The high end of the real estate market has followed a different path since the financial crisis and housing crash. But while the luxury home market was able to avoid some of the ups-and-downs the rest of the market has endured, things are beginning to change. In fact, one recent analysis shows the number of homes for sale priced at or above $1 million dollars fell significantly during the first quarter of this year, as compared to the year before. And, if inventory continues to drop, the luxury home market could see some of the spiking prices and competition for available homes that buyers have found in more affordable price ranges. However, those this may be true, the effects have, so far, been far more muted than in the overall market. For example, the average luxury home was on the market for 82 days during the last quarter. That’s faster than the same time last year but much longer than the overall average. For comparison, the National Association of Realtors’ most recent numbers show the typical existing home was on the market for just 30 days, with 50 percent of homes sold in less than a month. More here.

Compromise Isn’t Just For Home Buyers

With buyer demand high and the number of houses for sale low, today’s market is favorable for homeowners who want to sell. But though they’re likely to find interested buyers, homeowners shouldn’t expect that everything will always go their way. In fact, a home’s sale almost always involves a negotiation and home sellers, just like buyers, should expect to have to compromise here and there. For example, 76 percent of sellers said they had to make at least one concession when selling their home, according to one recent survey. That means, even in markets that favor sellers, homeowners should have some flexibility when it comes to working out the details of the final sale. Home sellers should also be prepared to make some pre-sale improvements to their house, as the vast majority of recent home sellers also said they had to fix up their home before listing it. In short, regardless of how hot your local market is, you still have to get your house in shape and work with your home’s buyer to ensure the sale is a success on both ends. More here.

Housing Outlook Says Take The Long View

If you spend any time following the real estate market or economy, you know there’s no shortage of data. Nearly every day there’s a new report detailing some corner of our economic lives, whether it’s consumer spending, mortgage rates, jobs, or home sales. But reading the day-to-day news reports can sometimes give you a distorted view of what’s really happening. That’s because monthly updates on the housing market’s ups-and-downs can be more volatile than a look at annual results. And so it’s important to take a big-picture view of the market from time to time. For example, Fannie Mae’s most recent Economic and Housing Outlook says, despite a slower-than-expected first quarter, the economy will continue to grow. And, according to Doug Duncan, Fannie Mae’s chief economist, home sales will also continue to improve, despite a more challenging environment for buyers. “Soft residential investment last quarter should prove temporary, as home sales resume their slow upward grind, with inventory shortages playing friend to prices but foe to affordability and sales.” More here.

One Reason Outdoor Spaces Are So Important

More Home Buyers Sign Contracts In February

If you want to get a feel for how many home buyers there are currently active in the housing market, the National Association of Realtors’ Pending Home Sales Index is a good place to start. It tracks the number of contracts to buy homes signed during the month and, because it measures contract signings and not closings, it’s a good future indicator of where home sales will be a month or so down the road. In short, if there are a lot of pending sales, there will likely be a lot of final sales. Which is why, February’s results are a pretty good indication that the spring season is ramping up. Contract signings were up 3.1 percent in February and rebounded in all four regions of the country. The largest increase was in the Northeast, though pending sales also saw significant improvement in the South. Still, despite the gains, NAR chief economist Lawrence Yun says the pace falls short of last year’s level. “Contract signings rebounded in most areas in February but the gains were not enough to keep up with last February’s level, which was the second highest in over a decade,” Yun said. More here.

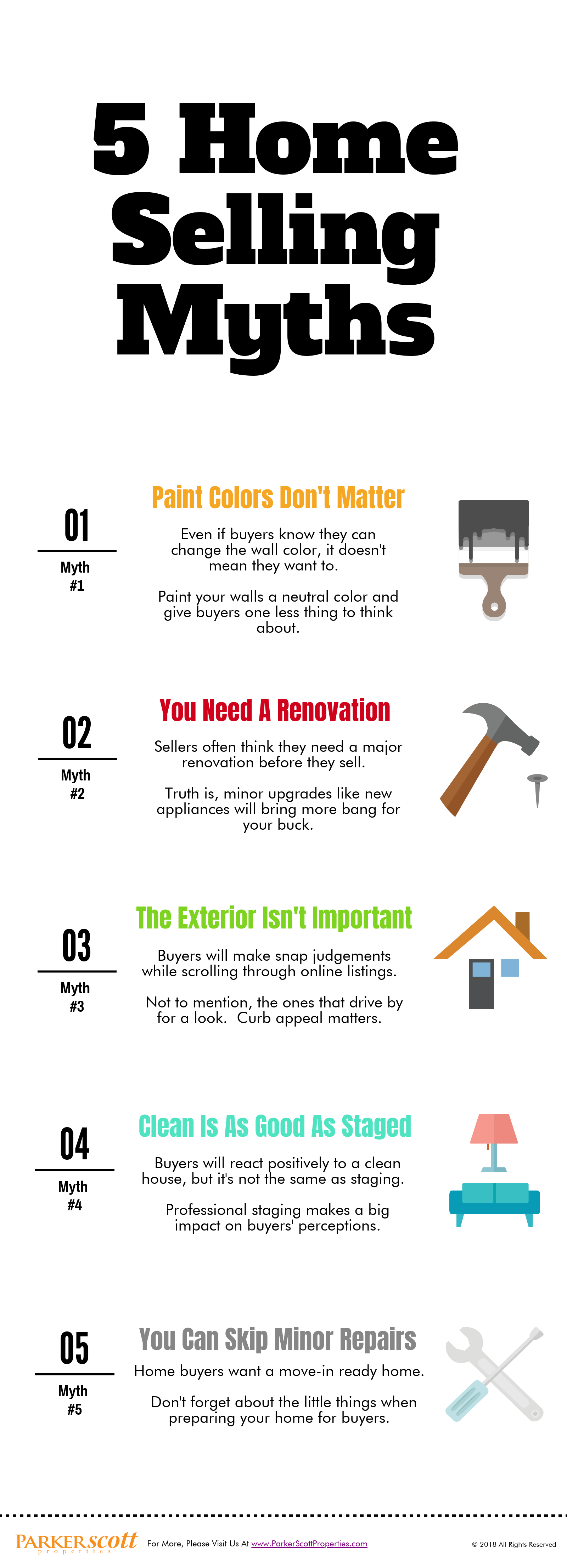

5 Home Selling Myths

Homes Stay On The Market For Fewer Days

These days, there are a lot of people interested in buying a house. A stronger economy, more jobs, and years of pent-up demand have led to a rising number of Americans who are eager to make a move. But while that’s positive, more buyers active in the market also means homes sell faster. In fact, according to Nationwide’s recent Health of Housing Markets Report, the average home was on the market for just 67 days in 2017 – with houses in some market going in half that time. That means, buyers need to do their homework, cause they may not have the luxury of being able to take their time debating each home’s pros and cons. It also means good news for sellers. “As we head into spring and the traditional season when sales heat up, buyers will find that desirable homes won’t be on the market for long,” says David Berson, Nationwide’s senior vice president and chief economist. “Today, the average home is on the market almost half the length of time that it was six years ago. Of course, that is good news for people looking to sell their home.” More here.

Are More New Houses On The Way?

Generally speaking, there are fewer homes available to buy right now than is considered normal. And though conditions will differ from one market to the next, when inventory is an issue, it leads to competition and higher prices. That’s because, there are too many buyers vying for the number of homes currently available. But when there are more buyers than there are homes for sale, conditions are also ripe for builders. And typically, they’ll take notice and build more homes to accommodate those buyers. Based on recent readings of the National Association of Home Builders’ Housing Market Index – which measures builders’ confidence in the market for new homes – that may be where the market is right now. For example, builders confidence has been at or above 70 for four consecutive months, on a scale where any number above 50 indicates more builders see conditions as good than poor. And most of their optimism is based on market conditions and their expectations for future sales, rather than current traffic. Which means, builders see an opportunity in this year’s market and may begin ramping up construction of new homes. If that happens, it’ll provide more choices for buyers and help slow spiking price increases. More here.

Income Has Risen But Will It Lead To Home Sales?

A rising number of Americans surveyed for Fannie Mae’s monthly Home Purchase Sentiment Index say their income is higher than it was last year at this time. But has more money made them more likely to buy or sell a house? Well, according to February’s survey results, it’s hard to say. That’s because, after an increase in January, housing sentiment fell in February – with respondents expressing less confidence in a number of categories. In fact, the number of participants who said it’s a good time to buy a house was down, as was the percentage of participants who said it was a good time to sell. But if January saw increases in housing confidence, why the drop in February? Doug Duncan, Fannie Mae’s senior vice president and chief economist, says some of the uncertainty has to do with changing economic headlines. “Volatility in consumer housing sentiment continued in February, with the new tax law beginning to impact respondents’ take-home pay and the stock market creating negative headlines due to early-month turbulence,” Duncan said. In short, people have more money but they’re still a bit unsure of what lies ahead for the market. More here.

The Top Sacrifices Millennial Buyers Say They’ll Make

Buying a house is a major financial transaction and, for most Americans, the largest one they’ll ever undertake. So pulling the necessary resources together to be able to afford the upfront costs, in addition to the ongoing obligations, maintenance, and upkeep can be difficult. Especially for first-time home buyers who don’t have the benefit of being able to sell a home to help fund their down payment. For this reason, many millennials who aspire to homeownership have decided it’s worth making a few sacrifices in order to help save money to buy a house. In fact, according to a recent survey from ValueInsured, there are some common sacrifices young Americans say they are willing to make in order to buy their first home. For example, nearly 60 percent of respondents said they would cut down or give up eating out – which made giving up restaurants the most popular sacrifice among survey participants. Other common sacrifices included taking a second job, not going on vacations, moving back in with their parents, and giving up shopping for clothes. More here.