Sales of previously owned homes were unchanged from the month before in August, according to new data from the National Association of Realtors. The number of available homes for sale was also flat, with unsold inventory at a 4.3-month supply at the current sales pace. But, though there was little change in the numbers, Lawrence Yun, NAR’s chief economist, says buyers may be getting ready to move. “Strong gains in the Northeast and a moderate uptick in the Midwest helped to balance out any losses in the South and West, halting months of downward momentum,” Yun said. “With inventory stabilizing and modestly rising, buyers appear ready to step back into the market.” In other words, though there hasn’t been a significant change in conditions, there is a sense that price increases and low inventory are beginning to move in the right direction. This can be seen in the regional results, which show that some areas are improving at a quicker pace than others. Another indicator that relief may be on the way is how long the typical property stayed on the market in August. That’s because, the number of days homes were available before selling moved up for the first time in months. But, despite the improvement, properties are still selling quickly. In fact, the typical home sold in just 29 days in August. More here.

HOW TO HURRICANE-PROOF YOUR HOME

Whether you are evacuating from the area or sheltering in place, performing a general assessment of your home and making it hurricane-ready is always the best plan. To prepare your home for hurricane season we suggest you perform an inspection of your property, get the supplies needed to strengthen your home, and talk with your insurance provider to ensure you have proper coverage.

The strong winds present during Hurricanes Matthew in 2016 lead to extensive property damage throughout Chatham County. Many of the ancient oak trees and tall Georgia pines found throughout the area were toppled over with their root system exposed. Before a hurricane strikes, be sure to remove or trim any dead or diseased tree limbs that are hanging over your house or garage. Ensure that trees that can reach your home are healthy and, if they are not, have them removed.

Take time now to do a quick home assessment for any outdoor hazards or repairs that need to be made. Make a list of any work that needs to be done outside as well as any openings to your home that could be penetrated by wind or rain. Check all outside entry doors to ensure they are securely fastened to their frame. If you have a garage door, ensure that you have a brace to help secure it against the strong winds seen during tropical storms and hurricanes. If strong winds are able to breach the garage door the only direction the wind can travel is up, which could remove the roof of your home.

By assessing your property, you could potentially save your home during a hurricane. The other benefit to assessing your home now is that it gives you the time you need to make repairs and purchase supplies. Before a storm hits, many stores sell out of essential items for protecting homes. Purchasing supplies early can save time, money, and ensure you have the products you need to secure your home

Did you know that most homeowner’s and renter’s insurance policies do not include flood insurance? This means that without a separate flood policy, you may be responsible for covering all hurricane-related flood damage out-of-pocket. This could leave you and your family in a tough situation. Given that flooding due to storm surge and heavy rain is one of the leading causes of damage during a hurricane, we urge you to do an insurance checkup. To do this, simply review your homeowner’s or renter’s insurance policy or call your insurance provider to ask if you have adequate coverage and a flood insurance policy. If you need coverage, CLICK HERE. FEMA provides the National Flood Insurance Program to help connect you to local flood insurance agents. Having flood insurance is a vital step in being prepared for hurricane season; act now- flood insurance policies require a 30 day waiting period. Also, it is important to note that flood zones for Chatham County are freshwater ratings, this means that they rate the risk of flooding from rain only and do not take into consideration the risk of rising saltwater flooding from storm surge. If you live in Chatham County you live in a storm surge zone and are at risk of saltwater flood damage. To see what evacuation zone you live in and what your storm surge risk is, CLICK HERE.

Lastly, when filing an insurance claim after a storm, insurance companies may ask for documentation of damages; this includes damage to your home, property, and belongings. One of the easiest things you can do to make this process smoother is to document your home on a regular basis. Documenting your home consists of taking photos and/or videos of your property, home, and belongings. This way you have proof of what you own and what condition your home was in prior to the storm.

By strengthening your home and checking in with your insurance provider now, you are helping to strengthen our community.

Fall Forecast Sees Improvement On The Horizon

There are many different factors that play a role in the housing market’s health. When home buyers and sellers decide that its time for them to make a move everything from their job security to the global economy has an effect. For example, economic instability half way around the world can move mortgage rates, which will affect how much house you can afford. But what you can afford is also affected by how much you earn and how secure you feel in your job. In short, there’s a lot to keep an eye on. That’s why it can be helpful to tune into expert forecasts and opinions, since most of us don’t have the time or inclination to weigh all of the moving parts that determine what it’ll cost to buy the home of our dreams. So what are the experts saying about the upcoming fall market? Well, according to Freddie Mac’s most recent outlook, there may be reason for optimism. That’s because, though they say fall buyers will face many of the same challenges that held summer sales back, Freddie Mac chief economist Sam Khater says there is good news to be found. “The good news is that the economy and labor market are very healthy right now, and mortgage rates, after surging earlier this year, have stabilized in recent months,” Khater says. “These factors should continue to create solid buyer demand, and ultimately an uptick in sales, in most parts of the country in the months ahead.” More here.

How to Mix and Match Your Kitchen Cabinet Hardware

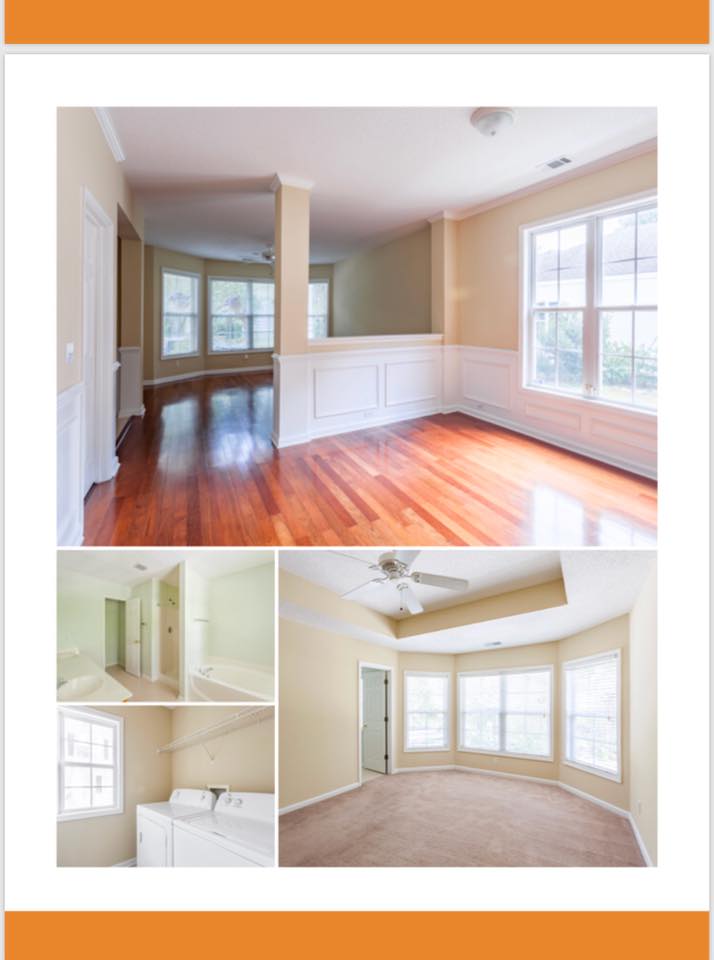

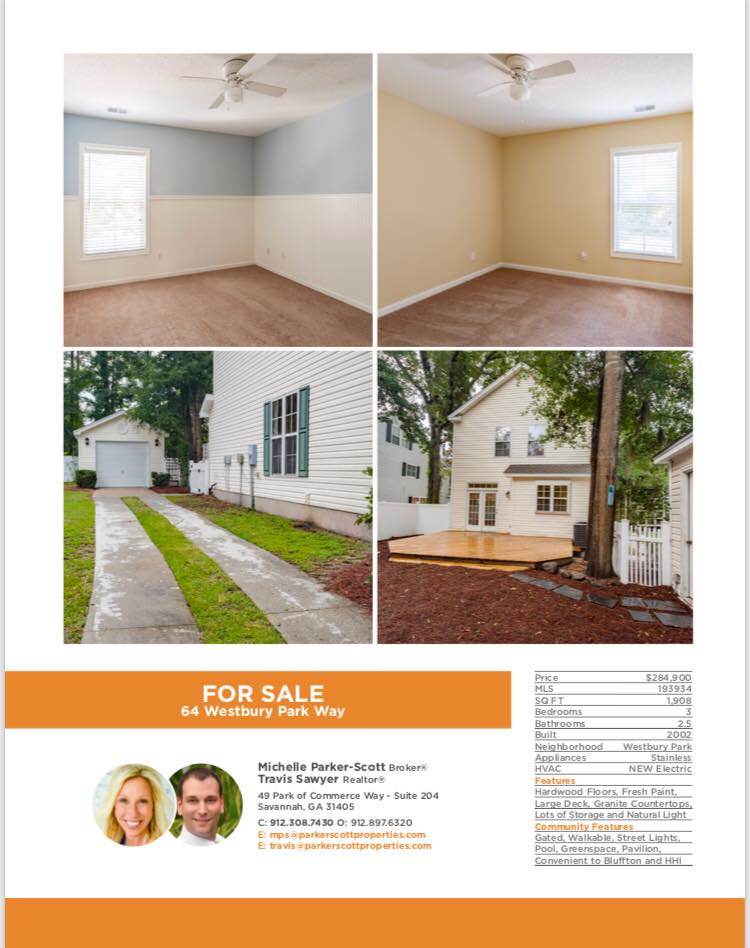

Beautiful Bluffton Listing!!

Why You Should Be Optimistic About Homeownership

Home buyers this year have faced higher prices, more competition, and rising mortgage rates. In short, it’s been a challenging year. But that’s not to say it isn’t a good time to buy a house. There are many reasons to be optimistic about homeownership, in fact – and a few that put current conditions in perspective. Take mortgage rates, for example. According to Freddie Mac, the long term average is 8.16 percent, which means today’s rates are still low historically. Also, home equity is increasing. In fact, it’s up 13% year-over-year. And rising home equity means today’s homeowners are seeing their investment grow. There is also evidence that market conditions may begin to improve. For one, new home construction has been making gains and that means more homes for buyers to choose from. It also means buyers should begin to see prices moderate and competition wane, as more new homes are built to meet today’s high level of buyer demand. In short, there are a lot of good reasons to be optimistic about buying a house this year, despite market challenges. More here.

Home buyers this year have faced higher prices, more competition, and rising mortgage rates. In short, it’s been a challenging year. But that’s not to say it isn’t a good time to buy a house. There are many reasons to be optimistic about homeownership, in fact – and a few that put current conditions in perspective. Take mortgage rates, for example. According to Freddie Mac, the long term average is 8.16 percent, which means today’s rates are still low historically. Also, home equity is increasing. In fact, it’s up 13% year-over-year. And rising home equity means today’s homeowners are seeing their investment grow. There is also evidence that market conditions may begin to improve. For one, new home construction has been making gains and that means more homes for buyers to choose from. It also means buyers should begin to see prices moderate and competition wane, as more new homes are built to meet today’s high level of buyer demand. In short, there are a lot of good reasons to be optimistic about buying a house this year, despite market challenges. More here.

Home Buyer Must Haves Mean Compromise

Searching for a home to buy can be frustrating. Mostly because it’s not always easy to find a house in the right neighborhood with every one of the features you dreamed of. If you find the perfect kitchen, the house will have too few bedrooms. Or you’ll find a house with the right number of bedrooms and the kitchen will be too small. In other words, buying a house means compromise. And, in today’s market, buyers are having to make difficult choices. For example, a new analysis from the National Association of Realtors’ consumer website found that for 73 percent of recent buyers school district was an important factor in deciding which house to buy. But, among those buyers, nearly 80 percent said they had to give up other home features in order to find a house in their preferred district. Some of the features these buyers said they gave up included a garage, a large backyard, an updated kitchen, and an outdoor living area. In short, you might not get everything you want in one house. So prioritize your wish list and know what’s most important to you. More here.

Searching for a home to buy can be frustrating. Mostly because it’s not always easy to find a house in the right neighborhood with every one of the features you dreamed of. If you find the perfect kitchen, the house will have too few bedrooms. Or you’ll find a house with the right number of bedrooms and the kitchen will be too small. In other words, buying a house means compromise. And, in today’s market, buyers are having to make difficult choices. For example, a new analysis from the National Association of Realtors’ consumer website found that for 73 percent of recent buyers school district was an important factor in deciding which house to buy. But, among those buyers, nearly 80 percent said they had to give up other home features in order to find a house in their preferred district. Some of the features these buyers said they gave up included a garage, a large backyard, an updated kitchen, and an outdoor living area. In short, you might not get everything you want in one house. So prioritize your wish list and know what’s most important to you. More here.

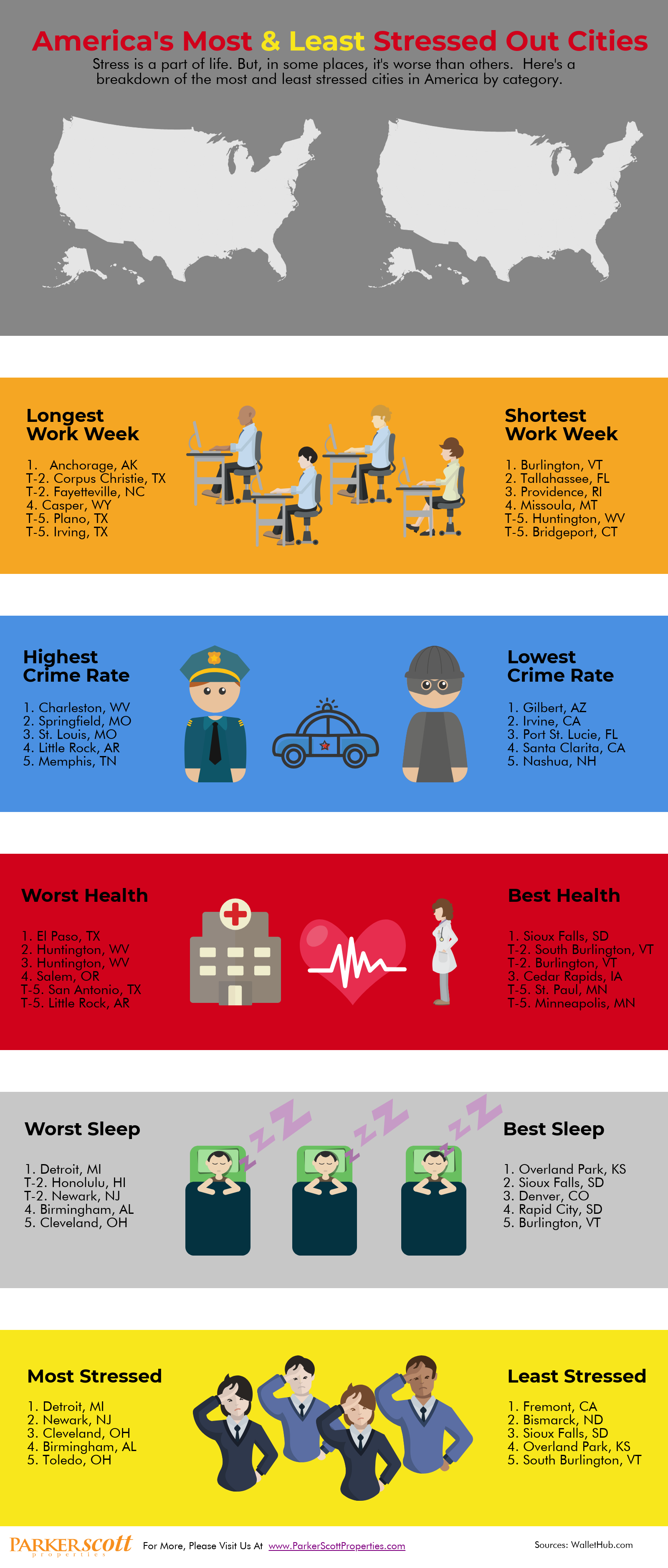

America’s Most & Least Stressed Out Cities

How Long Does It Take Renters To Save For A House?

With rental costs and home prices both increasing, it’s become more challenging for renters to save for a down payment. How much so? Well, according to one recent analysis, the typical renter will have to save for nearly six and a half years to come up with a 20 percent down payment on a median-priced home. And, since the median home value is currently $216,000, depending on your prospective neighborhood, it could take even longer to save up for a house. Renters who aspire to homeownership shouldn’t get discouraged, though. Despite the fact that a 20 percent down payment is the standard amount recommended by financial experts, it is not a requirement in order to buy a house. In fact, depending on the particular terms of your mortgage, you can put down as little as 3 percent. In 2017, for example, 29 percent of first-time buyers had a down payment between 3 and 9 percent. That’s why it’s important to explore your options before deciding homeownership is out of reach. More here.

Why Are Younger Americans Buying Fewer Homes?

In recent years, there’s been a lot of discussion about millennial home buying preferences. Mostly, this is due to the fact that first-time home buyers have historically made up about 40 percent of the home sales in any given year. And, because they account for a large number of the homes sold each year, any fluctuation in those numbers is notable. That’s why Freddie Mac recently took a look at why the homeownership rate among young adults has dropped 8 percent since hitting its peak in 2004. As you might imagine, there are a variety of reasons for this. Among them, affordability, not surprisingly, ranks highest. Concern about being able to afford homeownership is always an issue for younger buyers. But there are many other factors that have played a role in suppressing buyer demand among first-time buyers. Some of the other common reasons named included lower marriage and fertility rates, student-loan debt, borrowing constraints, and a preference for urban living, which tends to be more expensive. In short, young Americans – in addition to affordability challenges – have more debt and are starting families later in life. But, though lifestyle and demographic changes have influenced buying activity, Freddie Mac predicts homeownership rates will rebound, if the economy and wages continue to improve. More here.