For most of this year, new home builders have been optimistic. With high buyer demand and a stronger economy, the market for newly built homes was building some momentum. But, according to the most recent Housing Market Index from the National Association of Home Builders, conditions are changing and builders are reacting. In fact, the index – which measures builder confidence on a scale where any number above 50 indicates more builders view conditions as good than poor – dropped eight points in November. Robert Dietz, NAHB’s chief economist, says it’s partly due to increasing mortgage rates. “For the past several years, shortages of labor and lots along with rising regulatory costs have led to a slow recovery in single-family construction,” Dietz said. “While home price growth accommodated increasing construction costs during this period, rising mortgage interest rates in recent months coupled with the cumulative run-up in pricing has caused housing demand to stall.” Still, despite a drop this month, the index remains in positive territory at 60. Which means, though builders are concerned that mortgage rate increases may hurt demand for new homes, they still see market conditions as good. In fact, the index component measuring expectations for the next six months was at 65 in November. More here.

Home Prices Are Beginning To Slow Down

Home prices have been increasing for a while. Driven by high buyer demand and a lower-than-normal number of homes for sale, values have been on the rise. But, according to the latest S&P CoreLogic Case-Shiller Home Price Indices, the rate of home price increases is now starting to slow. In fact, the results show the National Index gained 5.5 percent year-over-year, which is down from 5.7 percent. Additionally, 16 of 20 included cities saw smaller annual increases. David M. Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, says month-over-month results show even more evidence that price increases are slowing. “On a monthly basis, nine cities saw prices decline in September compared to August,” Blitzer said. “In Seattle, where prices were rising at double-digit annual rates a few months ago, prices dropped last month.” Overall, prices were up just 0.4 percent month-over-month after seasonal adjustments. Naturally, the report is good news for prospective home buyers, as it means prices are beginning to moderate which will help improve affordability conditions. More here.

Four Things To Do Before You Buy

How Student Loan Debt Impacts Home Buyers

Young Americans want to own a home. Research consistently shows large majorities who say they aspire to one day become homeowners. And yet, the number of first-time home buyers active in the market has been lower than what is historically normal for several years. So why aren’t more young Americans buying houses? Well there are a number of factors at play but, among them, student loan debt is a big one. According to one recent study, the average monthly student debt payment for current renters who say they’d like to buy a home in the next year is $388. Naturally, an extra $400 a month to devote to a mortgage payment could go a long way. In fact, with that money, a buyer could afford a house that cost almost $100,000 more. But though that may seem discouraging, the same report also found that prospective buyers with student loan debt can still afford 52.3 percent of homes currently listed for sale. And, in areas where there are more affordable homes available for sale, it’s even easier to find something in a price range that works. In St. Louis, for example, a buyer with student loan debt can still afford nearly 75 percent of currently listed homes. More here.

HAPPY THANKSGIVING

Number Of Listings With Price Cut Up In October

One good way of measuring where home prices are headed is to look at how many homes for sale have had to adjust their initial listing price. If there are a lot of homes in your area with price reductions, it could be a sign that the local market is softening. And, according to one national report, it likely is. That’s because, new numbers show 31.3 percent of homes for sale in October had at least one price cut of more than 1 percent. By comparison, last year at the same time just 25 percent of homes had previously dropped their price. That means an increasing number of homeowners with homes for sale are adjusting their price to attract home buyers. Whether this is due to a seasonal slow down, a reaction to recent mortgage rate increases, or the beginning of a better balanced market remains to be seen. But with fewer than half of the metro areas included in the report showing month-over-month price gains, it’s definitely good news for prospective home buyers this fall and winter. More here.

Number Of Equity Rich Properties Hits New High

Homeownership isn’t a get rich quick scheme. So you shouldn’t buy a house expecting its value to skyrocket and your wealth to instantly rise. The housing market will have its ups-and-downs and there are no guarantees. Which means, you probably shouldn’t buy a house hoping it’ll make you rich. And while that’s generally good advice, it doesn’t mean owning a home won’t benefit your bottom line. For example, according to ATTOM Data Solutions’ Q3 2018 U.S. Home Equity & Underwater Report, there are now nearly 14.5 million equity rich properties across the country. Equity rich refers to when the amount owed on the mortgage is less than 50 percent of a property’s market value. And the new numbers are not only good news, they represent a new high and an increase of 433,000 from one year ago. Daren Blomquist, senior vice president of ATTOM, says part of the improvement is the fact that people are staying in their homes longer. “As homeowners stay put longer, they continue to build more equity in their homes despite the recent slowing in rates of home appreciation,” Blomquist said. In other words, the longer you stay in a house, the more likely you’ll see a return on your investment. More here.

Choosing Which Type Of House To Buy

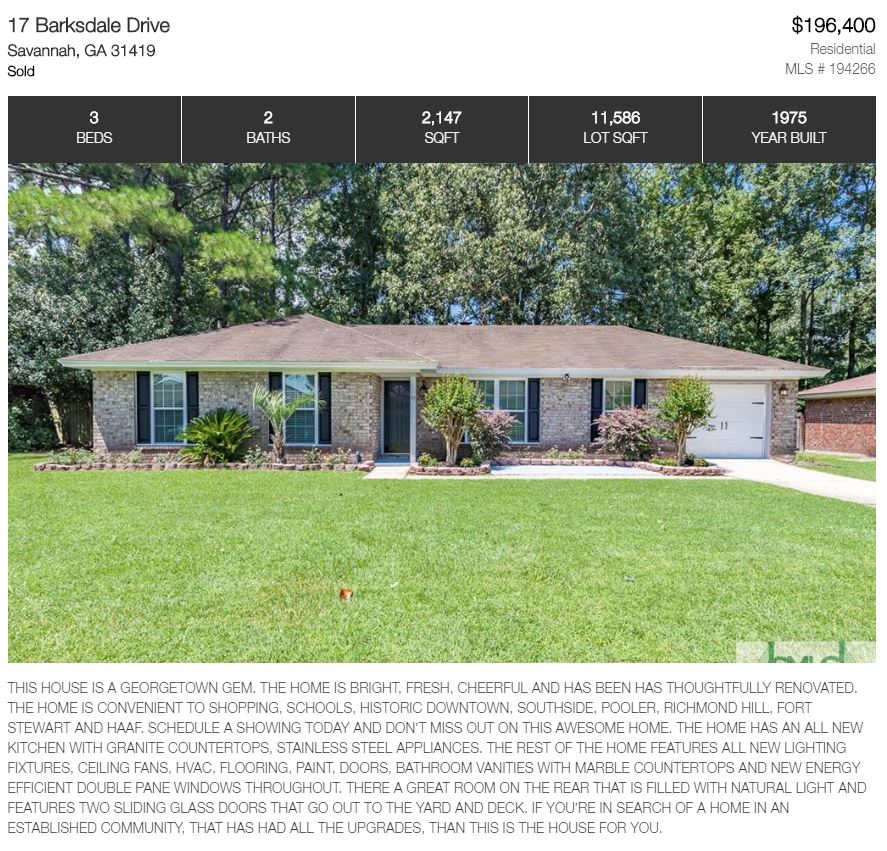

SOLD!!

November Newsletter