HOUSING SUPPLY & DEMAND

Supply & Demand Report for Wilmington Island Area

April 2018

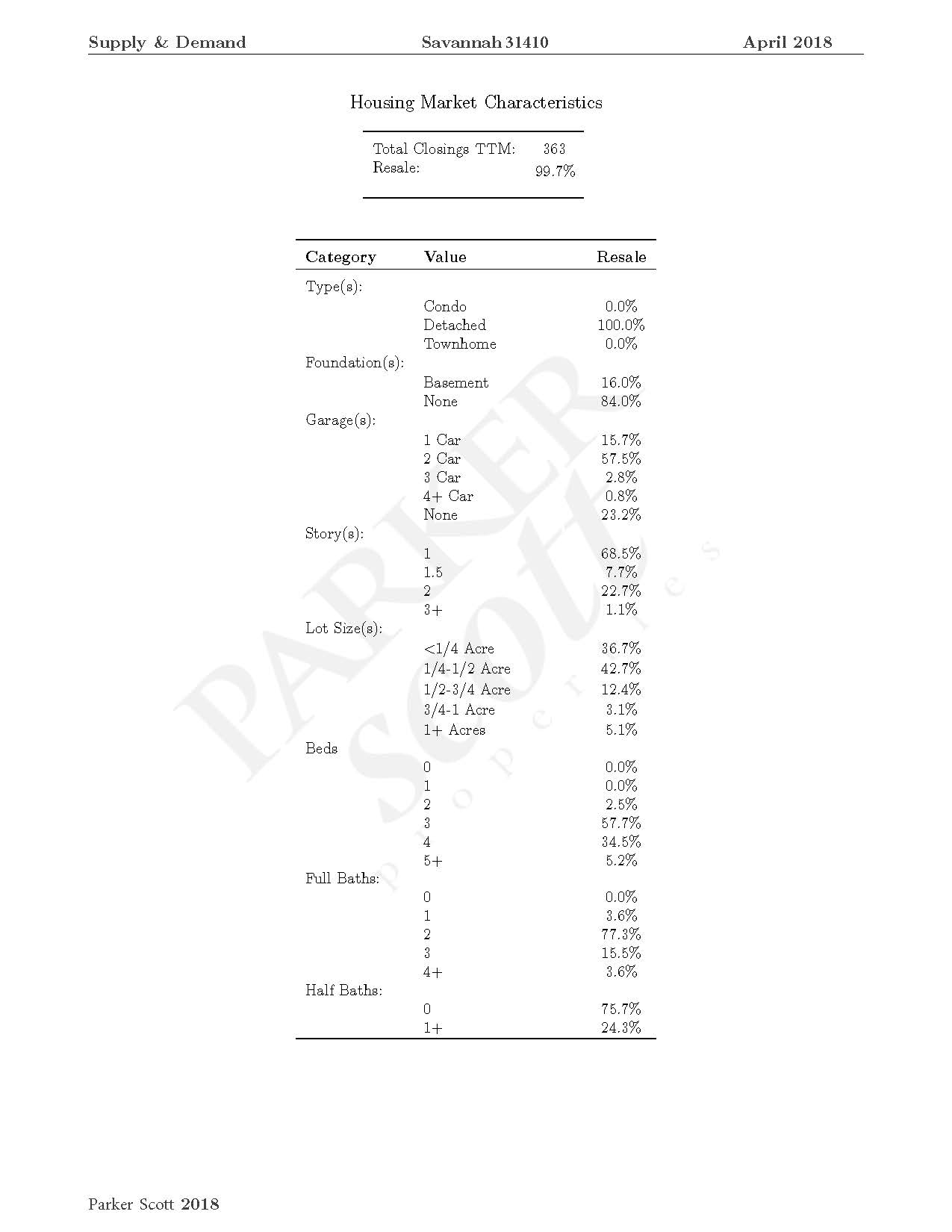

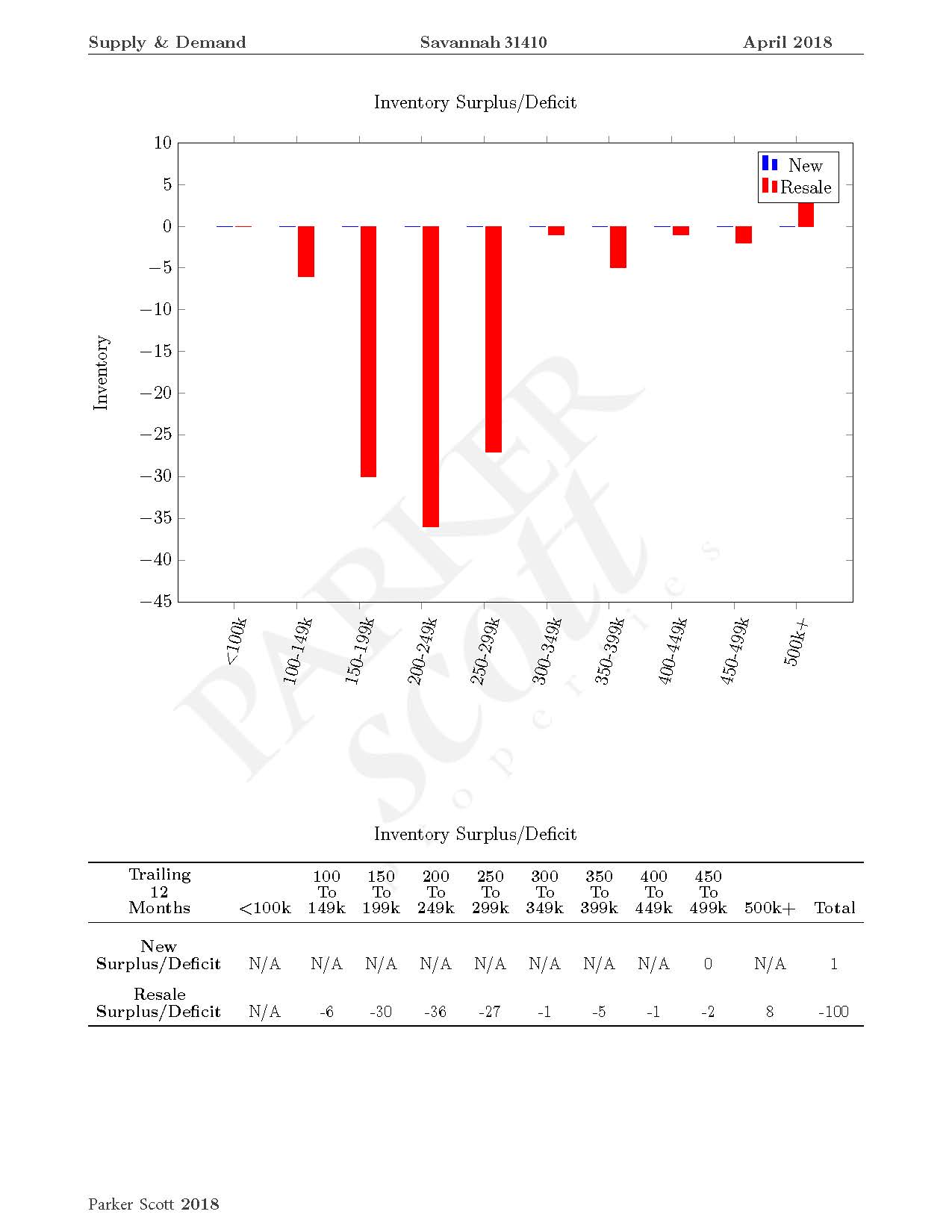

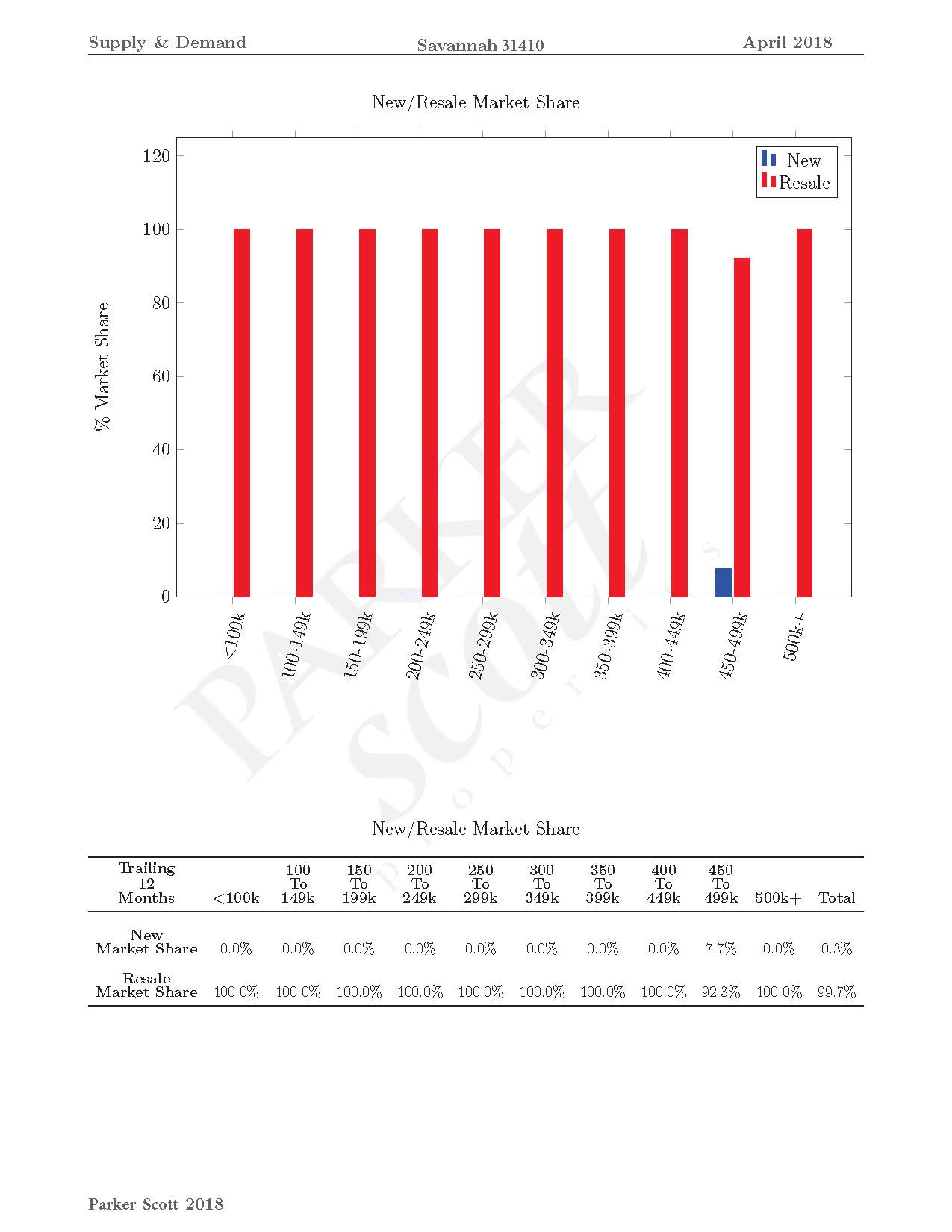

Report is based on single-family resale properties, that are detached homes (condos and townhomes not included in report). With a minimum price of $100,000 up to a maximum price of $500,000.

GARAGES

15.7% of the homes sold had 1 car garages, 57.5% had 2 car garages, 2.8% had 3 car garages, less than 1% had 4 car garages and 21% did not have a garage.

BEDROOMS

2.5% had two bedrooms, 57.7% with three bedrooms, 34.5% with four bedrooms and 3.6% had more than 4 bedrooms

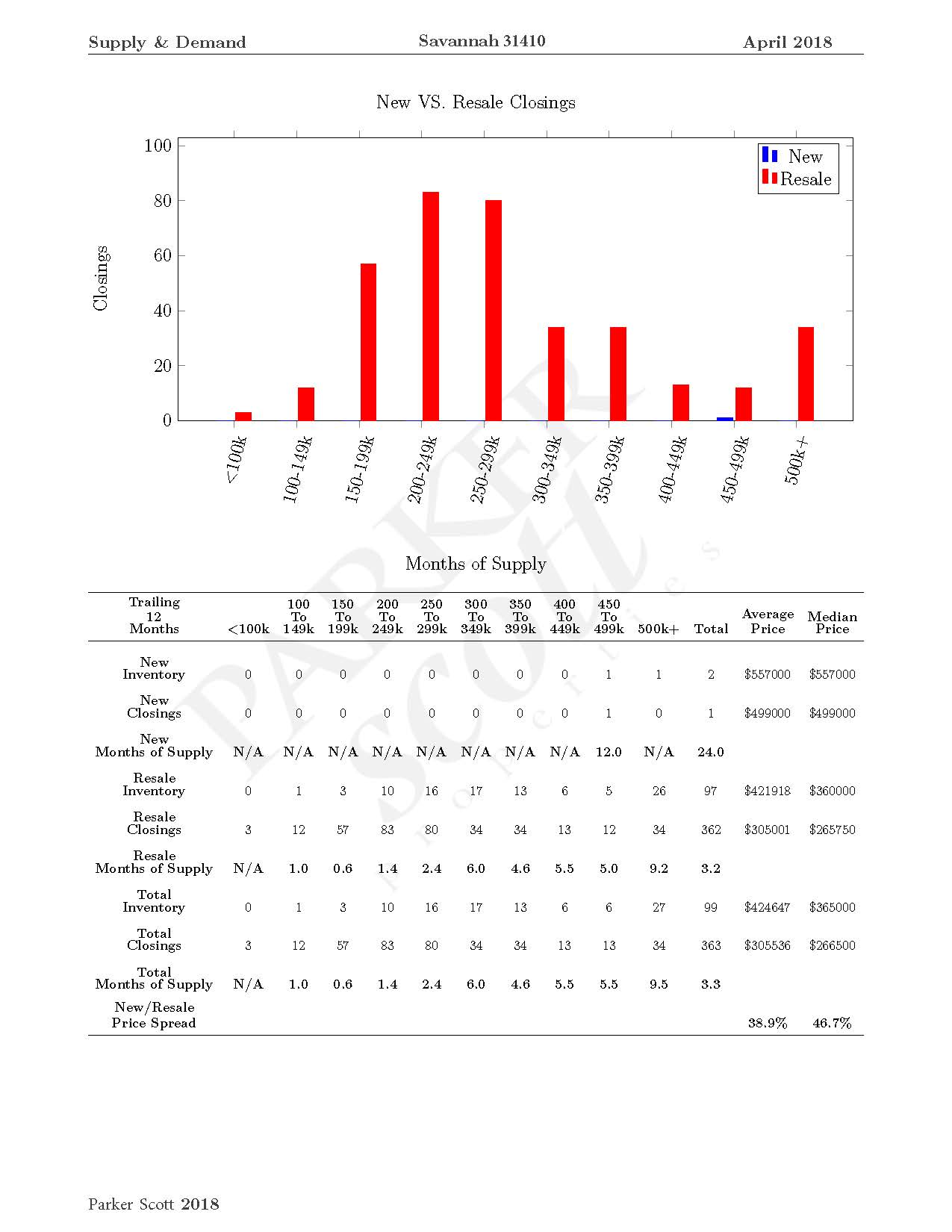

The highest percentage of homes sold were in the $200,000 to $249,000 pricepoint at 83% and the second highest pricepoint $250,000 – $299,000.

“IS THIS THE RIGHT TIME TO SELL”

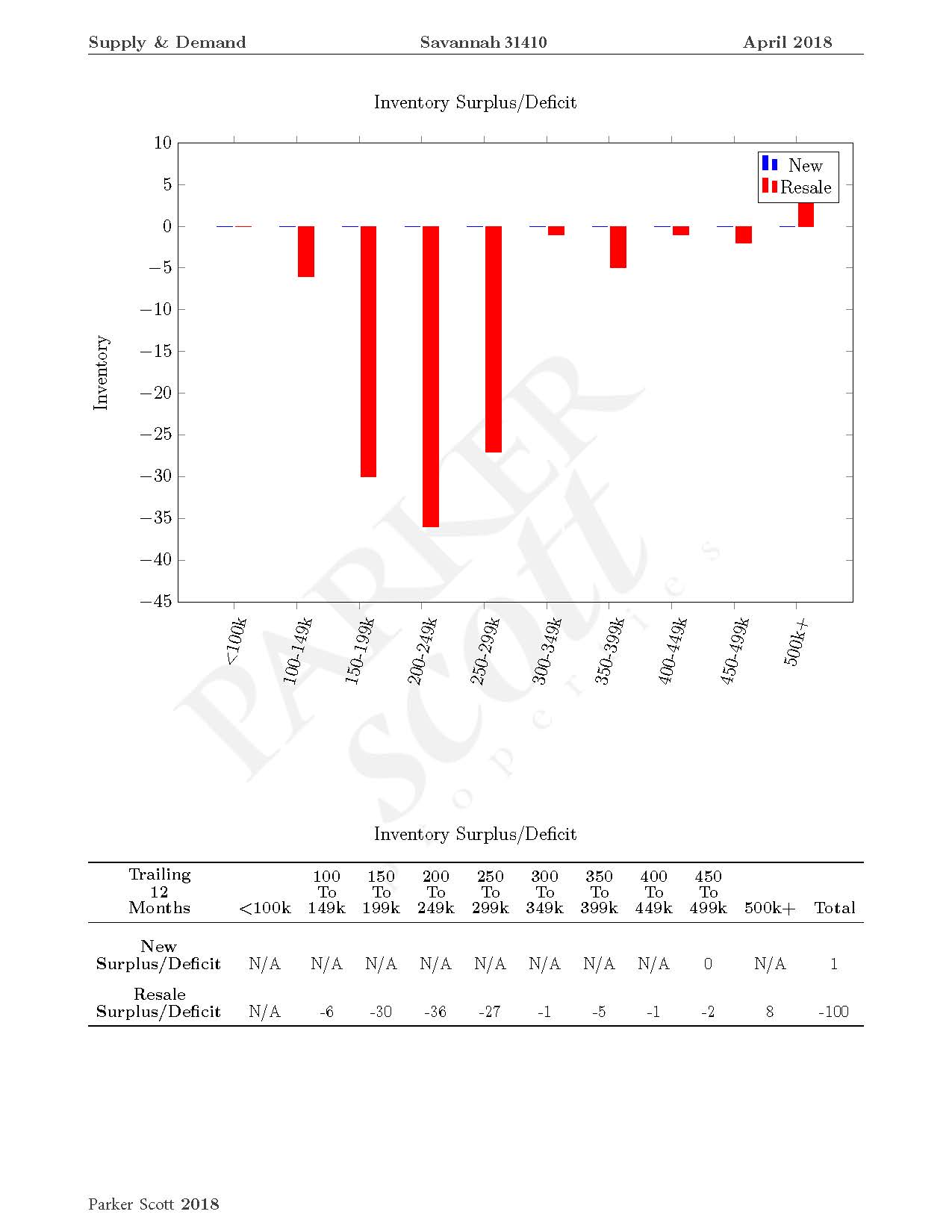

The question would be “is this the right time to sell” and based on market conditions yes! There is a deficit for the surplus of resale homes in the 31410 area.

For a complimentary market study on your property, contact one of our experts today! 912-897-6320 or visit Parker Scott Experts

Homes Sell At Fastest Recorded Pace In 2017

Making big decisions quickly is not usually a recipe for success. However, in today’s housing market, that’s exactly what home buyers have to do. That’s because homes are selling faster than ever these days. In fact, according to a recent analysis, the average home took 81 days to sell last year. And that includes closing, which usually takes four to six additional weeks. In other words, since many markets have more buyers than they do available homes, houses for sale are selling fast. So what should buyers do to prepare for possible competition? Well, for starters, adjust your expectations. A recent report from Zillow found the average buyer spends just over four months searching for a home and makes two offers before successfully buying a house. That means, expect a process. Outside of that, be prepared. Get prequalified, know what you want, what you want to spend, and what your dealbreakers are. The more prepared you are, the more likely you’ll make good decisions, even if they have to be made quickly. More here.

How To Know When It’s Your Time To Buy

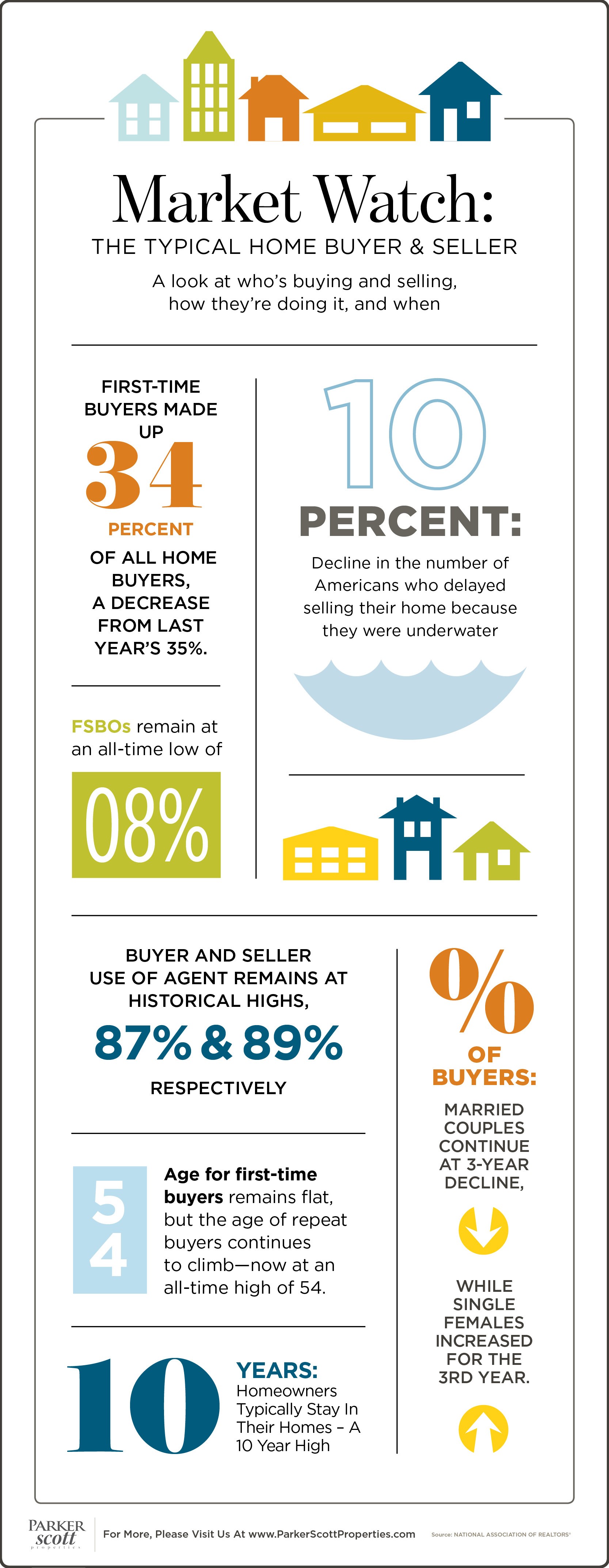

MARKET WATCH: The Typical Home Buyer & Seller

What To Look for When Looking At Homes

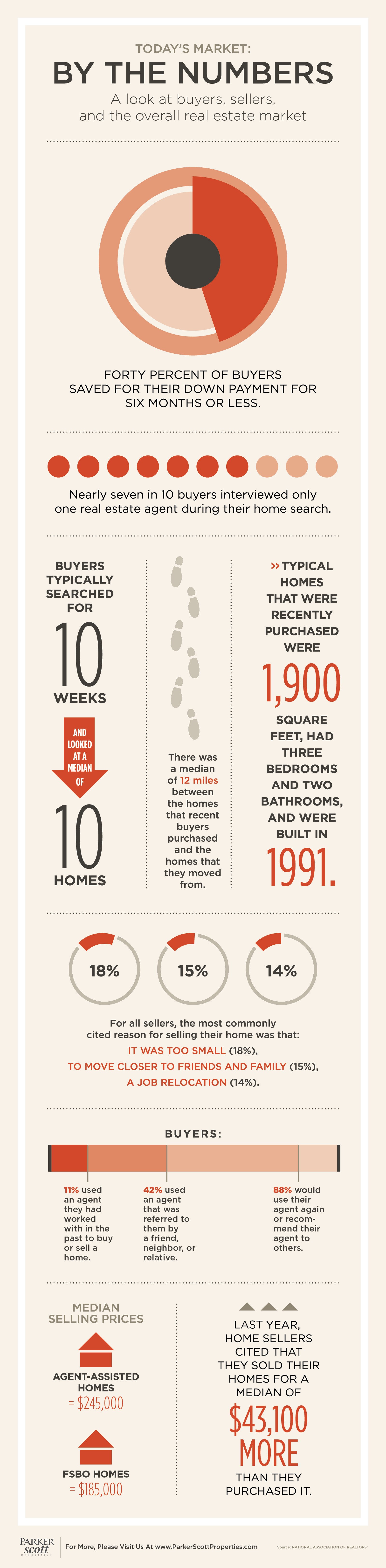

Today’s Market By The Numbers

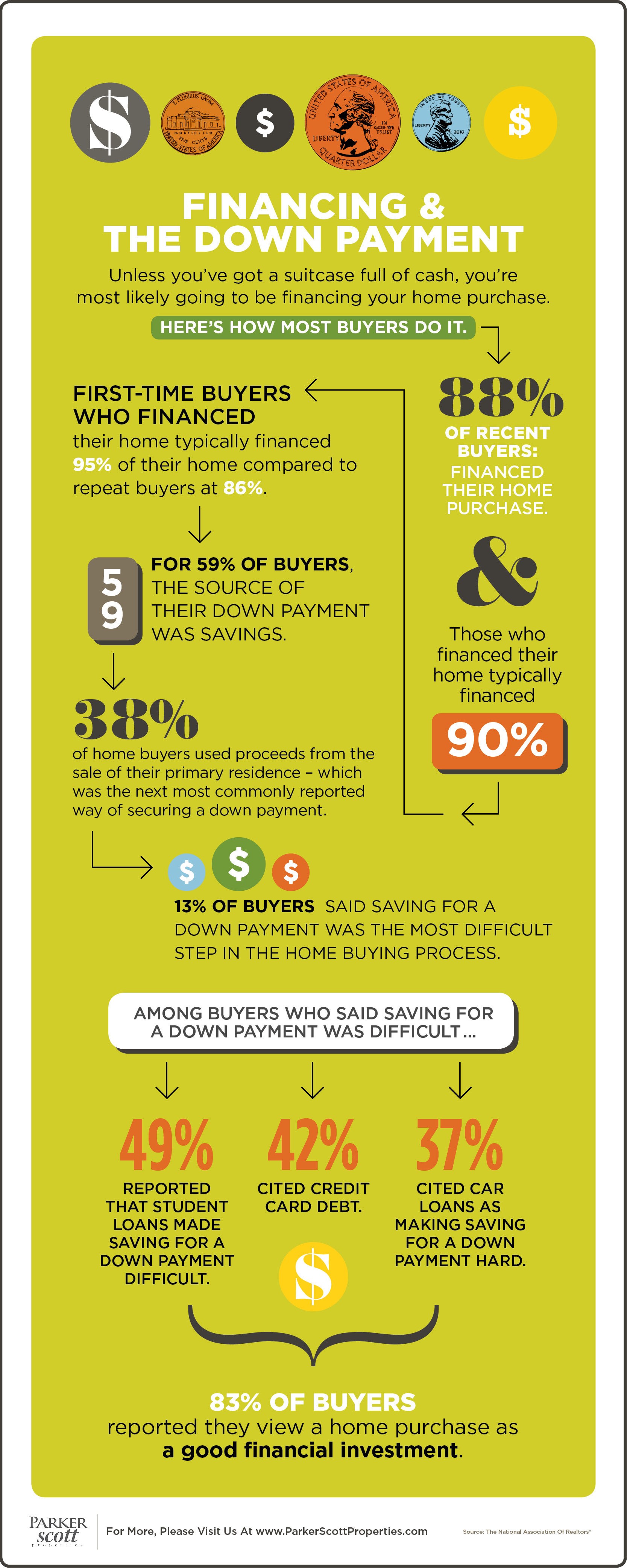

Financing & The Down Payment

Single Home Buyers Face Added Challenges

Without the benefit of two incomes, single home buyers face some added challenges when looking to buy a house. For one, it takes longer to save for a down payment. In fact, according to a new analysis, married or partnered couples can save a 20 percent down payment on the typical home in less than five years. For single home buyers, it takes closer to 11 years. Add to that, single home buyers are more likely to be looking for a smaller, affordable home – which is precisely the type of house that is currently in highest demand. Zillow senior economist, Aaron Terrazas, says two incomes helps with savings but also with increasing the number of homes available to buy. “Single buyers typically have more limited budgets, which means they are likely competing for lower-priced homes that are in high demand,” Terrazas said. “Having two incomes allows buyers to compete in higher priced tiers where competition is not as stiff.” Of course, your individual financial situation and local market conditions will ultimately determine how much you’ll need to save and how much competition you’ll face for available homes. But single, married, or otherwise, it’s best to be as prepared as possible before heading out to look for a house to buy. More here.

Young Adults Hold Key To This Year’s Market

First-time home buyers are an important demographic when tracking the health of the housing market. That’s because, they typically make up nearly half of all home sales. In recent years, however, young Americans have been buying fewer homes than in the past. In fact, Freddie Mac’s most recent monthly outlook says 15 percent of young adults between the ages of 25 and 35 are living in their parents’ home – a five percent increase from 2000. However, it isn’t because they’re not interested in homeownership. Largely, the economy and a lack of affordable starter homes have been to blame for a lower-than-normal number of first-time home buyers. But with an improved economy and job market, will more young adults become buyers this year? Len Kiefer, Freddie Mac’s deputy chief economist, says there’s reason for optimism. “Starting off the year, things are looking pretty good for the U.S. economy and housing markets,” Kiefer says. “Mortgage rates are low, economic growth has accelerated in recent quarters, and housing is coming off its best year in a decade.” More here.