One good way of measuring where home prices are headed is to look at how many homes for sale have had to adjust their initial listing price. If there are a lot of homes in your area with price reductions, it could be a sign that the local market is softening. And, according to one national report, it likely is. That’s because, new numbers show 31.3 percent of homes for sale in October had at least one price cut of more than 1 percent. By comparison, last year at the same time just 25 percent of homes had previously dropped their price. That means an increasing number of homeowners with homes for sale are adjusting their price to attract home buyers. Whether this is due to a seasonal slow down, a reaction to recent mortgage rate increases, or the beginning of a better balanced market remains to be seen. But with fewer than half of the metro areas included in the report showing month-over-month price gains, it’s definitely good news for prospective home buyers this fall and winter. More here.

Number Of Equity Rich Properties Hits New High

Homeownership isn’t a get rich quick scheme. So you shouldn’t buy a house expecting its value to skyrocket and your wealth to instantly rise. The housing market will have its ups-and-downs and there are no guarantees. Which means, you probably shouldn’t buy a house hoping it’ll make you rich. And while that’s generally good advice, it doesn’t mean owning a home won’t benefit your bottom line. For example, according to ATTOM Data Solutions’ Q3 2018 U.S. Home Equity & Underwater Report, there are now nearly 14.5 million equity rich properties across the country. Equity rich refers to when the amount owed on the mortgage is less than 50 percent of a property’s market value. And the new numbers are not only good news, they represent a new high and an increase of 433,000 from one year ago. Daren Blomquist, senior vice president of ATTOM, says part of the improvement is the fact that people are staying in their homes longer. “As homeowners stay put longer, they continue to build more equity in their homes despite the recent slowing in rates of home appreciation,” Blomquist said. In other words, the longer you stay in a house, the more likely you’ll see a return on your investment. More here.

Choosing Which Type Of House To Buy

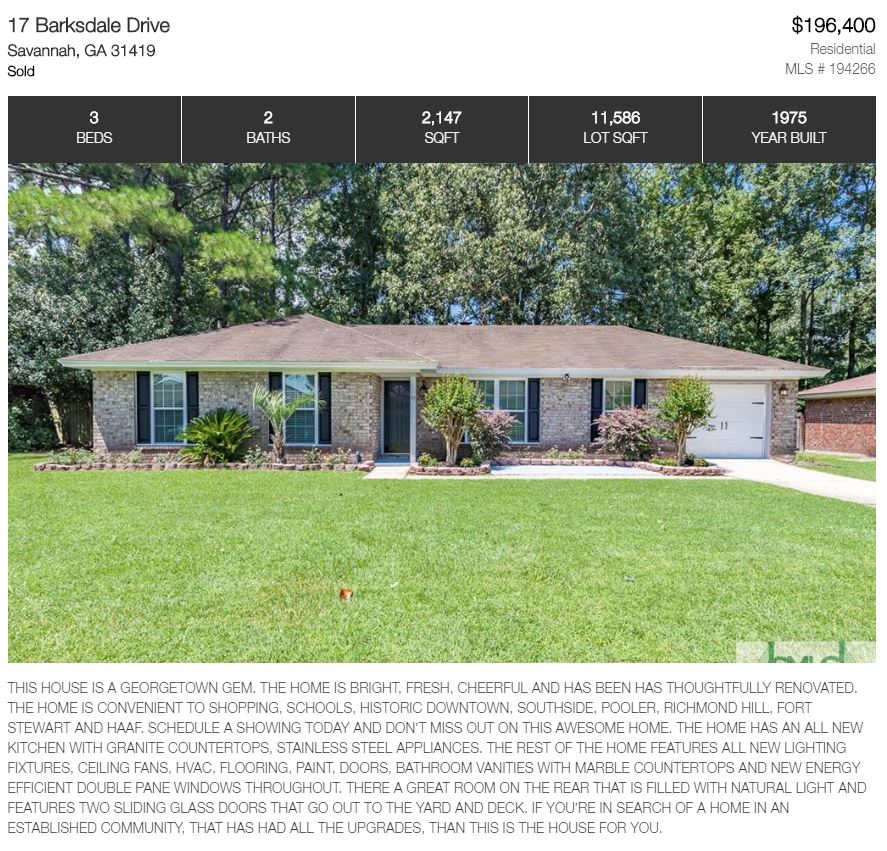

SOLD!!

November Newsletter

Another Happy Buyer!!

Housing Outlook Sees Similar Conditions Next Year

Real estate, of course, is about location. From neighborhood to neighborhood, conditions may differ. Pricier neighborhoods will have different dynamics than more affordable areas. Hot spots that offer buyers features and amenities will have different conditions than less popular areas farther from the action. That’s why most people work with professionals when buying or selling a home. It’s good to be able to lean on the experience of someone with expertise in the specific parts of town you’re interested in. But that’s not to say you can’t have a general sense of where the market is headed and what to expect when you hit the streets in search of a house. Take the most recent forecast from Freddie Mac, for example. The outlook says, though the market will slow down this fall and winter, high demand for homes will mean more sales and competition next year. It also says home price growth will begin to slow next year, though you should expect mortgage rates to continue to edge higher through 2020. Overall, according to Freddie Mac’s outlook, home buyers and sellers should expect next year’s market to look relatively similar to this year’s. More here.

The Winter Market May Be Good For Buyers

Typically, spring and summer are thought of as the prime times to buy or sell a home. There are a number of reasons for this, including weather and the end of the school year. But whatever the reason, there are usually more homes for sale and more active buyers during what is typically the busiest sales season. Fall and winter, on the other hand, are the time of the year when the housing market slows down. The approaching holidays and colder temperatures across much of the country mean fewer Americans are in the mood for a move. But that can mean opportunities for buyers who are. A recent analysis looked at the country’s largest metro areas and compared typical affordability levels, projected rent increases, and the share of listings with a price cut to determine where buyers might have the best chances in the coming months. The results showed conditions in hot markets like Orlando, Boston, Seattle, and Las Vegas are becoming more favorable as the end of the year approaches. That means, interested buyers may be in a better position this fall and winter than they will be next spring when things begin to heat back up. More here.

Should You Expect Your New House To Need Work?

3rd Quarter Prices Show Rate Of Increase Slowing

Among all the factors that can help prospective home buyers get an idea of what a particular property will cost them, price is perhaps the easiest to gauge. Things like mortgage rates, potential maintenance and upkeep, property taxes, and insurance are all part of the equation but not as simple to measure as a home’s listed price. So it’s no shock that Americans who are thinking about buying a house in the near future are also thinking about where home prices are headed. That’s why new numbers from ATTOM Data Solutions offer buyers some good news. According to their Q3 2018 U.S. Home Sales Report, home prices only rose 1 percent in the third quarter and are now up 4.8 percent from last year. That’s the slowest price appreciation since 2016. The report found that price increases slowed in 74 of the 150 metro areas analyzed, including Chicago, Los Angeles, Dallas-Fort Worth, Houston, and Miami. Despite the encouraging news, however, there are many markets where prices are still rising quickly. In fact, some metros continue to see double-digit gains year-over-year. More here.