From all accounts, this spring’s housing market is going to be a busy one. High buyer demand has carried over from last year and so have inventory concerns in many markets. In other words, anyone hoping to find and buy a house this spring should be prepared for competition from other interested buyers. What does that mean? Well, in short, it means moving quickly and saving up some extra money to sweeten the pot, if necessary. In fact, according to a recent survey, home buyers say they are checking online listings every day and 40 percent say they’re planning to put more than 20 percent down. Other strategies buyers say they’re employing this spring to beat the competition include setting price alerts and offering above asking price. Overall, home buyers are aware of current conditions and are preparing themselves for the possibility of having to win over a home seller with an offer that exceeds all others. As evidence of this, just six percent of survey respondents said they are doing nothing to prepare for competition from other buyers. More here.

Homes Stay On The Market For Fewer Days

These days, there are a lot of people interested in buying a house. A stronger economy, more jobs, and years of pent-up demand have led to a rising number of Americans who are eager to make a move. But while that’s positive, more buyers active in the market also means homes sell faster. In fact, according to Nationwide’s recent Health of Housing Markets Report, the average home was on the market for just 67 days in 2017 – with houses in some market going in half that time. That means, buyers need to do their homework, cause they may not have the luxury of being able to take their time debating each home’s pros and cons. It also means good news for sellers. “As we head into spring and the traditional season when sales heat up, buyers will find that desirable homes won’t be on the market for long,” says David Berson, Nationwide’s senior vice president and chief economist. “Today, the average home is on the market almost half the length of time that it was six years ago. Of course, that is good news for people looking to sell their home.” More here.

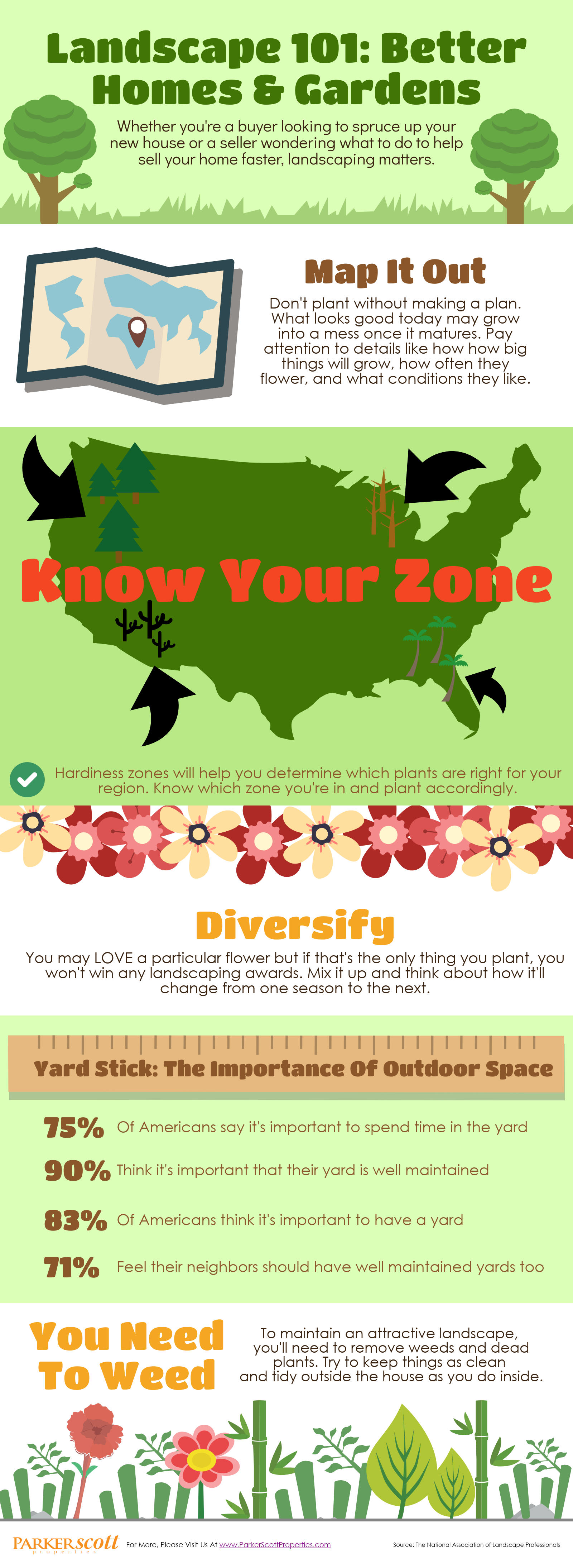

Landscape 101: Better Homes & Gardens

The Neighborhood Feature Buyers Want At Any Age

The factors that influence a home buyer’s decision to buy a particular house in a particular neighborhood are very similar across demographic groups. After all, our lives are more similar than they are different. We all want to live in a safe neighborhood with access to things we want and need, like recreation and health care providers. However, depending on the age of the buyer, there are some are other neighborhood features, like schools, that may appeal more to a younger home buyer than an older one. For that reason, the National Association of Realtors’ Home Buyer and Seller Generational Trends study takes an annual look at who’s buying homes, what kind of homes, and for what reasons. Lawrence Yun, NAR’s chief economist, says the results show there is one factor that appeals to buyers of all ages. “The sense of community and wanting friends and family nearby is a major factor for many home buyers of all ages,” Yun said. “Similar to Gen X buyers who have their parents living at home, millennial buyers with kids may seek the convenience of having family nearby to help raise their family.” In short, proximity to family and friends was important to buyers of all ages, whether they were millennials or baby boomers. More here.

Are More New Houses On The Way?

Generally speaking, there are fewer homes available to buy right now than is considered normal. And though conditions will differ from one market to the next, when inventory is an issue, it leads to competition and higher prices. That’s because, there are too many buyers vying for the number of homes currently available. But when there are more buyers than there are homes for sale, conditions are also ripe for builders. And typically, they’ll take notice and build more homes to accommodate those buyers. Based on recent readings of the National Association of Home Builders’ Housing Market Index – which measures builders’ confidence in the market for new homes – that may be where the market is right now. For example, builders confidence has been at or above 70 for four consecutive months, on a scale where any number above 50 indicates more builders see conditions as good than poor. And most of their optimism is based on market conditions and their expectations for future sales, rather than current traffic. Which means, builders see an opportunity in this year’s market and may begin ramping up construction of new homes. If that happens, it’ll provide more choices for buyers and help slow spiking price increases. More here.

Do You Know Where Your Down Payment Is Coming From?

Homeowner Equity Continues To Increase

When you buy a house, you’re not just purchasing a place to live. You’re also making an investment in the real estate market. Which means, as your home’s value grows, so does your equity. Equity, of course, refers to the amount a property is worth minus the amount still owed on the mortgage. Put simply, if your equity is growing, that’s good news. Which is why new numbers from the Board of Governors of the Federal Reserve System are encouraging. That’s because they show homeowner equity on the rise. In fact, the total value of homeowner equity has increased $1.2 trillion over the past year and reached $14.4 trillion in the fourth quarter of last year. In short, that means homeowners are seeing the value of their homes, and their investment, grow. Whether you’re a current homeowner or are about to become one, this is a positive sign – as it indicates that the real estate market is strengthening and offering Americans a good opportunity to find a place they can, not only call home, but also a good financial decision. More here.

The Top Sacrifices Millennial Buyers Say They’ll Make

Buying a house is a major financial transaction and, for most Americans, the largest one they’ll ever undertake. So pulling the necessary resources together to be able to afford the upfront costs, in addition to the ongoing obligations, maintenance, and upkeep can be difficult. Especially for first-time home buyers who don’t have the benefit of being able to sell a home to help fund their down payment. For this reason, many millennials who aspire to homeownership have decided it’s worth making a few sacrifices in order to help save money to buy a house. In fact, according to a recent survey from ValueInsured, there are some common sacrifices young Americans say they are willing to make in order to buy their first home. For example, nearly 60 percent of respondents said they would cut down or give up eating out – which made giving up restaurants the most popular sacrifice among survey participants. Other common sacrifices included taking a second job, not going on vacations, moving back in with their parents, and giving up shopping for clothes. More here.

The Importance Of Checking Your Credit Score

Nearly 60% Of Homeowners Plan Home Improvements

If you’re a homeowner, you know the to-do list is never ending. And, if you’re a buyer, you’ll know soon enough. That’s because, owning a home means maintaining a home. Proof of that can be seen in the fifth annual LightStream Home Improvement Survey. According to the results, 58 percent of surveyed homeowners say they’re planning to spend money on home improvement projects in 2018. And the number who said they plan on spending $35,000 or more has doubled from last year. But though there are more homeowners planning projects this year, the list of projects hasn’t changed all that much. Once again, outdoor upgrades remain the most popular, with decks, patios, and landscape projects topping the list. Kitchen and bathroom remodels, of course, also rank high, coming second and third on Americans’ home improvement, to-do list. So how are these homeowners planning on paying for all these upgrades and renovations? Well, the vast majority said they were paying for their projects out of savings. However, another way homeowners are saving on their home improvement bills is by doing, at least, some of the work themselves. More here

If you’re a homeowner, you know the to-do list is never ending. And, if you’re a buyer, you’ll know soon enough. That’s because, owning a home means maintaining a home. Proof of that can be seen in the fifth annual LightStream Home Improvement Survey. According to the results, 58 percent of surveyed homeowners say they’re planning to spend money on home improvement projects in 2018. And the number who said they plan on spending $35,000 or more has doubled from last year. But though there are more homeowners planning projects this year, the list of projects hasn’t changed all that much. Once again, outdoor upgrades remain the most popular, with decks, patios, and landscape projects topping the list. Kitchen and bathroom remodels, of course, also rank high, coming second and third on Americans’ home improvement, to-do list. So how are these homeowners planning on paying for all these upgrades and renovations? Well, the vast majority said they were paying for their projects out of savings. However, another way homeowners are saving on their home improvement bills is by doing, at least, some of the work themselves. More here