As more and more baby boomers enter retirement age, the question of whether they should sell their homes and move has become a hot topic. In today’s housing market climate, with low available inventory in the starter and trade-up home categories, it makes sense to evaluate your home’s ability to adapt to your needs in retirement.

According to the National Association of Exclusive Buyers Agents (NAEBA), there are 7 factors that you should consider when choosing your retirement home.

1. Affordability

“It may be easy enough to purchase your home today but think long-term about your monthly costs. Account for property taxes, insurance, HOA fees, utilities – all the things that will be due whether or not you have a mortgage on the property.”

Would moving to a complex with homeowner association fees actually be cheaper than having to hire all the contractors you would need to maintain your home, lawn, etc.? Would your taxes go down significantly if you relocated? What is your monthly income going to be like in retirement?

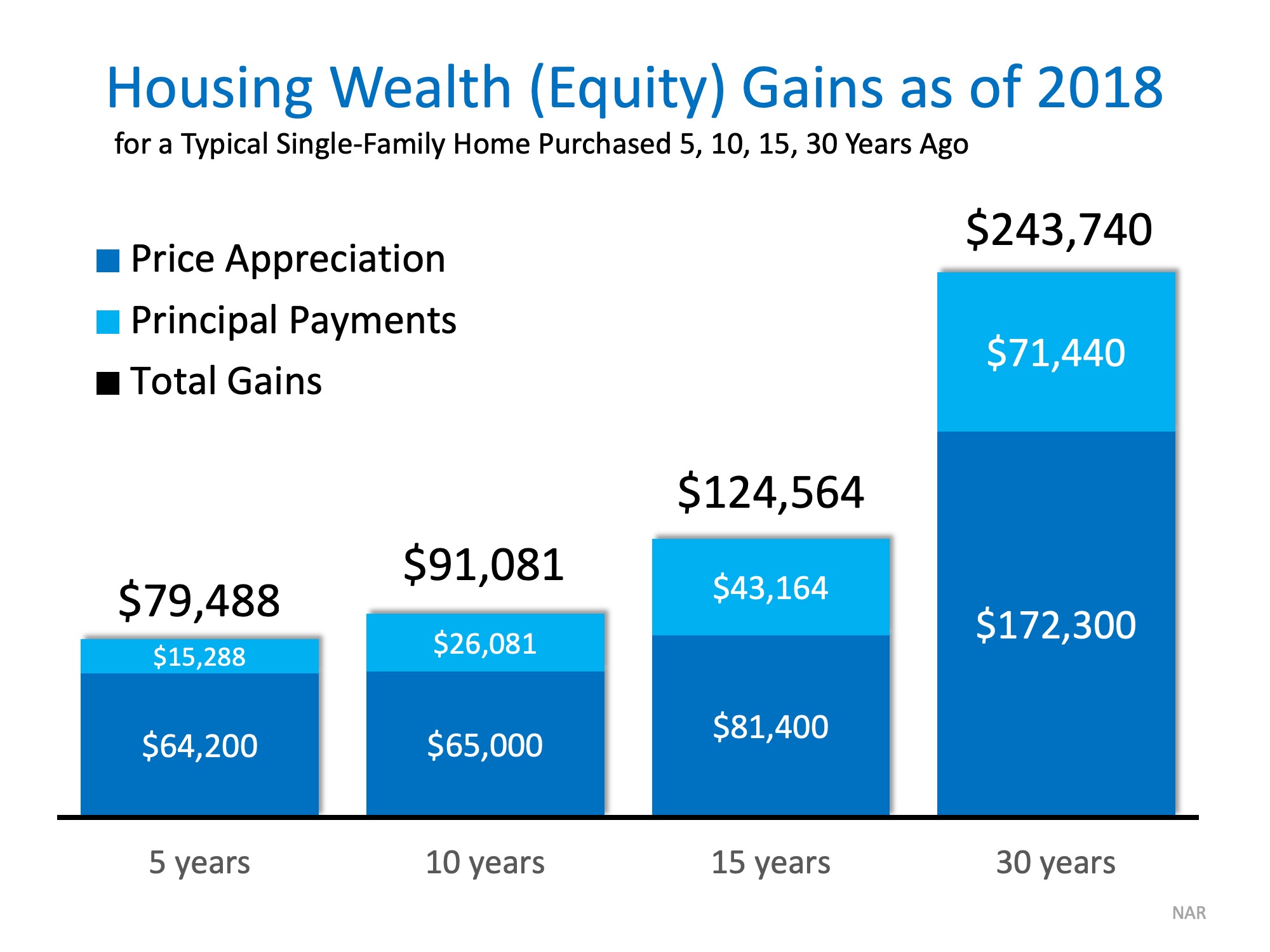

2. Equity

“If you have equity in your current home, you may be able to apply it to the purchase of your next home. Maintaining a healthy amount of home equity gives you a source of emergency funds to tap, via a home equity loan or reverse mortgage.”

The equity you have in your current home may be enough to purchase your retirement home with little to no mortgage. Homeowners in the US gained an average of over $9,700 in equity last year.

3. Maintenance

“As we age, our tolerance for cleaning gutters, raking leaves and shoveling snow can go right out the window. A condominium with low-maintenance needs can be a literal lifesaver, if your health or physical abilities decline.”

As we mentioned earlier, would a condo with an HOA fee be worth the added peace of mind of not having to do the maintenance work yourself?

4. Security

“Elderly homeowners can be targets for scams or break-ins. Living in a home with security features, such as a manned gate house, resident-only access and a security system can bring peace of mind.”

As scary as that thought may be, any additional security is helpful. An extra set of eyes looking out for you always adds to peace of mind.

5. Pets

“Renting won’t do if the dog can’t come too! The companionship of pets can provide emotional and physical benefits.”

Consider all of your options when it comes to bringing your ‘furever’ friend with you to a new home. Will there be necessary additional deposits if you are renting or in a condo? Is the backyard fenced in? How far are you from your favorite veterinarian?

6. Mobility

“No one wants to picture themselves in a wheelchair or a walker, but the home layout must be able to accommodate limited mobility.”

Sixty is the new 40, right? People are living longer and are more active in retirement, but that doesn’t mean that down the road you won’t need your home to be more accessible. Installing handrails and making sure your hallways and doorways are wide enough may be a good reason to look for a home that was built to accommodate these needs.

7. Convenience

“Is the new home close to the golf course, or to shopping and dining? Do you have amenities within easy walking distance? This can add to home value!”

How close are you to your children and grandchildren? Would relocating to a new area make visits with family easier or more frequent? Beyond being close to your favorite stores and restaurants, there are a lot of factors to consider.

Bottom Line

When it comes to your forever home, evaluating your current house for its ability to adapt with you as you age can be the first step to guaranteeing your comfort in retirement. If after considering all these factors you find yourself curious about your options, let’s get together to evaluate your ability to sell your house in today’s market and get you into your dream retirement home!

![Home Prices Up 5.73% Across the Country! [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/03/28120339/FHFA-ENG-MEM-1046x1600.jpg)

![10 Steps to Buying a Home [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/03/28110723/20190329-10-Steps-MEM-1046x808.jpg)