The Advantages Of Buying New

One of the main arguments in favor of buying a home is equity. When you rent, you’re sending your monthly payment to a landlord. As a buyer, your monthly mortgage payment is helping to build equity. Of course, many homeowners wait and then, following the sale of their house, use their accumulated equity to help buy their next home. But you can also use a home equity loan to access the value your home has accrued. So what do homeowners who take home equity loans do with the money? Well, a recent survey asked borrowers and came up with an answer. Not surprisingly, the top reason homeowners took out loans was to fund home improvement or remodeling projects. This is a common strategy since taking out a loan to improve your house means you may be able to recoup some of the cost if, and when, you sell the home. Other common answers included money to invest in another property, emergency expenses, retirement funds, and debt consolidation. More here.

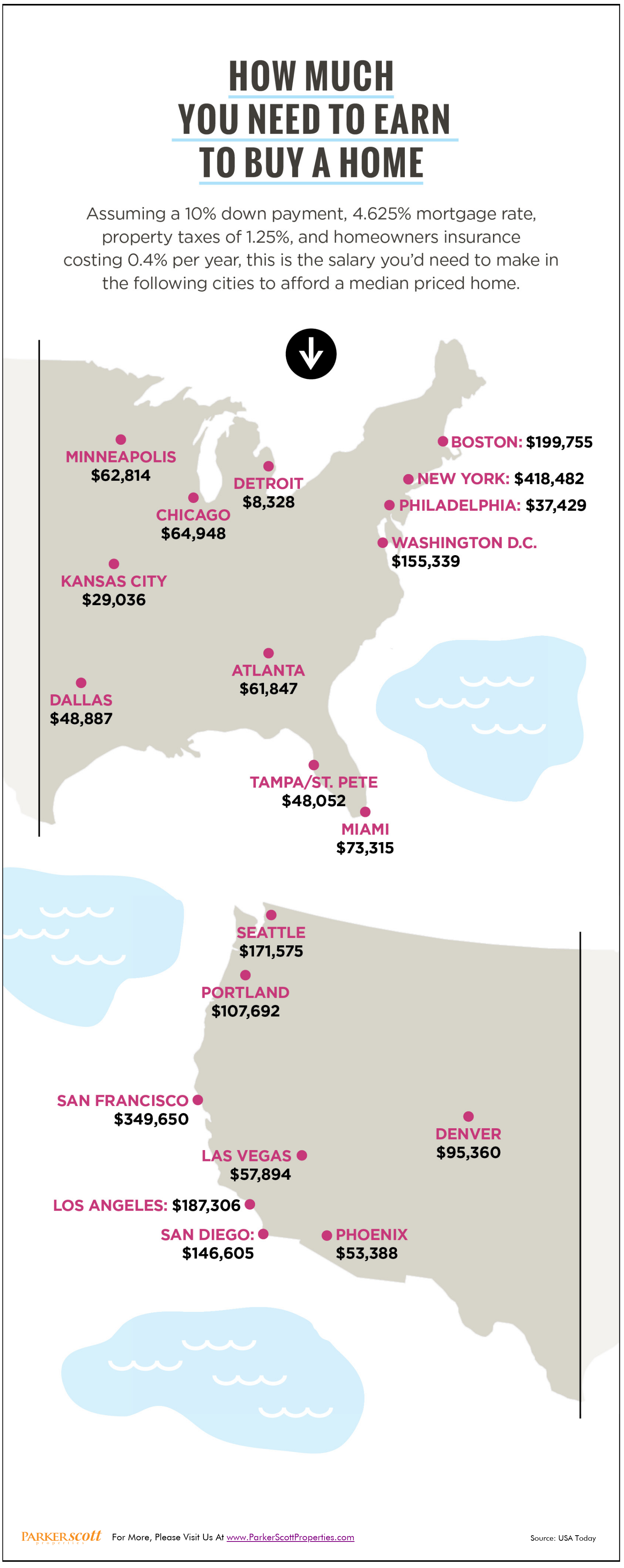

Affordability is the top concern for potential home buyers entering the summer season. That’s not a surprise. With prices and mortgage rates up, it’s natural that Americans who are hoping to buy might be leery when seeing news of rising housing costs. But, though affordability conditions are challenging in some markets, buyers may have some misconceptions that are adding unnecessary stress and anxiety. For example, according to the results of one recent survey, potential home buyers see saving for a down payment as the biggest obstacle preventing them from buying a house. But, at the same time, they overestimate the amount of money they’ll need to put down in order to buy. The survey found 58 percent of participants said they are planning for a 20 percent down payment. But though that may be the recommended down payment amount, it isn’t required. The National Association of Realtors, for example, found that the median down payment for first-time buyers has been at 6 percent for the past three years. In other words, though home buyers are right to take seriously the costs and responsibilities of becoming a homeowner, they may want to explore all of their options before deciding they can’t afford to buy. More here.

First-time home buyers are an important demographic when it comes to the health of the housing market. Because they’ve historically accounted for about 40 percent of home sales, they garner a lot of attention from experts, economists, and analysts hoping to gauge how the market is doing and where it’s headed. In recent years, first-time buyers have been less active than usual. The financial crash and recession led to a long period where Americans of typical home-buying age did not have the economic stability or job security to feel comfortable pursuing homeownership. Then, even after economic conditions began to improve, a lack of affordable, starter homes kept many younger Americans on the sidelines. This year, conditions are still challenging but new numbers from Freddie Mac show things may finally be changing. That’s because, first quarter results show that first-time buyers accounted for 46 percent of new mortgages during the early part of this year. That’s the largest quarterly share since 2012 and an indication that young Americans are finally becoming more active in the real-estate market. More here.

Generation Z – which is defined as people born between the mid-1990s and early 2000s – is quickly approaching adulthood and will soon face the decision of where to live and whether to rent or buy. But, according to a recent analysis, they may be facing challenges past generations didn’t. For example, the results of one study show that they will spend less time renting but will pay more than young people have in the past. With current median rent at $1,418 per month and rising, generation Z is expected to spend $226,000 on rent in their lifetime. That’s a lot. And it’s more than baby boomers or millennials spent. But despite that, generation Z is expected to become homeowners earlier than millennials have. One reason is the cyclical nature of the economy. Another is the fact that more than half say they considered buying before renting their current place. Also, they are just as likely as older generations to say they consider owning a home to be part of achieving the American Dream. In other words, if long-term economic trends hold up, the next generation of home buyers will have a better economy and job market to help fuel their dreams of homeownership. More here.

When shopping for a house to buy, it’s hard not to fantasize about the homes just out of your price range. Regardless of what you plan to spend, it’s fun to imagine buying a house even bigger, nicer, and more feature filled than the ones within your reach. And, with the Internet, it’s easier than ever to steal a glance inside the nicest homes in the area. In fact, you can shop real estate in any area. But, while we’re all familiar with famous luxury markets such as Beverly Hills or Aspen, Colo., what are the nation’s lesser-known, up-and-coming luxury markets? Well, according to a new index from the National Association of Realtors’ consumer website, East Coast house hunters looking for a warm weather getaway have propelled Sarasota and Collier counties in Florida to two of the top five spots on the list of fastest growing luxury markets. Other areas that made the list include counties containing Castle Rock, Colo., San Jose, Calif., Queens N.Y., Seattle, Jersey City, and Redwood City, Calif. But, if you’re planning a move to one of these hot spots, you have to move fast as they all have seen 10 to 20 percent price increases over the past year. More here.

There are a lot of things you need to set money aside for when you’re getting ready to buy a house. You have to have money for a down payment, closing costs, and moving expenses but you also need to consider how much you’ll need for any future home maintenance. Buying a home means you’re on the hook for any repairs and renovations you need along the way – and you will inevitably run into issues at some point, whether it’s a clogged toilet or a leaky faucet. When it happens, you can pay someone else to fix it or try doing it yourself. Naturally, though, these costs can add up, if you call in a contractor for every loose hinge or minor leak. So it’s a good idea for homeowners to do as much of their own work as possible. And, these days, it’s easier than ever to find how-to videos, tips, and information that can help you become handier around the house. Minor repairs can be surprisingly easy, once you have the right tools and some know-how. So, if you’d like one less thing to save for, start by brushing up on your home improvement skills. More here.

First-time home buyers are an important demographic when it comes to the health of the housing market. Because they’ve historically accounted for about 40 percent of home sales, they garner a lot of attention from experts, economists, and analysts hoping to gauge how the market is doing and where it’s headed. In recent years, first-time buyers have been less active than usual. The financial crash and recession led to a long period where Americans of typical home-buying age did not have the economic stability or job security to feel comfortable pursuing homeownership. Then, even after economic conditions began to improve, a lack of affordable, starter homes kept many younger Americans on the sidelines. This year, conditions are still challenging but new numbers from Freddie Mac show things may finally be changing. That’s because, first quarter results show that first-time buyers accounted for 46 percent of new mortgages during the early part of this year. That’s the largest quarterly share since 2012 and an indication that young Americans are finally becoming more active in the real-estate market. More here.

When you buy a house, you’re also buying the surrounding neighborhood. And, depending on your lifestyle and wishlist, the neighborhood may be even more important to you than the actual home you’re buying. After all, most of your life happens outside your home. So your proximity to schools, shopping, healthcare, recreation, and nature will have a large effect on how much you enjoy living in a particular house. In short, finding your dream house in the wrong neighborhood could make it a nightmare. Unconvinced? Well, a recent survey of Americans found large majorities who said the feel of a neighborhood was important when deciding where to live. In fact, 80 percent said the surrounding neighborhood had to fit their personality and an almost equal amount said they’d consider moving if they found they didn’t like their new neighborhood. In other words, when shopping for a new house, be sure to spend as much time considering the area around it as you do the areas inside it. It could even work out to be a better idea to find a smaller house in a great location than a big house somewhere you may grow to dislike. More here.