Young Americans Choose The City Over Suburbs

When choosing where you’d like to live, there are a number of factors that you have to weigh. For example, some people may value privacy over convenience while others may prefer proximity to family and friends over entertainment and recreation options. In short, it’s a personal choice. And a lot of times it comes down to whether you’d like to live in a city setting or the suburbs. This is a common debate and one that typically falls along demographic lines. In other words, where you are in life will determine where you want to live. More proof of this is found in a recent report detailing the preferences of millennials. According to the results, young Americans overwhelming choose metropolitan areas known for their hip neighborhoods and closeness to job opportunities. In fact, a look at the top 10 zip codes with the largest population of millennials shows that areas like Chicago’s West Loop, Boston’s North End, and Manhattan’s Financial District are overwhelmingly popular with a younger demographic. Other city neighborhoods that make the list include Capitol Hill in Denver, Mission Bay in San Francisco, and Dallas’ Arts District. More here.

Where Buyers Are Stretching Their Budgets Most

When calculating how much house you can comfortably afford, there are a few commonly cited rules that can be used. Among them, the one that says your home’s price shouldn’t be more than three times your annual income is popular. Of course, there are many other factors that play a role, including the amount of debt you have, your retirement goals, other expenses, etc. However, as a simple rule, it can be a good way to quickly come up with a ballpark price range before you work out the fine details. Using a variation on this rule, a recent study took data from the Home Mortgage Disclosure Act and looked at the median amount home buyers borrowed and compared it to borrowers’ median income to calculate how and where buyers were pushing their financial limits to purchase a house. The results, in all but a few cases, weren’t that surprising. That’s because the cities where home buyers had to stretch the most were mostly out West, including Los Angeles, San Francisco, Denver, and Seattle. However, though rust-belt metros like Cleveland, Detroit, and Buffalo were the least leveraged, the middle of the pack included places like Atlanta, Orlando, Chicago, Dallas, and Houston, which might not be the first places thought of when listing affordable areas to buy a house. More here.

Why You Should Be Optimistic About Homeownership

Home buyers this year have faced higher prices, more competition, and rising mortgage rates. In short, it’s been a challenging year. But that’s not to say it isn’t a good time to buy a house. There are many reasons to be optimistic about homeownership, in fact – and a few that put current conditions in perspective. Take mortgage rates, for example. According to Freddie Mac, the long term average is 8.16 percent, which means today’s rates are still low historically. Also, home equity is increasing. In fact, it’s up 13% year-over-year. And rising home equity means today’s homeowners are seeing their investment grow. There is also evidence that market conditions may begin to improve. For one, new home construction has been making gains and that means more homes for buyers to choose from. It also means buyers should begin to see prices moderate and competition wane, as more new homes are built to meet today’s high level of buyer demand. In short, there are a lot of good reasons to be optimistic about buying a house this year, despite market challenges. More here.

Home buyers this year have faced higher prices, more competition, and rising mortgage rates. In short, it’s been a challenging year. But that’s not to say it isn’t a good time to buy a house. There are many reasons to be optimistic about homeownership, in fact – and a few that put current conditions in perspective. Take mortgage rates, for example. According to Freddie Mac, the long term average is 8.16 percent, which means today’s rates are still low historically. Also, home equity is increasing. In fact, it’s up 13% year-over-year. And rising home equity means today’s homeowners are seeing their investment grow. There is also evidence that market conditions may begin to improve. For one, new home construction has been making gains and that means more homes for buyers to choose from. It also means buyers should begin to see prices moderate and competition wane, as more new homes are built to meet today’s high level of buyer demand. In short, there are a lot of good reasons to be optimistic about buying a house this year, despite market challenges. More here.

Homes Sell Quickly Even As Inventory Improves

New data from the National Association of Realtors shows the typical for-sale property was on the market for just 26 days in April. And, though sales were down during the month, the speed with which homes are selling is evidence that buyers are interested and active in the market. Lawrence Yun, NAR’s chief economist, says homes are selling at a record pace. “What is available for sale is going under contract at a rapid pace,” Yun said. “Since NAR began tracking this data in May 2011, the median days a listing was on the market was at an all-time low in April, and the share of homes sold in less than a month was at an all-time high.” In fact, 57 percent of homes were sold in less than 30 days in April. Among the reasons homes are selling so quickly this spring is a lower-than-normal number of homes available for sale. Since buyer demand is high and the number of homes available to buy is low, homes are being sold very quickly. However, April’s numbers also show inventory was up 9.8 percent from the month before, which is an encouraging sign for hopeful home buyers. More here.

Buyers Come Out Despite Market Challenges

For the second straight month, sales of previously owned homes increased from one month earlier, according to new numbers from the National Association of Realtors. In fact, sales of single-family homes, townhomes, condos, and co-ops, rose 1.1 percent to an annual rate of 5.60 million in March. Lawrence Yun, NAR’s chief economist, says warmer weather may have had something to do with the sales pickup. “Robust gains last month in the Northeast and Midwest – a reversal from the weather-impacted declines seen in February – helped overall sales activity rise to its strongest pace since last November at 5.72 million,” Yun said. Put simply, low inventory and higher prices have made the housing market more challenging for buyers in some markets but overall demand is running high and, as the weather improves, may even see further gains. For interested buyers, that means available homes are selling fast this spring. The NAR reports that the typical property was on the market for just 30 days in March and half of the homes that sold were purchased in less than a month. More here.

This Summer’s Luxury Home Market Is Hot

The challenge of finding an affordable entry-level home in today’s housing market gets a lot of coverage. First-time buyers facing higher rent, difficulty saving for a down payment, and low inventory are an important demographic and their habits have implications for the overall health of the market. But, at the same time as the starter-home market has been hot, demand for luxury homes has also ramped up. In fact, new research shows sales of homes $1 million and higher are up 25 percent over last year – which represents the largest jump since January 2014. In short, the improved economy and job market has also led to an increase in demand for luxury homes, the same way it has elevated demand across all segments of the housing market. Among specific regions, northern California leads the pack with four of the top 10 fastest-growing luxury markets. Other fast-growing markets include Denver, Seattle, and Nashville, which all have seen homes on the high-end of the market going under contract in fewer days than at this time last year. More here.

How A Sellers’ Market Could Be Good For Buyers

The housing market is about supply and demand. When there are a lot of buyers and too few homes, prices and competition rise, making it a good time for homeowners who want to sell. When there are more homes than buyers, prices fall and bargains abound. In short, the market will usually favor either buyers or sellers. But, naturally, conditions that are good for buyers will lead to more buyers and vice versa. In other words, the pendulum swings back and forth. Which is why, a recent survey holds hope for buyers concerned about higher prices and increasing competition. The National Association of Realtors’ Housing Opportunities and Market Experience survey found that 75 percent of Americans think now is a good time to sell a home. And, if the perception that it’s a good time to sell leads to more homes being listed for sale, that will soon begin to moderate prices, making buying a more affordable proposition for the almost equal number of Americans who say they think now is a good time to buy. More here.

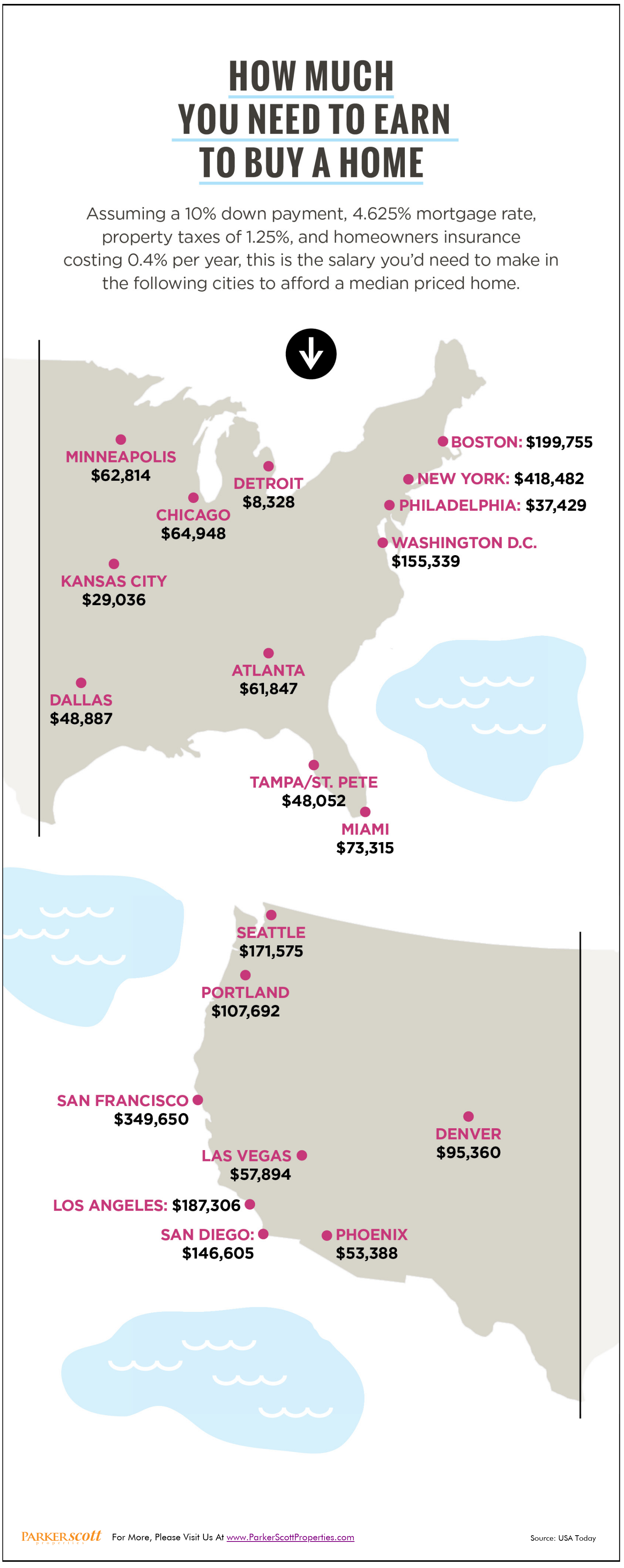

How Much You Need To Earn To Buy A Home

June 2018 Newsletter