Another Happy Buyer!!

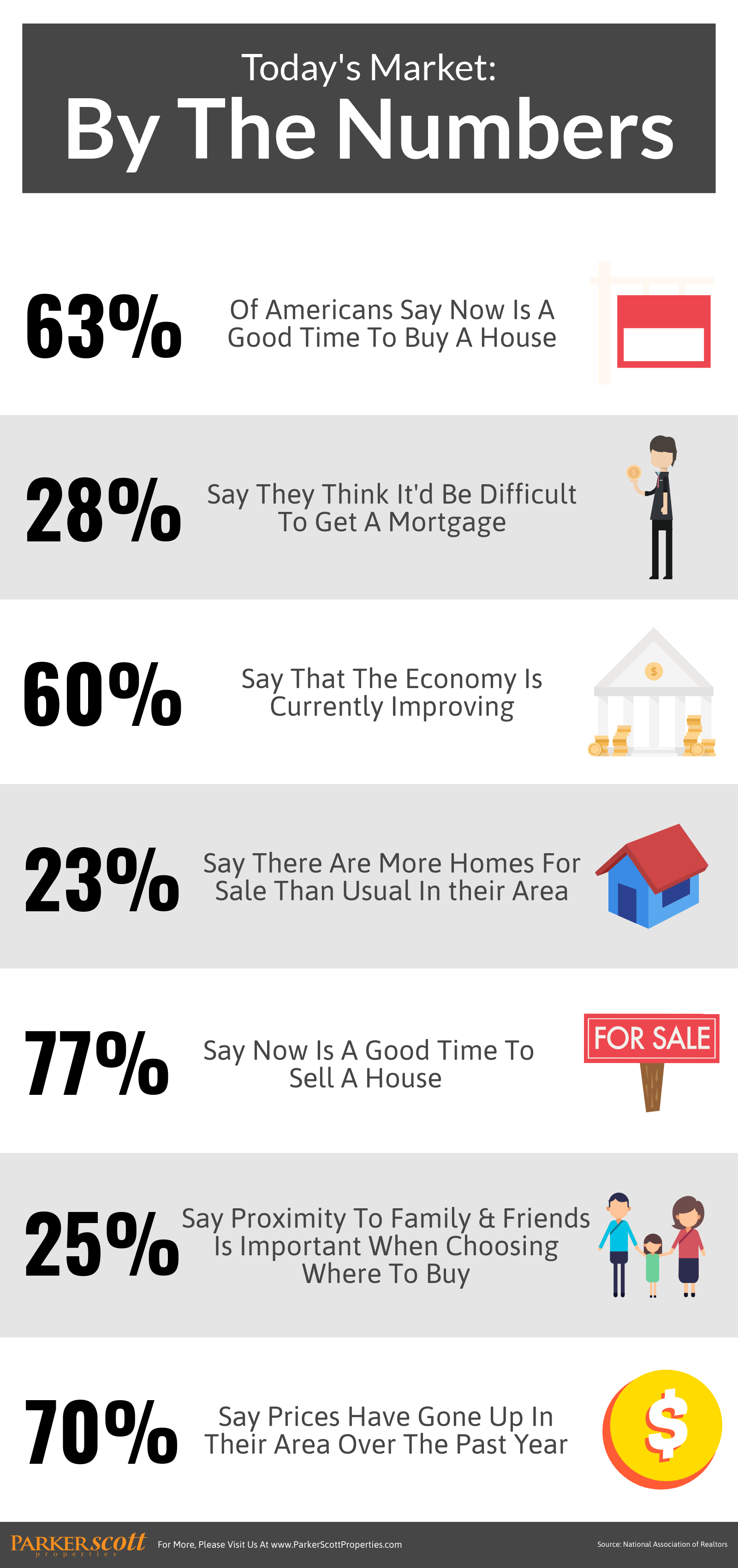

Real estate, of course, is about location. From neighborhood to neighborhood, conditions may differ. Pricier neighborhoods will have different dynamics than more affordable areas. Hot spots that offer buyers features and amenities will have different conditions than less popular areas farther from the action. That’s why most people work with professionals when buying or selling a home. It’s good to be able to lean on the experience of someone with expertise in the specific parts of town you’re interested in. But that’s not to say you can’t have a general sense of where the market is headed and what to expect when you hit the streets in search of a house. Take the most recent forecast from Freddie Mac, for example. The outlook says, though the market will slow down this fall and winter, high demand for homes will mean more sales and competition next year. It also says home price growth will begin to slow next year, though you should expect mortgage rates to continue to edge higher through 2020. Overall, according to Freddie Mac’s outlook, home buyers and sellers should expect next year’s market to look relatively similar to this year’s. More here.

Typically, spring and summer are thought of as the prime times to buy or sell a home. There are a number of reasons for this, including weather and the end of the school year. But whatever the reason, there are usually more homes for sale and more active buyers during what is typically the busiest sales season. Fall and winter, on the other hand, are the time of the year when the housing market slows down. The approaching holidays and colder temperatures across much of the country mean fewer Americans are in the mood for a move. But that can mean opportunities for buyers who are. A recent analysis looked at the country’s largest metro areas and compared typical affordability levels, projected rent increases, and the share of listings with a price cut to determine where buyers might have the best chances in the coming months. The results showed conditions in hot markets like Orlando, Boston, Seattle, and Las Vegas are becoming more favorable as the end of the year approaches. That means, interested buyers may be in a better position this fall and winter than they will be next spring when things begin to heat back up. More here.

Among all the factors that can help prospective home buyers get an idea of what a particular property will cost them, price is perhaps the easiest to gauge. Things like mortgage rates, potential maintenance and upkeep, property taxes, and insurance are all part of the equation but not as simple to measure as a home’s listed price. So it’s no shock that Americans who are thinking about buying a house in the near future are also thinking about where home prices are headed. That’s why new numbers from ATTOM Data Solutions offer buyers some good news. According to their Q3 2018 U.S. Home Sales Report, home prices only rose 1 percent in the third quarter and are now up 4.8 percent from last year. That’s the slowest price appreciation since 2016. The report found that price increases slowed in 74 of the 150 metro areas analyzed, including Chicago, Los Angeles, Dallas-Fort Worth, Houston, and Miami. Despite the encouraging news, however, there are many markets where prices are still rising quickly. In fact, some metros continue to see double-digit gains year-over-year. More here.

When asked, most Americans who don’t own a home say they’d like to become homeowners someday. Regardless of current market conditions or the state of the economy, the desire to own a home endures. Part of this is because it helps to build wealth. The other part is homeownership’s long-cemented status as a key element of the American dream. So what’s keeping aspiring homeowners from pursuing their dream? Well, one main factor is coming up with a down payment. The down payment is among the biggest obstacles that keep people from buying. Mostly, this is because the traditional 20 percent down payment can be difficult to save. In fact, according to one recent analysis, someone making the median income and saving 10 percent of their earnings each month would take more than seven years to save a down payment on the typical American home. And, because home prices have grown faster than incomes over the past few decades, the amount of time it takes has been increasing. Fortunately, though, a 20 percent down payment isn’t required, depending on the type of loan you choose. Also, where you’re looking to buy will affect the amount of time it’ll take. For example, a down payment in Pittsburgh will take just 4.8 years to save, while in cities like Boston or Miami it can take twice that long. More here.

During the spring and summer, homes for sale were selling fast. So fast that the typical home was on the market less than a month. And while home buyers should still expect desirable homes to go quickly, there may be some relief in sight. That’s because, new numbers from the National Association of Realtors show that the majority of homes are now on the market more than a month. In fact, properties typically sold in 32 days in September, an improvement over August when homes moved in just 29 days. Lawrence Yun, NAR’s chief economist, says a trend may be developing. “There is a clear shift in the market with another month of rising inventory on a year over year basis, though seasonal factors are leading to a third straight month of declining inventory,” Yun said. “Homes will take a bit longer to sell compared to the super-heated fast pace seen earlier this year.” At the current sales pace, there is a 4.4-month supply of available homes for sale. A 6-month supply is generally considered a healthy market. More here.

No one wants to make big decisions hastily. It’s a great way to make mistakes and end up with regrets. Which is why, in an ideal situation, home buyers would have time to consider the pros and cons of multiple houses and choose the one that best fits their needs and wishlist. Unfortunately, in a competitive market, that’s not always possible. And so, buyers have to be prepared and ready to make an offer when they see a house they like. The good news is, now that inventory is beginning to rise and houses are staying on the market longer, home buyers have more time to weigh their decision. In fact, according to a recent survey, the number of buyers who made an offer on a house without seeing it first has fallen 15 percent since late last year. This is a good indication that buyers are feeling some relief and aren’t feeling pressured to move as quickly as they were when inventory was tighter. But though this is encouraging news for potential buyers, it doesn’t mean the market isn’t competitive. If you’re interested in purchasing a home any time soon, it’s still best to do your homework, be prepared, prequalified, and ready to make an offer when you find a house you like. More here.

Sometimes picking a house to buy can cause anxiety. After all, what if you choose the wrong one and aren’t happy living there? What if there are structural or mechanical issues that go undetected and will end up meaning costly renovations? It’s hard to imagine that you could possibly cover all the potential issues in just a few walkthroughs. And so, it’s natural to worry about buyer’s remorse. But, according to a new survey, you might be worrying yourself unnecessarily. That’s because, the results show an overwhelming majority of respondents said they love their current home. In fact, 83 percent of participants said they were happy in their house. To some degree, the responses fell along demographic lines, with people 55 years or older and retirees being the most likely groups to say they love their home and have no plans to move. Respondents between 18 and 34 were more likely to want to move. There were also regional differences. For example, residents in Boston and Detroit were more likely to say they like their current home and would rather renovate than move, while the survey found Los Angeles residents were the most likely to say they’d prefer a new house. More here.