Today’s Market: By The Numbers

When asked, most Americans who don’t own a home say they’d like to become homeowners someday. Regardless of current market conditions or the state of the economy, the desire to own a home endures. Part of this is because it helps to build wealth. The other part is homeownership’s long-cemented status as a key element of the American dream. So what’s keeping aspiring homeowners from pursuing their dream? Well, one main factor is coming up with a down payment. The down payment is among the biggest obstacles that keep people from buying. Mostly, this is because the traditional 20 percent down payment can be difficult to save. In fact, according to one recent analysis, someone making the median income and saving 10 percent of their earnings each month would take more than seven years to save a down payment on the typical American home. And, because home prices have grown faster than incomes over the past few decades, the amount of time it takes has been increasing. Fortunately, though, a 20 percent down payment isn’t required, depending on the type of loan you choose. Also, where you’re looking to buy will affect the amount of time it’ll take. For example, a down payment in Pittsburgh will take just 4.8 years to save, while in cities like Boston or Miami it can take twice that long. More here.

During the spring and summer, homes for sale were selling fast. So fast that the typical home was on the market less than a month. And while home buyers should still expect desirable homes to go quickly, there may be some relief in sight. That’s because, new numbers from the National Association of Realtors show that the majority of homes are now on the market more than a month. In fact, properties typically sold in 32 days in September, an improvement over August when homes moved in just 29 days. Lawrence Yun, NAR’s chief economist, says a trend may be developing. “There is a clear shift in the market with another month of rising inventory on a year over year basis, though seasonal factors are leading to a third straight month of declining inventory,” Yun said. “Homes will take a bit longer to sell compared to the super-heated fast pace seen earlier this year.” At the current sales pace, there is a 4.4-month supply of available homes for sale. A 6-month supply is generally considered a healthy market. More here.

No one wants to make big decisions hastily. It’s a great way to make mistakes and end up with regrets. Which is why, in an ideal situation, home buyers would have time to consider the pros and cons of multiple houses and choose the one that best fits their needs and wishlist. Unfortunately, in a competitive market, that’s not always possible. And so, buyers have to be prepared and ready to make an offer when they see a house they like. The good news is, now that inventory is beginning to rise and houses are staying on the market longer, home buyers have more time to weigh their decision. In fact, according to a recent survey, the number of buyers who made an offer on a house without seeing it first has fallen 15 percent since late last year. This is a good indication that buyers are feeling some relief and aren’t feeling pressured to move as quickly as they were when inventory was tighter. But though this is encouraging news for potential buyers, it doesn’t mean the market isn’t competitive. If you’re interested in purchasing a home any time soon, it’s still best to do your homework, be prepared, prequalified, and ready to make an offer when you find a house you like. More here.

Sometimes picking a house to buy can cause anxiety. After all, what if you choose the wrong one and aren’t happy living there? What if there are structural or mechanical issues that go undetected and will end up meaning costly renovations? It’s hard to imagine that you could possibly cover all the potential issues in just a few walkthroughs. And so, it’s natural to worry about buyer’s remorse. But, according to a new survey, you might be worrying yourself unnecessarily. That’s because, the results show an overwhelming majority of respondents said they love their current home. In fact, 83 percent of participants said they were happy in their house. To some degree, the responses fell along demographic lines, with people 55 years or older and retirees being the most likely groups to say they love their home and have no plans to move. Respondents between 18 and 34 were more likely to want to move. There were also regional differences. For example, residents in Boston and Detroit were more likely to say they like their current home and would rather renovate than move, while the survey found Los Angeles residents were the most likely to say they’d prefer a new house. More here.

Affordability is always a top concern for people thinking about buying a house. Of course, there are other factors that are important when deciding whether or not to move. But what you can or can’t afford may be the biggest. After all, if you don’t have enough for a down payment or couldn’t keep up with the mortgage on a new place, it doesn’t really matter how close to the office it is or in what school district. That’s why a new report from the National Association of Realtors’ consumer website is good news for prospective home buyers. The report shows that the number of homes for sale saw it’s largest year-over-year gain in five years. Why’s this important? Well, in today’s market, the rate of home price increases is being driven by the fact that there are too few homes for sale. In other words, since there are more buyers than homes, sellers can demand a higher price. But as more homes become available, buyers will have more choices and price increases will begin to slow. The fact that inventory is up 8 percent over the year before and showing signs of additional gains means there may be relief on the way for buyers worried that they won’t be able to find a home they like or one in their price range. More here.

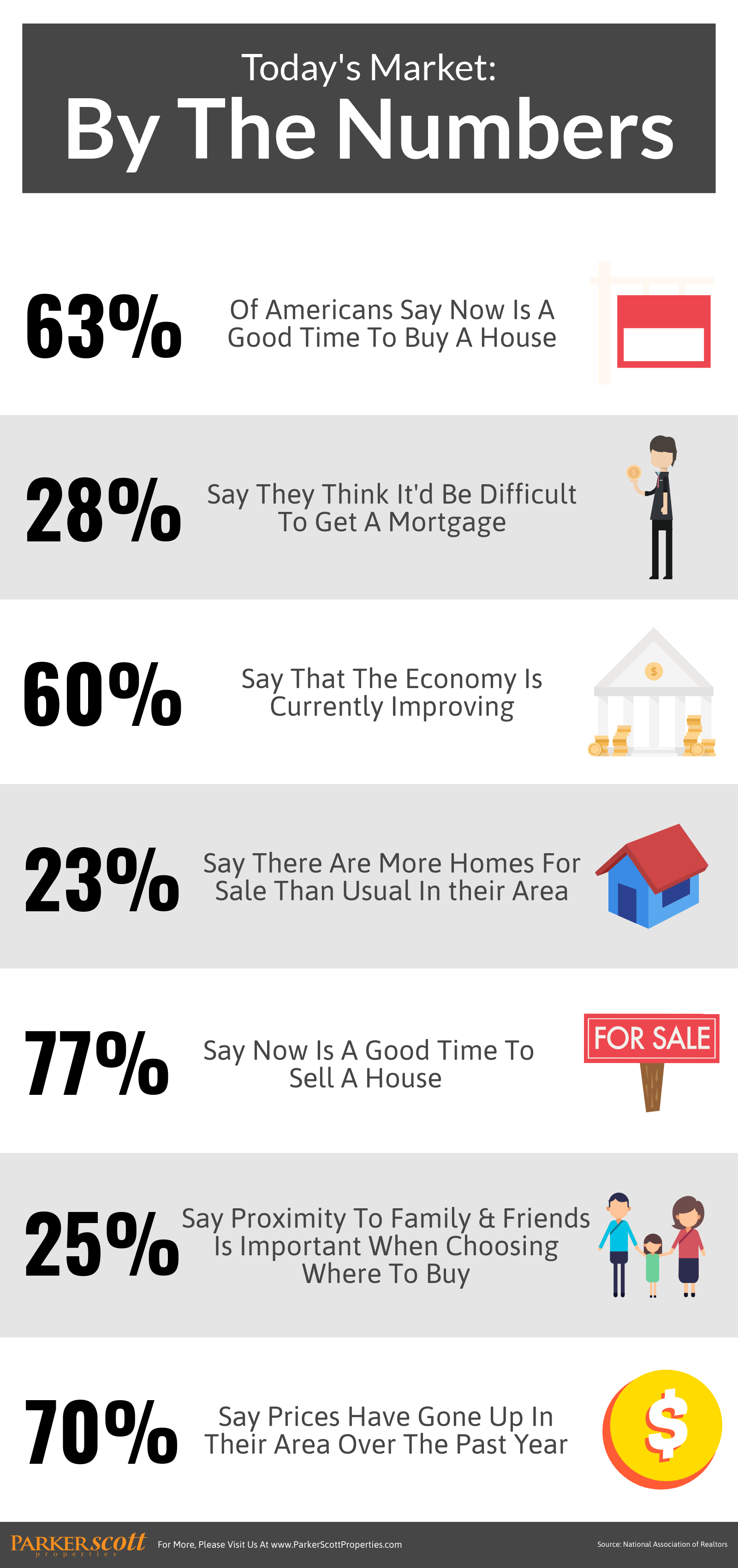

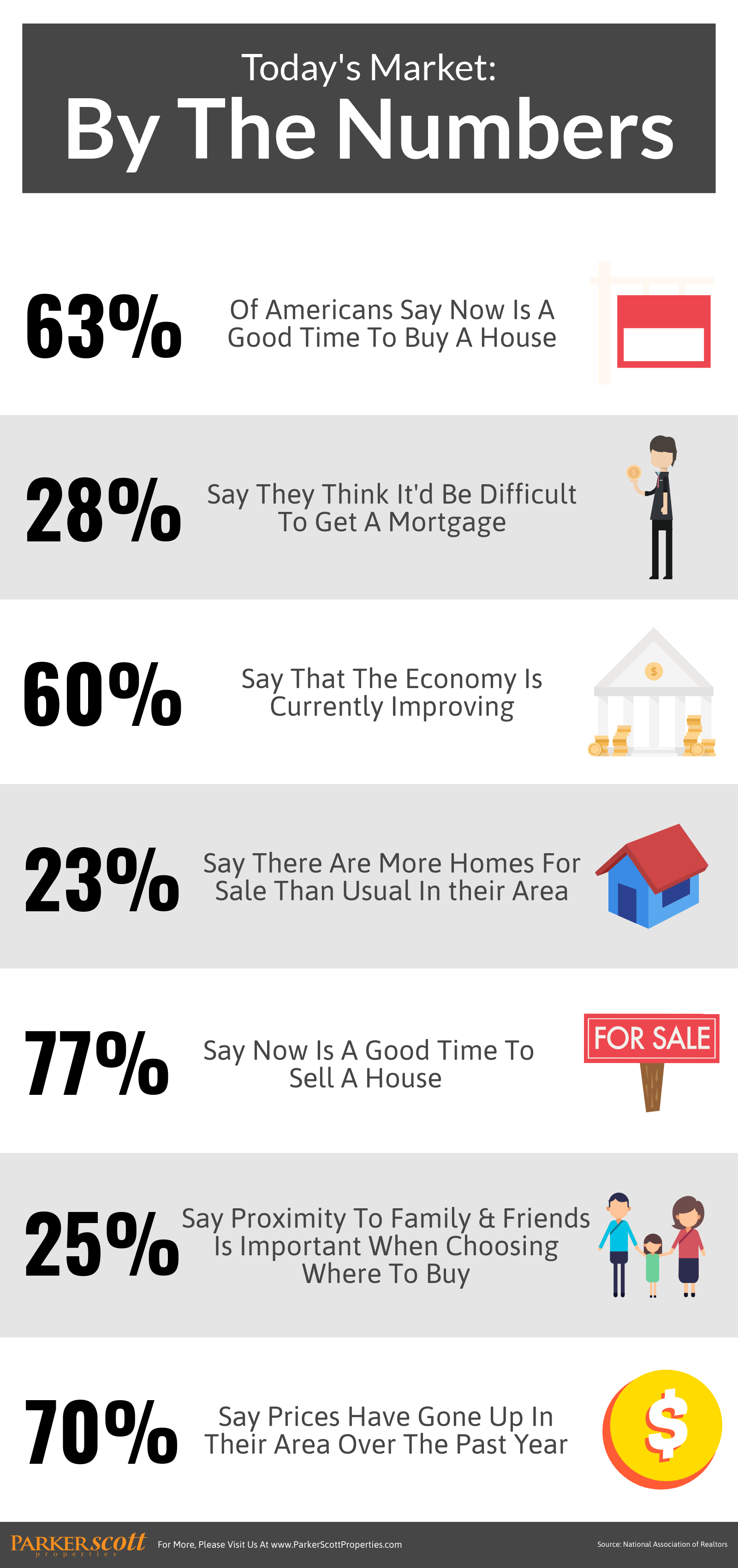

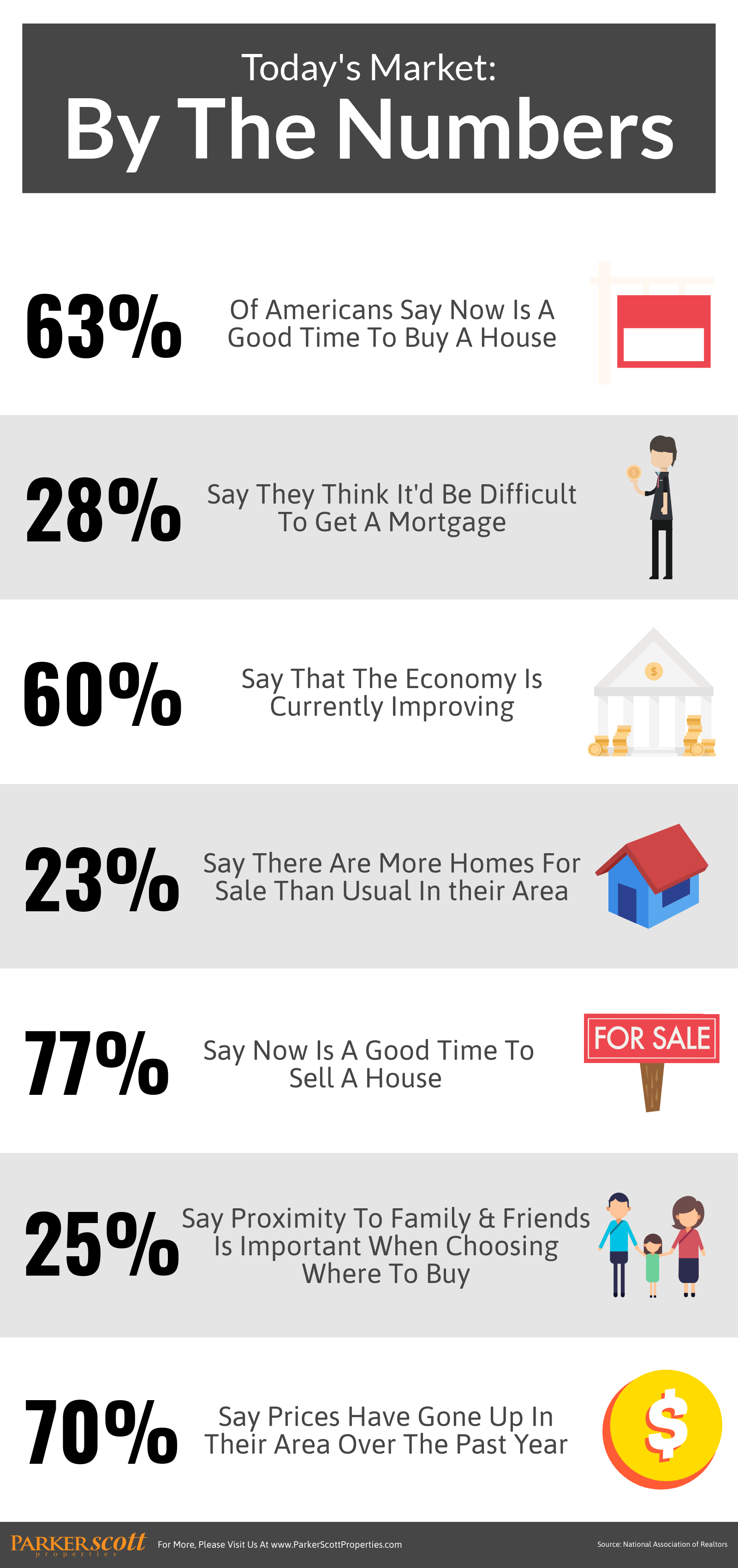

Deciding to buy a house is mainly a money decision. You either feel secure enough financially to make a move or you don’t. This helps explain the current real estate market. After all, survey after survey shows Americans think home prices and mortgage rates are moving higher and making it less affordable to buy. And yet, home buying demand remains high. Why? Well, mostly because, at the same time, people also feel more secure in their jobs and money due to a stronger economy and job market. Take Fannie Mae’s most recent Home Purchase Sentiment Index as an example. The survey found a rising number of respondents who said it was a good time to buy a home, despite increasing numbers who also say they believe mortgage rates and prices will continue to rise. Doug Duncan, Fannie Mae’s senior vice president and chief economist, says the economy explains it. “Downside risk to housing is limited by broader economic strength, which helped boost perceptions of current home buying conditions,” Duncan said. “For consumers who say now is a good time to buy, the share citing overall economic conditions as a reason rose to a survey high.” More here.

Meet our newest Parker Scott Properties Agent. We are excited about having her on our team and we know you will be too.

Talmadge Bridge, which connects Savannah to South Carolina’s Lowcountry, will be closed to all traffic starting at 9 p.m. Wednesday, according to the Georgia Department of Transportation.

Anticipated “gale-force winds” related to Hurricane Michael will make the bridge dangerous for drivers, the agency said in a news release.

“Motorists attempting to navigate vehicles across the bridge in conditions with the high wind levels anticipated from Hurricane Michael may not be able to properly control the vehicles. The bridge is being closed for the safety of the public,” the news release said.

After the storm passes, the Talmadge Bridge will be inspected, so a reopening time was not available, officials said.

In order for a home to be considered truly green, there are six elements it needs to contain, according to the Appraisal Institute, a professional association of real estate appraisers. These include water efficiency, energy efficiency, indoor air quality, materials, and operations and maintenance. Put simply, to retrofit a home to meet those standards would require a lot of work. But that doesn’t mean you can’t improve your home’s performance through smaller measures. And Appraisal Institute president, James L. Murrett, says, if you do, you’ll not only be able to lower your bills but you may also be able to sell your house for more when the time comes. “The latest research shows that green and energy-efficient home improvements have the potential to pay dividends for buyers and sellers,” Murrett says. “However, it depends on the improvements made. Some green renovations, such as adding Energy Star appliances and extra insulation, are likely to pay the homeowner back in lowered utility bills relatively quickly.” Whether you’re searching for a home to buy or thinking about selling one, a home’s efficiency and performance is an important factor to consider. More here.