Unless you’re buying a new house, you’re likely to be choosing which house to buy based on how much work it might need. And if you don’t have the time and expertise to do the work yourself, you’re going to have to factor possible remodeling costs into your buying equation. In other words, it can get complicated. That’s why, today’s home buyer says they’re looking for a move-in ready home that requires very little renovation. Busy schedules and tight budgets mean many Americans don’t have the resources or time to invest in a major kitchen overhaul or bathroom upgrade. But is it realistic to expect to find the perfect home in perfect condition at a time when many markets have lower-than-normal inventory levels? Well, probably not. That’s why buyers should have an idea about what they will or won’t compromise on before heading out to shop homes. Conversely, home sellers should think about any investments they can make before listing that might help sell their house at a higher price.

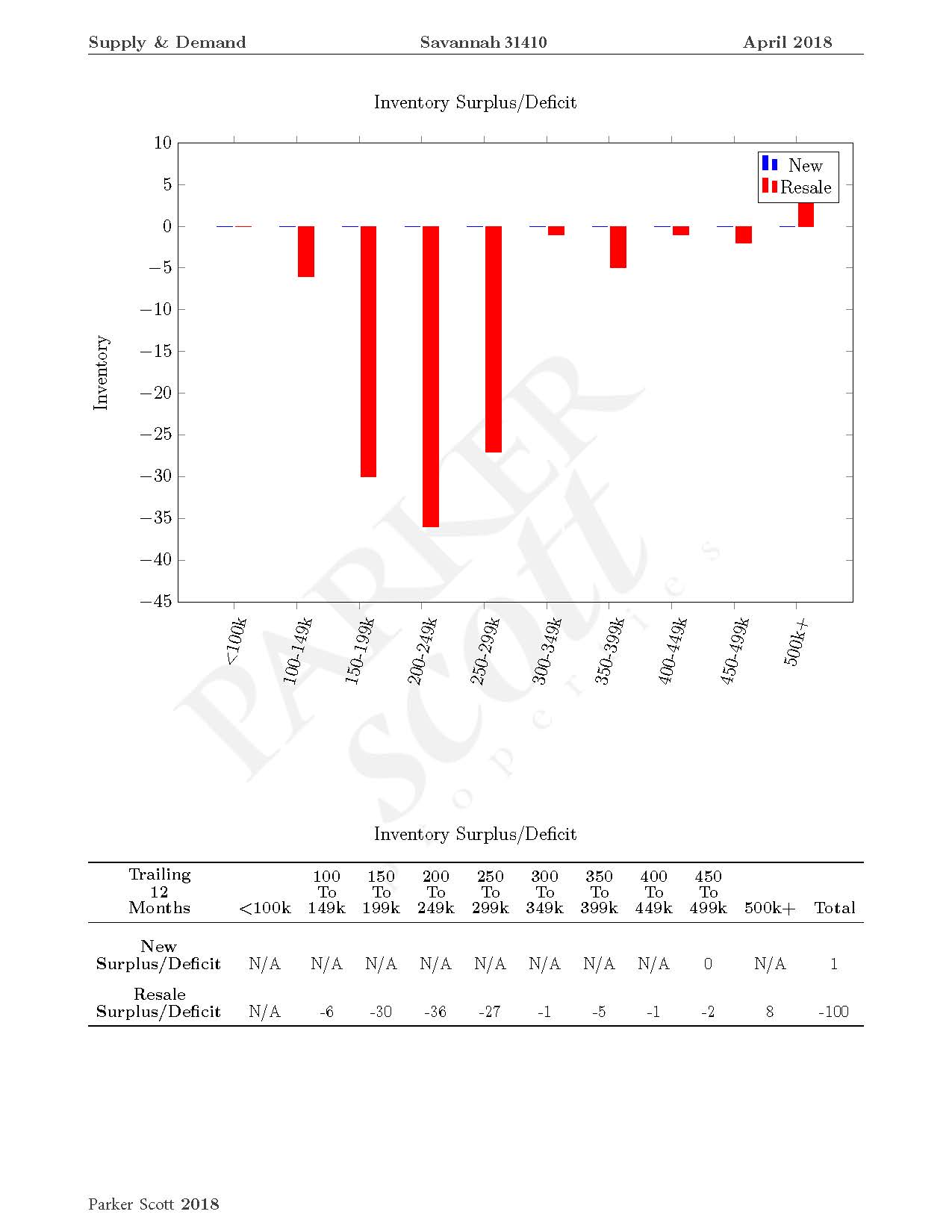

HOUSING SUPPLY & DEMAND

Supply & Demand Report for Wilmington Island Area

April 2018

Report is based on single-family resale properties, that are detached homes (condos and townhomes not included in report). With a minimum price of $100,000 up to a maximum price of $500,000.

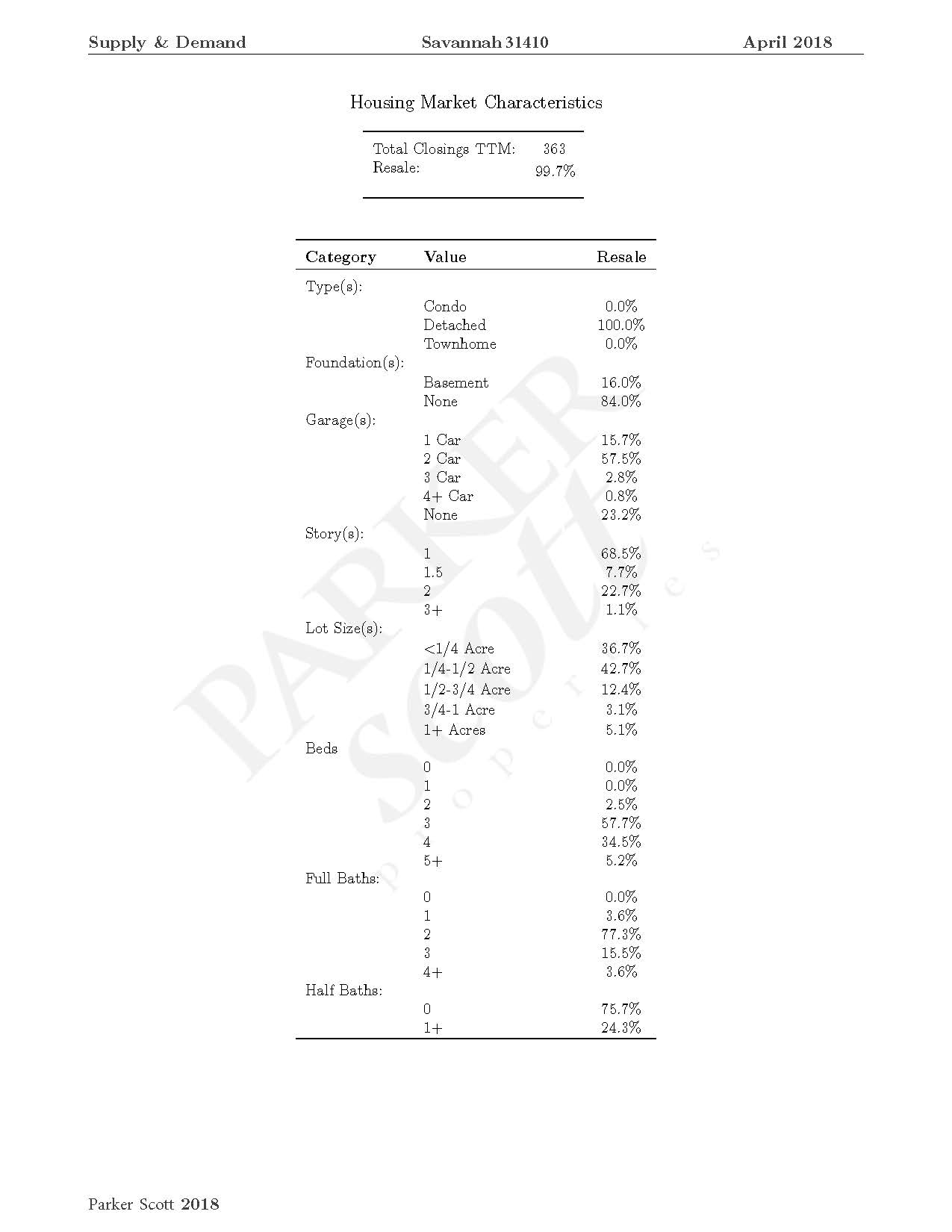

GARAGES

15.7% of the homes sold had 1 car garages, 57.5% had 2 car garages, 2.8% had 3 car garages, less than 1% had 4 car garages and 21% did not have a garage.

BEDROOMS

2.5% had two bedrooms, 57.7% with three bedrooms, 34.5% with four bedrooms and 3.6% had more than 4 bedrooms

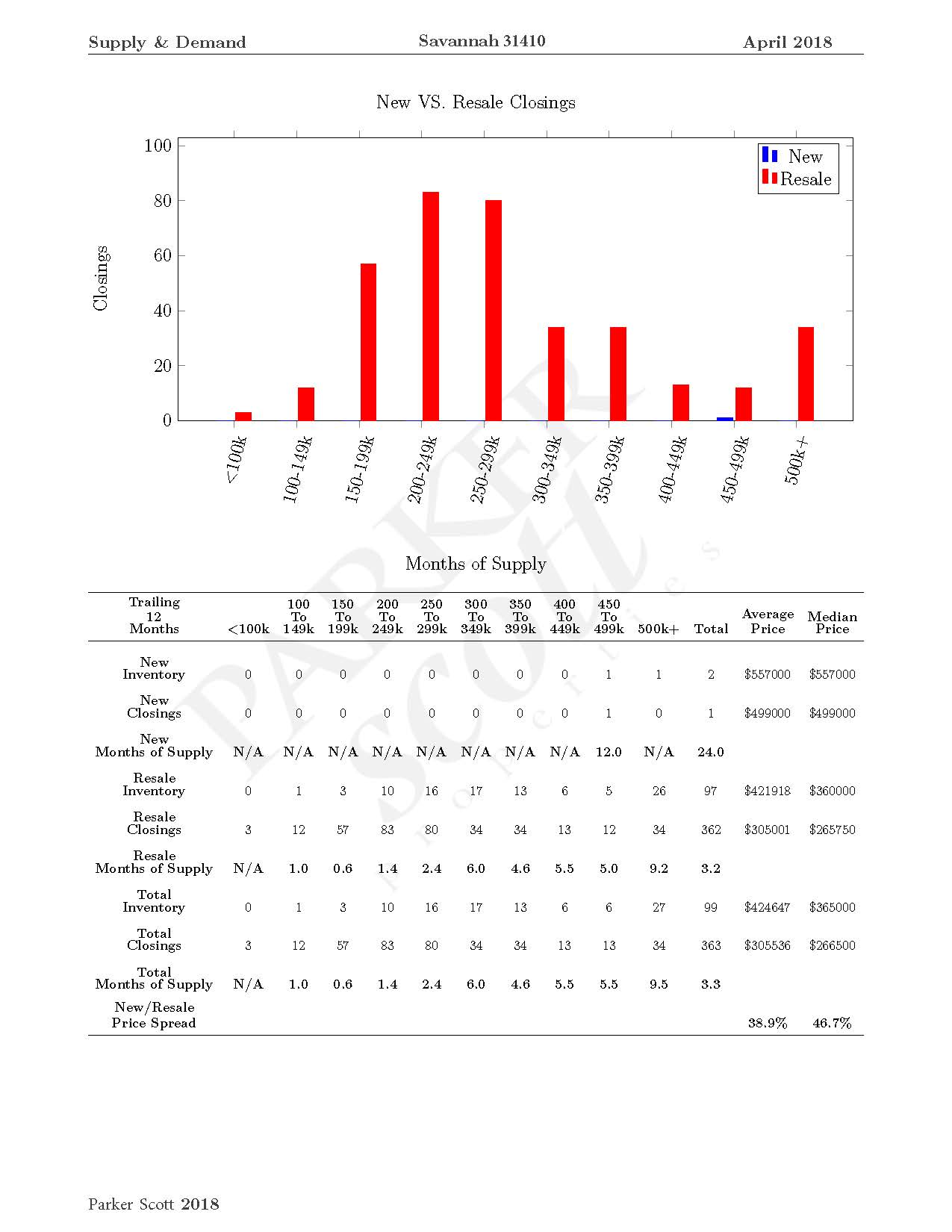

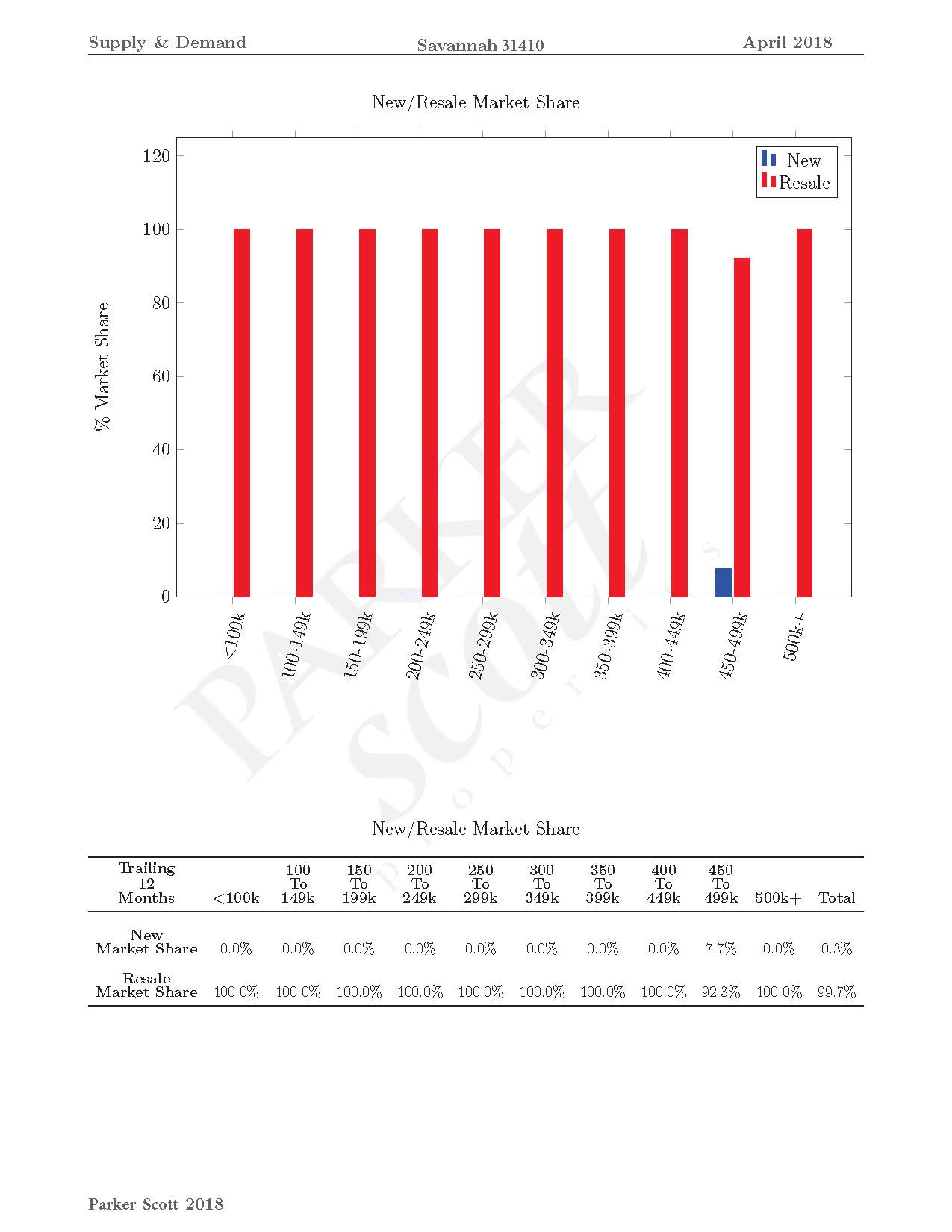

The highest percentage of homes sold were in the $200,000 to $249,000 pricepoint at 83% and the second highest pricepoint $250,000 – $299,000.

“IS THIS THE RIGHT TIME TO SELL”

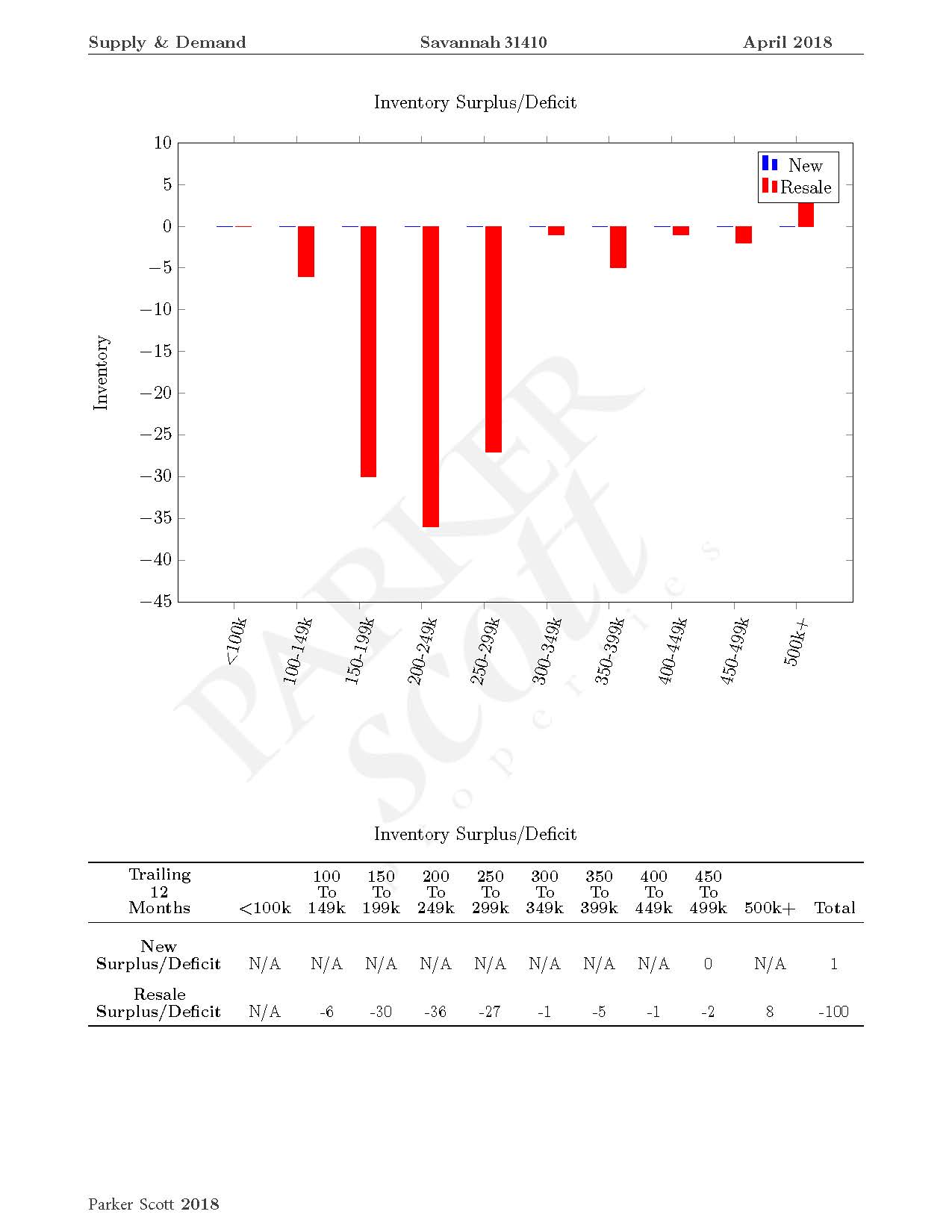

The question would be “is this the right time to sell” and based on market conditions yes! There is a deficit for the surplus of resale homes in the 31410 area.

For a complimentary market study on your property, contact one of our experts today! 912-897-6320 or visit Parker Scott Experts

Prices Below Peak In Nearly Half Of All Markets

If you’ve been at all interested in shopping for a home, you’ve likely heard news about rising home prices. Since the housing crash, home values have rebounded and, in some areas, the climb has been quick. However, news about increasing prices should be measured against how far they fell. In other words, though prices have rebounded, they are still below their previous peaks in many markets. In fact, according to recent numbers from ATTOM Data Solutions, median home prices are still below their pre-recession peaks in 46 percent of the 105 metro areas analyzed – including cities like Chicago, Baltimore, Tucson, Las Vegas, and New York-Newark-Jersey City. That’s why it’s always a good idea to look into where prices are in the specific neighborhoods where you’d most be interested in buying. Price increases will vary from one city to the next. So there may still be opportunities for buyers in the areas you’d like to live, despite home prices’ overall upward trend. More here.

Homes Sell At Fastest Recorded Pace In 2017

Making big decisions quickly is not usually a recipe for success. However, in today’s housing market, that’s exactly what home buyers have to do. That’s because homes are selling faster than ever these days. In fact, according to a recent analysis, the average home took 81 days to sell last year. And that includes closing, which usually takes four to six additional weeks. In other words, since many markets have more buyers than they do available homes, houses for sale are selling fast. So what should buyers do to prepare for possible competition? Well, for starters, adjust your expectations. A recent report from Zillow found the average buyer spends just over four months searching for a home and makes two offers before successfully buying a house. That means, expect a process. Outside of that, be prepared. Get prequalified, know what you want, what you want to spend, and what your dealbreakers are. The more prepared you are, the more likely you’ll make good decisions, even if they have to be made quickly. More here.

One Reason Outdoor Spaces Are So Important

Analysis Finds Property Tax On The Rise

When considering the costs of homeownership, it’s sometimes easy to forget about property tax. Home buyers focus a lot of attention on their prospective mortgage payment and the potential cost of any remodels and renovations but often forget to think about how much taxes will run them each year. This is a mistake. Take, for example, new research from ATTOM Data Solutions. Their recent tax analysis found that the average property tax on a single family home last year was $3,399, a 3 percent increase from 2016. That’s nearly $300 a month. But property taxes can differ from one place to the next. As evidence, states like Hawaii, Alabama, Colorado, Tennessee, and West Virginia were found to have lower than average effective property tax rates. They can also vary from city to city. That’s why it’s a good idea to look into how much homeowners pay in property taxes in the areas where you’d most like to buy a home. It may not sway your decision on where you buy, but it will give you a more accurate assessment of how much it’ll cost to buy a house in a particular city. More here.

How Mortgage Rate Increases Affect Home Buyers

Mortgage rates have been increasing lately and there is an expectation that they will move higher this year. But while home prices get a lot of attention, rising mortgage rates are a little more difficult for buyers to calculate in terms of what it will cost them. Here’s some help. According to one recent model, a less than one percent increase in mortgage rates over the next year would result in a $100 increase to the typical monthly mortgage payment. But since the costs of homeownership are influenced by many different factors, this projection has to make certain assumptions about things like the rate at which home prices will increase, for example. In other words, any increase to mortgage rates will cost home buyers but just how much is difficult to calculate precisely. So what should home buyers expect? Well, since a stronger economy and improved job market make it more likely that the Fed will raise interest rates further this year, buyers should expect that mortgage rates will remain low by historical standards but continue to edge higher, taking monthly mortgage payments higher along with them. More here.

More Home Buyers Sign Contracts In February

If you want to get a feel for how many home buyers there are currently active in the housing market, the National Association of Realtors’ Pending Home Sales Index is a good place to start. It tracks the number of contracts to buy homes signed during the month and, because it measures contract signings and not closings, it’s a good future indicator of where home sales will be a month or so down the road. In short, if there are a lot of pending sales, there will likely be a lot of final sales. Which is why, February’s results are a pretty good indication that the spring season is ramping up. Contract signings were up 3.1 percent in February and rebounded in all four regions of the country. The largest increase was in the Northeast, though pending sales also saw significant improvement in the South. Still, despite the gains, NAR chief economist Lawrence Yun says the pace falls short of last year’s level. “Contract signings rebounded in most areas in February but the gains were not enough to keep up with last February’s level, which was the second highest in over a decade,” Yun said. More here.

What Style Of House Do You Prefer?

Most regions offer house hunters a variety of architectural styles to choose from. Whether you prefer bungalows to ranches or modern over contemporary, you can likely find something that fits your preference. But, according to one recent survey, what you’re looking for might depend on your age. That’s because the results show millennial home buyers are looking for a different kind of home than older buyers. For example, younger buyers expressed a preference for colonial and contemporary homes, when they had a preference at all. On the other hand, buyers over the age of 55 were much more interested in finding a ranch – which is an architectural style favored by only 6 percent of millennials. Of course, some of this has to do with practicalities – such as retirees in search of a one-story home because it eliminates any concern about future mobility and navigating stairs – but it’s also a question of personal taste and aesthetics. Ultimately, though, whatever type of house Americans say they prefer, they generally all say they want that house to have ample storage, a garage, and multiple bedrooms. More here.

5 Home Selling Myths