Home Buyer Must Haves Mean Compromise

Searching for a home to buy can be frustrating. Mostly because it’s not always easy to find a house in the right neighborhood with every one of the features you dreamed of. If you find the perfect kitchen, the house will have too few bedrooms. Or you’ll find a house with the right number of bedrooms and the kitchen will be too small. In other words, buying a house means compromise. And, in today’s market, buyers are having to make difficult choices. For example, a new analysis from the National Association of Realtors’ consumer website found that for 73 percent of recent buyers school district was an important factor in deciding which house to buy. But, among those buyers, nearly 80 percent said they had to give up other home features in order to find a house in their preferred district. Some of the features these buyers said they gave up included a garage, a large backyard, an updated kitchen, and an outdoor living area. In short, you might not get everything you want in one house. So prioritize your wish list and know what’s most important to you. More here.

Remodeling Index Finds Home Repairs On The Rise

Maintenance is a big part of being a homeowner. Put simply, owning a home means having a never-ending to-do list and, depending on your level of know-how, some of it will require the help of a professional. These jobs can range from major renovations such as putting an addition on your house to basic upkeep and repairs like having ducts cleaned and fixing leaks. Essentially, you are your home’s temporary caretaker and how well you take care of it will affect not only how comfortable and enjoyable your home is to live in but also how much you can ask for it when you sell. These days, it seems Americans are increasingly interested in fixing up their homes. In fact, newly released data from the National Association of Home Builders shows home remodeling contractors are busy right now. So what kind of jobs are most in demand? Well, results show demand is highest for basic maintenance and repairs, while additions and alterations – both major and minor – saw slight declines during the second quarter. In short, Americans are tackling their to-do lists and fixing up their homes. This could be due to improved economic conditions and a stronger job market, though it may also be that current homeowners are tending to their homes in hopes of listing them someday soon. More here.

How Affordability Perceptions Affect The Market

Perception doesn’t always match reality but, when it comes to financial markets, it can make a difference. For example, if you’ve ever invested in the stock market, you know that a company’s stock can rise or fall based on the day’s news, even if the company’s fundamentals and outlook remain the same as the day before. In short, perception matters. And, in today’s housing market, there’s a perception that there are few affordable homes available to prospective buyers. In fact, according to a recent analysis from Fannie Mae, though only 8 percent of homeowners consider their current mortgage unaffordable, 45 percent said that affordable housing is difficult to find in their area. Which provides a snapshot of what is going on in many markets across the country. Homeowners that want to sell may be waiting because they don’t feel they’ll find an affordable house to move into. The flip side of this, however, is that as long as current homeowners aren’t selling their homes, inventory shortages will continue, which is the primary factor behind recent price increases. More here.

July Newsletter

Homeowners See Big Gains On Home Sales

Home prices have been climbing for the past few years. And while that has presented affordability challenges for buyers in some markets, it’s also produced big gains for homeowners who’ve sold a home recently. Take, for example, new estimates showing that, nationally, the typical home seller, after living somewhere for eight years, made nearly $40,000 on their home sale. That’s good news for homeowners. And, in some markets, the sales gain is even higher. Homeowners in the Dallas-Fort Worth area saw a median sales gain of $56,297 after just 7.4 years and, in San Jose, sellers’ median price gain was nearly $300,000. But while that may be encouraging for anyone who hopes to sell soon, there is a flip side. Because many home sellers hope to use any money they make on their home sale as a down payment for their next home, the amount gained on a sale may not seem as significant, especially if you’re buying a home in the same market and price range. More here.

Sales Trail Hot Summer Housing Market

The National Association Of Realtors’ most recent Pending Home Sales Index shows that the hot summer housing market has not deterred hopeful home buyers from looking for a house to buy. But though there is a high level of demand from buyers, supply issues continue to hold back sales numbers. In fact, the index found that the number of contracts to buy homes signed in May was essentially flat from the month before. Lawrence Yun, NAR’s chief economist, says sales are being hurt by low inventory but recent news that new home construction hit a 10-year high should be encouraging to prospective buyers. “Several would-be buyers this spring were kept out of the market because of supply and affordability constraints,” Yun said. “The healthy economy and job market should keep many of them actively looking to buy, and any rise in inventory would certainly help them find a home.” Regionally, results were mixed, with the Midwest, Northeast, and West all seeing modest increases, while the South saw a 3.5 percent drop. Pending home sales numbers are an important indicator, as they cover contract signings and not closings, which means they often foreshadow upcoming sales data. More here.

How To Keep Your House Cool This Summer

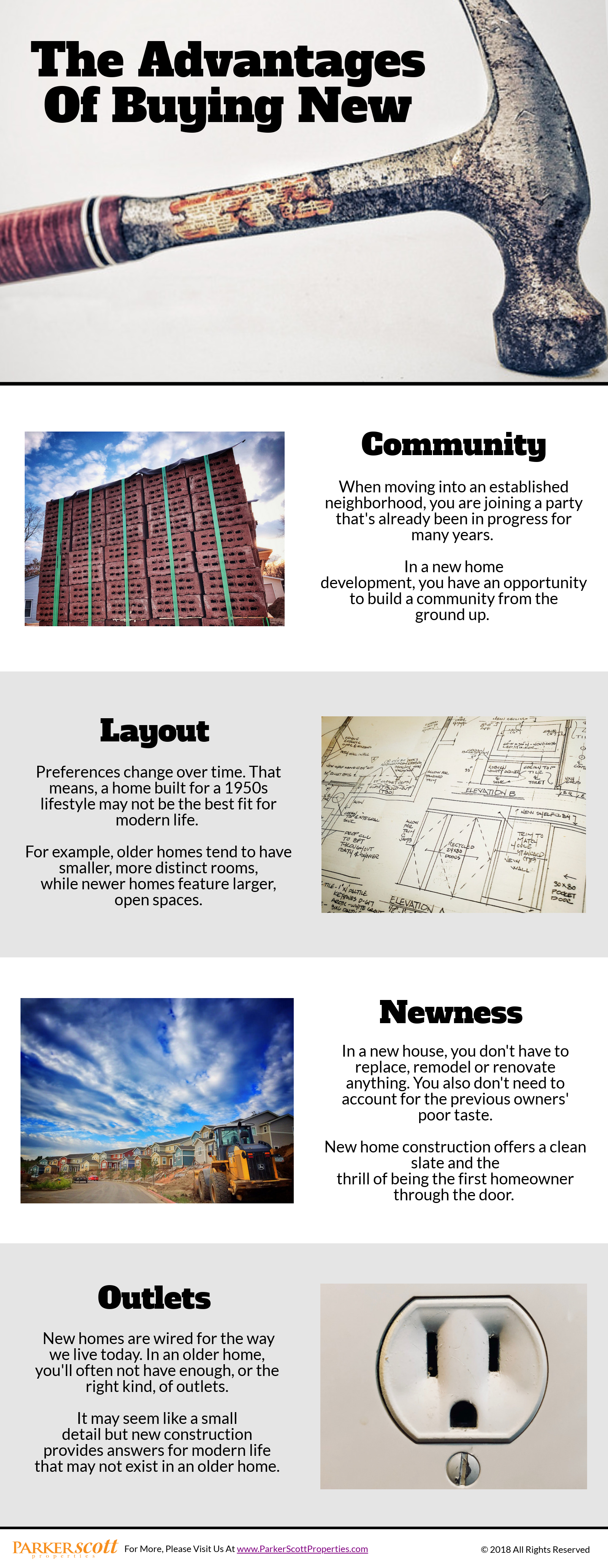

The Advantages Of Buying New

Where Are The Fastest Growing Luxury Markets?

When shopping for a house to buy, it’s hard not to fantasize about the homes just out of your price range. Regardless of what you plan to spend, it’s fun to imagine buying a house even bigger, nicer, and more feature filled than the ones within your reach. And, with the Internet, it’s easier than ever to steal a glance inside the nicest homes in the area. In fact, you can shop real estate in any area. But, while we’re all familiar with famous luxury markets such as Beverly Hills or Aspen, Colo., what are the nation’s lesser-known, up-and-coming luxury markets? Well, according to a new index from the National Association of Realtors’ consumer website, East Coast house hunters looking for a warm weather getaway have propelled Sarasota and Collier counties in Florida to two of the top five spots on the list of fastest growing luxury markets. Other areas that made the list include counties containing Castle Rock, Colo., San Jose, Calif., Queens N.Y., Seattle, Jersey City, and Redwood City, Calif. But, if you’re planning a move to one of these hot spots, you have to move fast as they all have seen 10 to 20 percent price increases over the past year. More here.