Maintenance is a big part of being a homeowner. Put simply, owning a home means having a never-ending to-do list and, depending on your level of know-how, some of it will require the help of a professional. These jobs can range from major renovations such as putting an addition on your house to basic upkeep and repairs like having ducts cleaned and fixing leaks. Essentially, you are your home’s temporary caretaker and how well you take care of it will affect not only how comfortable and enjoyable your home is to live in but also how much you can ask for it when you sell. These days, it seems Americans are increasingly interested in fixing up their homes. In fact, newly released data from the National Association of Home Builders shows home remodeling contractors are busy right now. So what kind of jobs are most in demand? Well, results show demand is highest for basic maintenance and repairs, while additions and alterations – both major and minor – saw slight declines during the second quarter. In short, Americans are tackling their to-do lists and fixing up their homes. This could be due to improved economic conditions and a stronger job market, though it may also be that current homeowners are tending to their homes in hopes of listing them someday soon. More here.

Majority Say They Want To Own A Home In Retirement

The vast majority of surveyed Americans say that homeownership is among their retirement goals, according to a recent survey. In fact, 85 percent of non-retiree respondents said they want to own their own home in retirement and believe they can pay off their mortgage before they retire. But, though non-retiree participants feel like they’ll have their mortgage paid off in time, more than 25 percent of retired respondents said they’re still paying off a mortgage and over half of those had a balance of more than $50,000. In short, Americans may be a bit too optimistic. But regardless of whether or not they make it, the debate about homeownership and retirement will continue. On the one hand, tax breaks and equity make a good case for the wealth-building benefits of owning a home. But, on the other hand, property tax, maintenance and potential renovation costs can add unpredictability to a household budget that may largely be fixed. In the end, which situation is the right one for you will ultimately depend on your personal finances, assets, and outlook – as there is no one-size fits all strategy for meeting your retirement goals. More here.

Price reduction & $2000 agent BONUS!!

144 Cairnburgh Road Richmond Hill, GA, 31324 Located in beautiful Buckhead this 4 bedroom 2 1/2 bath home offers a wonderful open floor plan with an eat-in kitchen that overlooks the family room. Split floor plan with the master bathroom completely updated with a brand new vanity, granite countertop, double sinks, a large tiled shower and a walk-in closet. The entire house has been painted, has new carpet and solid bamboo flooring in the living room, dining room and entrance. The 4th bedroom upstairs has its own half bath and 2 closets. To complete this perfect home it also has its own in-ground pool.

This Summer’s Luxury Home Market Is Hot

The challenge of finding an affordable entry-level home in today’s housing market gets a lot of coverage. First-time buyers facing higher rent, difficulty saving for a down payment, and low inventory are an important demographic and their habits have implications for the overall health of the market. But, at the same time as the starter-home market has been hot, demand for luxury homes has also ramped up. In fact, new research shows sales of homes $1 million and higher are up 25 percent over last year – which represents the largest jump since January 2014. In short, the improved economy and job market has also led to an increase in demand for luxury homes, the same way it has elevated demand across all segments of the housing market. Among specific regions, northern California leads the pack with four of the top 10 fastest-growing luxury markets. Other fast-growing markets include Denver, Seattle, and Nashville, which all have seen homes on the high-end of the market going under contract in fewer days than at this time last year. More here.

How Long Does It Take Renters To Save For A House?

With rental costs and home prices both increasing, it’s become more challenging for renters to save for a down payment. How much so? Well, according to one recent analysis, the typical renter will have to save for nearly six and a half years to come up with a 20 percent down payment on a median-priced home. And, since the median home value is currently $216,000, depending on your prospective neighborhood, it could take even longer to save up for a house. Renters who aspire to homeownership shouldn’t get discouraged, though. Despite the fact that a 20 percent down payment is the standard amount recommended by financial experts, it is not a requirement in order to buy a house. In fact, depending on the particular terms of your mortgage, you can put down as little as 3 percent. In 2017, for example, 29 percent of first-time buyers had a down payment between 3 and 9 percent. That’s why it’s important to explore your options before deciding homeownership is out of reach. More here.

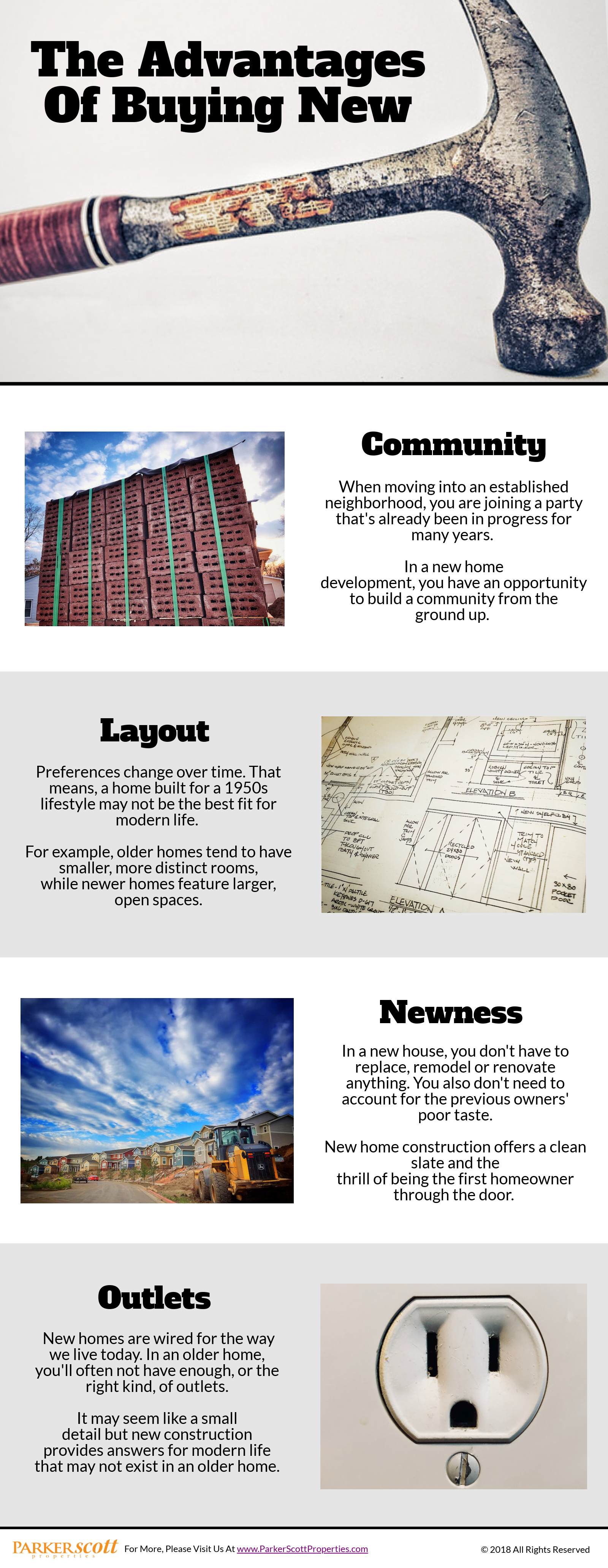

The Advantages Of Buying New

The Summer Features Home Buyers Want Most

How Affordability Perceptions Affect The Market

Perception doesn’t always match reality but, when it comes to financial markets, it can make a difference. For example, if you’ve ever invested in the stock market, you know that a company’s stock can rise or fall based on the day’s news, even if the company’s fundamentals and outlook remain the same as the day before. In short, perception matters. And, in today’s housing market, there’s a perception that there are few affordable homes available to prospective buyers. In fact, according to a recent analysis from Fannie Mae, though only 8 percent of homeowners consider their current mortgage unaffordable, 45 percent said that affordable housing is difficult to find in their area. Which provides a snapshot of what is going on in many markets across the country. Homeowners that want to sell may be waiting because they don’t feel they’ll find an affordable house to move into. The flip side of this, however, is that as long as current homeowners aren’t selling their homes, inventory shortages will continue, which is the primary factor behind recent price increases. More here.

Are Cities Becoming More Popular Than Suburbs?

Suburbs sprouted out of a desire to have the conveniences of urban life but also the space and privacy of living outside the city. In other words, the best of both worlds. And for decades, suburban areas, based on that promise, grew at a faster rate than the nation’s cities. Americans spread out from city centers and moved further and further away. But, according to a new report from the Urban Land Institute, we may now be starting to move back. In fact, between 2010 and 2015, dense urban locations saw their populations grow faster than the residential neighborhoods of their surrounding suburbs. There are a few reasons for this. One is that rental apartment inventory grew at about twice the rate of inventory in the suburbs. Also, there were more jobs created in city centers than in suburbia during this period. However, though there are many factors driving Americans back into the city, the report also notes that urban living costs more, which means younger Americans – who are most likely to desire an urban lifestyle – may be increasingly unable to afford it. More here.

Are Waterfront Homes Selling For Less?

There are two reasons home buyers typically have to pay more for a house on the water. The first is that people want to live on the water. It’s a desirable location. Secondly, there are a limited number of houses with water access. And when you combine high demand and low supply, you usually have a recipe for higher prices. But new research shows that waterfront property isn’t selling at as high a premium this year. In fact, waterfront homes in the first quarter sold for a 36 percent premium, which is the lowest level since 2002. By comparison, the average premium since 1996 is 41 percent and in 2012 the premium was as high as 54 percent. In other words, the difference in price between homes on the water and those further inland is lower than normal. But since having an ocean or lake view hasn’t become any less desirable, what might be behind this trend? Well one explanation is that a lower overall number of homes for sale has helped raise prices for homes all over, which has narrowed the price gap between waterfront and inland homes. More here.