making an investment in the real estate market. Which means, as your home’s value grows, so does your equity. Equity, of course, refers to the amount a property is worth minus the amount still owed on the mortgage. Put simply, if your equity is growing, that’s good news. Which is why new numbers from the Board of Governors of the Federal Reserve System are encouraging. That’s because they show homeowner equity on the rise. In fact, the total value of homeowner equity has increased $1.2 trillion over the past year and reached $14.4 trillion in the fourth quarter of last year. In short, that means homeowners are seeing the value of their homes, and their investment, grow. Whether you’re a current homeowner or are about to become one, this is a positive sign – as it indicates that the real estate market is strengthening and offering Americans a good opportunity to find a place they can, not only call home, but also a good financial decision. More here.

Income Has Risen But Will It Lead To Home Sales?

A rising number of Americans surveyed for Fannie Mae’s monthly Home Purchase Sentiment Index say their income is higher than it was last year at this time. But has more money made them more likely to buy or sell a house? Well, according to February’s survey results, it’s hard to say. That’s because, after an increase in January, housing sentiment fell in February – with respondents expressing less confidence in a number of categories. In fact, the number of participants who said it’s a good time to buy a house was down, as was the percentage of participants who said it was a good time to sell. But if January saw increases in housing confidence, why the drop in February? Doug Duncan, Fannie Mae’s senior vice president and chief economist, says some of the uncertainty has to do with changing economic headlines. “Volatility in consumer housing sentiment continued in February, with the new tax law beginning to impact respondents’ take-home pay and the stock market creating negative headlines due to early-month turbulence,” Duncan said. In short, people have more money but they’re still a bit unsure of what lies ahead for the market. More here.

Conditions Are Ripe For Spring Home Buyers

As the spring home buying season approaches, there are many moving parts analysts and experts look at to determine how home buyers and sellers might fare. Economic growth, the job market, interest rates, home prices, buyer demand, and inventory are just some of the factors that will determine how many hopeful home buyers find new homes this year. According to one outlook – from Fannie Mae’s Economic and Strategic Research Group – conditions are good for buyers, except for one specific, long-standing obstacle. “We don’t expect rates to play much of a role in total home sales, especially with anticipated stronger disposable household income growth,” Doug Duncan, Fannie Mae’s chief economist, said. “The ongoing inventory shortages should constrain sales despite otherwise ripe home buying conditions.” In other words, though mortgage rates may inch upward this year, so will household income. That leaves inventory as the main challenge to buyers this spring. With fewer homes for sale, there will be more competition and pressure on prices. More here.