Steps to Take Before You Buy A Home

Optimism About Income Helps Housing Sentiment

For a while now, there’s been a balance between the feeling that buying a home is becoming less affordable and the perception that the economy is getting stronger. Americans are concerned about rising home prices and mortgage rates but, at the same time, they’re also seeing more job opportunities and higher wages. How this might affect a decision about making a move is fairly obvious. In short, your feelings about whether or not it’s a good time for you to buy a house are likely tied to your feelings about your job security and income. If you’re feeling confident in your money, you’re more likely to consider buying. Which is part of the reason Fannie Mae’s monthly Home Purchase Sentiment Index has been relatively unchanged over the past several months. The index – which measures Americans perceptions of the housing market, economy, and their personal financial situation – was virtually flat in November from the month before. Doug Duncan says housing sentiment has cooled but it’s been offset by optimism about the economy. “Consumers perceptions of growth in their household income reached a survey high this month, helping to absorb some of the impact of increasing mortgage rates on housing market activity,” Duncan said. “Meanwhile, the net share of consumers expecting home prices to increase over the next 12 months continues to moderate, dropping by 13 percentage points since this time last year.” More here.

Taking The Long View Of The Housing Market

When you’re in the middle of something, it can be hard to see things clearly. Only after you’ve gained some perspective and had time to reflect do things become clearer. Hindsight, after all, is 20/20. This is also true when it comes to the housing market. Each month, more data is released and compared to the previous month’s data. And, if you follow along, it’s easy to get the feeling that things are worse and/or better than they actually are. But taking a step back can help put things in context. Perhaps that’s why Lawrence Yun, the National Association of Realtors’ chief economist, recently said that he’s very optimistic about the housing market’s long-term outlook. When compared to historical data, conditions look pretty good. As an example, Yun says home sales are now around the same level they were in 2000 but a comparison of fundamentals shows we’re in much better shape now than we were then. “Mortgage rates are much lower today compared to earlier this century, when mortgage rates averaged 8 percent,” Yun said. “Additionally, there are more jobs today than there were two decades ago. So, while the long-term prospects look solid, we just have to get through this short-term period of uncertainty.” More here.

What Home Buyers Want Most In 2019

Home design trends can be fleeting. This year’s hot color combination will be old news before you know it. So, unless you want to paint your home every six months, you’re better off choosing your home’s décor based on the things you love rather than the things you read about. There are, however, some trends that are more meaningful and can help you save money and make your life more comfortable. For example, a new list of trends from national home builder and developer Taylor Morrison offers some interesting ideas about what buyers want in 2019. According to the list, home buyers are looking for healthier, greener homes that aren’t as high maintenance or too tailored. In other words, buyers are focused on comfort and want finishes and features that aren’t a lot of work to maintain. Think soft rugs, cozy furnishings, more plants and less work. It seems today’s home buyers are more interested in enjoying their home than spending their time on maintenance, cleaning, and keeping up with the latest catalogue-worthy looks. More here.

Meet our newest Parker Scott Properties Agent. We are excited about having her on our team and we know you will be too.

Why You Should Be Optimistic About Homeownership

Home buyers this year have faced higher prices, more competition, and rising mortgage rates. In short, it’s been a challenging year. But that’s not to say it isn’t a good time to buy a house. There are many reasons to be optimistic about homeownership, in fact – and a few that put current conditions in perspective. Take mortgage rates, for example. According to Freddie Mac, the long term average is 8.16 percent, which means today’s rates are still low historically. Also, home equity is increasing. In fact, it’s up 13% year-over-year. And rising home equity means today’s homeowners are seeing their investment grow. There is also evidence that market conditions may begin to improve. For one, new home construction has been making gains and that means more homes for buyers to choose from. It also means buyers should begin to see prices moderate and competition wane, as more new homes are built to meet today’s high level of buyer demand. In short, there are a lot of good reasons to be optimistic about buying a house this year, despite market challenges. More here.

Home buyers this year have faced higher prices, more competition, and rising mortgage rates. In short, it’s been a challenging year. But that’s not to say it isn’t a good time to buy a house. There are many reasons to be optimistic about homeownership, in fact – and a few that put current conditions in perspective. Take mortgage rates, for example. According to Freddie Mac, the long term average is 8.16 percent, which means today’s rates are still low historically. Also, home equity is increasing. In fact, it’s up 13% year-over-year. And rising home equity means today’s homeowners are seeing their investment grow. There is also evidence that market conditions may begin to improve. For one, new home construction has been making gains and that means more homes for buyers to choose from. It also means buyers should begin to see prices moderate and competition wane, as more new homes are built to meet today’s high level of buyer demand. In short, there are a lot of good reasons to be optimistic about buying a house this year, despite market challenges. More here.

Home Buyer Must Haves Mean Compromise

Searching for a home to buy can be frustrating. Mostly because it’s not always easy to find a house in the right neighborhood with every one of the features you dreamed of. If you find the perfect kitchen, the house will have too few bedrooms. Or you’ll find a house with the right number of bedrooms and the kitchen will be too small. In other words, buying a house means compromise. And, in today’s market, buyers are having to make difficult choices. For example, a new analysis from the National Association of Realtors’ consumer website found that for 73 percent of recent buyers school district was an important factor in deciding which house to buy. But, among those buyers, nearly 80 percent said they had to give up other home features in order to find a house in their preferred district. Some of the features these buyers said they gave up included a garage, a large backyard, an updated kitchen, and an outdoor living area. In short, you might not get everything you want in one house. So prioritize your wish list and know what’s most important to you. More here.

Searching for a home to buy can be frustrating. Mostly because it’s not always easy to find a house in the right neighborhood with every one of the features you dreamed of. If you find the perfect kitchen, the house will have too few bedrooms. Or you’ll find a house with the right number of bedrooms and the kitchen will be too small. In other words, buying a house means compromise. And, in today’s market, buyers are having to make difficult choices. For example, a new analysis from the National Association of Realtors’ consumer website found that for 73 percent of recent buyers school district was an important factor in deciding which house to buy. But, among those buyers, nearly 80 percent said they had to give up other home features in order to find a house in their preferred district. Some of the features these buyers said they gave up included a garage, a large backyard, an updated kitchen, and an outdoor living area. In short, you might not get everything you want in one house. So prioritize your wish list and know what’s most important to you. More here.

New Home Prices Now 4% Lower Than Last Year

New homes are generally more expensive than existing homes. There are a couple of reasons for this. One is that everything in a new home is brand new and you’re going to pay a premium for that. This is really no different than paying more for an older home that’s recently undergone an extensive renovation. New things cost more than used things. The other reason new homes are generally higher priced is that builders, for the past several years, have been primarily building houses for the high-end of the market, due to the fact that there was more demand for new homes among luxury buyers following the housing crash. But new numbers from the U.S. Census Bureau and the Department of Housing and Urban Development should be good news for buyers who are interested in buying new but may not have a luxury-home budget. That’s because June’s new residential sales statistics show a 4.2 percent drop in the median sales price for new homes year-over-year. The median sales price is now $302,100. Surging new home sales between $200,000 and $299,000 were behind the decline, indicating an uptick in new homes available in more affordable price ranges. More here.

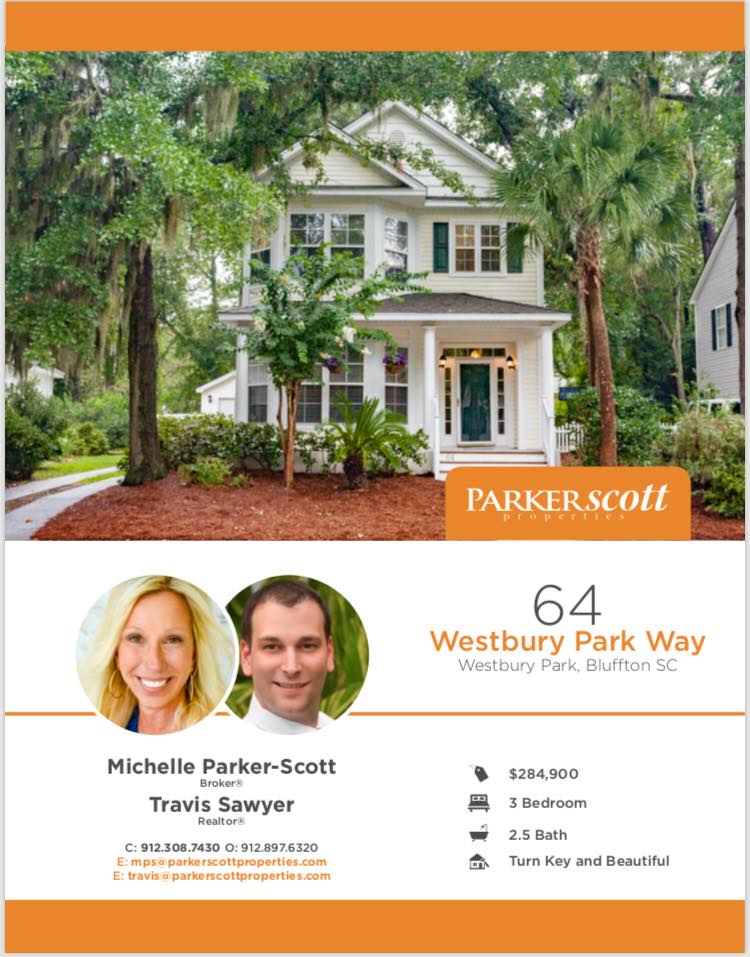

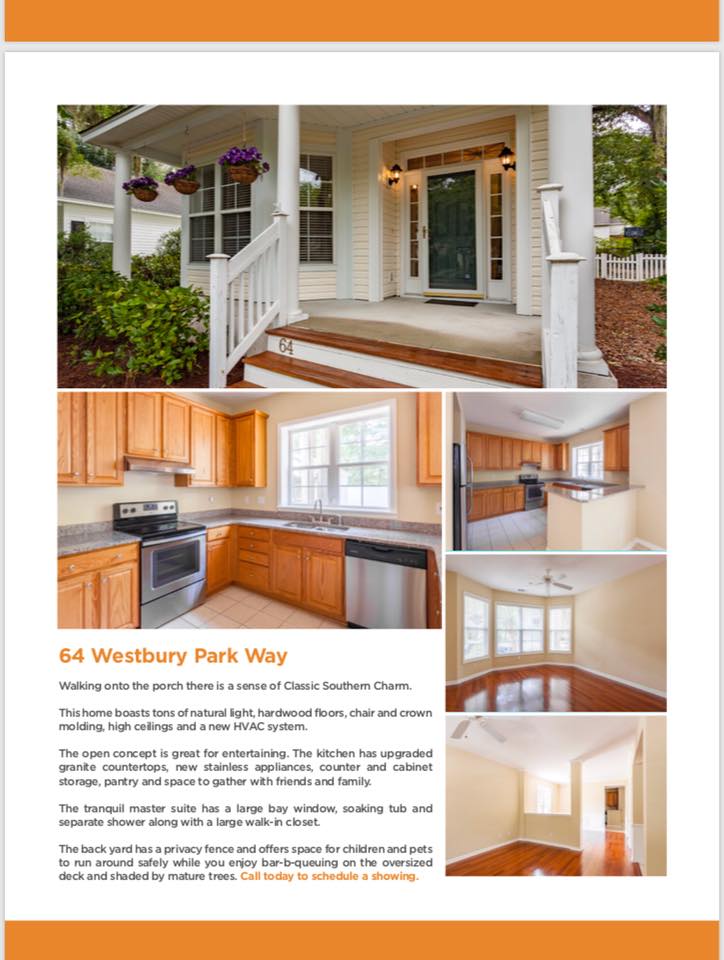

The pictures speak for themselves. Take the tour now and see why this home is ideal for you.