https://www.parkerscottproperties.com/

Nearly 60% Of Homes Within Reach of Typical Buyer

Not surprisingly, affordability ranks high among home buyers’ concerns. Rising prices and rumors of future mortgage rate increases have some prospective buyers questioning whether or not they can handle the financial obligations that come along with homeownership. However, new data from the National Association of Home Builders says, in most markets, they can. That’s because, the NAHB’s quarterly measure of affordability found 58.3 percent of new and existing homes sold between the beginning of July and the end of September were affordable to families earning the median income of $68,000. That’s encouraging news for hopeful home shoppers. And, according to Robert Dietz, NAHB’s chief economist, there are a rising number of them hoping to take advantage of conditions while they’re still favorable. “Solid economic growth, along with ongoing quarterly job gains and rising household formations, are fueling housing demand,” Dietz said. “Tight inventories and a forecast of rising mortgage interest rates through 2018 will keep home prices on a gradual upward path and slowly lessen housing affordability in the quarters ahead.” More here.

Despite Price Spike, No Evidence Of Housing Bubble

Along with rising home prices, there has also been increasing concern that the housing market may be entering a bubble. And that’s not surprising, considering the housing crash is still fresh in peoples’ memories. So as home prices reach or exceed previous highs, potential buyers and current homeowners are naturally concerned about the possibility of another housing bubble and crash. According to a recent analysis from Freddie Mac, however, there is a pretty good reason to doubt that today’s price spikes are, in fact, evidence of an emerging bubble. Put simply, one of the primary reasons bubbles form is a perception that home prices will always rise. This causes investors to bid prices up and some mortgage lenders to offer easier credit. In short, a bubble isn’t real. Today’s price increases, on the other hand, are being driven by a lack of for-sale inventory and slower-than-normal new home construction. That means, it is more likely that prices aren’t being driven upward by irrational confidence but, instead, are being driven by an unbalanced market. “The evidence indicates there currently is no house price bubble in the U.S., despite the rapid increase of house prices over the last five years,” Freddie Mac’s chief economist Sean Becketti said. “However, the housing sector is significantly out of balance.” More here.

Figuring Out The Best Down Payment Strategy

Coming up with a down payment strategy can be difficult for some buyers – especially first-time home buyers who don’t have the benefit of a home to sell. In fact, among first-time home buyers, nearly 60 percent put less than 20 percent down on their house. And while that can be a good option for some buyers, it does have downsides. For one, smaller down payments typically mean you’ll have to pay mortgage insurance. It also means you may be edged out when making an offer on a home. Data from Zillow shows that buyers with larger down payments are more likely to get their offer accepted. On the other hand, waiting to save a larger down payment means risking an increase in home prices that makes it so you can’t afford next year what you could afford right now. What is the best move for today’s buyer? Well that depends a lot on their personal financial situation and how much they already have saved. But, according to Zillow, the median home will be worth just over $6,000 more next year at this time – which means you’ll have to save an additional $105 per month to cover the rise in prices. More here.

Housing Sentiment Cools Heading Into Fall

There are many reasons autumn is a good time to buy a house. But, because spring and summer are traditionally seen as the best seasons for home shoppers, the housing market often cools in the months following its busiest season. Evidence of this can be found in Fannie Mae’s most recent Home Purchase Sentiment Index. The index – which asks Americans for their feelings about buying and selling homes, mortgage rates, home prices, etc. – reached an all-time high in September but saw a decline in October. In short, fewer Americans feel now is a good time to buy or sell a house. But that’s normal, according to Fannie Mae’s chief economist, Doug Duncan. “The modest decrease in October’s Home Purchase Sentiment Index is driven in large part by decreases in favorable views of the current home-buying and home-selling climates, a shift we expect at this time of year moving out of the summer home-buying season,” Duncan said. “Indicators of broader economic and personal financial sentiment remain relatively steady.” In other words, because Americans generally feel better about their economic security, the dip in sentiment is likely to be temporary. More here.

Do You Know What Type Of Home Is Right For You?

November Newsletter

September Home Sales Improve Slightly

After consecutive months of decline, sales of existing homes – including single-family homes, townhomes, condominiums, and co-ops – rose 0.7 percent in September, according to the National Association of Realtors. The improvement may have been even greater if not for lack of inventory in some markets and the effects of recent hurricanes in Texas and Florida. Lawrence Yun, NAR’s chief economist, says the fact that there are too few homes for sale has been holding the housing market back, as there has been no shortage of interested home buyers this year. “Realtors this fall continue to say the primary impediments stifling sales growth are the same as they have been all year: not enough listings – especially at the lower end of the market – and fast-rising prices that are straining the budgets of prospective buyers.” But while inventory has been an issue this year, recent data shows listings have been on the rise lately. In fact, they were up another 1.6 percent in September. And, following the busy summer sales season, competition for available homes usually begins to cool, meaning there may be good opportunities for potential home buyers who want to take advantage of improved conditions this fall. More here.

How To Make Buying A House Less Complicated

When asked, Americans overwhelmingly say they value homeownership and believe it increases financial stability. In fact, one recent survey found 93 percent of respondents said they felt that homeownership was an important part of the American dream. Still, despite their desire to buy and own a home, many Americans hesitate before pursuing their dream of becoming homeowners. And while there are many reasons for this, one of them is misconceptions about the home buying process. NeighborWorks America’s fifth annual national housing survey, for example, found a growing number of respondents who say the home buying process is confusing. According to the results, 74 percent of adults said they strongly or somewhat agree that “the home buying process is complicated.” That’s up from 67 percent last year. What accounts for the increase is anybody’s guess but it reinforces the fact that prospective buyers should make choosing a reputable lender and real estate agent among the first steps they take after deciding to buy a home. Working with experienced professionals will demystify the buying process and help you navigate the ins-and-outs of purchasing a house. More here.

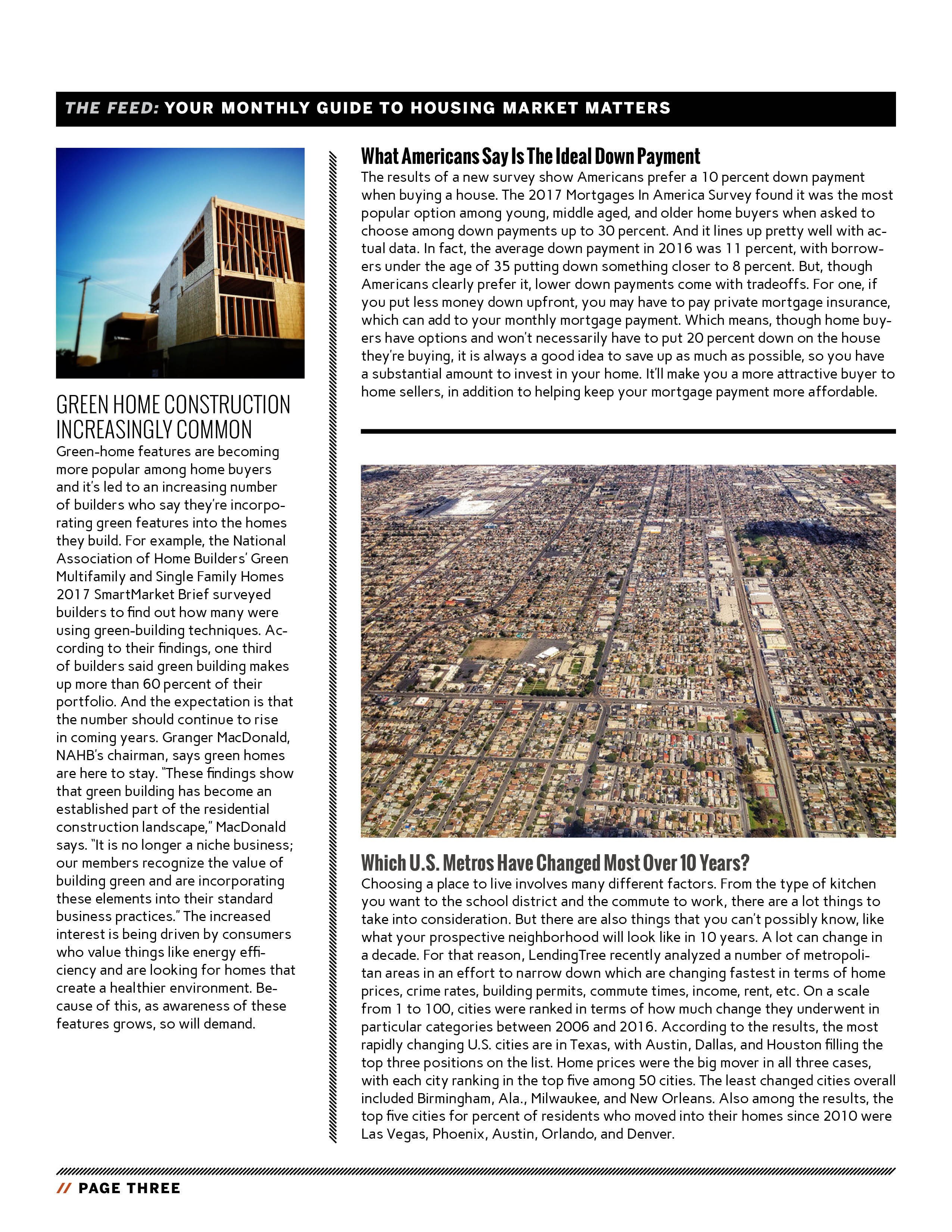

What Do Americans Say Is Their Ideal Down Payment?

The results of a new survey show Americans prefer a 10 percent down payment when buying a house. The 2017 Mortgages In America Survey found it was the most popular option among young, middle aged, and older home buyers when asked to choose among down payments up to 30 percent. And it lines up pretty well with actual data. In fact, the average down payment in 2016 was 11 percent, with borrowers under the age of 35 putting down something closer to 8 percent. But, though Americans clearly prefer it, lower down payments come with tradeoffs. For one, if you put less money down upfront, you may have to pay private mortgage insurance, which can add to your monthly mortgage payment. Which means, though home buyers have options and won’t necessarily have to put 20 percent down on the house they’re buying, it is always a good idea to save up as much as possible, so you have a substantial amount to invest in your home. It’ll make you a more attractive buyer to home sellers, in addition to helping keep your mortgage payment more affordable. More here.