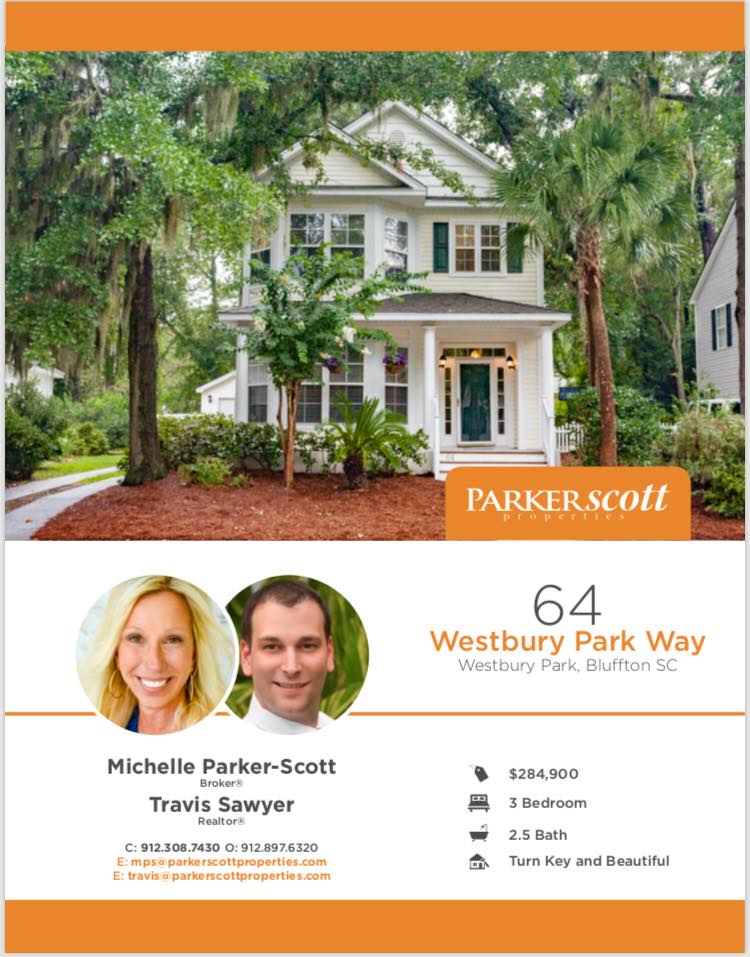

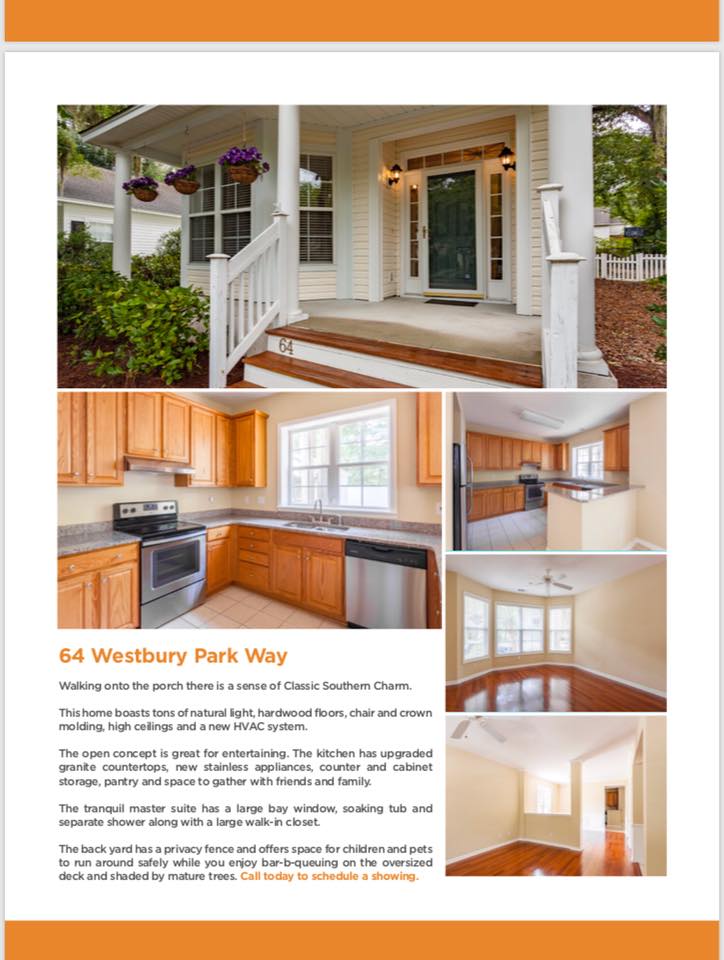

Beautiful Bluffton Listing!!

Why You Should Be Optimistic About Homeownership

Home buyers this year have faced higher prices, more competition, and rising mortgage rates. In short, it’s been a challenging year. But that’s not to say it isn’t a good time to buy a house. There are many reasons to be optimistic about homeownership, in fact – and a few that put current conditions in perspective. Take mortgage rates, for example. According to Freddie Mac, the long term average is 8.16 percent, which means today’s rates are still low historically. Also, home equity is increasing. In fact, it’s up 13% year-over-year. And rising home equity means today’s homeowners are seeing their investment grow. There is also evidence that market conditions may begin to improve. For one, new home construction has been making gains and that means more homes for buyers to choose from. It also means buyers should begin to see prices moderate and competition wane, as more new homes are built to meet today’s high level of buyer demand. In short, there are a lot of good reasons to be optimistic about buying a house this year, despite market challenges. More here.

Home buyers this year have faced higher prices, more competition, and rising mortgage rates. In short, it’s been a challenging year. But that’s not to say it isn’t a good time to buy a house. There are many reasons to be optimistic about homeownership, in fact – and a few that put current conditions in perspective. Take mortgage rates, for example. According to Freddie Mac, the long term average is 8.16 percent, which means today’s rates are still low historically. Also, home equity is increasing. In fact, it’s up 13% year-over-year. And rising home equity means today’s homeowners are seeing their investment grow. There is also evidence that market conditions may begin to improve. For one, new home construction has been making gains and that means more homes for buyers to choose from. It also means buyers should begin to see prices moderate and competition wane, as more new homes are built to meet today’s high level of buyer demand. In short, there are a lot of good reasons to be optimistic about buying a house this year, despite market challenges. More here.

Home Buyer Must Haves Mean Compromise

Searching for a home to buy can be frustrating. Mostly because it’s not always easy to find a house in the right neighborhood with every one of the features you dreamed of. If you find the perfect kitchen, the house will have too few bedrooms. Or you’ll find a house with the right number of bedrooms and the kitchen will be too small. In other words, buying a house means compromise. And, in today’s market, buyers are having to make difficult choices. For example, a new analysis from the National Association of Realtors’ consumer website found that for 73 percent of recent buyers school district was an important factor in deciding which house to buy. But, among those buyers, nearly 80 percent said they had to give up other home features in order to find a house in their preferred district. Some of the features these buyers said they gave up included a garage, a large backyard, an updated kitchen, and an outdoor living area. In short, you might not get everything you want in one house. So prioritize your wish list and know what’s most important to you. More here.

Searching for a home to buy can be frustrating. Mostly because it’s not always easy to find a house in the right neighborhood with every one of the features you dreamed of. If you find the perfect kitchen, the house will have too few bedrooms. Or you’ll find a house with the right number of bedrooms and the kitchen will be too small. In other words, buying a house means compromise. And, in today’s market, buyers are having to make difficult choices. For example, a new analysis from the National Association of Realtors’ consumer website found that for 73 percent of recent buyers school district was an important factor in deciding which house to buy. But, among those buyers, nearly 80 percent said they had to give up other home features in order to find a house in their preferred district. Some of the features these buyers said they gave up included a garage, a large backyard, an updated kitchen, and an outdoor living area. In short, you might not get everything you want in one house. So prioritize your wish list and know what’s most important to you. More here.

August Newsletter

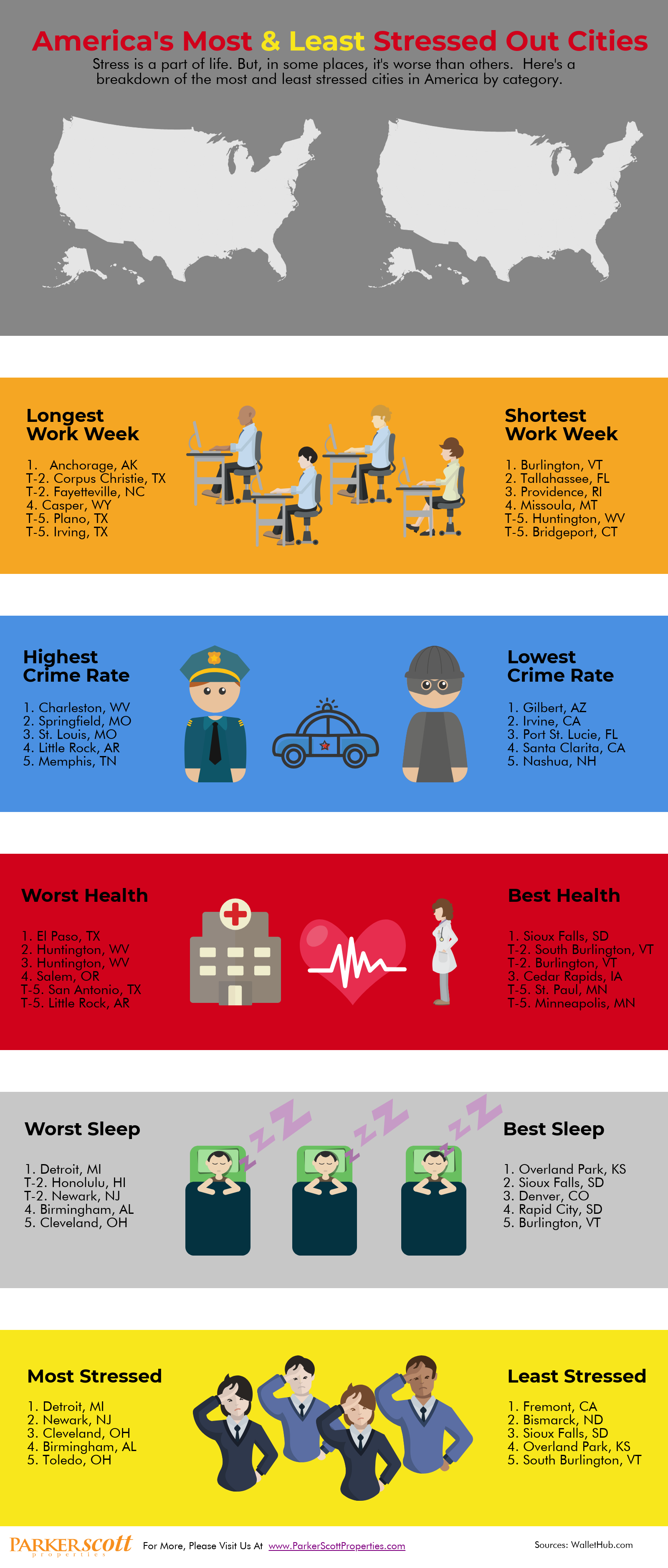

America’s Most & Least Stressed Out Cities

Why You Should Be Optimistic About Homeownership

Home buyers this year have faced higher prices, more competition, and rising mortgage rates. In short, it’s been a challenging year. But that’s not to say it isn’t a good time to buy a house. There are many reasons to be optimistic about homeownership, in fact – and a few that put current conditions in perspective. Take mortgage rates, for example. According to Freddie Mac, the long term average is 8.16 percent, which means today’s rates are still low historically. Also, home equity is increasing. In fact, it’s up 13% year-over-year. And rising home equity means today’s homeowners are seeing their investment grow. There is also evidence that market conditions may begin to improve. For one, new home construction has been making gains and that means more homes for buyers to choose from. It also means buyers should begin to see prices moderate and competition wane, as more new homes are built to meet today’s high level of buyer demand. In short, there are a lot of good reasons to be optimistic about buying a house this year, despite market challenges. More here.

A Quick List Of Things To Do Before The Move

Why Are Younger Americans Buying Fewer Homes?

In recent years, there’s been a lot of discussion about millennial home buying preferences. Mostly, this is due to the fact that first-time home buyers have historically made up about 40 percent of the home sales in any given year. And, because they account for a large number of the homes sold each year, any fluctuation in those numbers is notable. That’s why Freddie Mac recently took a look at why the homeownership rate among young adults has dropped 8 percent since hitting its peak in 2004. As you might imagine, there are a variety of reasons for this. Among them, affordability, not surprisingly, ranks highest. Concern about being able to afford homeownership is always an issue for younger buyers. But there are many other factors that have played a role in suppressing buyer demand among first-time buyers. Some of the other common reasons named included lower marriage and fertility rates, student-loan debt, borrowing constraints, and a preference for urban living, which tends to be more expensive. In short, young Americans – in addition to affordability challenges – have more debt and are starting families later in life. But, though lifestyle and demographic changes have influenced buying activity, Freddie Mac predicts homeownership rates will rebound, if the economy and wages continue to improve. More here.

The Summer Features Home Buyers Want Most