Supply & Demand Report for Wilmington Island Area

April 2018

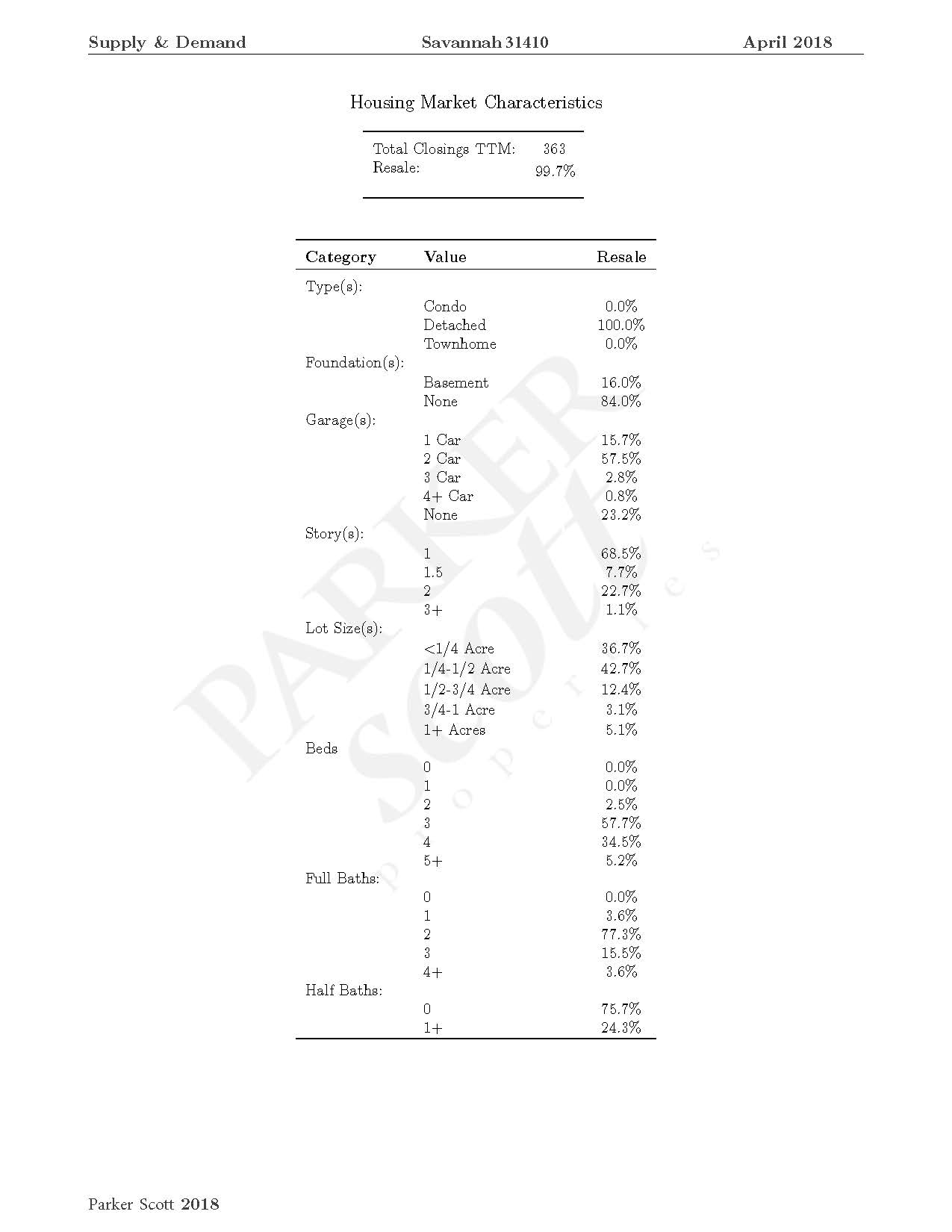

Report is based on single-family resale properties, that are detached homes (condos and townhomes not included in report). With a minimum price of $100,000 up to a maximum price of $500,000.

GARAGES

15.7% of the homes sold had 1 car garages, 57.5% had 2 car garages, 2.8% had 3 car garages, less than 1% had 4 car garages and 21% did not have a garage.

BEDROOMS

2.5% had two bedrooms, 57.7% with three bedrooms, 34.5% with four bedrooms and 3.6% had more than 4 bedrooms

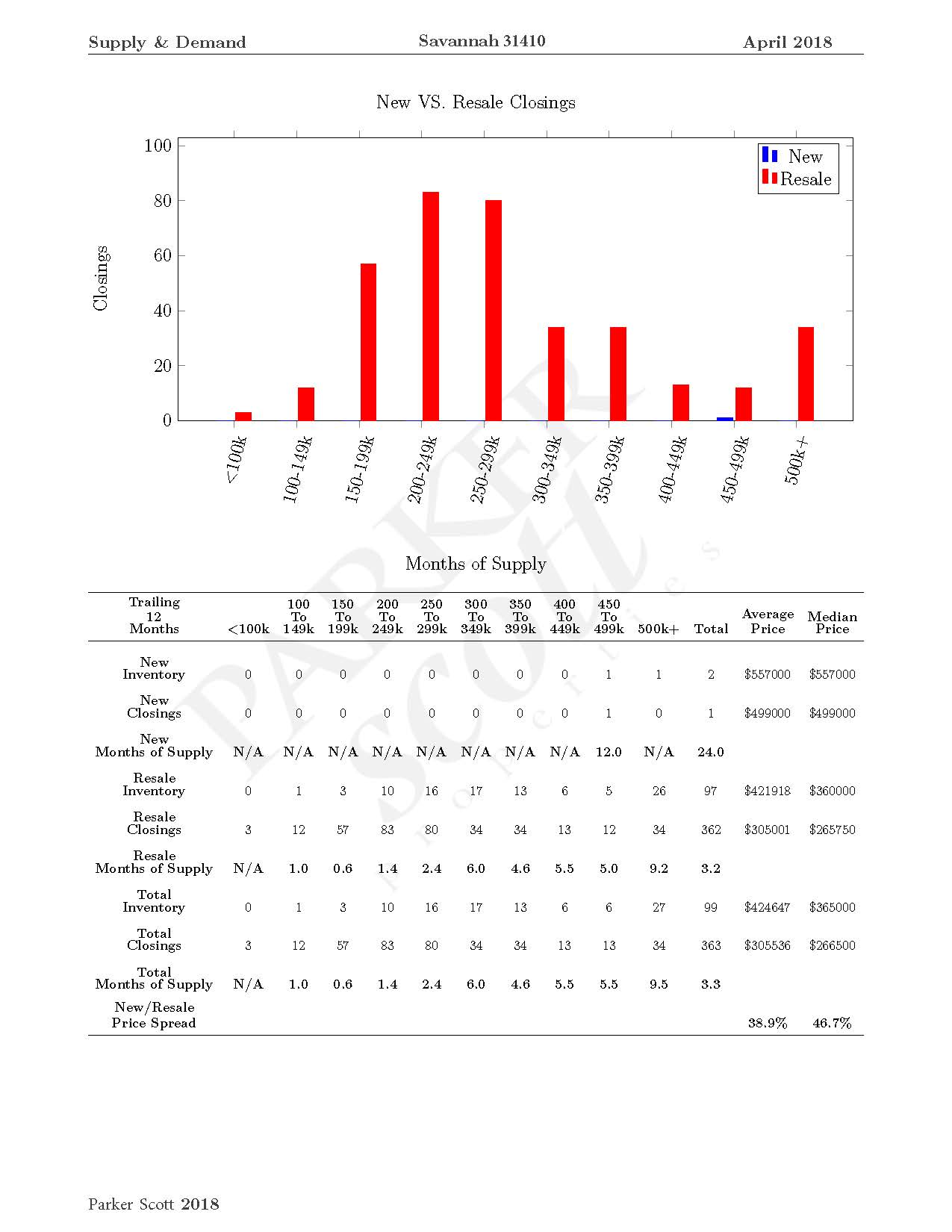

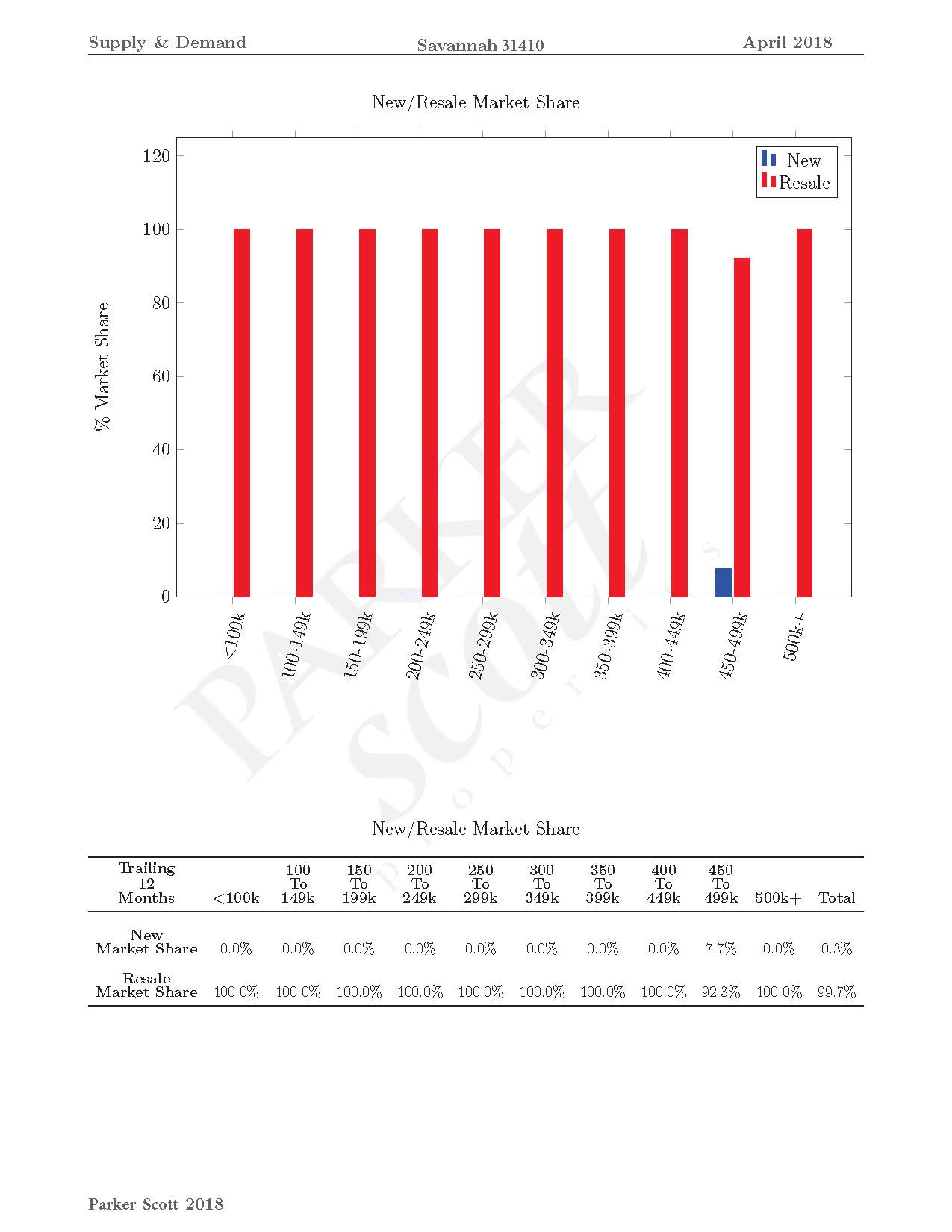

The highest percentage of homes sold were in the $200,000 to $249,000 pricepoint at 83% and the second highest pricepoint $250,000 – $299,000.

“IS THIS THE RIGHT TIME TO SELL”

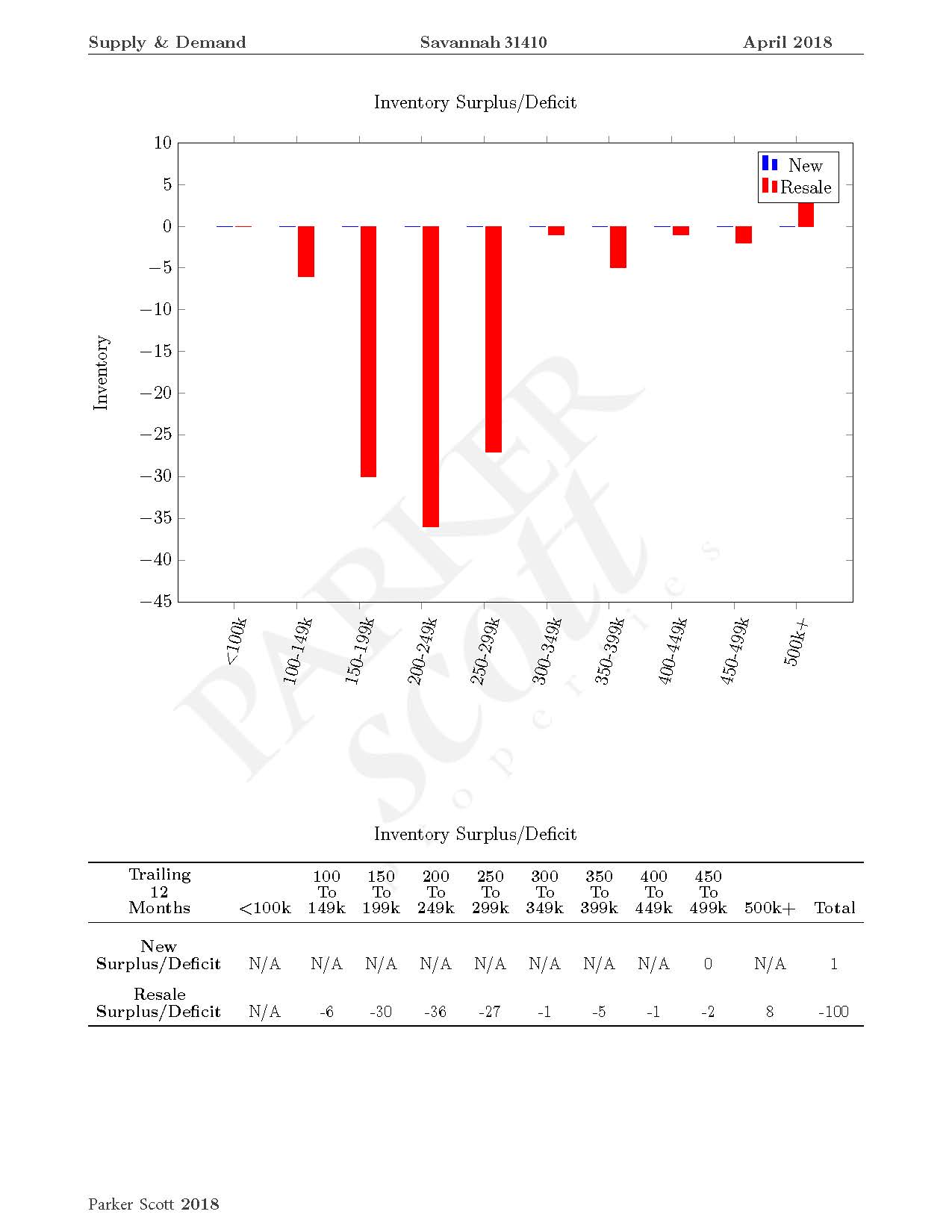

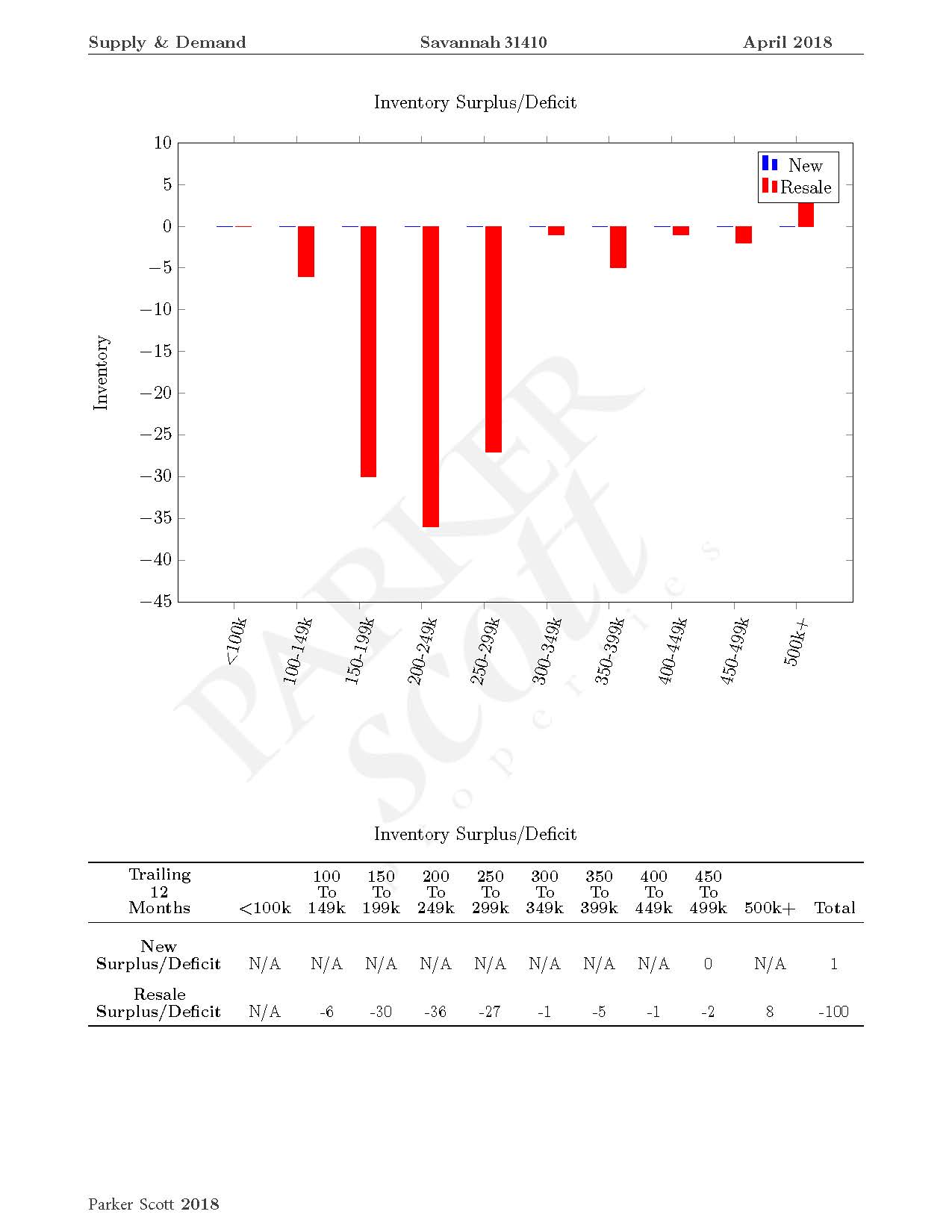

The question would be “is this the right time to sell” and based on market conditions yes! There is a deficit for the surplus of resale homes in the 31410 area.

For a complimentary market study on your property, contact one of our experts today! 912-897-6320 or visit Parker Scott Experts