HOUSING SUPPLY & DEMAND

Supply & Demand Report for Wilmington Island Area

April 2018

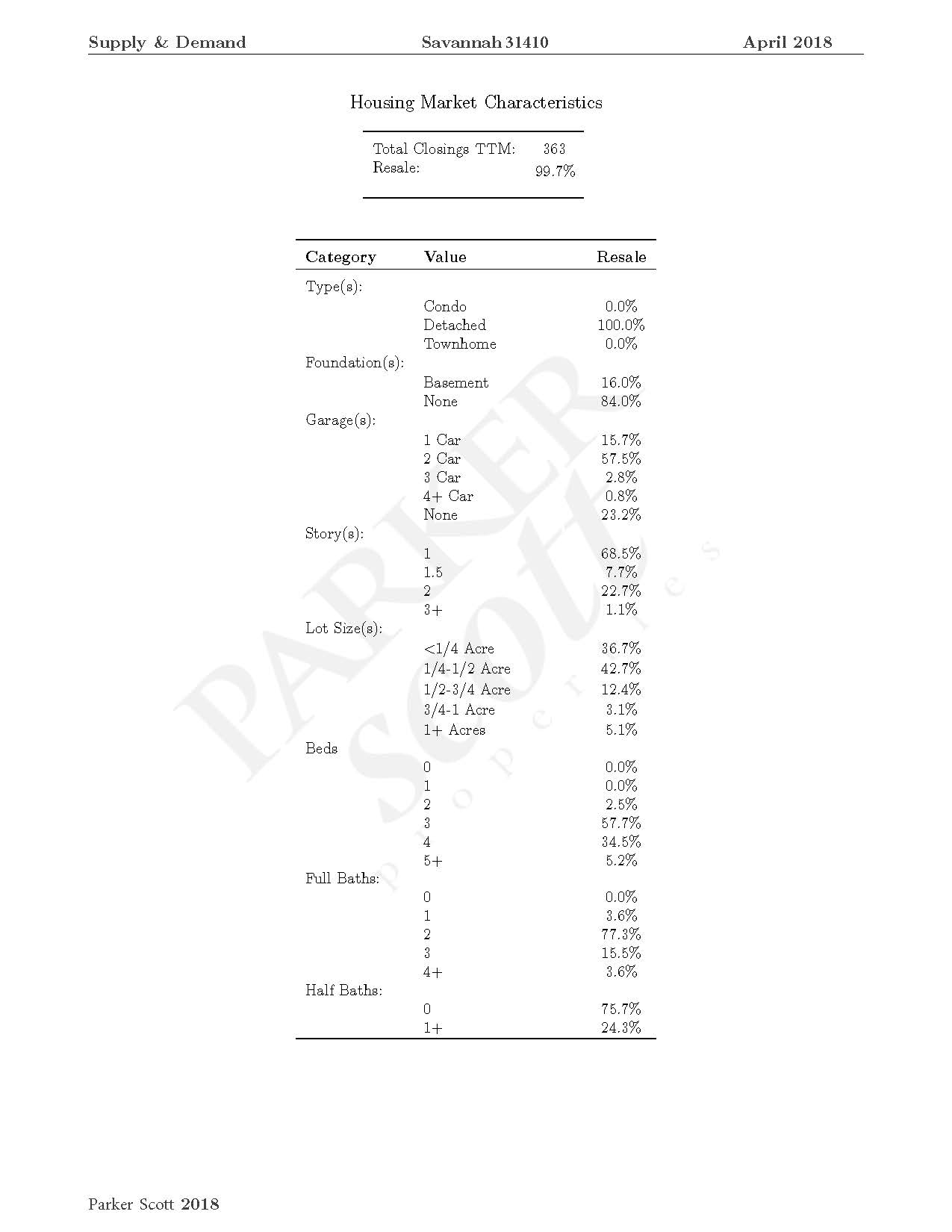

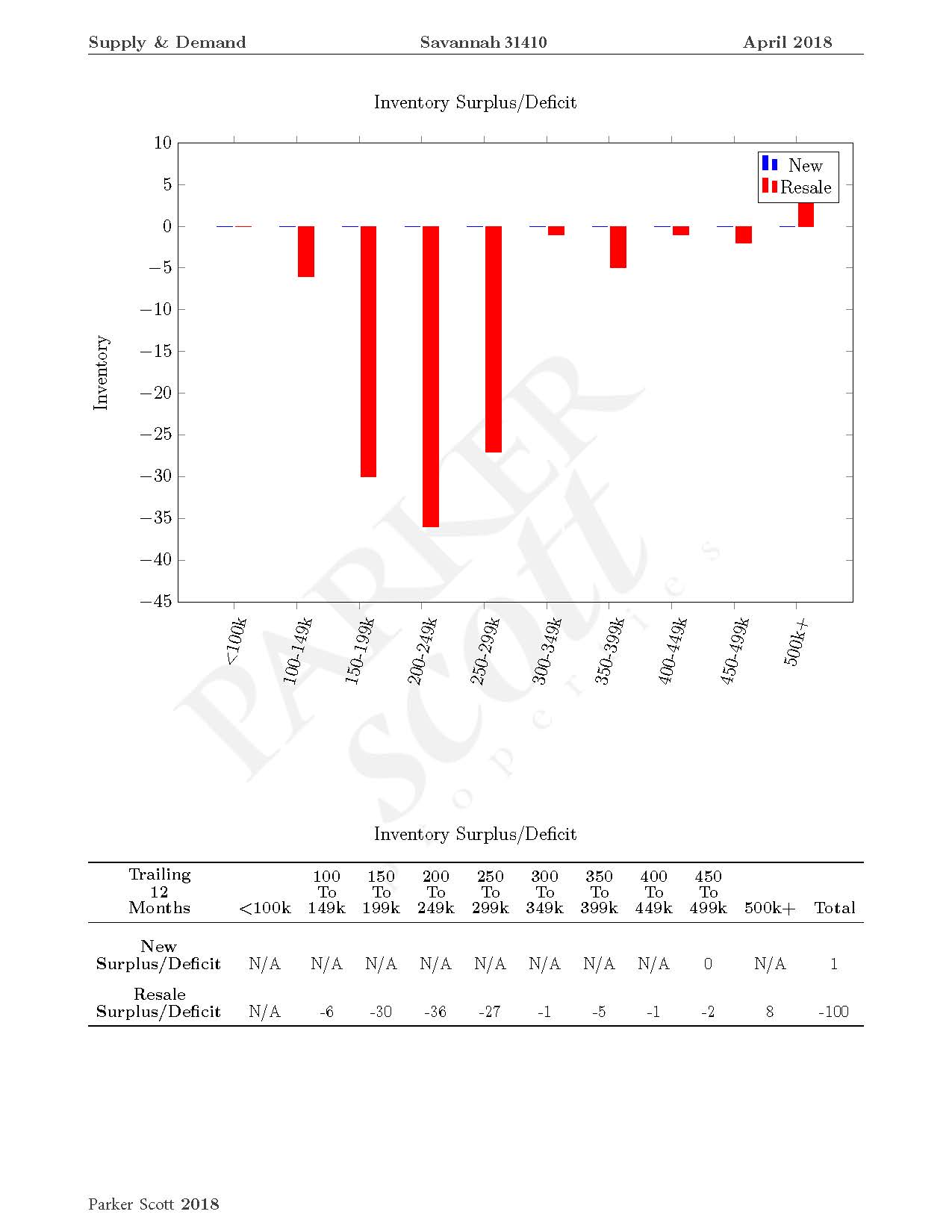

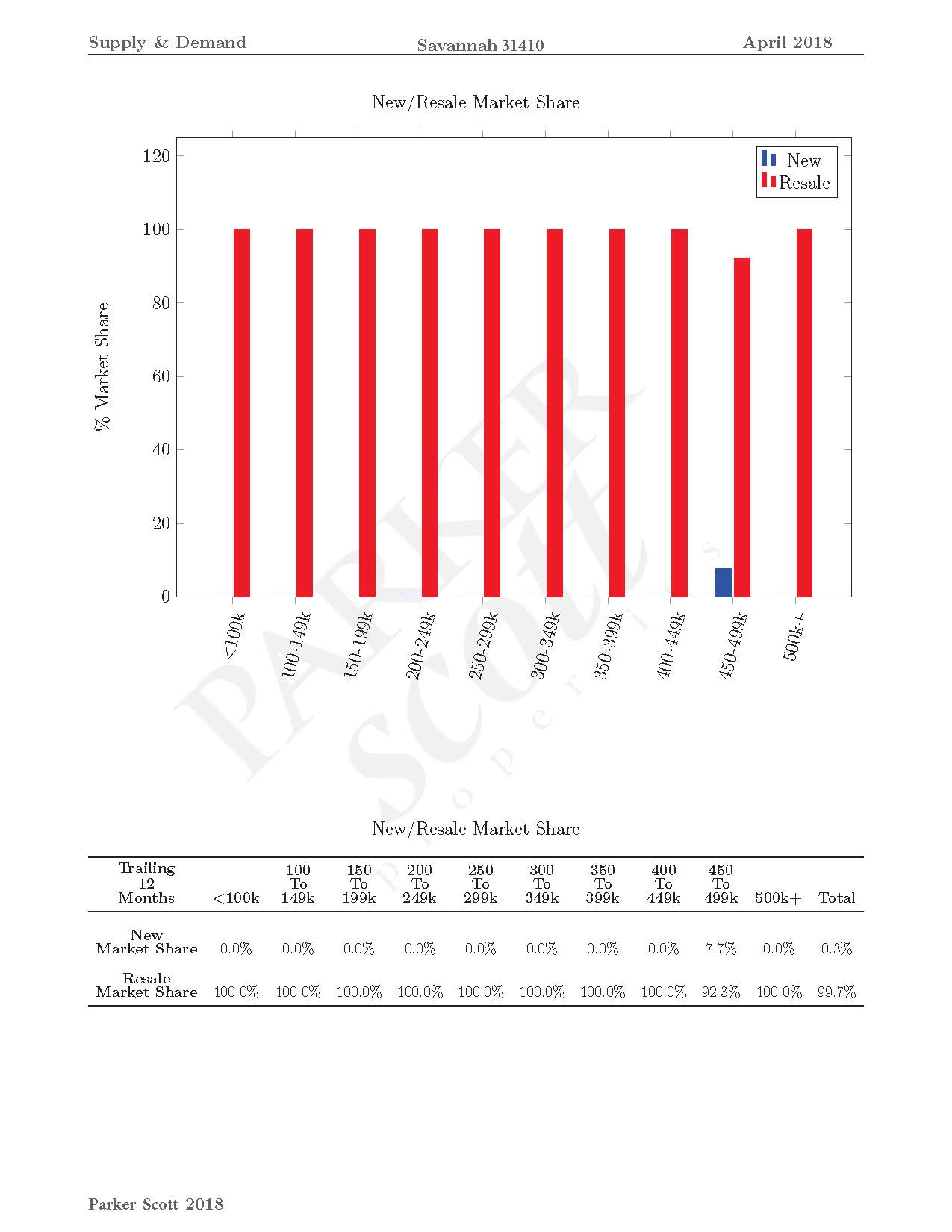

Report is based on single-family resale properties, that are detached homes (condos and townhomes not included in report). With a minimum price of $100,000 up to a maximum price of $500,000.

GARAGES

15.7% of the homes sold had 1 car garages, 57.5% had 2 car garages, 2.8% had 3 car garages, less than 1% had 4 car garages and 21% did not have a garage.

BEDROOMS

2.5% had two bedrooms, 57.7% with three bedrooms, 34.5% with four bedrooms and 3.6% had more than 4 bedrooms

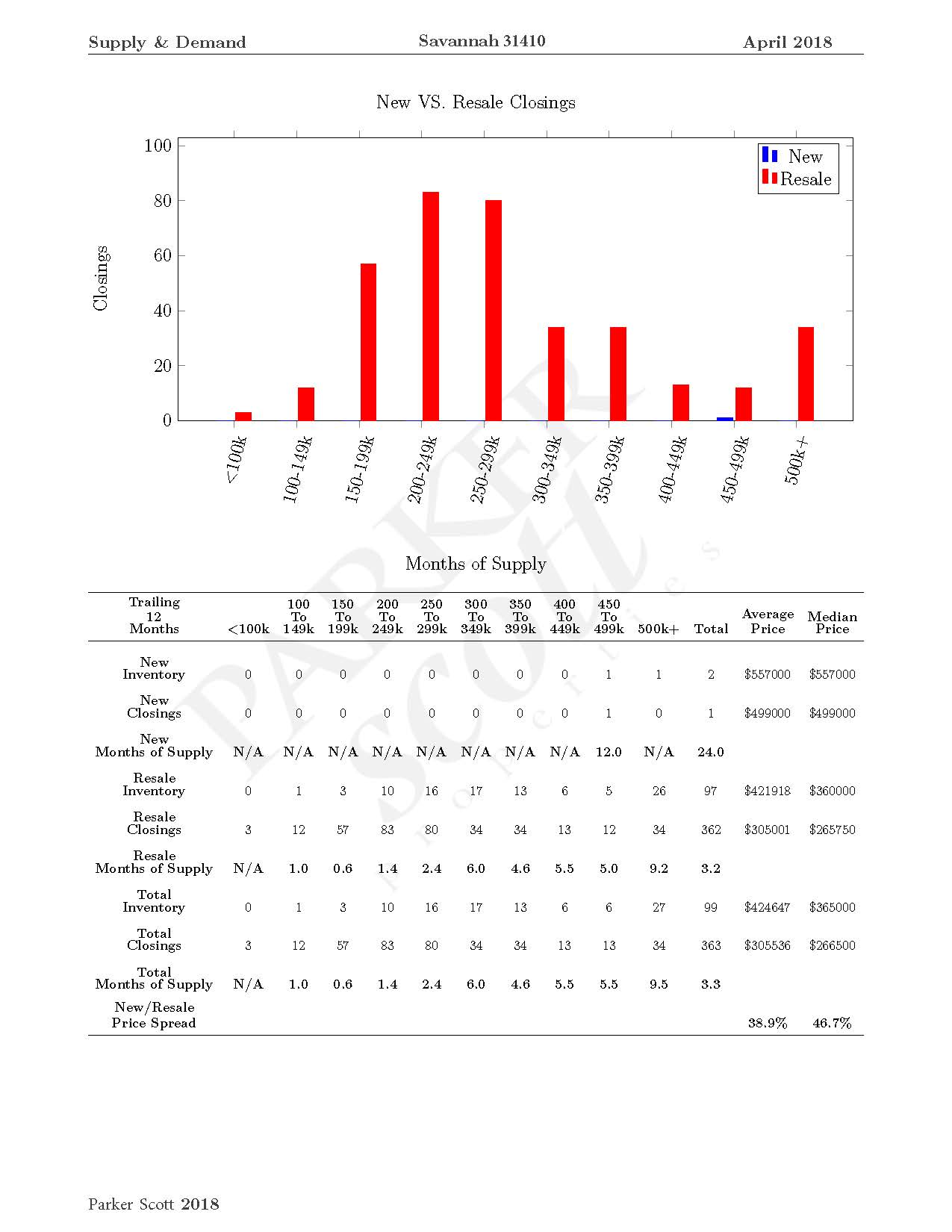

The highest percentage of homes sold were in the $200,000 to $249,000 pricepoint at 83% and the second highest pricepoint $250,000 – $299,000.

“IS THIS THE RIGHT TIME TO SELL”

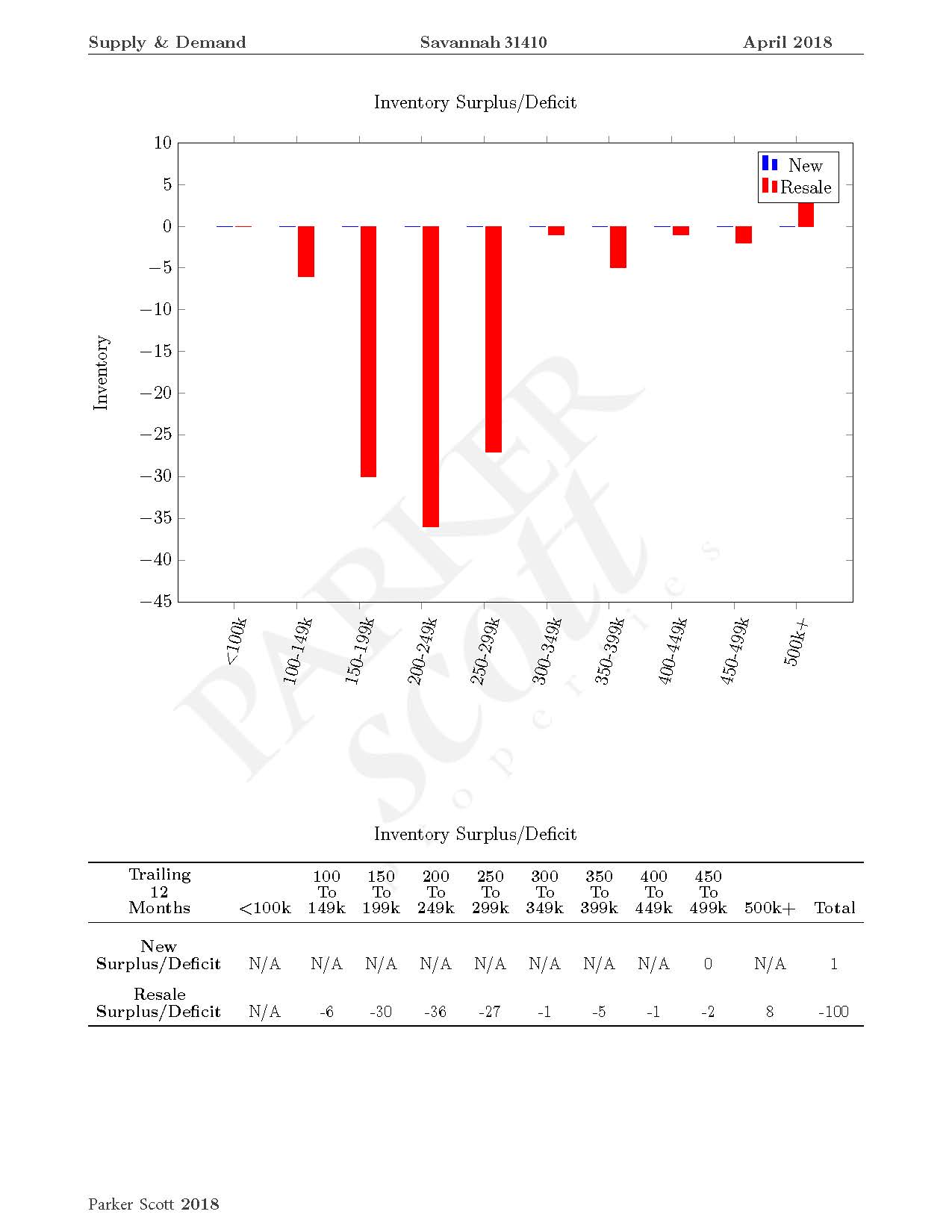

The question would be “is this the right time to sell” and based on market conditions yes! There is a deficit for the surplus of resale homes in the 31410 area.

For a complimentary market study on your property, contact one of our experts today! 912-897-6320 or visit Parker Scott Experts

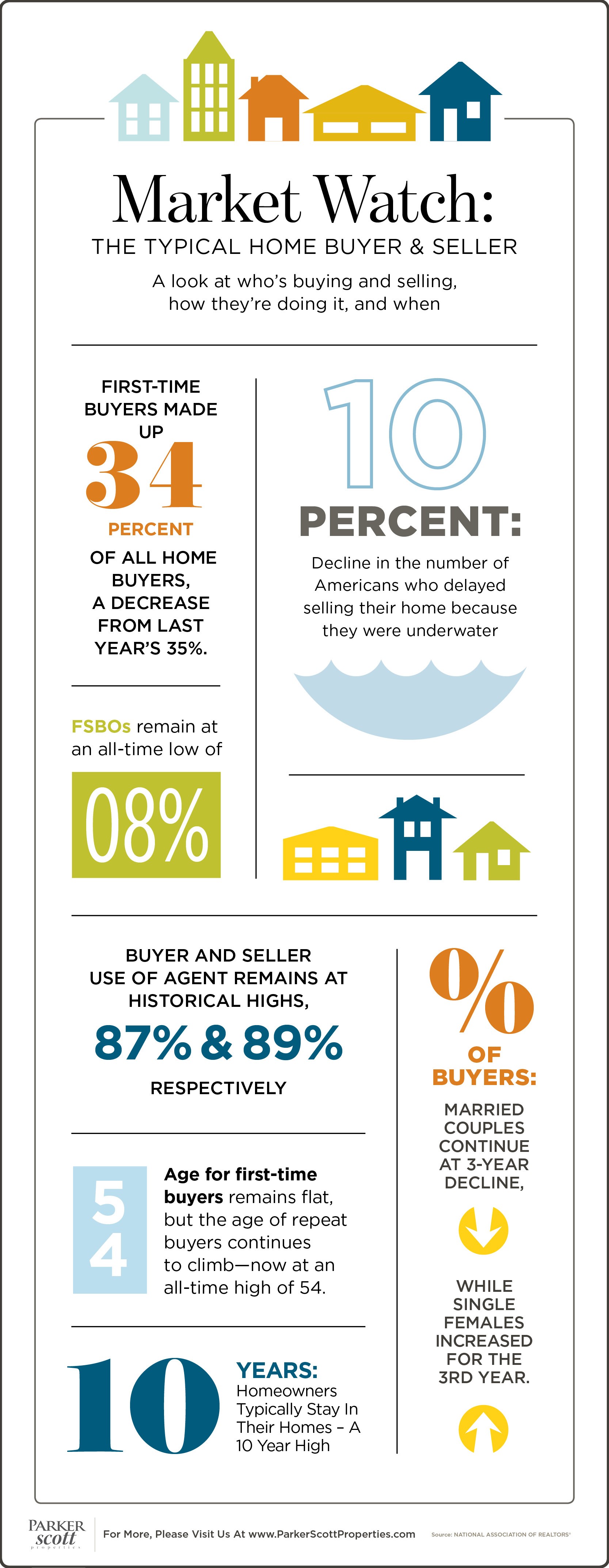

MARKET WATCH: The Typical Home Buyer & Seller

What To Look for When Looking At Homes

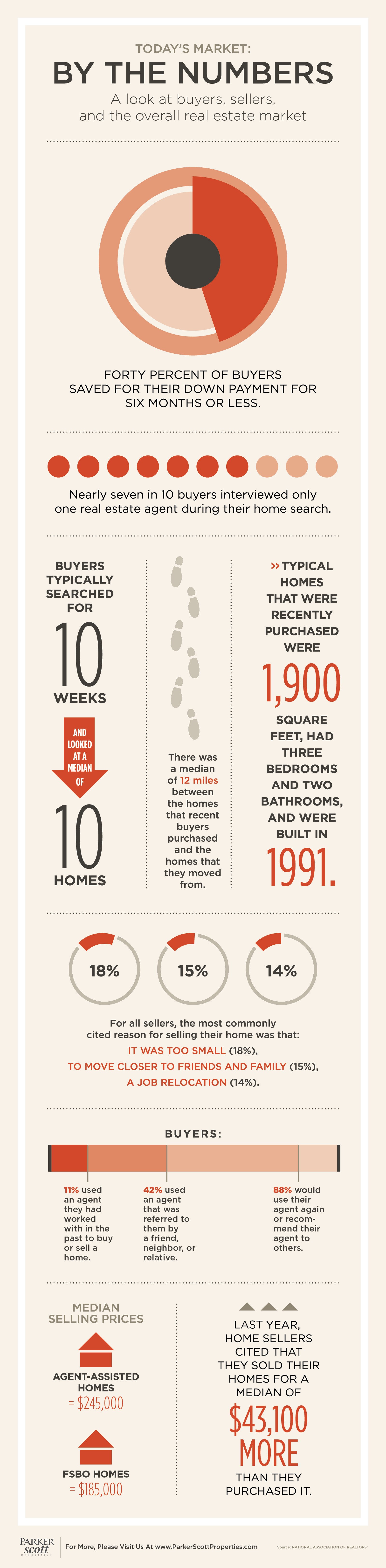

Today’s Market By The Numbers

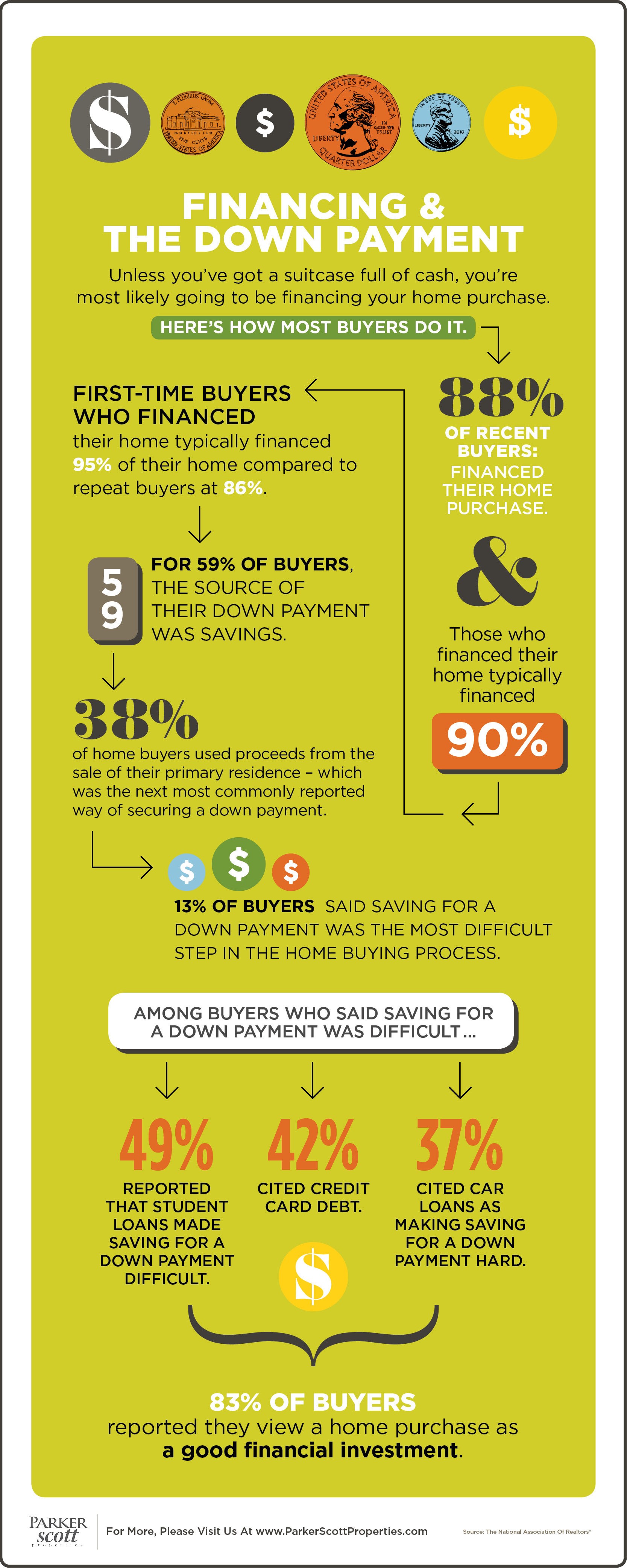

Financing & The Down Payment

What To Do If You Live In A Competitive Market

These days, competition and affordability are two of home buyers’ main concerns. This isn’t surprising, as no one likes to pay more for less. Naturally, we prefer to find a bargain and we certainly don’t want to have to fight off other interested buyers to get it. That’s why recent research looking at the country’s most competitive markets is of interest. The results show the most competitive markets are located in the West, though in just about any desirable neighborhood you could find more buyers than available homes. That means, even if you aren’t living in San Francisco or Seattle, you should be ready for the possibility that you won’t be the only home buyer interested in the house you choose. So what’s the best way to increase your odds of beating the competition and getting the house you want? Preparation. Be prepared and get prequalified before you start shopping. Buyers with financing in place before they start looking at houses are more appealing to sellers. If you’ve got your financing in place and a firm idea of what your price range and budget are, you will be in better position should you find yourself in a bidding war. More here.

Americans Feel Optimistic About Home Buying

An increasing number of Americans say they feel now is a good time to buy a house, according to the most recent Home Purchase Sentiment Index from Fannie Mae. The index – a monthly measure of how consumers feel about real estate, home prices, mortgage rates, job security, and their financial situation – is now nearing its all-time high, reached in September. Doug Duncan, Fannie Mae’s chief economist, says Americans’ perception of the real estate market is improving. “In November, the HPSI rebounded to near its all-time high, returning the index to its gradual upward trend and suggesting fairy stable consumer home-buying attitudes,” Duncan said. “These results are consistent with our expectation that the housing market will continue its modest expansion going forward.” Among respondents, there was a 7 percent increase in participants who said now was a good time to buy a house and a 4 percent increase in the number who feel it’s a good time to sell. More here.

Nearly 60% Of Homes Within Reach of Typical Buyer

Not surprisingly, affordability ranks high among home buyers’ concerns. Rising prices and rumors of future mortgage rate increases have some prospective buyers questioning whether or not they can handle the financial obligations that come along with homeownership. However, new data from the National Association of Home Builders says, in most markets, they can. That’s because, the NAHB’s quarterly measure of affordability found 58.3 percent of new and existing homes sold between the beginning of July and the end of September were affordable to families earning the median income of $68,000. That’s encouraging news for hopeful home shoppers. And, according to Robert Dietz, NAHB’s chief economist, there are a rising number of them hoping to take advantage of conditions while they’re still favorable. “Solid economic growth, along with ongoing quarterly job gains and rising household formations, are fueling housing demand,” Dietz said. “Tight inventories and a forecast of rising mortgage interest rates through 2018 will keep home prices on a gradual upward path and slowly lessen housing affordability in the quarters ahead.” More here.

Despite Price Spike, No Evidence Of Housing Bubble

Along with rising home prices, there has also been increasing concern that the housing market may be entering a bubble. And that’s not surprising, considering the housing crash is still fresh in peoples’ memories. So as home prices reach or exceed previous highs, potential buyers and current homeowners are naturally concerned about the possibility of another housing bubble and crash. According to a recent analysis from Freddie Mac, however, there is a pretty good reason to doubt that today’s price spikes are, in fact, evidence of an emerging bubble. Put simply, one of the primary reasons bubbles form is a perception that home prices will always rise. This causes investors to bid prices up and some mortgage lenders to offer easier credit. In short, a bubble isn’t real. Today’s price increases, on the other hand, are being driven by a lack of for-sale inventory and slower-than-normal new home construction. That means, it is more likely that prices aren’t being driven upward by irrational confidence but, instead, are being driven by an unbalanced market. “The evidence indicates there currently is no house price bubble in the U.S., despite the rapid increase of house prices over the last five years,” Freddie Mac’s chief economist Sean Becketti said. “However, the housing sector is significantly out of balance.” More here.