In order for a home to be considered truly green, there are six elements it needs to contain, according to the Appraisal Institute, a professional association of real estate appraisers. These include water efficiency, energy efficiency, indoor air quality, materials, and operations and maintenance. Put simply, to retrofit a home to meet those standards would require a lot of work. But that doesn’t mean you can’t improve your home’s performance through smaller measures. And Appraisal Institute president, James L. Murrett, says, if you do, you’ll not only be able to lower your bills but you may also be able to sell your house for more when the time comes. “The latest research shows that green and energy-efficient home improvements have the potential to pay dividends for buyers and sellers,” Murrett says. “However, it depends on the improvements made. Some green renovations, such as adding Energy Star appliances and extra insulation, are likely to pay the homeowner back in lowered utility bills relatively quickly.” Whether you’re searching for a home to buy or thinking about selling one, a home’s efficiency and performance is an important factor to consider. More here.

Where Buyers Are Stretching Their Budgets Most

When calculating how much house you can comfortably afford, there are a few commonly cited rules that can be used. Among them, the one that says your home’s price shouldn’t be more than three times your annual income is popular. Of course, there are many other factors that play a role, including the amount of debt you have, your retirement goals, other expenses, etc. However, as a simple rule, it can be a good way to quickly come up with a ballpark price range before you work out the fine details. Using a variation on this rule, a recent study took data from the Home Mortgage Disclosure Act and looked at the median amount home buyers borrowed and compared it to borrowers’ median income to calculate how and where buyers were pushing their financial limits to purchase a house. The results, in all but a few cases, weren’t that surprising. That’s because the cities where home buyers had to stretch the most were mostly out West, including Los Angeles, San Francisco, Denver, and Seattle. However, though rust-belt metros like Cleveland, Detroit, and Buffalo were the least leveraged, the middle of the pack included places like Atlanta, Orlando, Chicago, Dallas, and Houston, which might not be the first places thought of when listing affordable areas to buy a house. More here.

Flat Home Sales A Sign Of Market Challenges

New numbers from the National Association of Realtors show sales of existing homes were virtually unchanged from the month before. Down 0.7 percent from June, sales were up in the West but a drop in the Northeast negated the gains. Lawrence Yun, NAR’s chief economist, says a lack of available homes continues to hold sales back. “Listings continue to go under contract in under a month, which highlights the feedback from Realtors that buyers are swiftly snatching up moderately-priced properties,” Yun said. “Existing supply is still not at a healthy level, and new home construction is not keeping up to meet demand.” In short, there are more buyers than there are homes for sale in many markets and it’s making it challenging for buyers this summer. Fifty-five percent of the homes sold in July were on the market for less than a month and, though inventory had been seeing modest gains, it stalled in July. That means, market conditions aren’t likely to change much in the months to come, so buyers should prepare for competition this fall and make sure to be pre-approved by a lender before heading out to look at homes. More here.

Housing Health A Decade After The Crash

Following the housing crash and financial crisis, there was talk that Americans may stop aspiring to homeownership and would no longer see the housing market as a sound investment and reliable creator of wealth. After all, homeowners who saw the values of their homes plummet might become leery and those who hadn’t yet bought a home may’ve considered themselves lucky. And yet, a decade down the road, the market has largely recovered and demand from buyers is running high. Lawrence Yun, the National Association of Realtors’ chief economist, says that is thanks to reforms enacted after the crash. “Over the past 10 years, prudent policy reforms and consumer protections have strengthened lending standards and eliminated loose credit, as evidenced by the higher than normal credit scores of those who are able to obtain a mortgage and near record-low defaults and foreclosures, which contributed to the last recession,” Yun says. And it’s true. Today, market conditions are fueled, not by a lack of a demand, but by a lack of enough homes to meet the high level of demand. Fortunately, Yun sees even more improvement on the horizon. In fact, his forecast for the next year includes rising inventory, moderating price growth, and more home sales as affordability conditions ease and make homeownership even more attractive to prospective buyers. More here.

Four Things To Look For In A Neighborhood

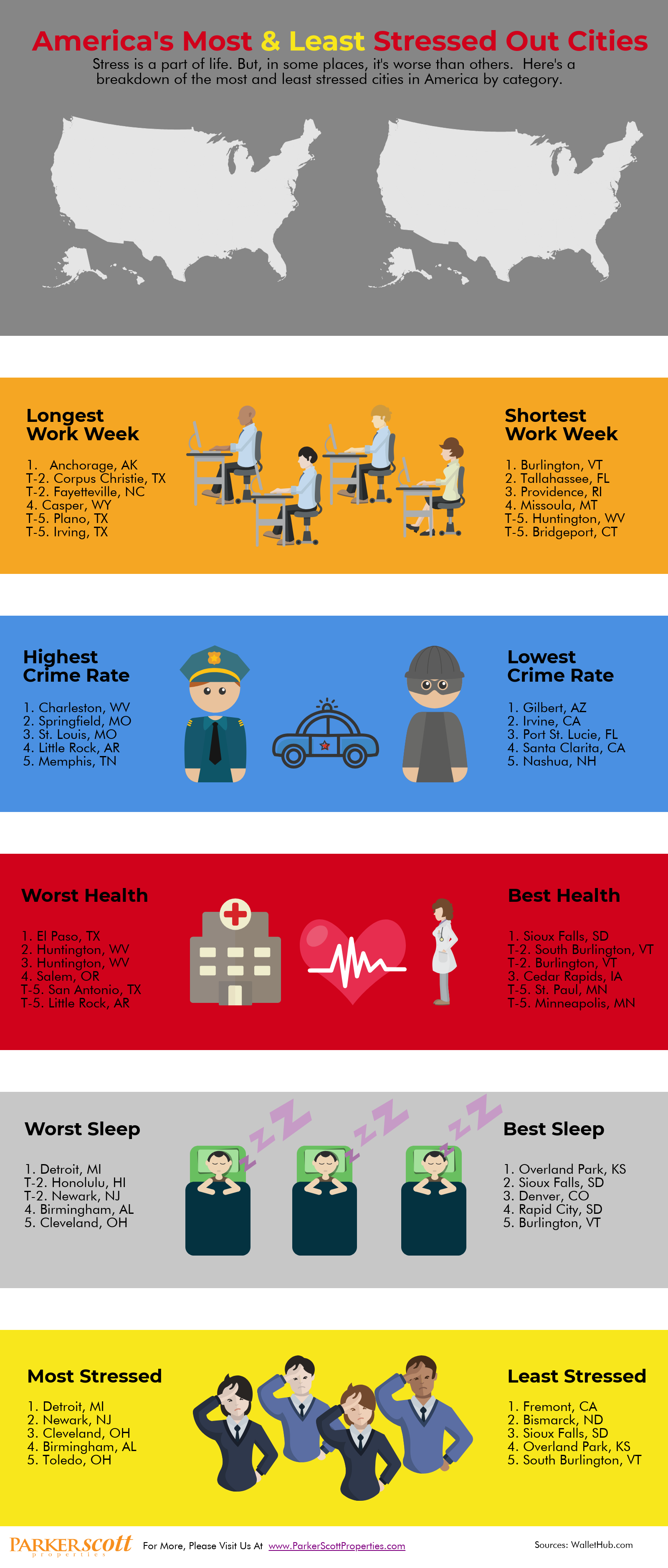

America’s Most & Least Stressed Out Cities

America’s Homes Are Growing Older

You can tell a lot about the way an area grew by the age of its homes. The pace of suburban sprawl, for example, can be mapped just by observing the way homes get newer as you get further from the city’s center. Houses built in the 1920s give way to homes from the ’50s and ’60s and so on. But that’s not all you can learn from paying attention to the collective age of the country’s housing stock. You can also tell a lot about the housing market’s ups-and-downs. One example can be found in a recent analysis from the National Association of Home Builders. According to the NAHB, the median age of owner-occupied homes is now 37 years, which is up from 31 years in 2005. In fact, more than half of our homes were built before 1980 and 38 percent were built before 1970. In other words, America’s homes are getting older. But why? One reason is that there have been fewer new homes built over the past decade, mostly due to the housing crash and financial crisis. That has caused an increase in the median age of the housing stock. It also has caused a boost to the remodeling industry, as older homes require more renovations to keep up with new technology and features desired by home buyers. More here.

Head Vs. Heart: Why Buyers Need To Be Careful

Log And Timber Homes Increasing In Popularity

If you were asked to name a hot home design trend, you probably wouldn’t guess log homes. And yet, new data from the National Association of Home Builders shows last year’s sales of log and timber homes were 56% higher than in 2012. That’s a big jump. So what’s behind the increase? Well, for one thing, today’s log and timber homes don’t resemble what might come to mind when thinking of an old-fashioned “log cabin.” According to the NAHB, “Revenues from log and timber frame homes have risen at a faster pace than units sold over the past six years as floorplans for the homes have expanded and offerings more extravagant.” In other words, today’s log homes are bigger and more luxurious than in the past. In fact, the average log home is 2,031 square feet. Still, the popularity of the homes is impressive when considering the fact that sales last year were only 7.8 percent below the number sold in 2006, while the rest of the single-family construction industry is down 42 percent. In short, log homes have been around forever and, based on their current popularity, they aren’t going anywhere any time soon. More here.