For the second straight month, sales of previously owned homes increased from one month earlier, according to new numbers from the National Association of Realtors. In fact, sales of single-family homes, townhomes, condos, and co-ops, rose 1.1 percent to an annual rate of 5.60 million in March. Lawrence Yun, NAR’s chief economist, says warmer weather may have had something to do with the sales pickup. “Robust gains last month in the Northeast and Midwest – a reversal from the weather-impacted declines seen in February – helped overall sales activity rise to its strongest pace since last November at 5.72 million,” Yun said. Put simply, low inventory and higher prices have made the housing market more challenging for buyers in some markets but overall demand is running high and, as the weather improves, may even see further gains. For interested buyers, that means available homes are selling fast this spring. The NAR reports that the typical property was on the market for just 30 days in March and half of the homes that sold were purchased in less than a month. More here.

Saving A Down Payment May Be Easier Than You Think

Saving for a down payment is one of the biggest obstacles first-time home buyers face. While repeat buyers can use the sale of their home to help fund a down payment on a new house, first timers have to save from scratch. And this can be difficult when also facing hurdles like higher rent payments and student loan debt. But, like everything real-estate related, location matters. In fact, according to a new analysis, saving a down payment for an entry-level home is much easier in some locations than others. For example, after factoring the median household income among millennials and their estimated annual savings, the analysis determined that a first-time home buyer could save for a 20 percent down payment in under five years in 10 major cities, including Chicago, Dallas, Baltimore, St. Louis, Austin, and Washington DC. Of course, the time it takes to save a down payment is longer on the West Coast, where home prices are higher. But considering the fact that a 20 percent down payment is not a requirement, even in pricier areas saving up enough to buy a home is not an unattainable goal. More here.

Four Things To Look For In A Neighborhood

August Newsletter

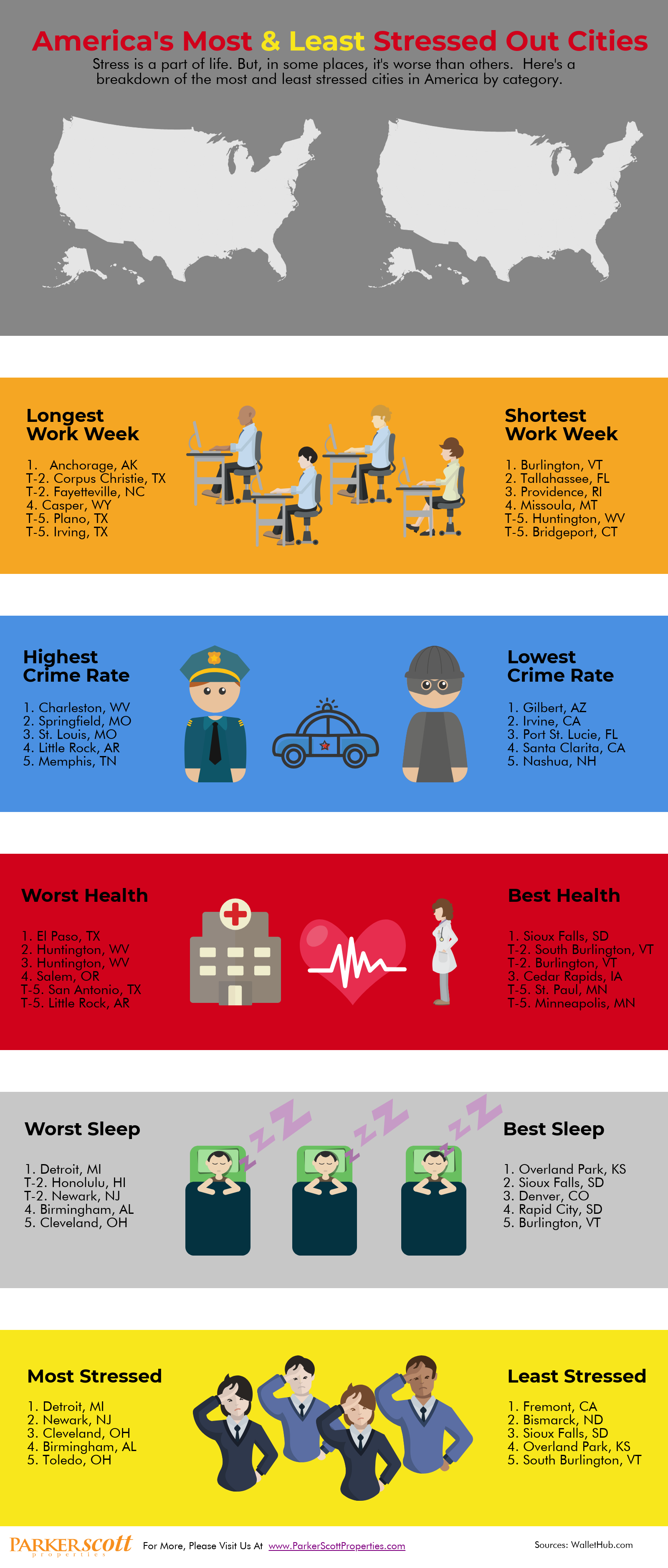

America’s Most & Least Stressed Out Cities

Number Of Million Dollar Metros On The Rise

As everyone knows, real estate is mostly about location. What $500,000 buys you in one neighborhood will be far different than what it affords you in another. Put another way, your money will go a lot farther in the Midwest than it will on the West Coast. Which is why a recent analysis showing a growing number of cities where the median home value is $1 million or more isn’t quite what it initially seems. Though it’s true that the number of million dollar cities has doubled over the past five years and that, within a year, there will likely be 23 more, a closer look at where these cities are will help explain the numbers. That’s because most of those new million dollar cities are located in areas that are already among the most expensive in the country. For example, more than half of the new metros added will be in the areas surrounding major cities like Los Angeles, New York, Seattle, and San Jose. Which means, while it still represents an increase in home values across the country, the growing number of million-dollar metros doesn’t necessarily reflect an acceleration in home price increases. More here.

America’s Homes Are Growing Older

You can tell a lot about the way an area grew by the age of its homes. The pace of suburban sprawl, for example, can be mapped just by observing the way homes get newer as you get further from the city’s center. Houses built in the 1920s give way to homes from the ’50s and ’60s and so on. But that’s not all you can learn from paying attention to the collective age of the country’s housing stock. You can also tell a lot about the housing market’s ups-and-downs. One example can be found in a recent analysis from the National Association of Home Builders. According to the NAHB, the median age of owner-occupied homes is now 37 years, which is up from 31 years in 2005. In fact, more than half of our homes were built before 1980 and 38 percent were built before 1970. In other words, America’s homes are getting older. But why? One reason is that there have been fewer new homes built over the past decade, mostly due to the housing crash and financial crisis. That has caused an increase in the median age of the housing stock. It also has caused a boost to the remodeling industry, as older homes require more renovations to keep up with new technology and features desired by home buyers. More here.

Wilmington Island Open House

How Long Does It Take Renters To Save For A House?

With rental costs and home prices both increasing, it’s become more challenging for renters to save for a down payment. How much so? Well, according to one recent analysis, the typical renter will have to save for nearly six and a half years to come up with a 20 percent down payment on a median-priced home. And, since the median home value is currently $216,000, depending on your prospective neighborhood, it could take even longer to save up for a house. Renters who aspire to homeownership shouldn’t get discouraged, though. Despite the fact that a 20 percent down payment is the standard amount recommended by financial experts, it is not a requirement in order to buy a house. In fact, depending on the particular terms of your mortgage, you can put down as little as 3 percent. In 2017, for example, 29 percent of first-time buyers had a down payment between 3 and 9 percent. That’s why it’s important to explore your options before deciding homeownership is out of reach. More here.