Not surprisingly, affordability ranks high among home buyers’ concerns. Rising prices and rumors of future mortgage rate increases have some prospective buyers questioning whether or not they can handle the financial obligations that come along with homeownership. However, new data from the National Association of Home Builders says, in most markets, they can. That’s because, the NAHB’s quarterly measure of affordability found 58.3 percent of new and existing homes sold between the beginning of July and the end of September were affordable to families earning the median income of $68,000. That’s encouraging news for hopeful home shoppers. And, according to Robert Dietz, NAHB’s chief economist, there are a rising number of them hoping to take advantage of conditions while they’re still favorable. “Solid economic growth, along with ongoing quarterly job gains and rising household formations, are fueling housing demand,” Dietz said. “Tight inventories and a forecast of rising mortgage interest rates through 2018 will keep home prices on a gradual upward path and slowly lessen housing affordability in the quarters ahead.” More here.

Along with rising home prices, there has also been increasing concern that the housing market may be entering a bubble. And that’s not surprising, considering the housing crash is still fresh in peoples’ memories. So as home prices reach or exceed previous highs, potential buyers and current homeowners are naturally concerned about the possibility of another housing bubble and crash. According to a recent analysis from Freddie Mac, however, there is a pretty good reason to doubt that today’s price spikes are, in fact, evidence of an emerging bubble. Put simply, one of the primary reasons bubbles form is a perception that home prices will always rise. This causes investors to bid prices up and some mortgage lenders to offer easier credit. In short, a bubble isn’t real. Today’s price increases, on the other hand, are being driven by a lack of for-sale inventory and slower-than-normal new home construction. That means, it is more likely that prices aren’t being driven upward by irrational confidence but, instead, are being driven by an unbalanced market. “The evidence indicates there currently is no house price bubble in the U.S., despite the rapid increase of house prices over the last five years,” Freddie Mac’s chief economist Sean Becketti said. “However, the housing sector is significantly out of balance.” More here.

Ipsos, an independent market research company, recently gathered a panel of experts to weigh in on the future of housing. From climate concerns to home automation, the panel looked at what changes may be necessary in order for our homes to meet our needs in the future. One of the topics focused on the fact that Americans are growing older. In fact, by 2060, nearly 100 million Americans will be over the age of 65 and – if current numbers are any indication – the vast majority of them will prefer to stay in their own homes and communities as they age. According to Rodney Harrell, director of livable communities for AARP’s Public Policy Institute, the current housing stock may not be suited to the needs of an aging population. “The problem is you can’t create a new housing stock overnight, so we have to start working now,” Harrell said. “Nobody should be forced from their home because it doesn’t work for them.” How our homes adapt to our needs will depend, in part, on advancements in smart-home technology but also on how soon builders and home remodelers begin installing features that make it easier for the elderly to preserve their independence. More here.

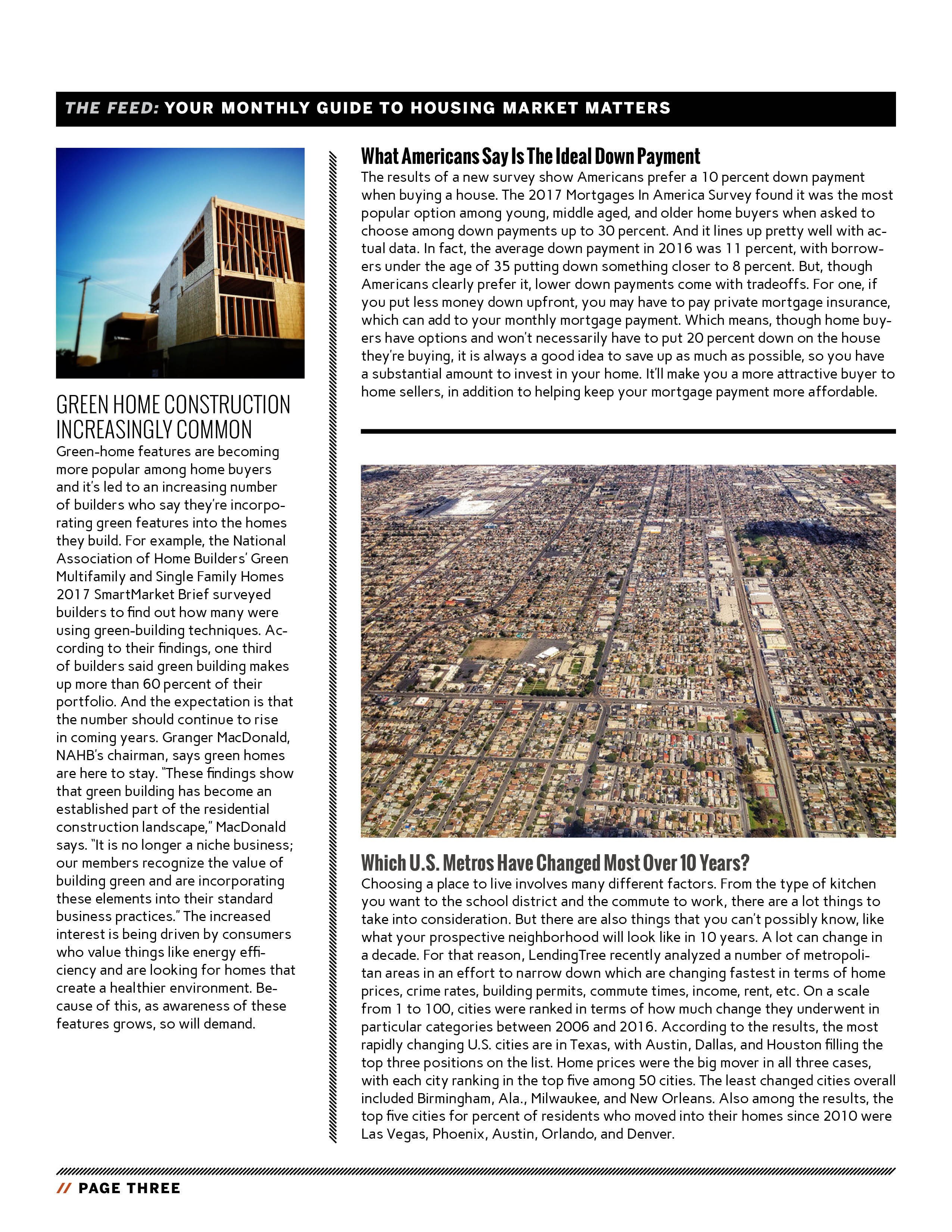

Choosing a place to live involves many different factors. From the type of kitchen you want to the school district and the commute to work, there are a lot things to take into consideration. But there are also things that you can’t possibly know, like what your prospective neighborhood will look like in 10 years. A lot can change in a decade. For that reason, LendingTree recently analyzed a number of metropolitan areas in an effort to narrow down which are changing fastest in terms of home prices, crime rates, building permits, commute times, income, rent, etc. On a scale from 1 to 100, cities were ranked in terms of how much change they underwent in particular categories between 2006 and 2016. According to the results, the most rapidly changing U.S. cities are in Texas, with Austin, Dallas, and Houston filling the top three positions on the list. Home prices were the big mover in all three cases, with each city ranking in the top five among 50 cities. The least changed cities overall included Birmingham, Ala., Milwaukee, and New Orleans. Also among the results, the top five cities for percent of residents who moved into their homes since 2010 were Las Vegas, Phoenix, Austin, Orlando, and Denver. More here.