The Cost of Waiting: Interest Rates Edition

![The Cost of Waiting: Interest Rates Edition [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/07/19100001/20190719-MEM-1046x784.jpg)

Some Highlights:

- Interest rates are projected to increase steadily heading into 2020.

- The higher your interest rate, the more money you will end up paying for your home and the higher your monthly payment will be.

- Rates are still low right now – don’t wait until they hit 5% to start searching for your dream home!

Is Renting Right for Me?

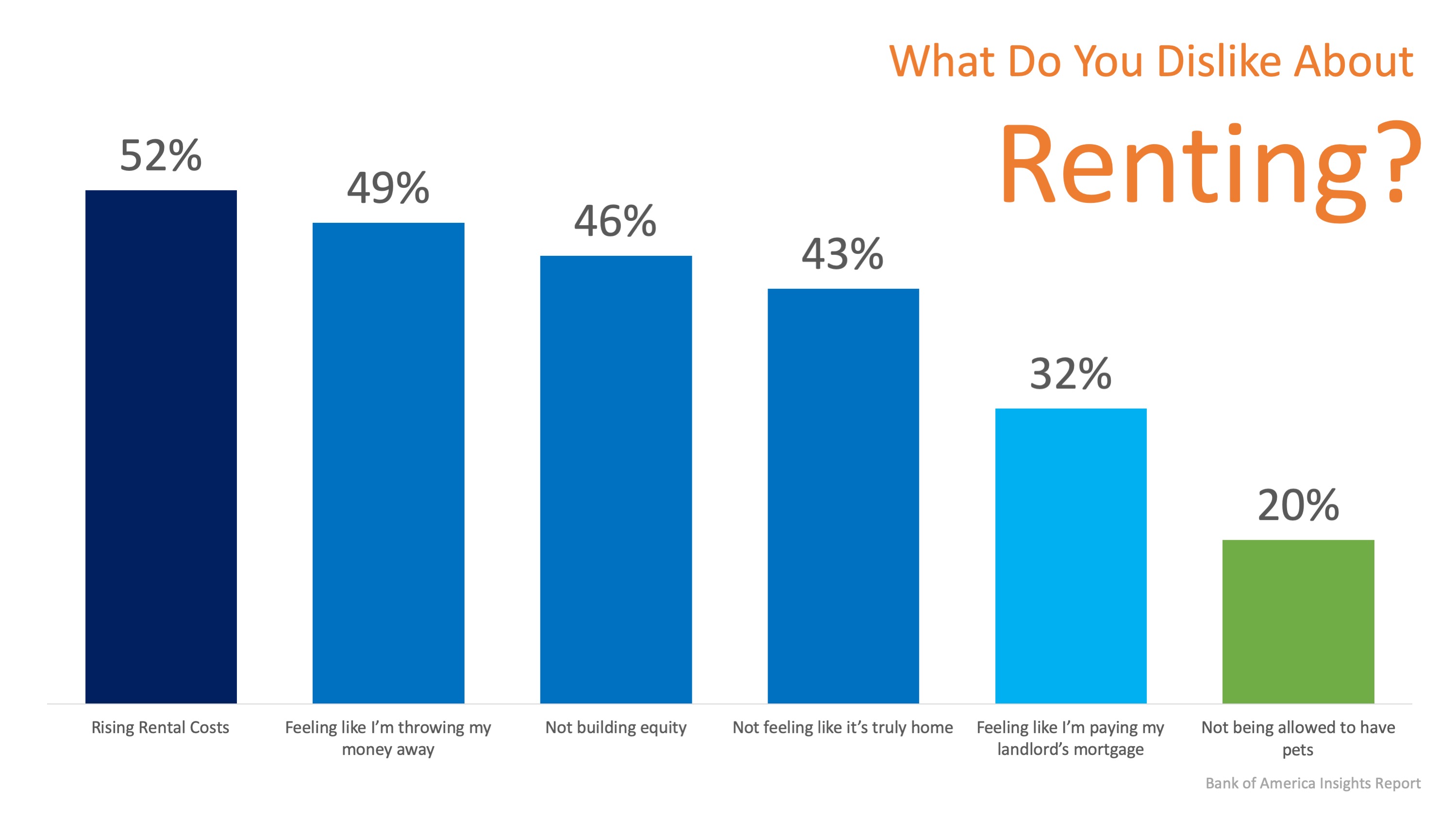

If you’re currently renting and have dreams of owning your own home, it may be a good time to think about your next move. With rent costs rising annually and many helpful down payment assistance programs available, homeownership may be closer than you realize.

According to the 2018 Bank of America Homebuyer Insights Report, 74% of renters plan on buying within the next 5 years, and 38% are planning to buy within the next 2 years.

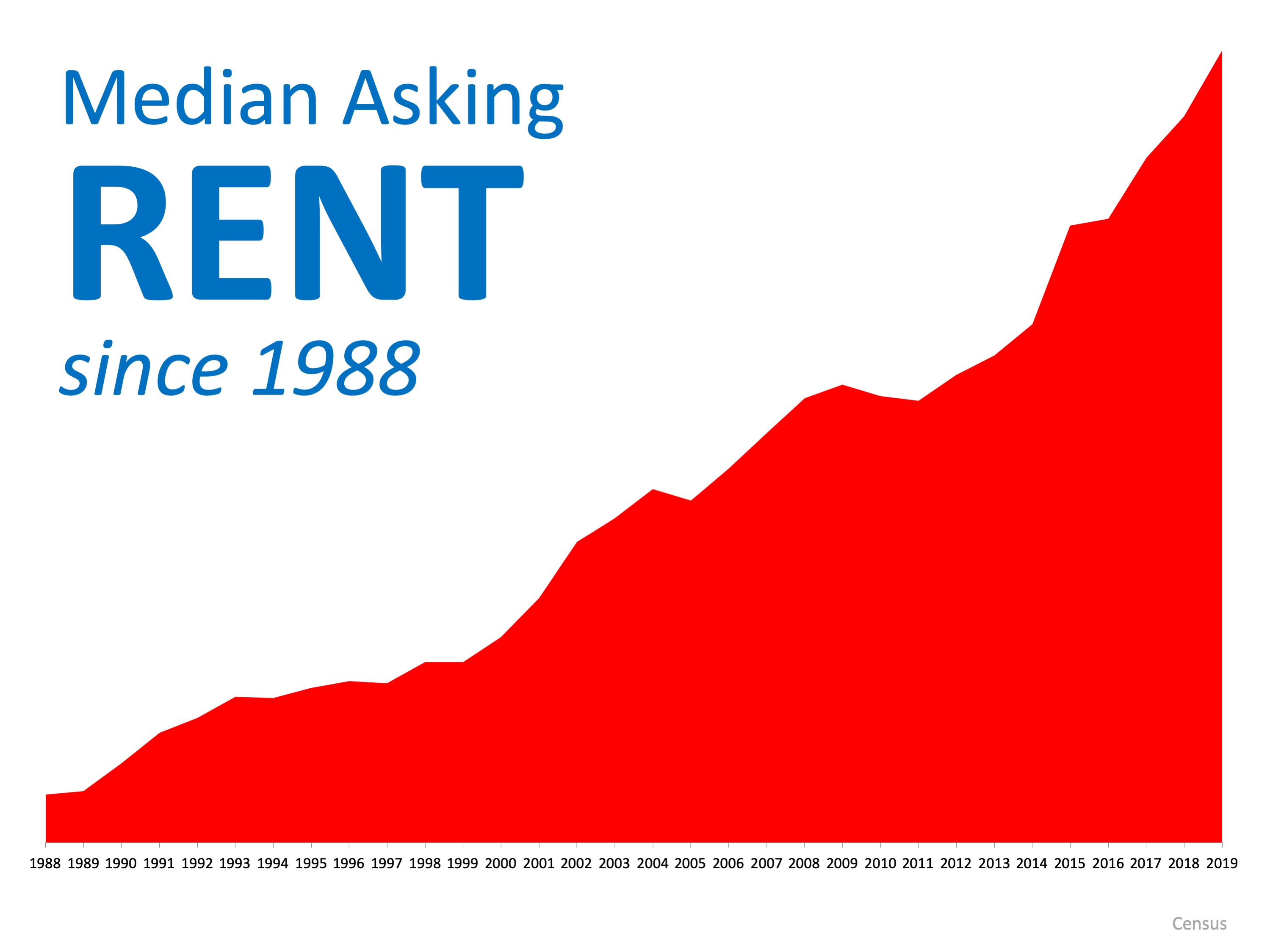

When those same renters were asked why they disliked renting, 52% said rising rental costs were their top reason, and 42% of renters believe their rent will rise every year. The full results of the survey can be seen below: It’s no wonder rising rental costs came in as the top answer. The median asking rent price has risen steadily over the last 30 years, as you can see below.

It’s no wonder rising rental costs came in as the top answer. The median asking rent price has risen steadily over the last 30 years, as you can see below. There is a long-standing rule that a household should not spend more than 28% of its income on housing expenses. With nearly half of renters (48%) surveyed already spending more than that, and with their rents likely to rise again, it’s never a bad idea to reconsider your family’s plan and ask yourself if renting is your best angle going forward. When asked why they haven’t purchased a home yet, not having enough saved for a down payment (44%) came in as the top response. The report went on to reveal that nearly half of all respondents believe that “a 20% down payment is required to buy a home.”

There is a long-standing rule that a household should not spend more than 28% of its income on housing expenses. With nearly half of renters (48%) surveyed already spending more than that, and with their rents likely to rise again, it’s never a bad idea to reconsider your family’s plan and ask yourself if renting is your best angle going forward. When asked why they haven’t purchased a home yet, not having enough saved for a down payment (44%) came in as the top response. The report went on to reveal that nearly half of all respondents believe that “a 20% down payment is required to buy a home.”

The reality is, the need to produce a 20% down payment is one of the biggest misconceptions of homeownership, especially for first-time buyers. That means a large number of renters may be able to buy now, and they don’t even know it.

Bottom Line

If you’re one of the many renters who are tired of rising rents but may be confused about what is required to buy in today’s market, let’s get together to determine your path to homeownership.

Should I Refinance My Home?

With the recent lower interest rates, many homeowners are wondering if they should refinance.

To decide if refinancing is the best option for your family, start by asking yourself these questions:

Why do you want to refinance?

There are many reasons to refinance, but here are three of the most common ones:

- Lower your interest rate and payment – This is the most popular reason. If you have a 5% interest rate or higher, it might be worth seeing if you can take advantage of the current lower interest rates, hovering below 4%, to reduce your monthly payment and overall cost of the loan.

- Shorten the term of your loan – If you have a 30-year loan, it may be advantageous to change it to a 15 or 20-year loan to pay off your mortgage sooner.

- Cash-out refinance – With home prices increasing, you might have enough equity to cash out and invest in something else, like your children’s education, a vacation home, or a new business.

Once you know why you might want to refinance, ask yourself the next question:

How much is it going to cost?

There are fees and closing costs involved in refinancing, and Lenders Network explains:

“If you were to refinance that loan into a new loan, total closing costs will run between 2%-4% of the loan amount.”

They also explain that there are options for no-cost refinance loans, but be on the lookout:

“A no-cost refinance loan is when the lender pays the closing costs for the borrower. However, you should be aware that the lender makes up this money from other aspects of the mortgage. Usually pay charging a slightly higher interest rate so they can make the money back.”

If you’re comfortable with the costs of refinancing, then ask yourself one more question:

Is it worth it?

To answer this one, we’ll use an example. Let’s assume you have a $200,000 home loan. A 4% refinance cost will be $10,000. If you want to lower your interest rate from 6% to 4%, then refinancing is going to save you $244 per month. To break even ($10,000/$244), you need to continue owning your home for over 40 months.

Now that you know how the math shakes out, think about how much longer you’d like to own your current home. If you plan to stay for more than 3 years, then maybe it is advantageous for you to refinance.

If, however, your current home does not fulfill your present needs, you might want to consider using your potential refinance costs for a down payment on a new move-up home. You will still get a lower interest rate than the one you have on your current house, and with the equity you’ve already built, you can finally purchase the home of your dreams.

Bottom Line

There are many opportunities for growth in the current real estate market. To find out what’s right for your family, let’s get together to help you understand your options and guide you toward the best decision.

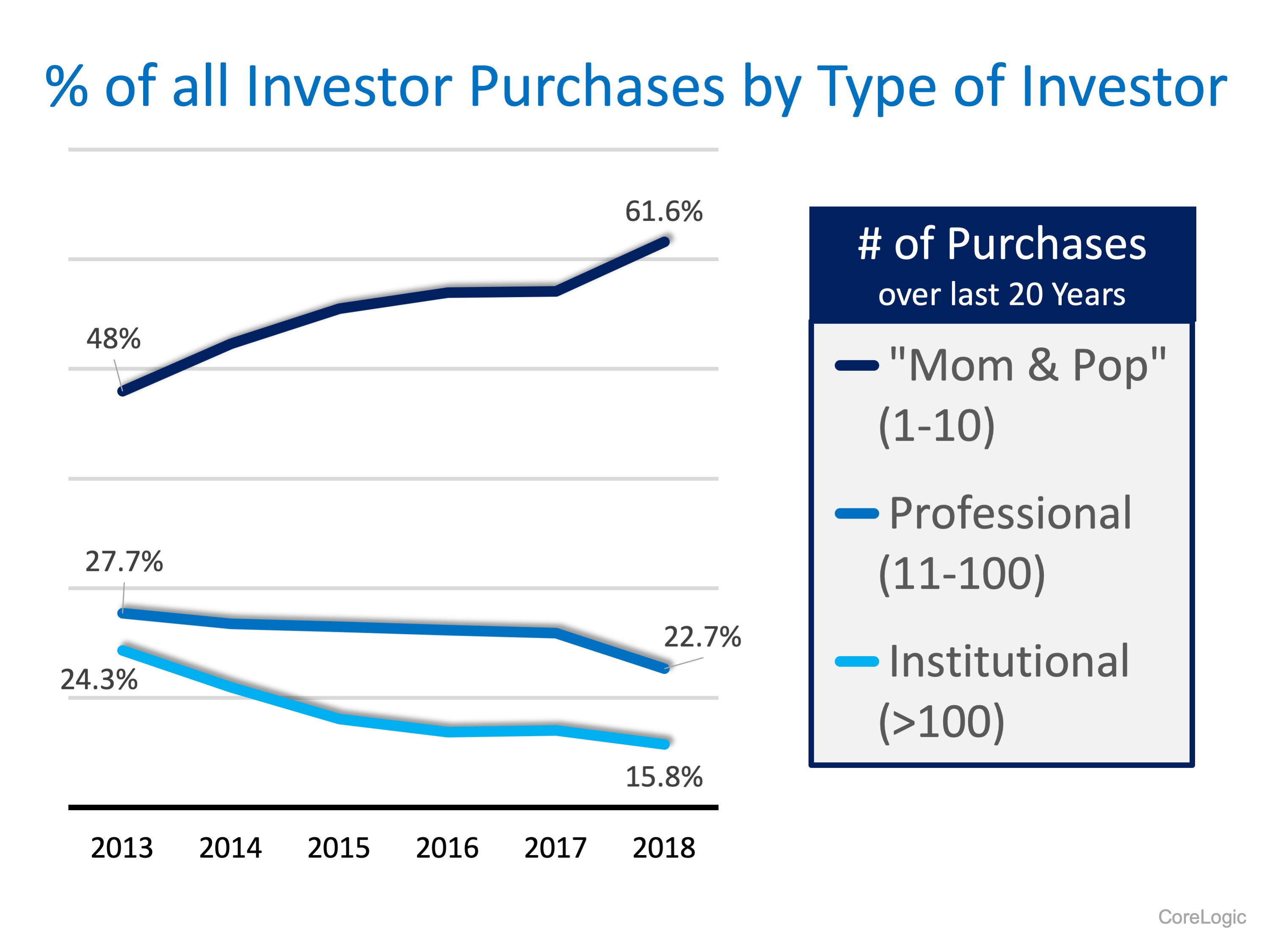

The Surprising Profile of the Real Estate Investor

Over 10% of all residential homes are purchased by investors, and that number continues to rise. Who are these investors?

Many have speculated that the large institutional conglomerates such as Blackstone, American Homes 4 Rent, and Colony Starwood dominate investor purchases. However, a special report on investor home buying by CoreLogic, Don’t Call it a Comeback: Housing Investors Have Been Here for Years, shows this is not the case.

Ralph McLaughlin, CoreLogic’s Deputy Chief Economist and author of the report, explained his findings at the recent National Association of Real Estate Editors conference in Austin:

“Investor buying activity in the U.S. is at record highs. And our records go back confidently, about 20 years…

What’s going on and why? Well, it turns out, it’s not the big institutional guys that are leading the increase in home buying. It’s actually the smaller guys. It’s those that have bought between one and ten properties over this 20-year period, they’re the ones that are really leading the increase in investor home buying.”

Here is the breakdown of the percentage of purchasers by type of investor over the last six years according to the report: As the graph shows, the percentage of “Mom & Pop” investors is currently dominating the number of homes purchased by investors, as the percentage of homes purchased by both professional and institutional investors is falling.

As the graph shows, the percentage of “Mom & Pop” investors is currently dominating the number of homes purchased by investors, as the percentage of homes purchased by both professional and institutional investors is falling.

Bottom Line

Most houses purchased by an investor are bought by small investors looking to diversify their financial portfolio by adding a real estate component. If you are investing in real estate as either a landlord or someone who fixes-up and flips the house, let’s chat about the ways you can build or liquidate your current portfolio of properties.

Is Your First Home Now Within Your Grasp?

![Is Your First Home Now Within Your Grasp? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/06/24131009/FTHB-Demographics-ENG-MEM-1046x1477.jpg)

Some Highlights:

- According to the US Census Bureau, “millennials” are defined as 18-36-year-olds.

- According to NAR’s latest Profile of Home Buyers & Sellers, the median age of all first-time home buyers is 32.

- More and more “old millennials” (25-36) are realizing that homeownership is within their grasp now!

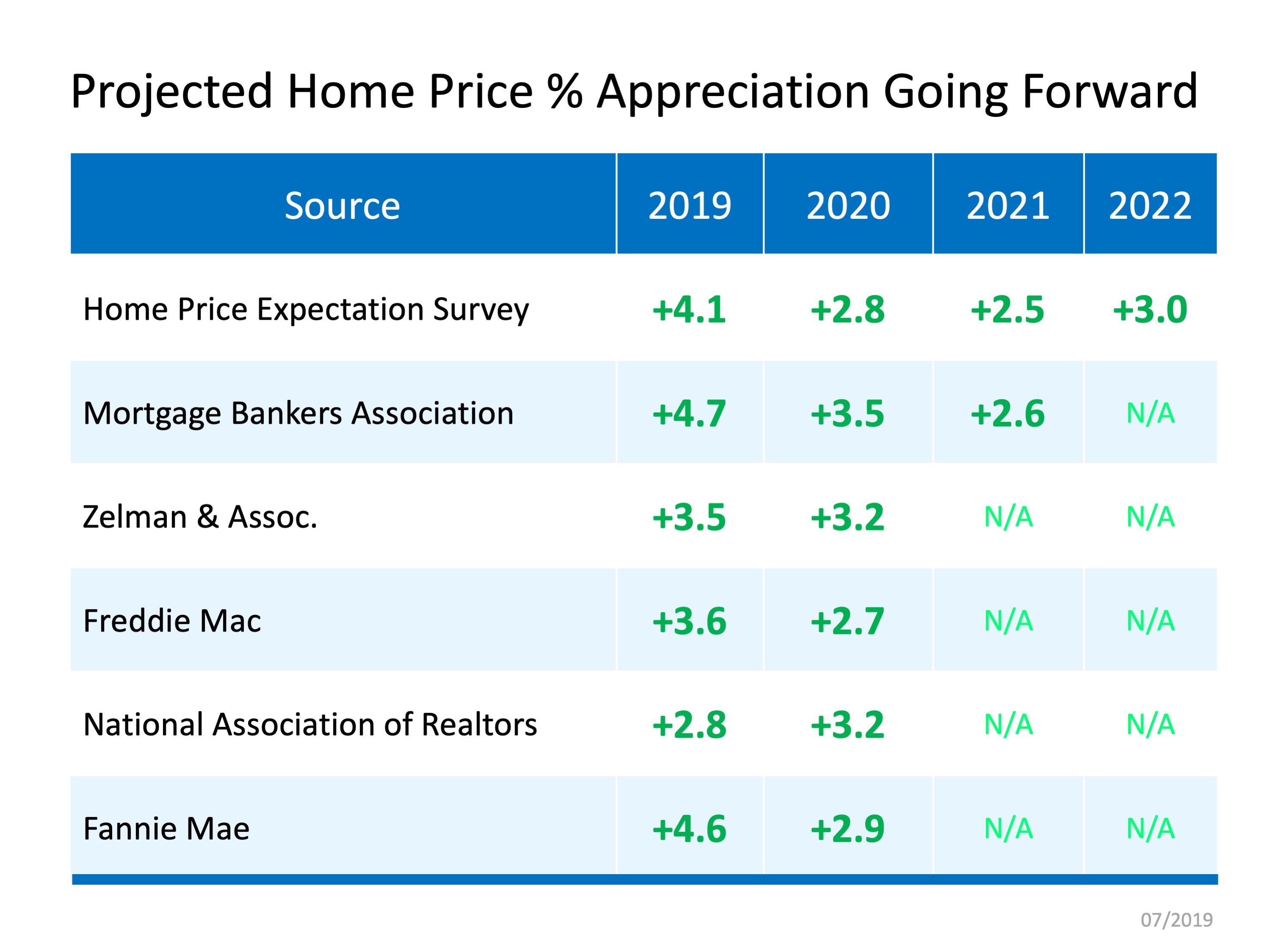

Home Price Appreciation Forecast

Questions continue to come up about where home prices will head throughout the rest of this year, as well as where they may be going over the few years beyond.

We’ve gathered current data from the industry’s most reliable sources to help answer these questions:

The Home Price Expectation Survey – A survey of over 100 market analysts, real estate experts, and economists conducted by Pulsenomics each quarter.

Mortgage Bankers Association (MBA) – As the leading advocate for the real estate finance industry, the MBA enables members to successfully deliver fair, sustainable, and responsible real estate financing within ever-changing business environments.

Zelman & Associates – The firm leverages unparalleled housing market expertise, extensive surveys of industry executives, and rigorous financial analysis to deliver proprietary research and advice to leading global institutional investors and senior-level company executives.

Freddie Mac – An organization whose mission is to provide liquidity, stability, and affordability to the U.S. housing market in all economic conditions extending to all communities from coast to coast.

The National Association of Realtors (NAR) – The largest association of real estate professionals in the world.

Fannie Mae – A leading source of financing for mortgage lenders, providing access to affordable mortgage financing in all markets.

Here’s the home price appreciation these experts are projecting over the next few years:

Bottom Line

Every source sees home prices continuing to appreciate, which is great news for the strength of the market. The increase is steepest throughout the rest of 2019, and prices should continue to rise as we move through 2020 and beyond.

How to Present an Offer that Stands Out

4 Tips to Sell Your Home Faster

Since June of last year, we have seen an increase in the inventory of homes for sale month per month. Every spring and summer, the inventory increases because people want to sell their home. For those with children, they may want to be in their new home for the beginning of the school year.

If you are one of those sellers, you may find these 4 tips helpful in getting your home sold more quickly.

1. Make buyers feel at home

Declutter your home! Pack away all personal items like pictures, awards, and sentimental belongings. Make them feel like they belong in this house! According to the Profile of Home Staging by the National Association of Realtors,

“83% of buyers’ agents said staging a home made it easier for a buyer to visualize the property as a future home.”

Not only will your house spend less time on the market, but the same report mentioned that,

“One-quarter of buyers’ agents said that staging a home increased the dollar value offered between 1 – 5%, compared to other similar homes on the market that were not staged.”

2. Keep it organized

Since you took the time to declutter, keep it organized! Before the buyers show up, pick up toys, make the bed, and put away clean dishes. It is also a good idea to put out some cookies fresh from the oven or a scented candle. Buyers will remember the smell of your home! According to the same report, the kitchen is one of the most important rooms to stage in order to attract more buyers.

3. Give buyers full access

One of the top four elements when selling your home is access! If your home is available anytime, that opens up more opportunity to find a buyer right away. Some buyers, especially those relocating, don’t have much time available. If they cannot get into the house, they will move on to the next one.

4. Price it right

As we mentioned at the beginning, more inventory coming into the market guarantees there will be some competition. You want to make sure your home is noticed. The key to selling your house in 2019 is ensuring it is Priced to Sell Immediately (PTSI). That way, your home will be seen by the greatest amount of buyers and will sell at a great price before more competition comes to market!

Bottom Line

If you want to sell your house in the least amount of time at the best price with as little hassle as possible, a local real estate professional is a useful guide. Call them today to find out what you need to do to sell your home more quickly.

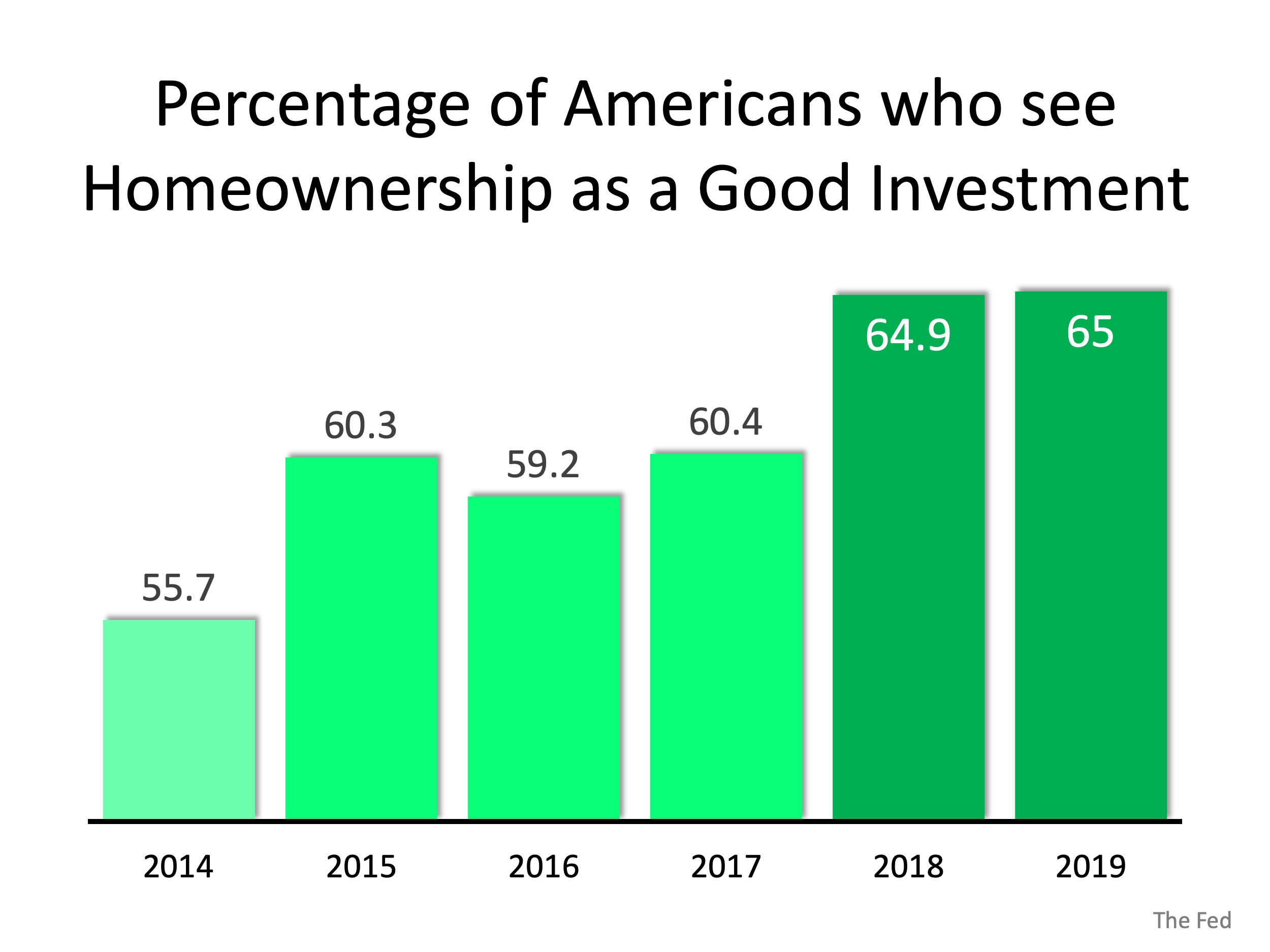

Americans’ Powerful Belief in Homeownership as an Investment

The Federal Reserve Bank (The Fed) recently released their 2019 Survey of Consumer Expectations Housing Survey. The survey reported that 65% of Americans believe homeownership is a good financial investment. Since 2014, the percentage has increased by over nine percent. The Fed’s survey also showed that when the results are broken down by age, education, income, or region of the country, more than 55% of Americans in each category see homeownership as a good investment.

The Fed’s survey also showed that when the results are broken down by age, education, income, or region of the country, more than 55% of Americans in each category see homeownership as a good investment.

This coincides with a recent Gallup survey of Americans which revealed that real estate was their number one choice for the best long-term investment when compared to stocks, savings accounts or gold.

Bottom Line

Americans’ belief in residential real estate as a good financial investment continues to grow as the housing market returns to normalcy.